- Bitcoin’s long/short ratio fell sharply on the charts

- A few statistics suggested that investors should still consider buying BTC

It’s been quite a few days already Bitcoin [BTC] started trading below the $70,000 mark. While the state of the market remained somewhat bearish, some major players in the crypto space opted to exit it. Hence the question: does this mean that investors should no longer consider accumulating BTC? Let’s find out.

Whales sell Bitcoin

CoinMarketCaps facts revealed that BTC has failed to rise above $70,000 since June 10. In fact, the king of cryptos fell victim to a massive price correction, dropping it below $67,000. At the time of writing, BTC was trading at $66,196.58 with a market cap of over $1.3 billion.

Meanwhile, whales began reducing their long positions.

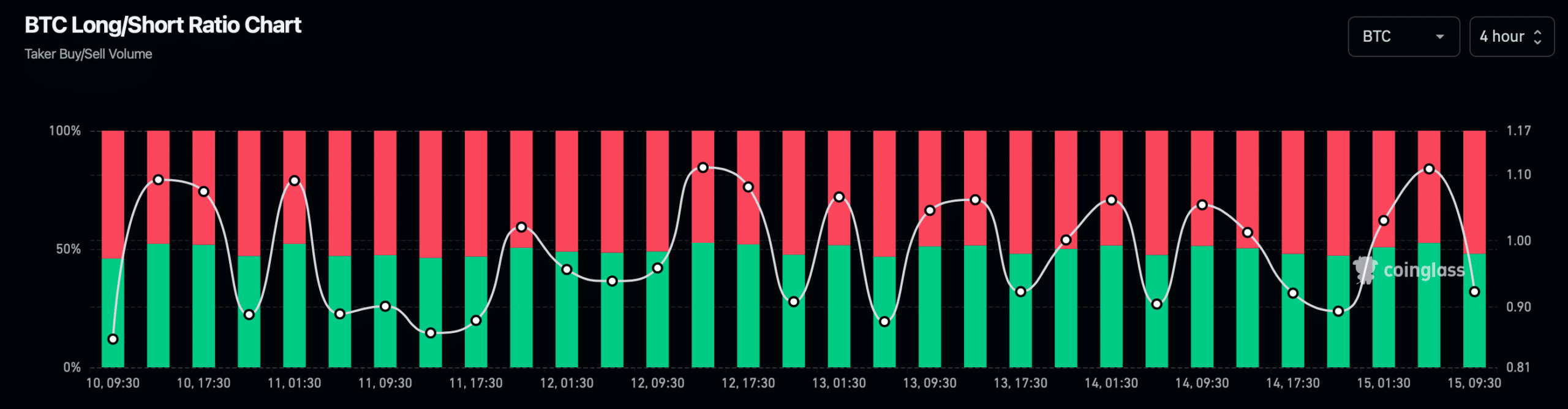

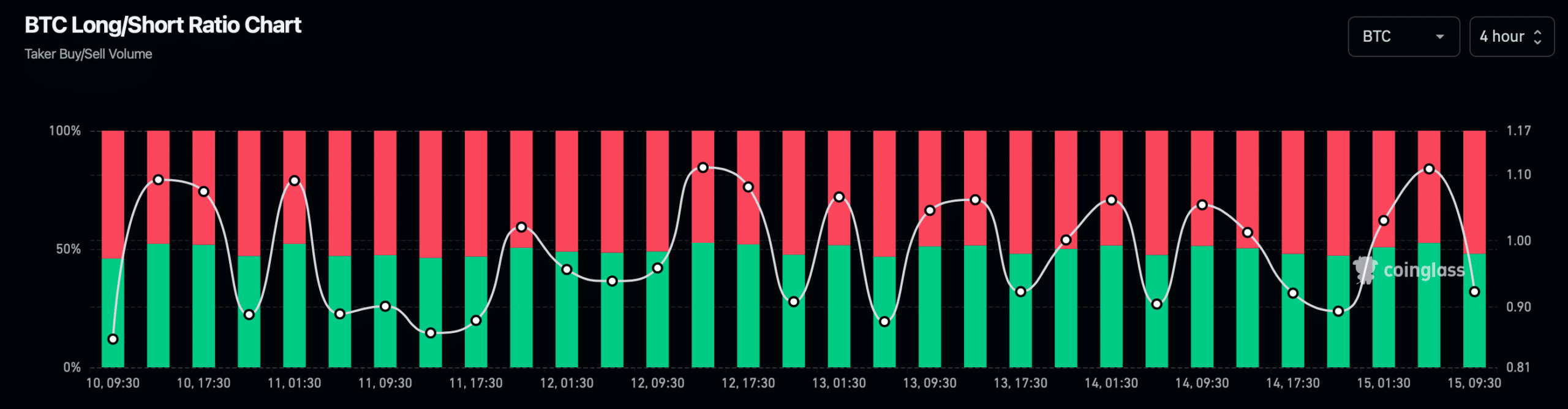

AMBCrypto’s analysis of Coinglass data revealed that BTC’s long/short ratio also fell sharply. This is a sign of bearish sentiment, with a greater emphasis on selling or shorting assets.

Source: Coinglass

Meanwhile, Lookonchain recently shared a tweet listing some key statistics that gave a better idea of whether investors should still consider buying Bitcoin. For starters, the tweet mentioned the Bitcoin Rainbow Chart.

According to the same, the rainbow chart showed that now is still a good time to buy BTC. Here, the Bitcoin Rainbow Chart is a tool that plots Bitcoin’s long-term price movements on a logarithmic scale.

The Relative Strength Index (RSI) is also a crucial indicator. According to Lookonchain data, BTC’s RSI had a value of 69.93. This, compared to historical data, implied that BTC has still not reached a market top. Apart from this, the 200-week moving average heat map highlighted that the prevailing price point was blue. Simply put, the price top has not yet been reached and it is time to hold and buy.

Is there anything bullish in the short term?

Since the aforementioned data sets pointed to BTC’s potential to grow further, AMBCrypto then analyzed Santiment’s data to look out for other bullish signals.

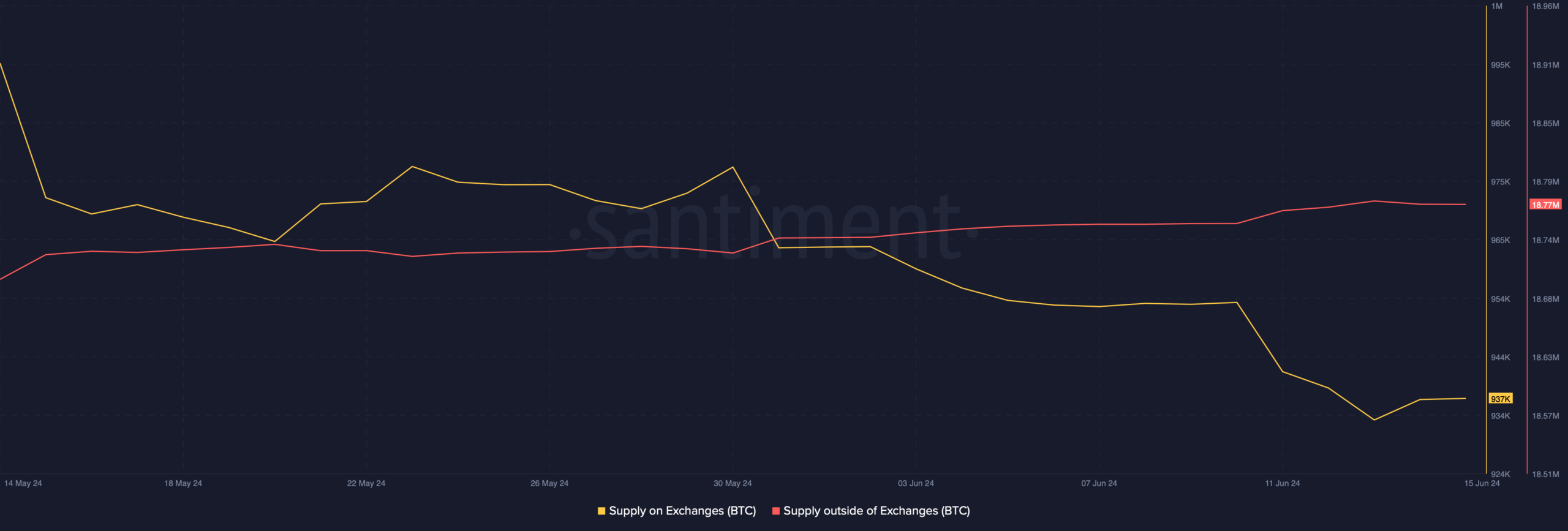

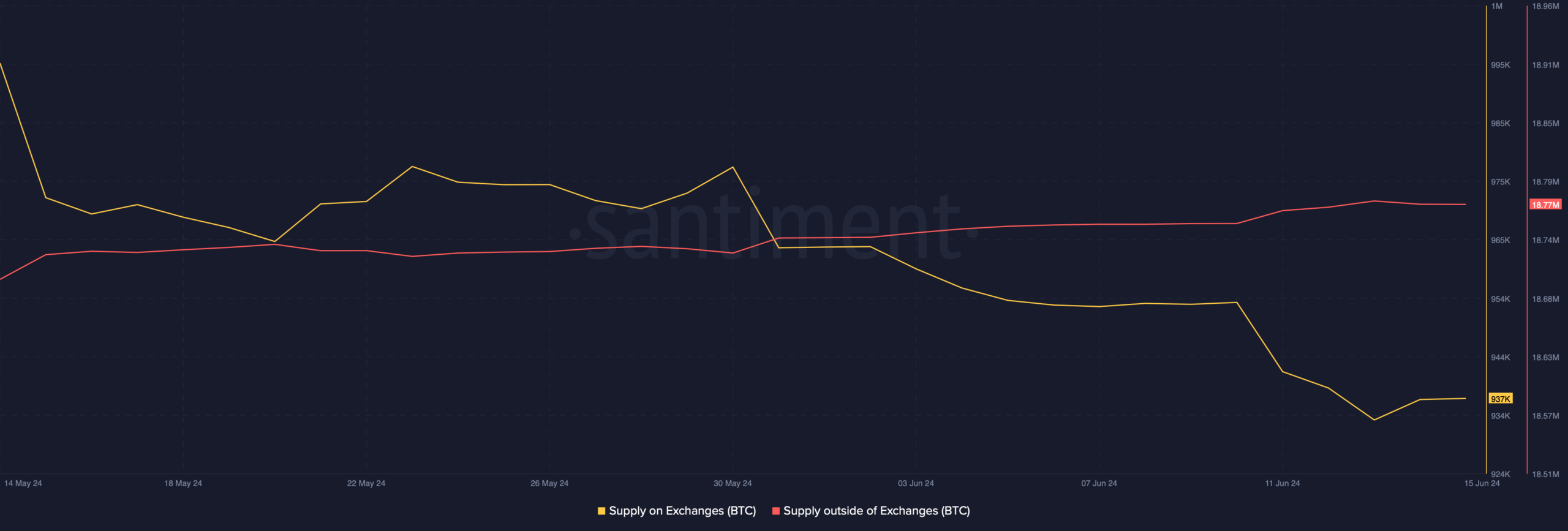

Source: Santiment

Likewise, buying pressure on BTC remains high, which can be inferred as a bullish signal. This was evident from the decline in supply on trade fairs and an increase in supply outside the trade fairs.

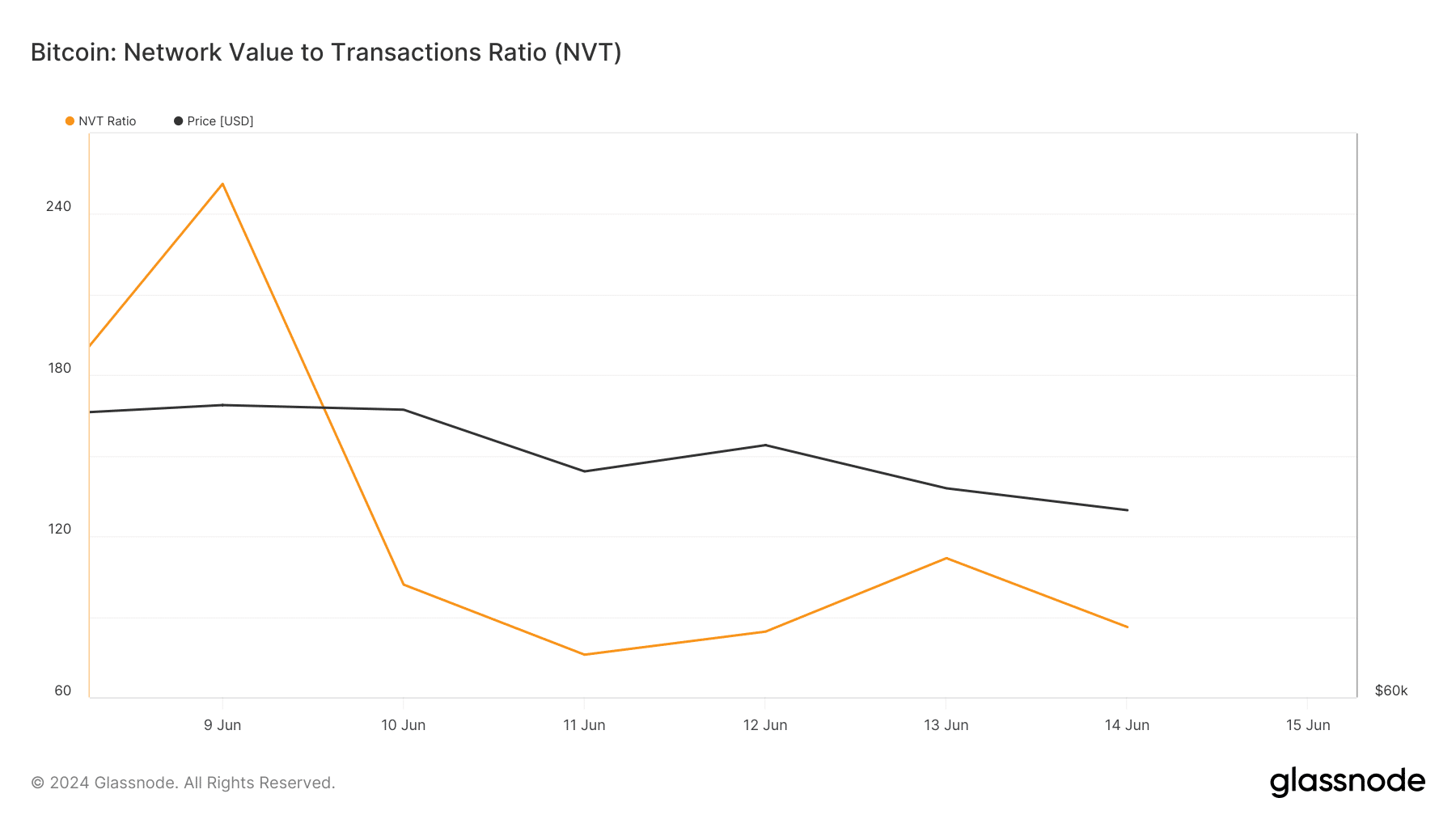

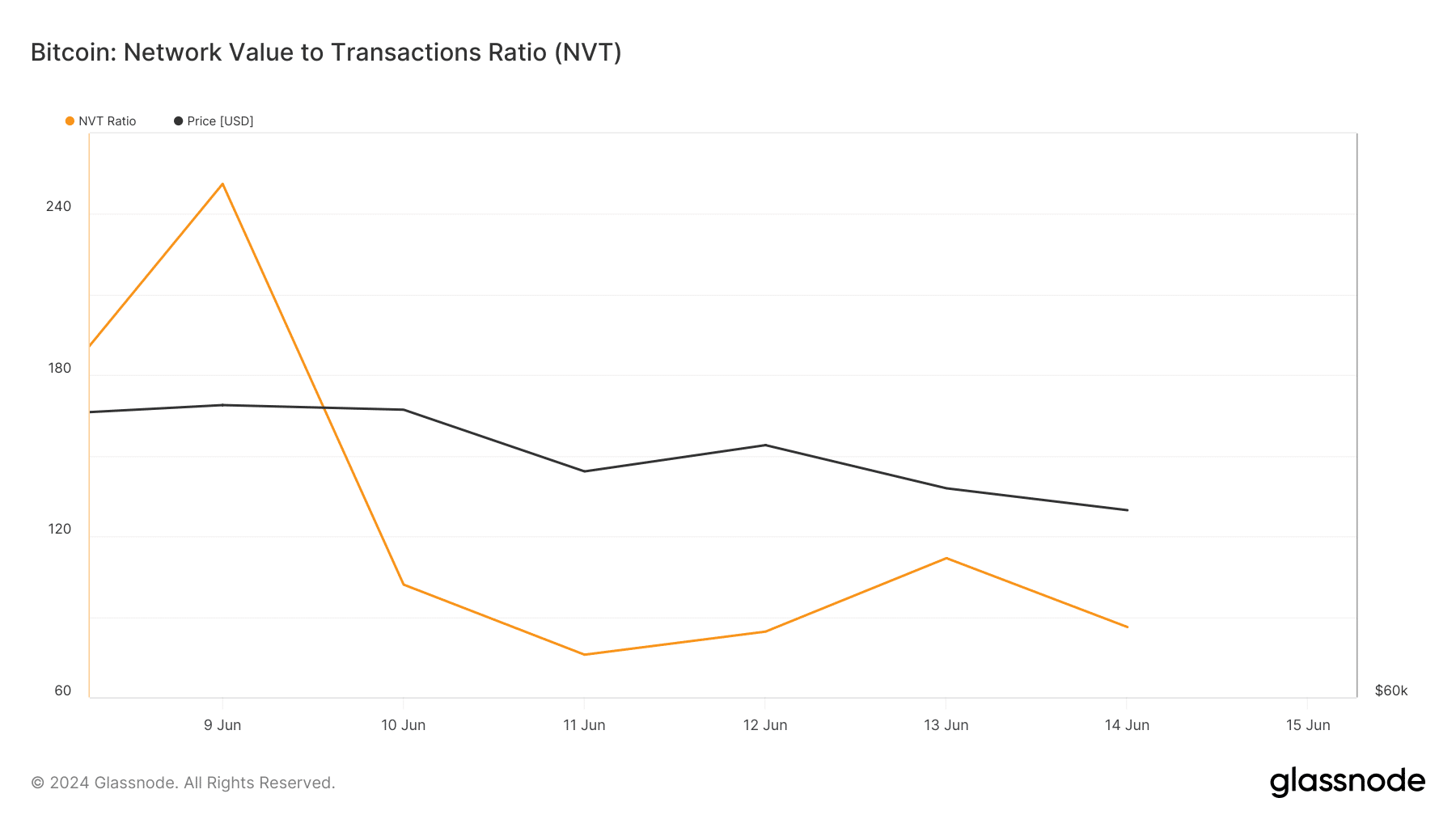

A look at Glassnode’s data also highlighted that BTC’s NVT ratio fell. A decline in this measure usually indicates a price increase in the future.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024-25

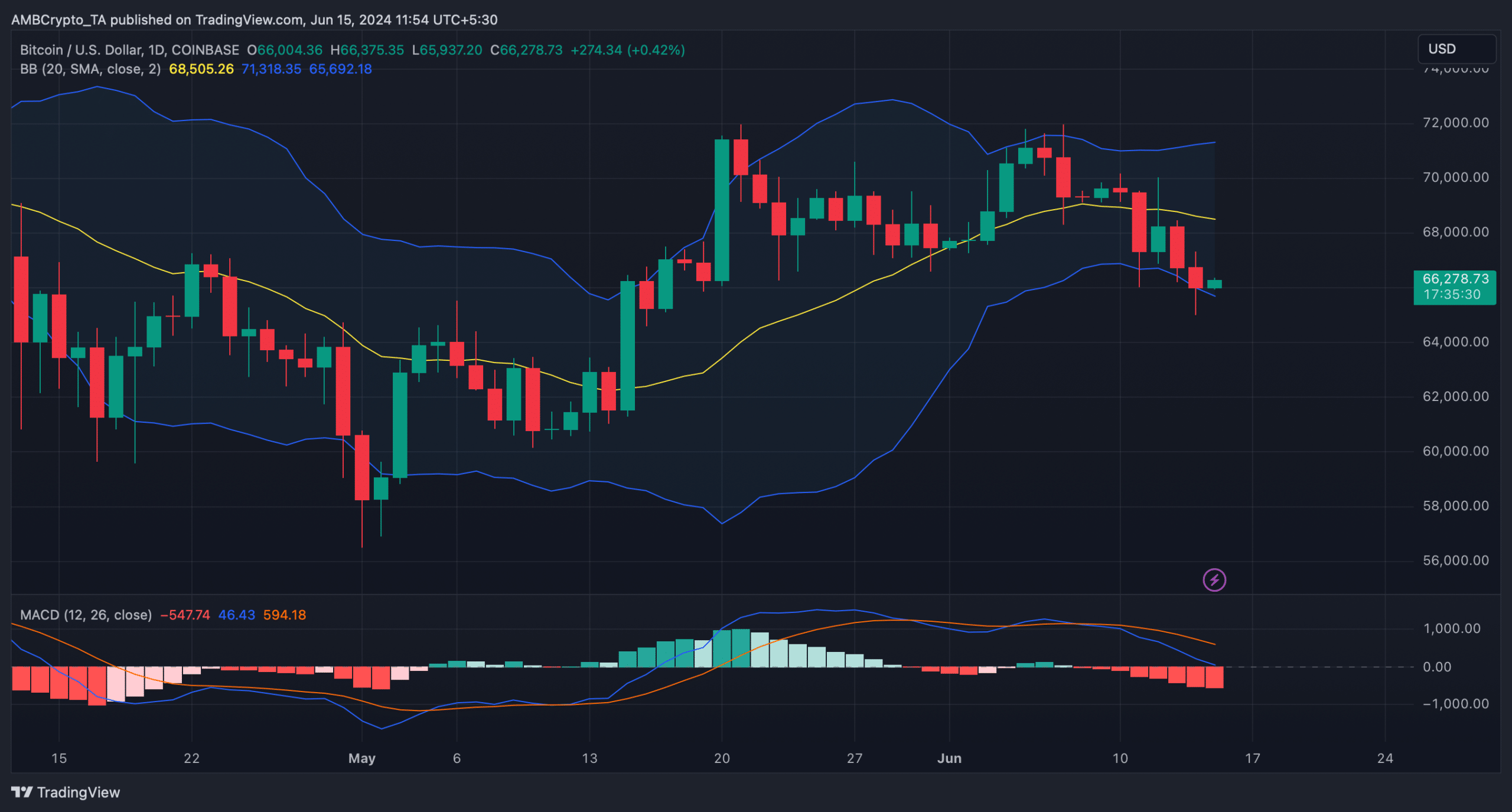

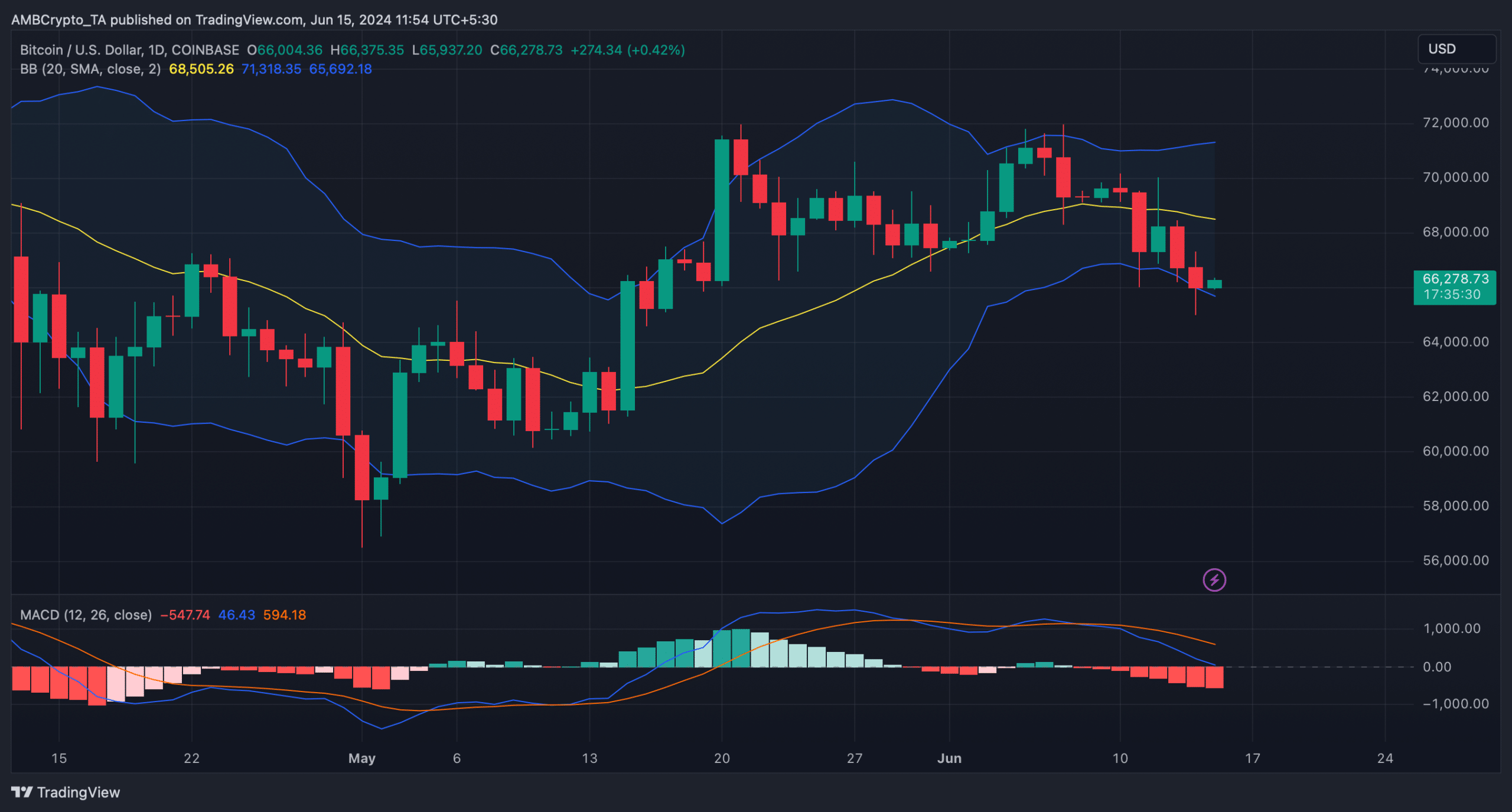

Finally, AMBCrypto’s analysis of the cryptocurrency’s daily chart revealed that BTC’s price reached the lower bound of the Bollinger Bands, indicating a possible price recovery.

On the contrary, the MACD showed a bearish advantage, indicating a further price decline. Ergo, some degree of caution wouldn’t be the worst idea for traders looking to profit from Bitcoin’s prevailing market trend.

Source: TradingView