- Filecoin’s price fell sharply before recovering and showed signs of recovery amid the market volatility

- The significant trading volume and OIs underlined continued investor interest in Filecoin

Over the past week, Filecoin (FIL) has seen significant volatility in its price movements. In fact, the altcoin’s price fell sharply from around $4.20 to less than $3.40 on July 5. This decline was followed by a recovery phase, during which the price rose again to around $4.00 on July 7.

At the time of writing, Filecoin was priced at $3.92, thanks to an increase of 1.7% compared to the previous trading period. The price has fluctuated within a 24-hour range of $3.84 to $3.98, indicating a relatively stable but slightly upward trend in the short term. These modest gains came amid fluctuating market conditions and investor sentiment.

Market activity and investor interest

Filecoin’s trading volume over the last 24 hours was $102,563,467, indicating a healthy level of market activity. Its market capitalization also reached $2,225,402,277, making it a notable player in the cryptocurrency market. However, what does this mean for FIL’s price action in the near term? Is it time for buyers to finally enter the altcoin market?

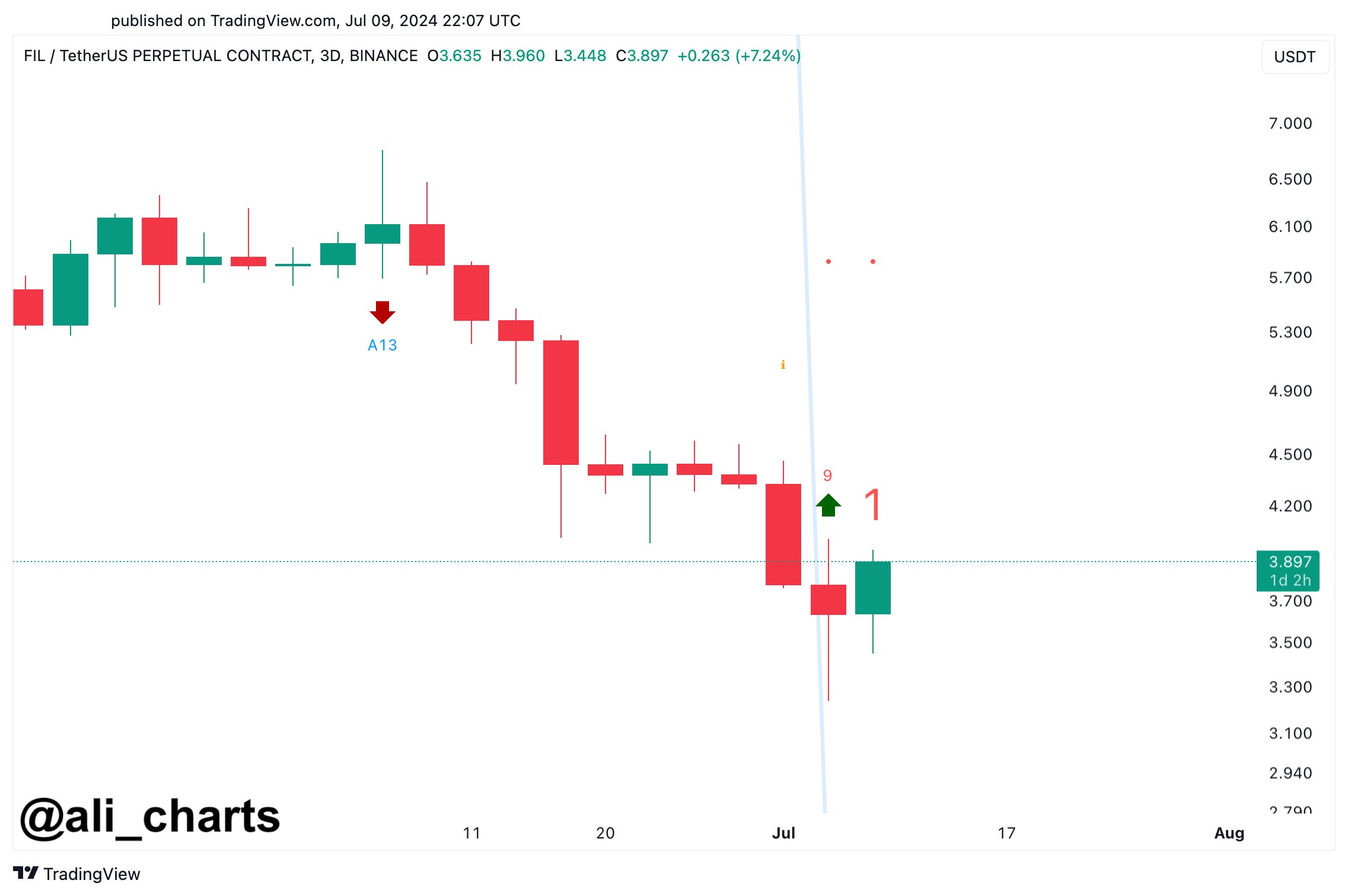

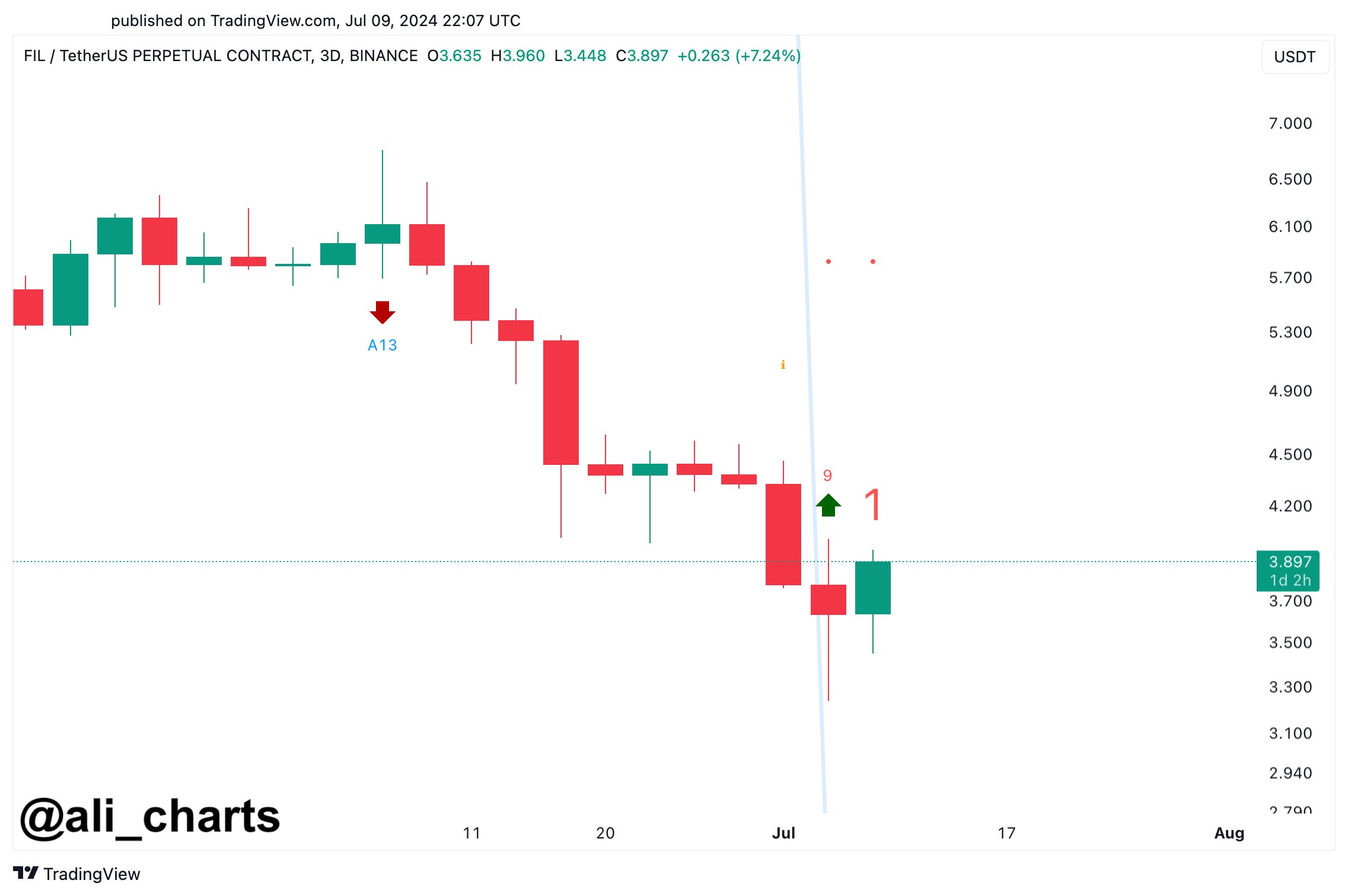

Ali, a market analyst at X, had something to say about this: to observe,

“The TD Sequential presents a buy signal on the #Filecoin $FIL 3-day chart, anticipating a one to four candlestick recovery.”

Simply put, a potentially bullish trend can be observed in the short term.

Source:

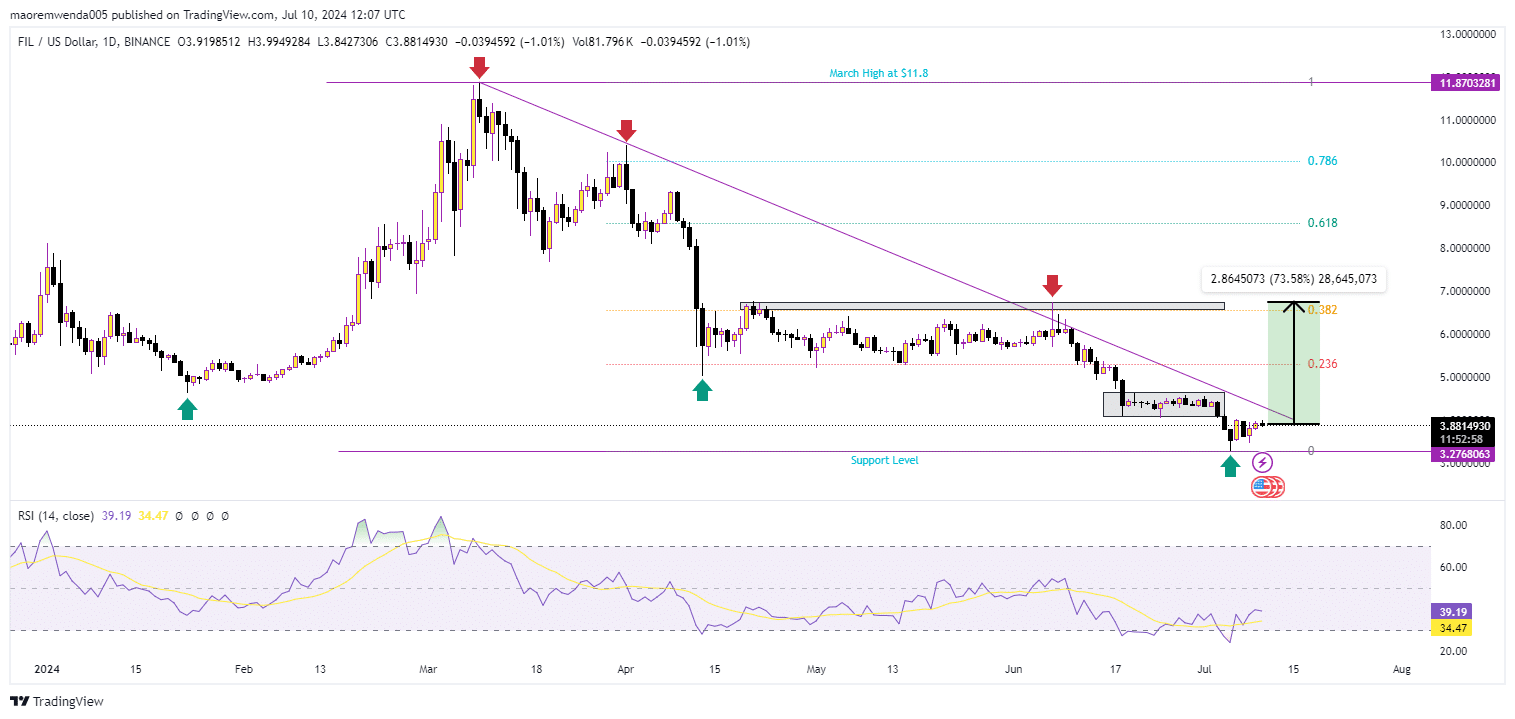

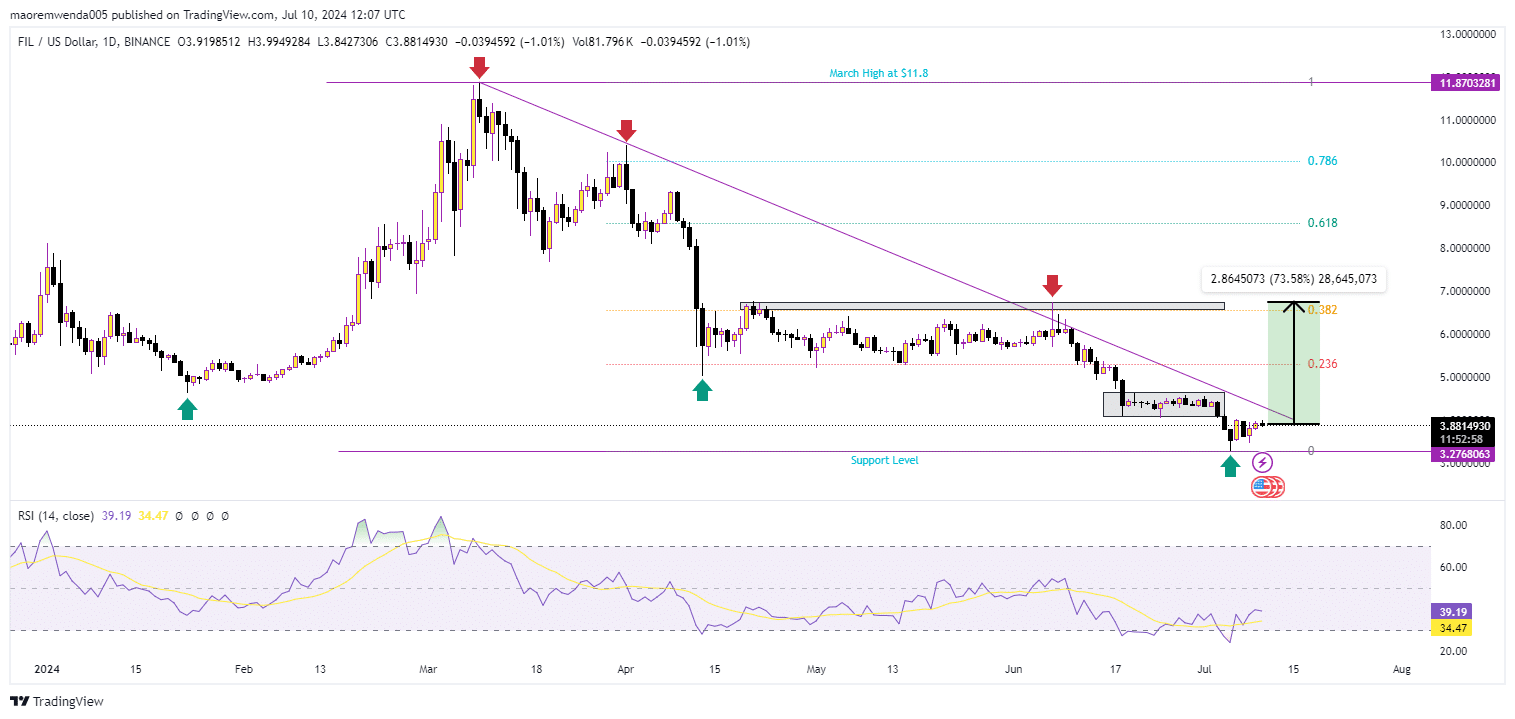

Technical analysis and support levels of Filecoin

The altcoin’s TA identified significant resistance levels near $11.87 and around $7.00-$7.20, with the same aligning with the Fibonacci retracement levels. A support level was also seen at $3.77, which the price recently tested and recovered from, creating a bullish candlestick pattern. Additional support appeared to be around $4.00, which correlated with the Fibonacci retracement level of 0.236.

The Relative Strength Index (RSI) was at 39.19, below the neutral 50 mark – well within bearish territory. On the contrary, it also underlined signs of upward movement due to increasing buying momentum.

Volume analysis also indicated significant buying interest around the $3.77 support level, as indicated by green arrows on the chart.

Source: FIL/USD, TradingView

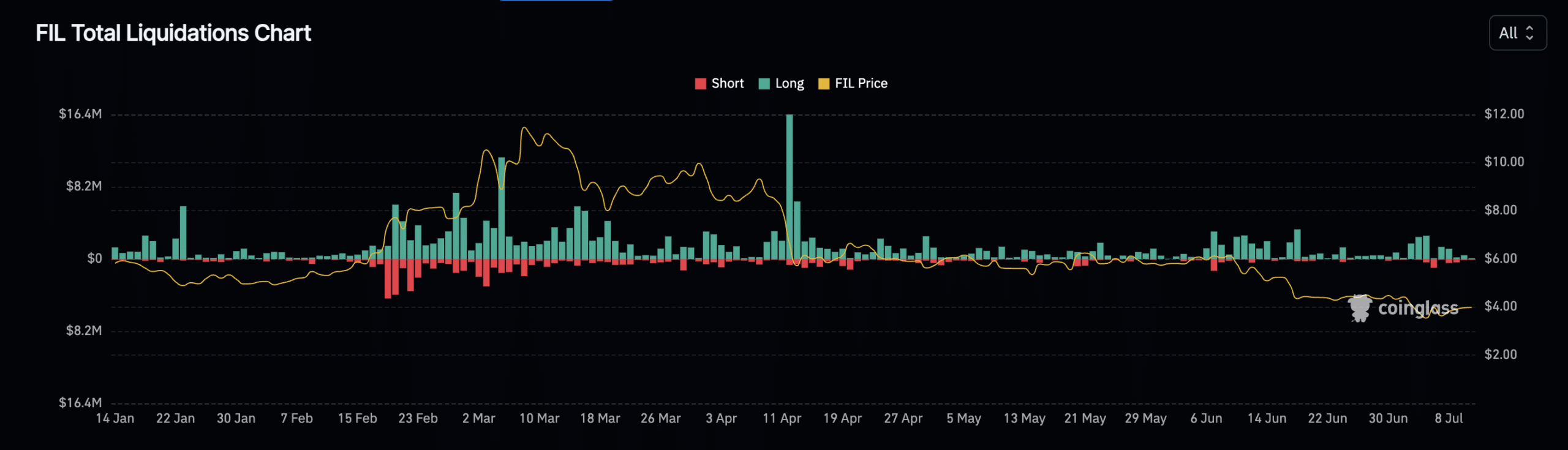

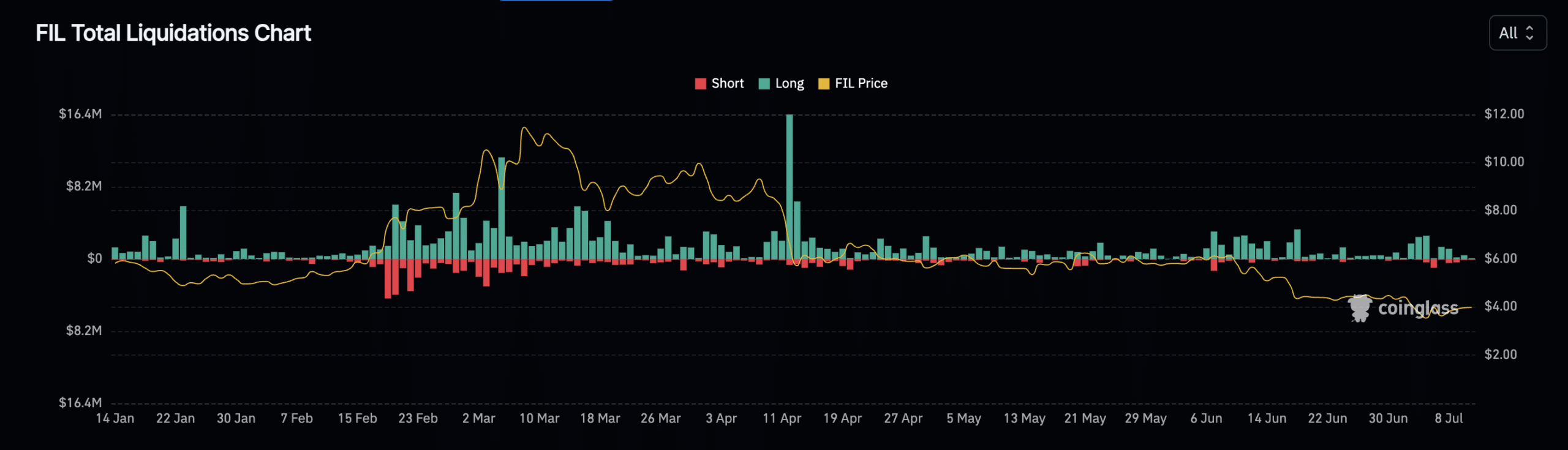

Finally, according to Mint glassthere were minimum short liquidations of $59.2K and long liquidations of $279.11K, indicating a lower level of liquidation activity for the day. FIL’s Futures Open Interest also recorded figures of around $130 million, reflecting the total value of outstanding Futures contracts for Filecoin.

Source: Coinglass