- Cardano rose by more than 4% in 24 hours

- Altcoin’s Open Interest fell despite its rise in the charts

In the past 24 hours, Cardano has shown the first signs of recovery after a series of recent declines. This positive price movement is a welcome change for investors and holders. However, sustaining this upward trend will require broader support from additional key metrics.

Cardano sees recovery in trends

The recent price development for Cardano, as analyzed on a daily time frame, indicated a recovery after a notable downtrend.

According to AMBCrypto’s analysis, ADA registered a decline of more than 4% between July 22 and 26. The price fell from about $0.4 to about $0.39 during this period.

However, there has been a significant reversal in the past 24 hours. The price rose more than 4% to settle at around $0.41. This rebound has effectively halted the previous decline, putting ADA back into the $0.4 price zone.

Source: TradingView

Furthermore, the altcoin’s price movement at press time brought Cardano to the brink of crossing the neutral line on its Relative Strength Index (RSI). Typically, an RSI reading of 50 represents neutral market dynamics, neither clearly bullish nor bearish.

ADA’s RSI approaching this point indicates that bearish momentum is losing steam, potentially paving the way for stable market conditions or a bullish trend if the recovery continues.

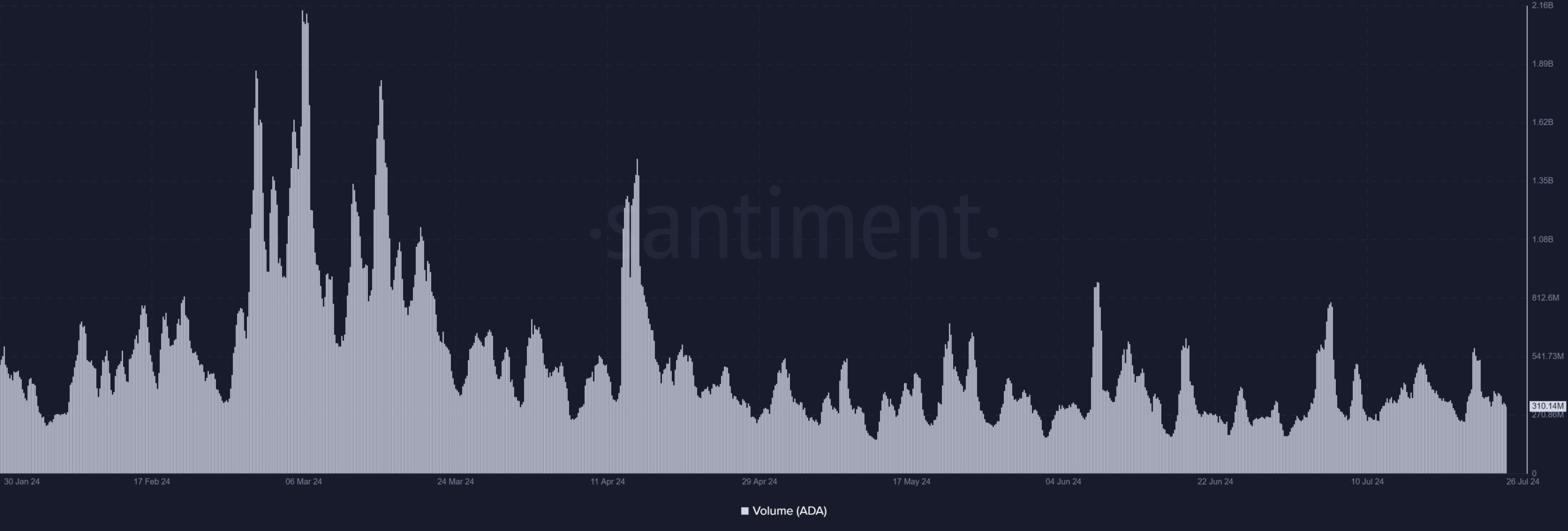

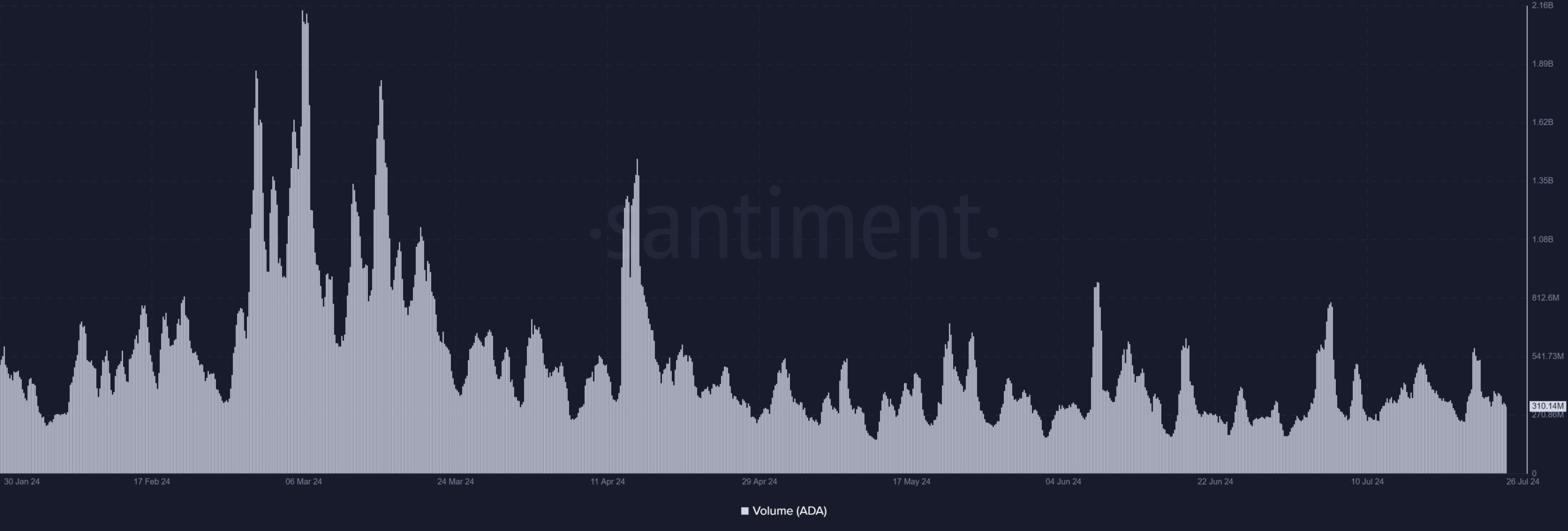

Cardano’s volume is decreasing

However, trading volume for Cardano (ADA) showed a significant decline over the past 24 hours. Volume increased from approximately $390 million on July 25 to approximately $310 million. This over 15% decline in trading volume is a crucial aspect to consider, especially given ADA’s recent price discovery.

Source: Santiment

For ADA, the observed decline in trading volume could pose a challenge to maintaining the ongoing uptrend.

If trading volume continues to decline or remains low, this could indicate a weakening in demand at higher price levels. This could lead to price stabilization or even a reversal if sellers dominate.

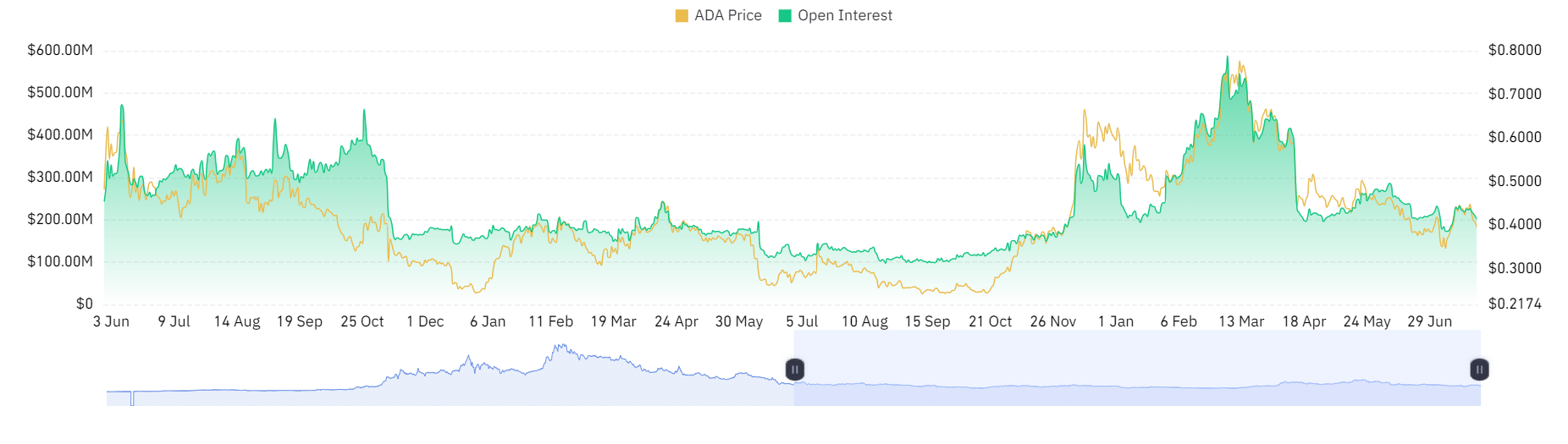

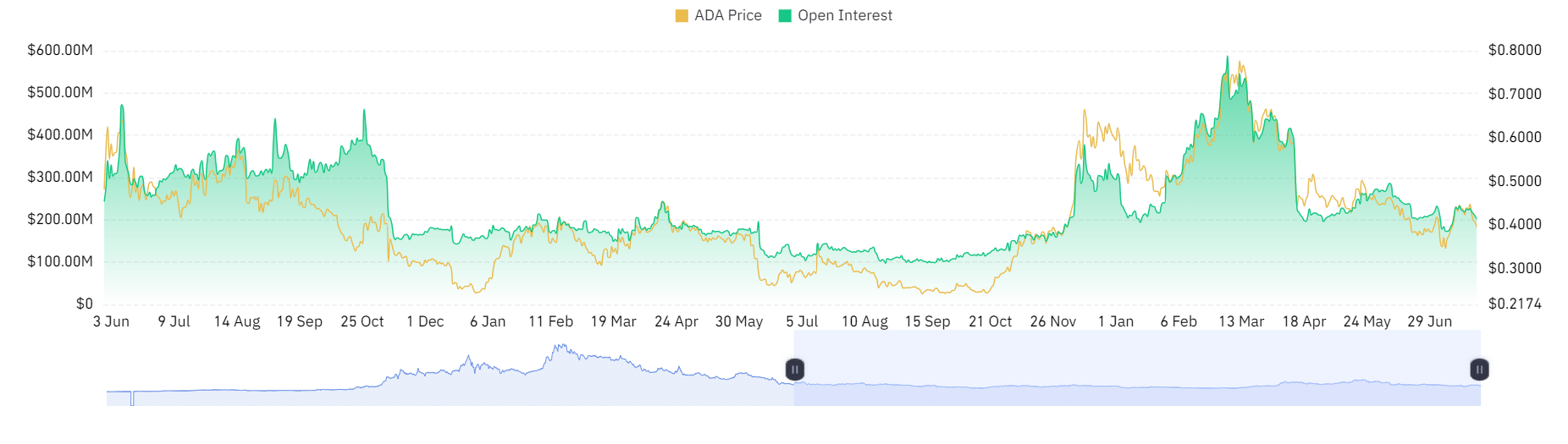

Declining interest in ADA

An analysis of Cardano’s Open Interest Mint glass There has been a slight decrease in the past 24 hours. It fell to around $201 million from about $208 million in the previous trading session.

Open interest measures the total number of outstanding derivative contracts (such as futures and options) that have not yet been settled. A drop in Open Interest usually indicates that some traders are closing their positions.

Source: Coinglass

– Is your portfolio green? View the Cardano Profit Calculator

For Cardano, this drop in open interest could mean a decline in market confidence or a reduction in speculative activity, especially if this trend continues.

It suggests that new trading interests are not strongly supporting recent price movements, which affects the sustainability of continued price increases.