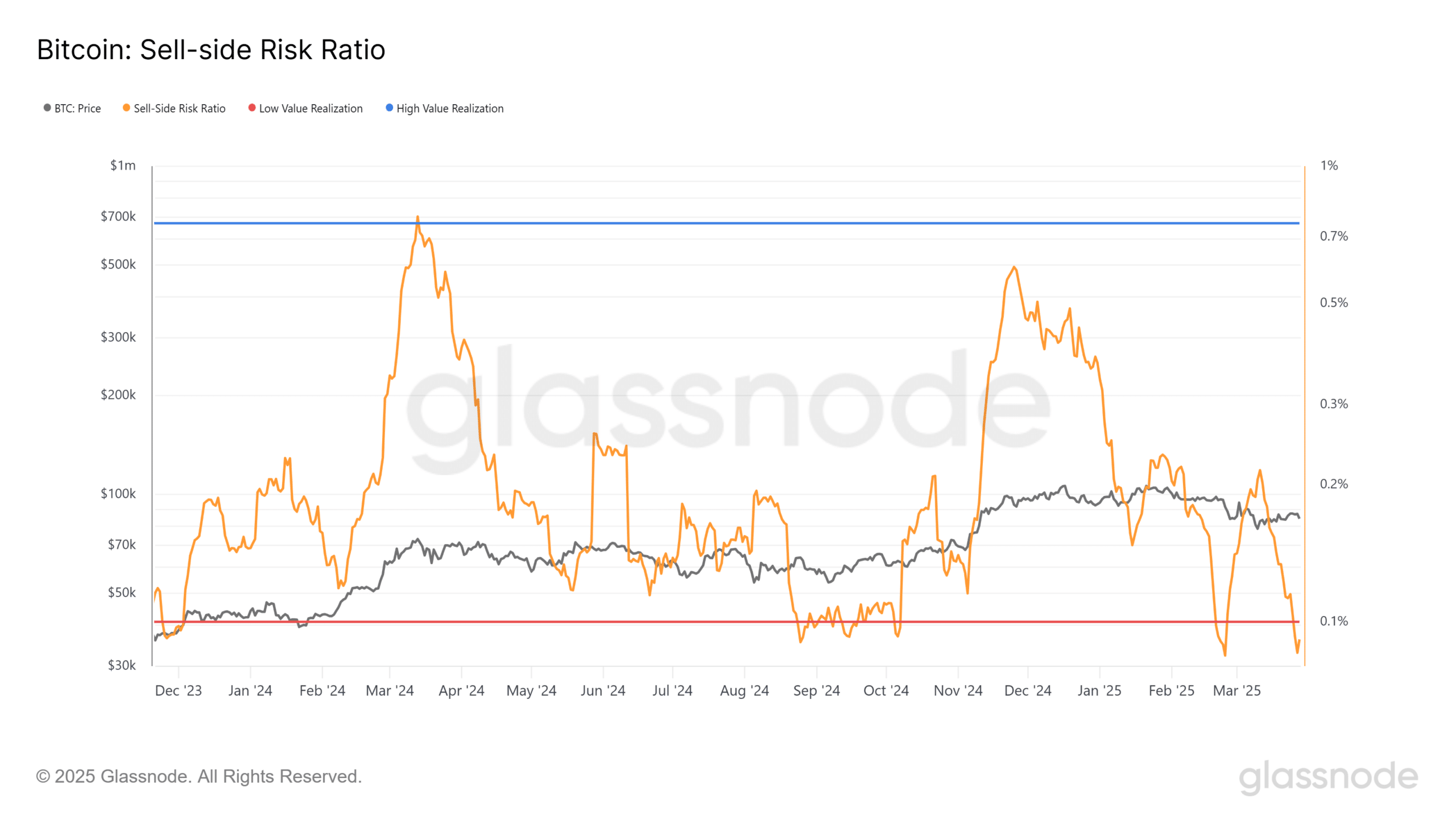

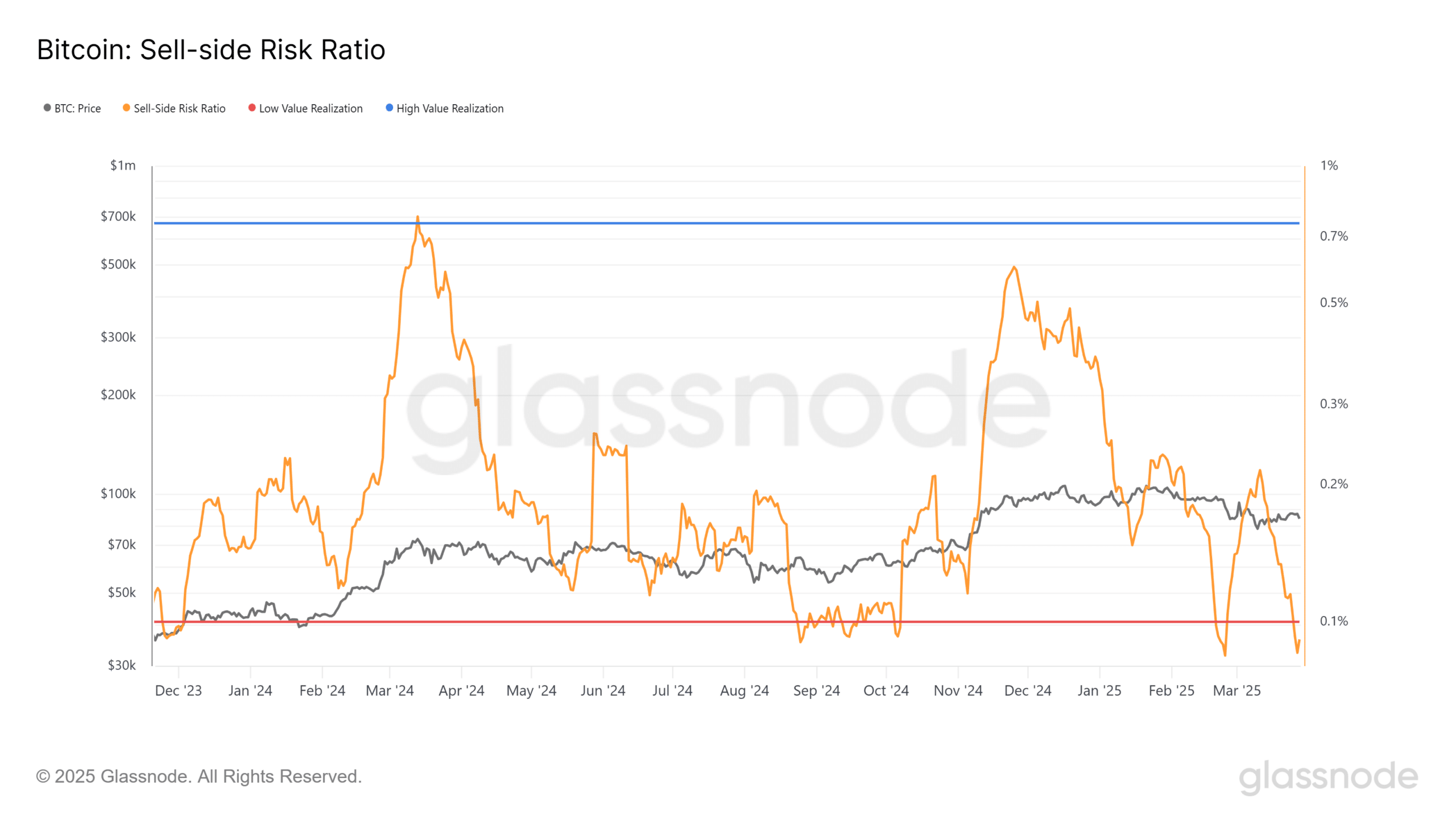

- The Bitcoin sales ratio drops to 0.086%, historically a level that precedes large rebounds.

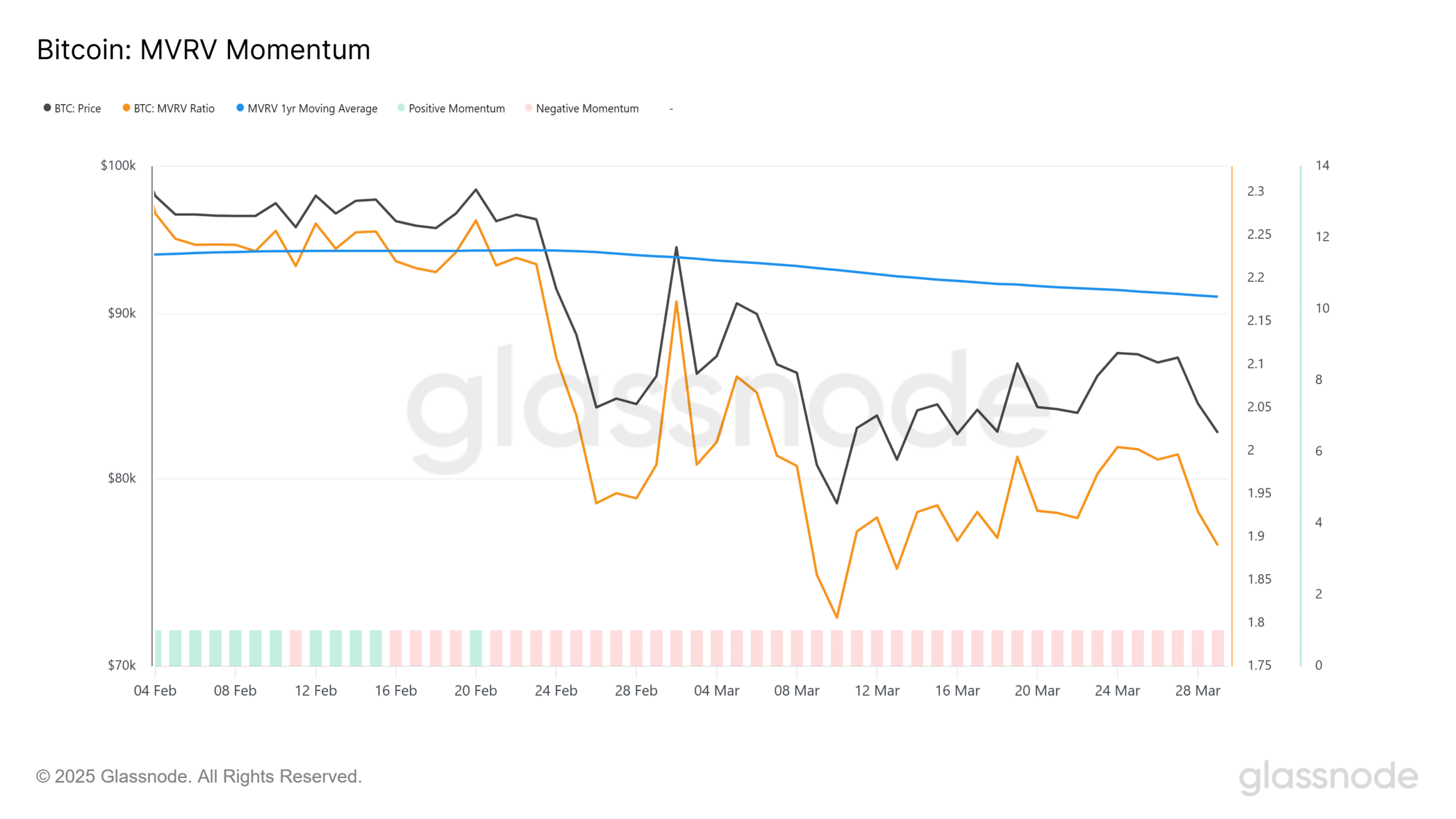

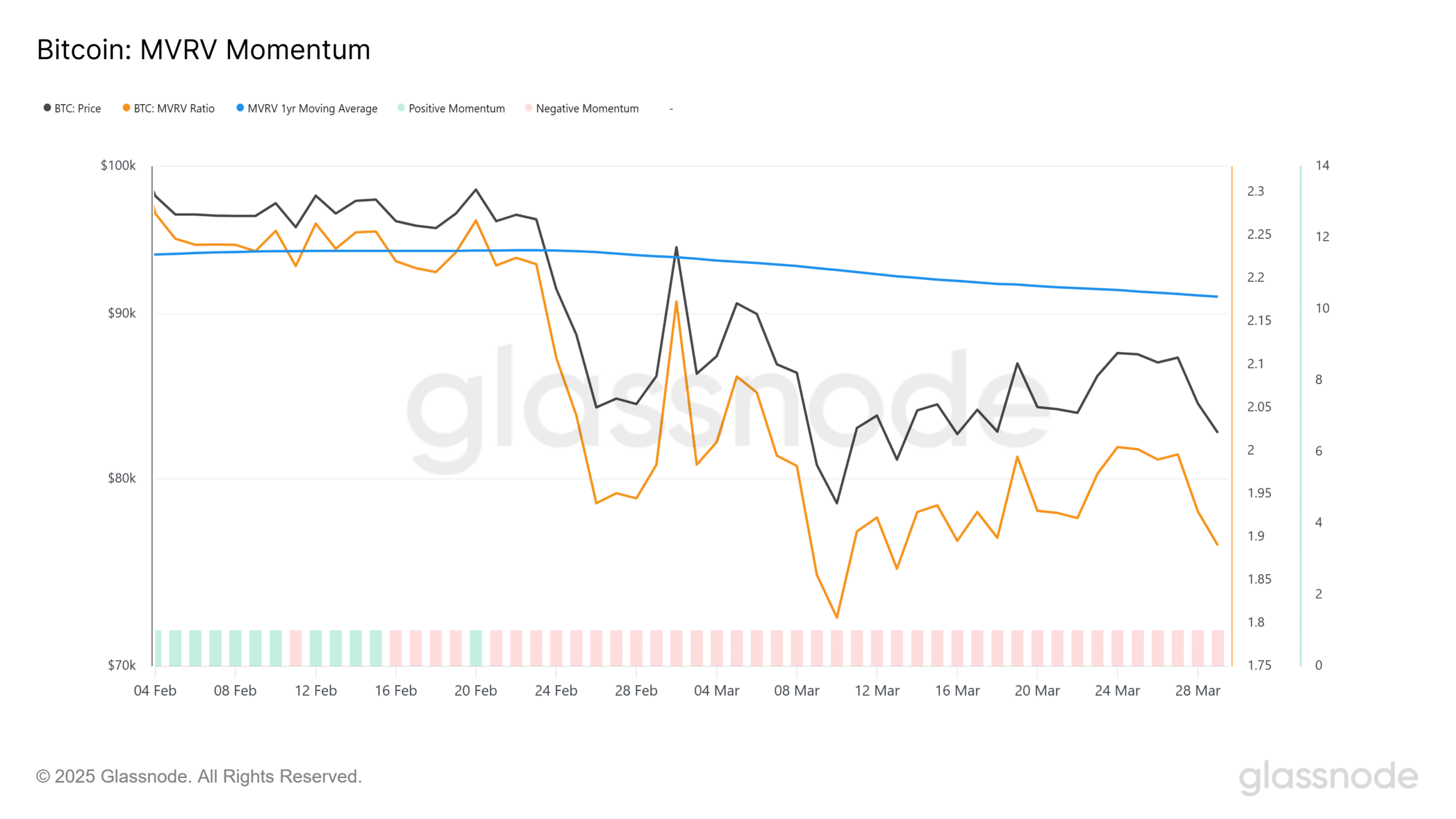

- MVRV Momentum can turn bullish around if the ratio over his 70-day advancing average crosses.

Bitcoin [BTC] Can prepare for a new rally, with two important indicators in chains that flash historic reversal signals.

The latest decrease in sales on the sales side and a potential bullish crossover in MVRV Momentum bring optimism back to the market.

Immerse

Bitcoin’s SSELL-SIDE-RISCOIN have fallen to 0.086%, the lowest level in months.

Historically, this metriek that falls under 0.1% has strong bounce-back zones, which is a reflection of suppressed profit achieved compared to market capitalization.

Source: Glassnode

These periods with a low risk often coincide with the hesitation of investors to sell, which reduces the overhead pressure on the price.

The last time the ratio dropped below this level was during the correction of Bitcoin in September 2024, just before it organized a recovery of new highlights in Q4.

Currently, the ratio again signals a limited risk of taking a profit, making it a scene for a possible reversal such as buying momentum return.

Bitcoin MVRV close to Bullish Crossover

The 70-day MVRV momentum is about to break above the advancing average, a crossover that has confirmed historic soil formations.

The MVRV ratio, which compares the market value with realized value, is often used to identify undervaluation zones.

Source: Glassnode

The MVRV ratio of Bitcoin has remained below the 70-day average for weeks and reflects the pre-bullish setups that were observed at the end of October and January.

A confirmed breakout could act as the final attachment of a soil, especially because the wider macroom environment stabilizes.

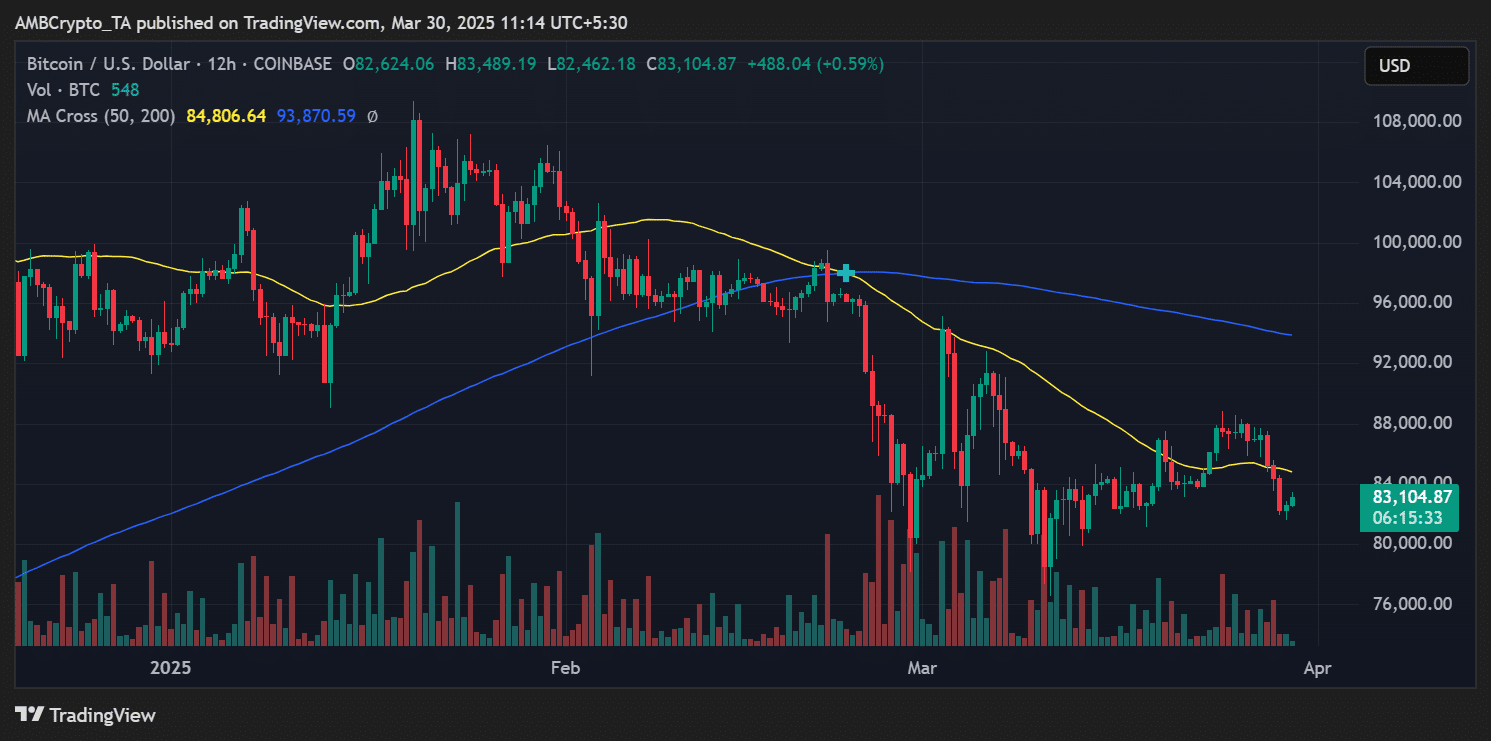

Bitcoin price is struggling under the most important progressive averages

Bitcoin traded around $ 81,100 at the time of the press, with the 50-day and 200-day advanced averages at $ 84,934 and $ 93,916 respectively.

Source: TradingView

The inability to win back the 50-day MA remains a concern in the short term. However, the technical setup and on-chain statistics suggest that sellers are exhausted and that accumulation is gradually returning.

As BTC $ 85k, this can unlock this bullish momentum to the psychological barrier of $ 90k. Until then, the market can vary, with the current setup prefer accumulation strategies.