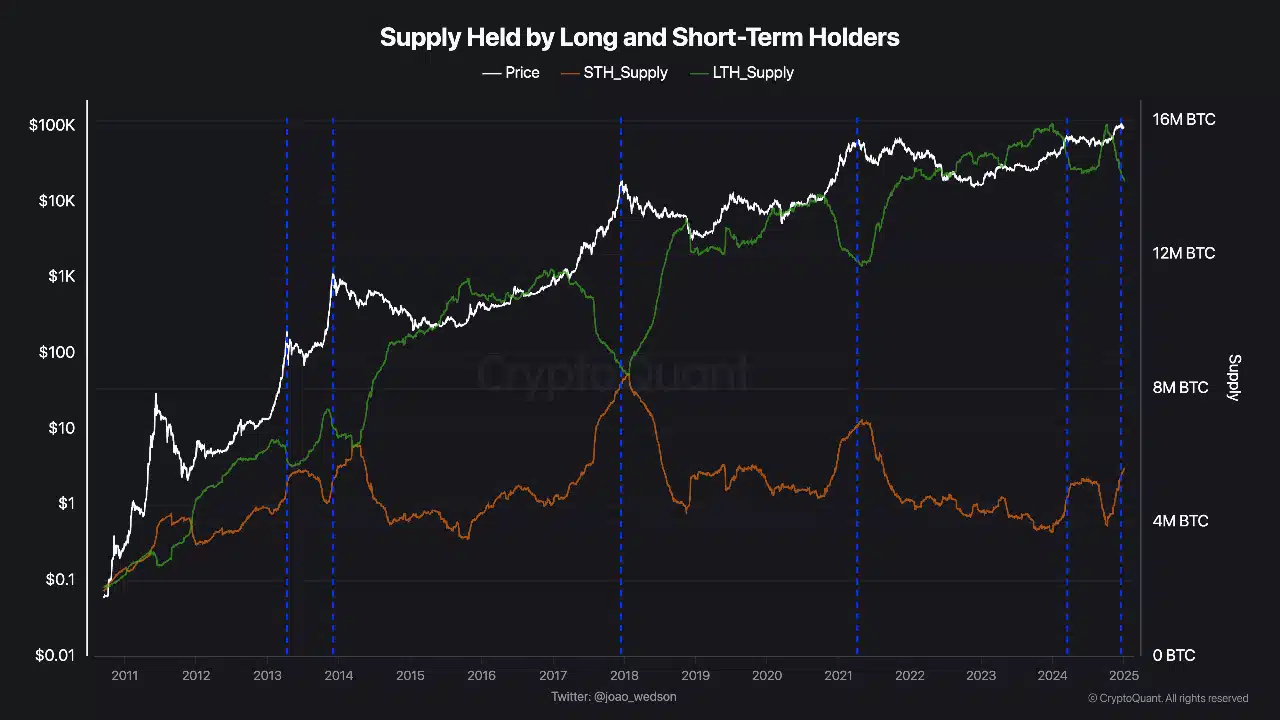

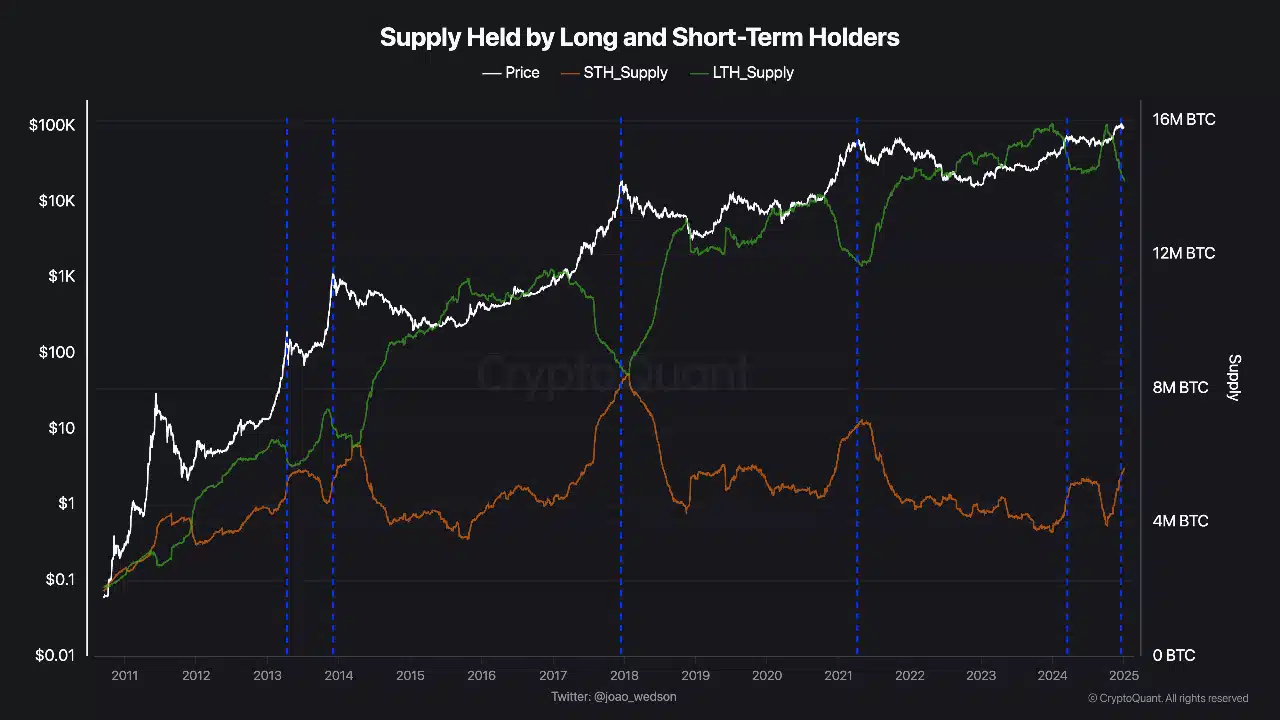

Bitcoin: supply dynamics and market behavior

Source: Cryptoquant

The dynamics between long-term and short-term holders play a crucial role in shaping Bitcoin’s price trends. STH supply spikes often correlate with market tops, contributing to increased volatility.

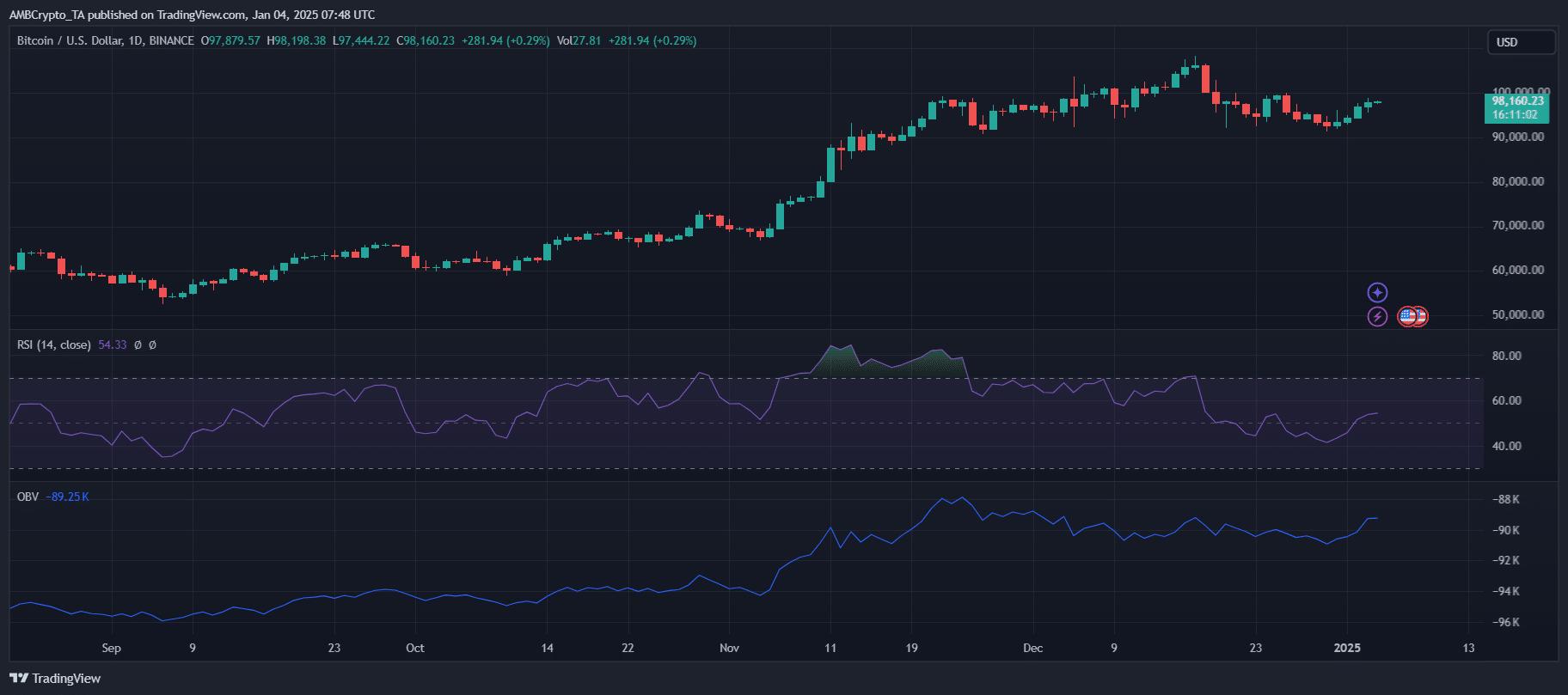

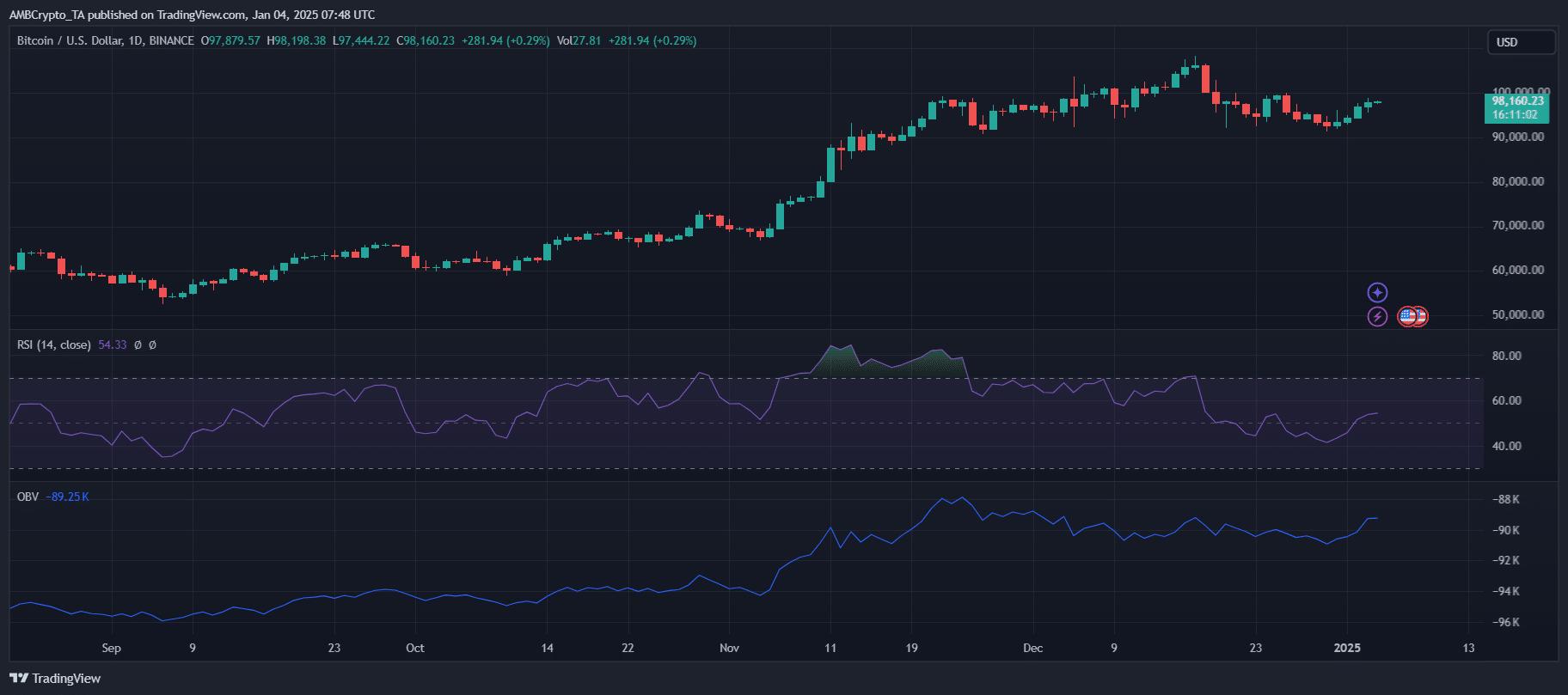

The STH SOPR’s recent neutral stance indicated selling pressure at breakeven levels, adding to investor hesitation. Resistance around $85,000 – $99,000 further suggested that consolidation or cautious accumulation could be likely, with the potential for greater volatility in the near term.

Read Bitcoin’s [BTC] Price forecast 2025-26

The way forward

Source: TradingView

Bitcoin’s STH SOPR trends pointed to a pivotal moment for market sentiment. Investors should keep an eye on the key support at $85,000 and the resistance at $99,000 as signals for the next move.

A break below $85,000 could lead to further selling pressure, while regaining $99,000 could lead to renewed bullish momentum. Given the ongoing consolidation phase, cautious accumulation could be feasible, but traders should be prepared for potential volatility.