- Bitcoin’s recent on-chain metrics pointed to a potential market top, with a cycle peak similar to previous years.

- Analysts noted increased sales activity, in line with historical trends.

Bitcoin [BTC] was going through a recession at the time of writing, reversing the previous rally above $63,000.

Over the past week, the cryptocurrency has now seen a decline of 1.1%, with a more significant drop of 2.7% in the past 24 hours alone, dropping its trading price to $60,929.

Amid these market movements, Charles Edwards, the founder of Capriole Investments, has done just that indicated that several on-chain metrics point to a possible weakening of Bitcoin’s market strength.

Bitcoin’s turning point?

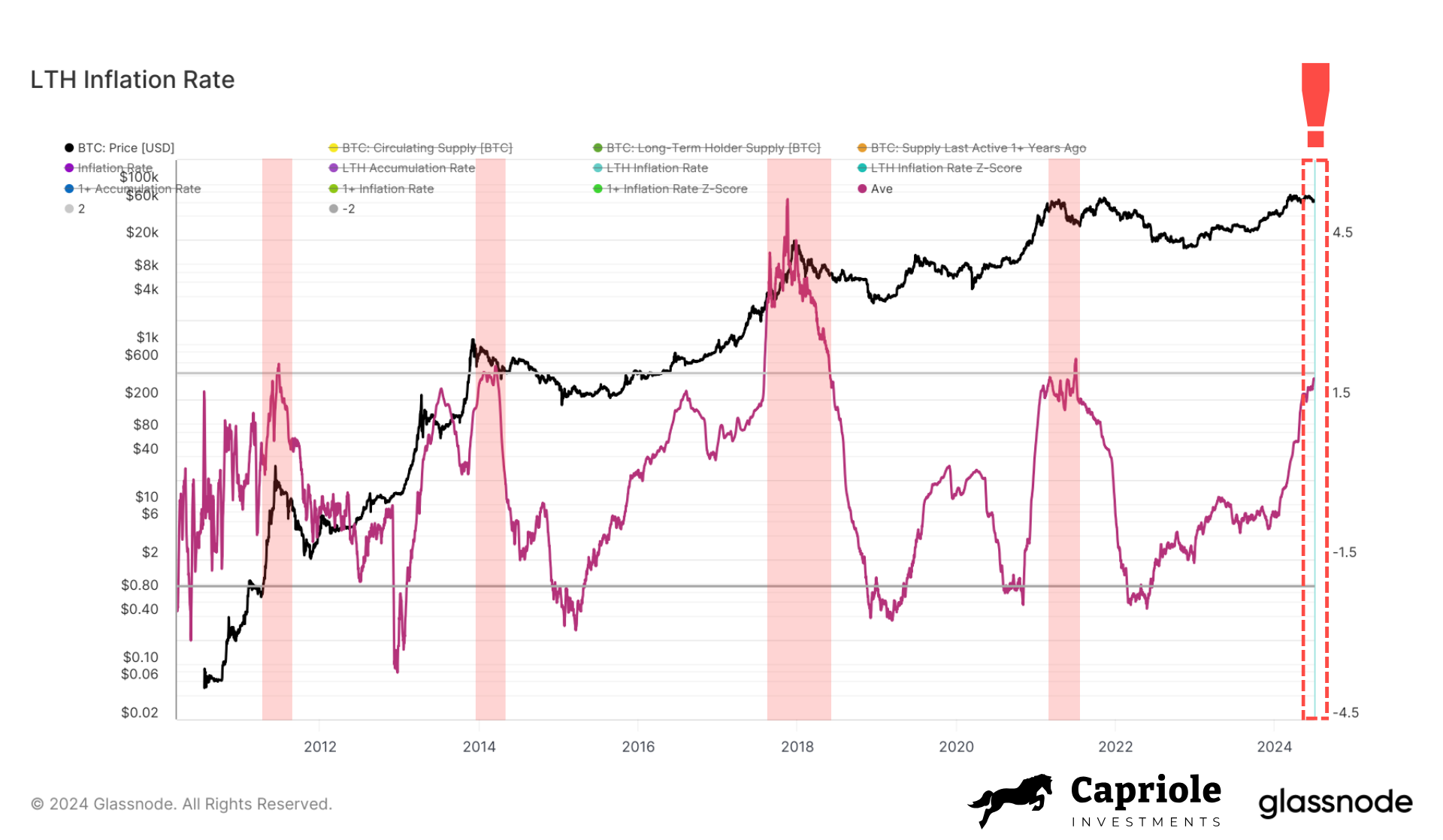

Charles Edwards pointed to several indicators in the chain as potential for market exhaustion. OA key sign is the behavior of Bitcoin long-term inflation (LTH), which Glassnode monitors.

The LTH inflation rate, which measures the annual rate at which long-term holders sell their Bitcoin against newly mined coins, has been rising steadily over the past two years.

Currently it is hovering near a critical point historically associated with market tops. Edwards noted that LTH market inflation approaching nominal inflation of 2.0 often signals a cycle peak.

At the time of writing, the king coin was dangerously close to 1.9.

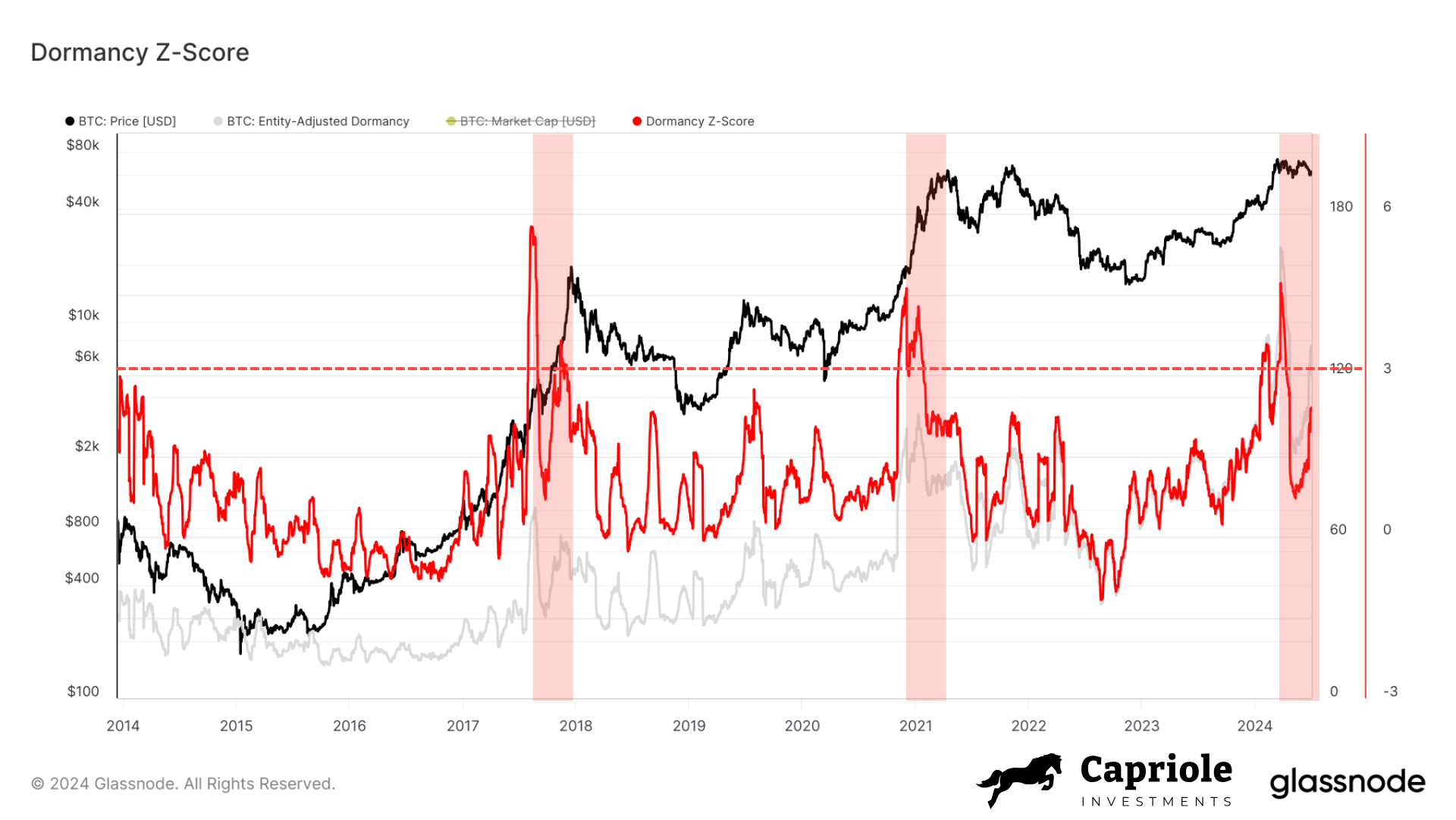

Another crucial metric discussed by Edwards was the Dormancy Flow, which evaluated the value of coins issued relative to their age and total transaction volume.

Recent data has shown a sharp increase in the Dormancy Z-score, especially in April 2024, which could imply that older coins are moving at a pace reminiscent of a cycle top.

Edwards explained:

“Peaks in this metric (z-score) typically see a cycle top only three months later. Well, it’s now three months later. The price has only continued to decline and the peak of the Dormancy Z-Score continues to exhibit a structure very similar to the peaks of 2017 and 2021.”

The Dormancy Flow Z-score suggested at the time of writing that Bitcoin’s price may be peaking for this cycle as it appeared overvalued based on the transaction volumes of older coins, possibly signaling a broader market decline.

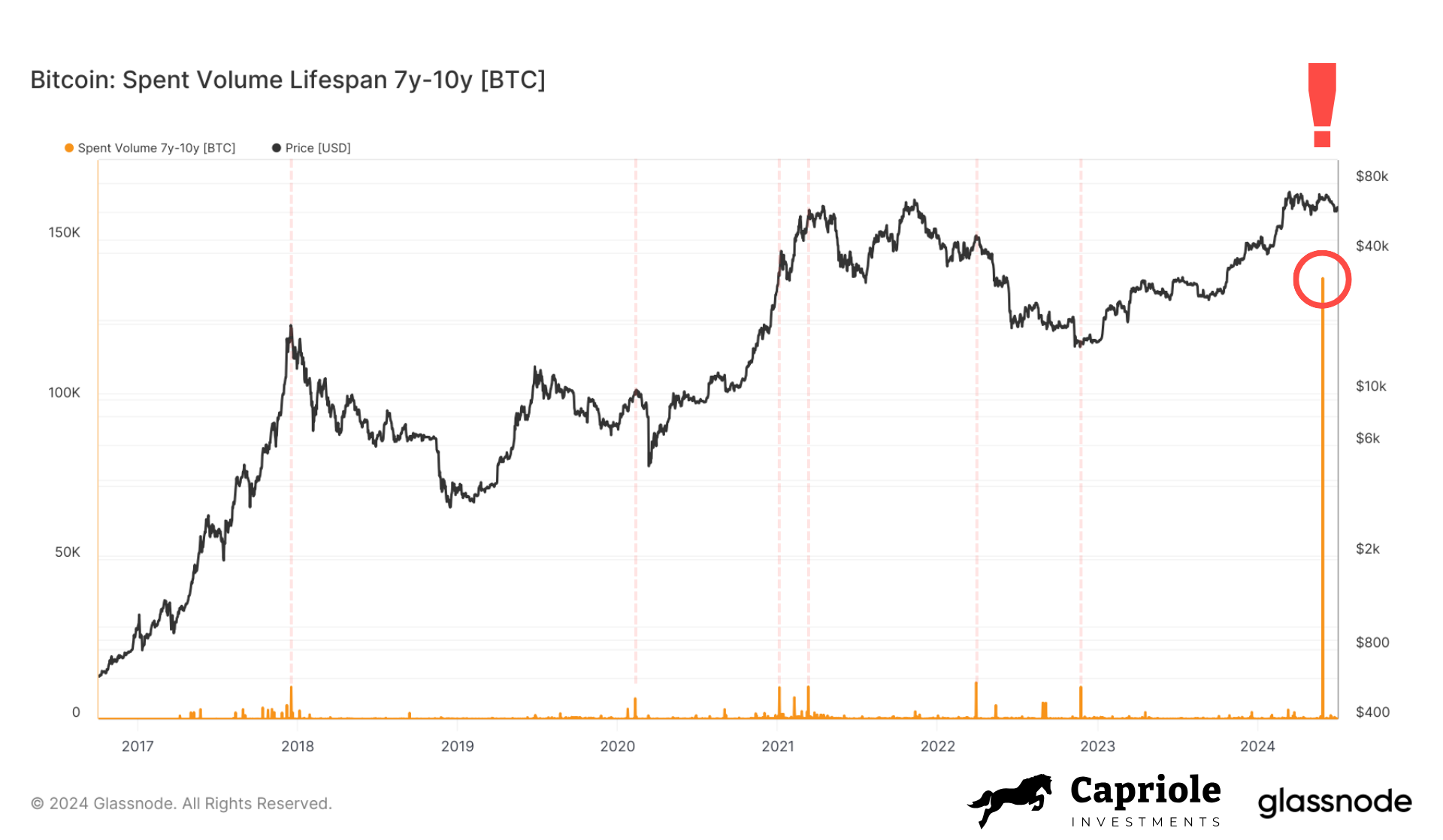

Additionally, spikes in Bitcoin issued volume, especially for 7- to 10-year-old coins, often indicate the peak of a cycle due to increasing market risk.

Edwards noted a significant increase in issued volume in 2024 and described the movement of an unprecedented amount of Bitcoin on-chain as extraordinary.

He also mentioned that more than $9 billion worth of Bitcoin has been mobilized from dormant accounts more than a decade old, mainly in connection with the settlement activities of the defunct Mount Gox exchange.

Cycle top in: are traders aware?

Although Charles Edwards highlighted potential weaknesses in Bitcoin’s price, it is wise to explore other perspectives.

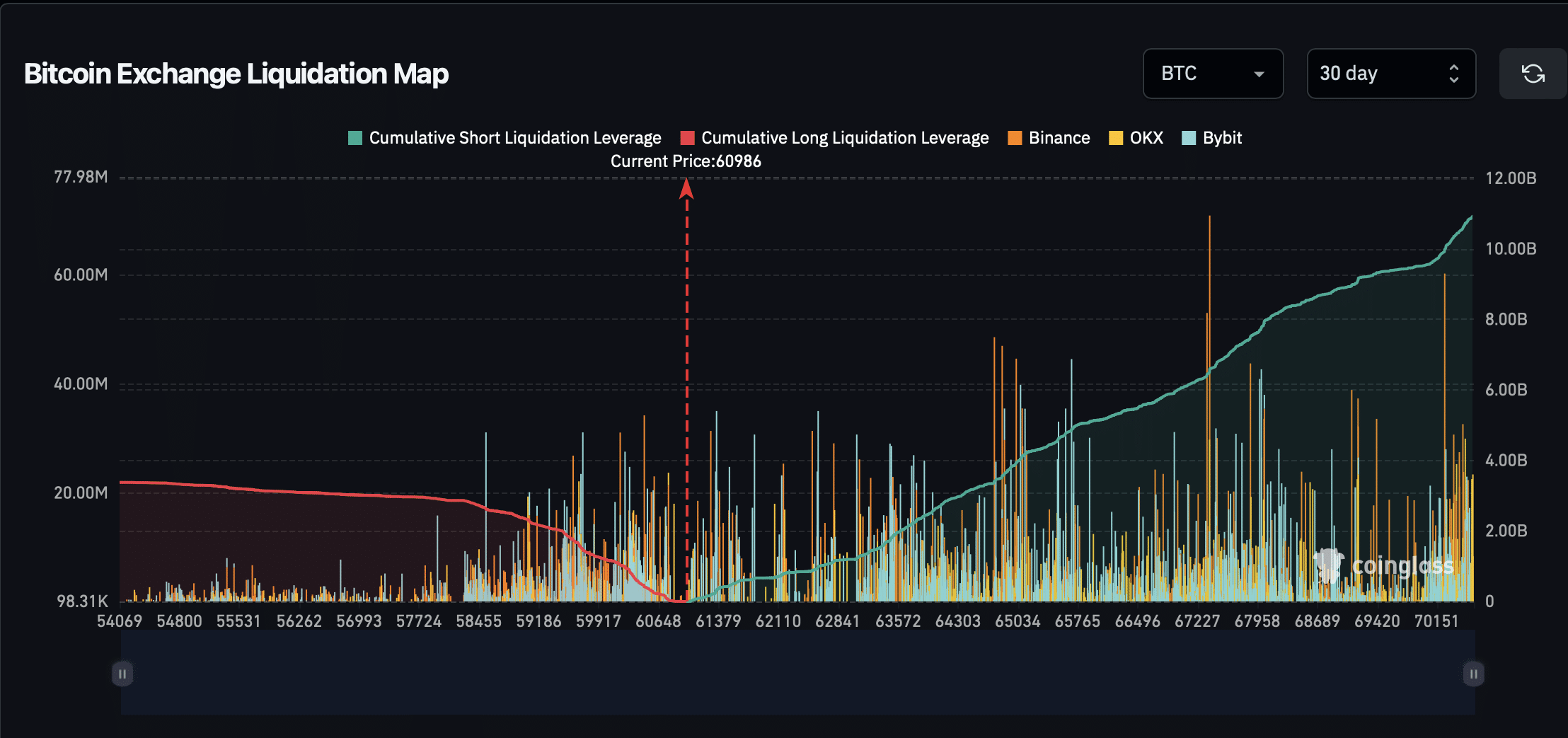

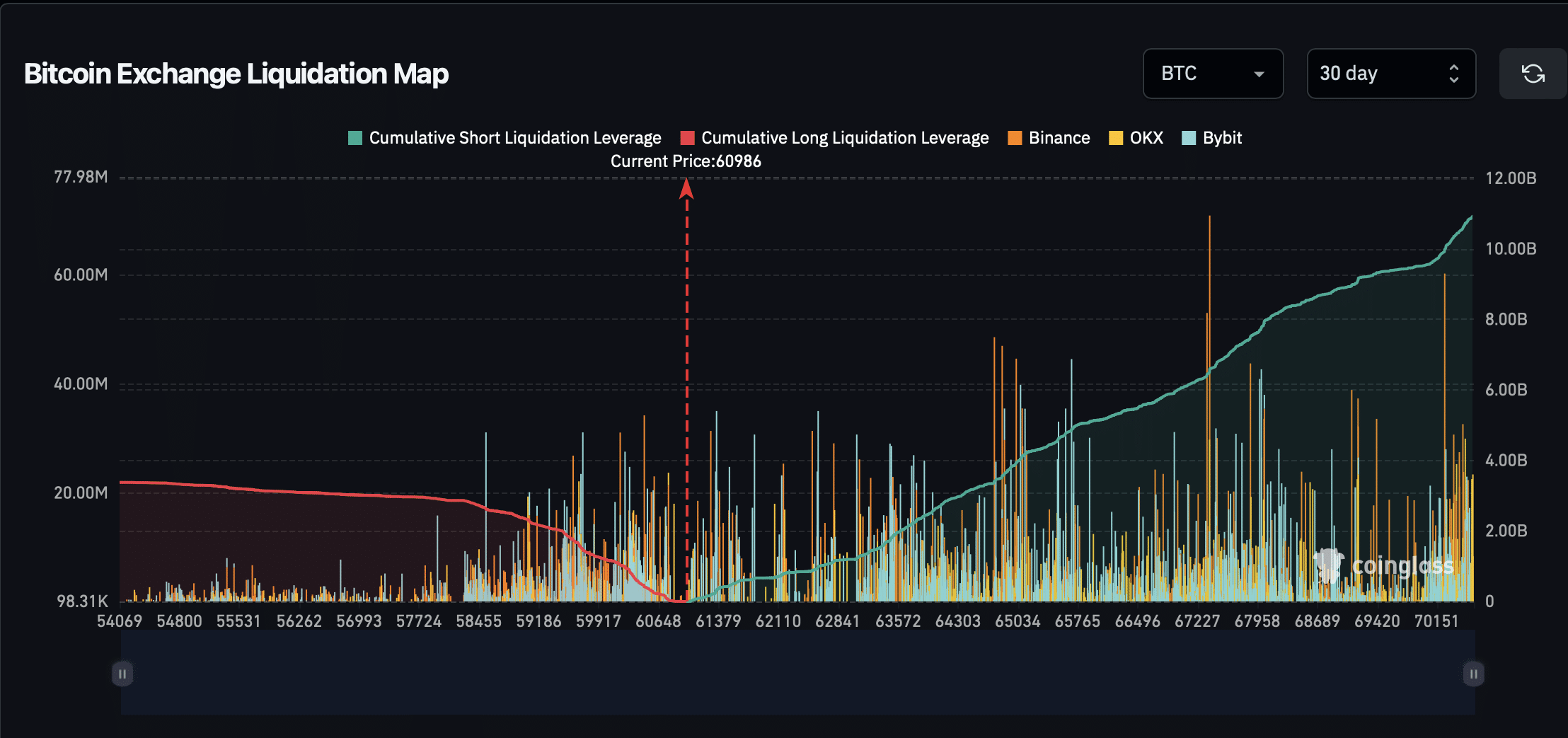

Analysis of BTC’s short and long liquidation leverage on Coinglass, facts revealed that the majority of liquidations over the past 30 days were long positions, indicating that many traders expect a rise in Bitcoin’s value.

Source: Coinglass

Only time can tell whether these long positions will prove profitable for traders or whether Bitcoin’s price will continue to decline, confirming Edwards’ perspective.

Read Bitcoin’s [BTC] Price forecast 2024-25

In terms of where the price is headed, according to AMBCrypto’s recent report hinted in the event of a positive shift in mining activity.

Specifically, there has been a notable increase in miners’ reserves, which could potentially increase the price of Bitcoin.