On Saturday, Bitcoin staged a robust rally, climbing above $58,250. Despite this upward move, the price was unable to maintain momentum and close above the 200-day Exponential Moving Average (EMA). This led to the formation of a bearish engulfed candlestick pattern on Sunday, indicating potential downside momentum. Currently, Bitcoin is trading below $56,000, which puts it at a critical juncture in terms of technical analysis and market sentiment.

Sina G, the COO and co-founder of 21st Capital, as long as a breakdown of the factors influencing Bitcoin’s price trajectory today, especially highlighting its recent declines and evaluating its undervalued state through advanced metrics. Starting with a historical overview, Sina pointed out that Bitcoin had suffered a drastic 26% decline from a peak of $73,000 in March, falling around $56,000 in recent weeks.

Related reading

This sharp decline is attributed to several macroeconomic and sector-specific factors. According to him, Bitcoin’s decline from March’s peak of $73,000 to $56,000 is consistent with historical bull market corrections, which often have significant but temporary retracements.

The influence of Bitcoin ETFs has been critical. Initially, these ETFs contributed significantly to the price increase from $16,000 to $73,000 as investors heavily engaged in a buy-the-rumor, buy-the-news strategy. “Until mid-March, ETF flows were very strong and the market was up. Since then, ETFs have slowed and bankruptcy outflows have taken over, causing weak price action to $56,000.

A notable recent impact on Bitcoin’s price has been the sales activity of the German government, which sold Bitcoin seized in 2013 from the illegal content platform Movie2k.to. “The government’s decision to liquidate approximately 10,000 coins in three transactions directly coincided with significant price declines on specific dates in June and July,” he noted. This sell-off contributed to a steep 24% crash in June and July, exacerbated by the large volume of Bitcoin introduced to the market.

Related reading

Is Bitcoin Undervalued?

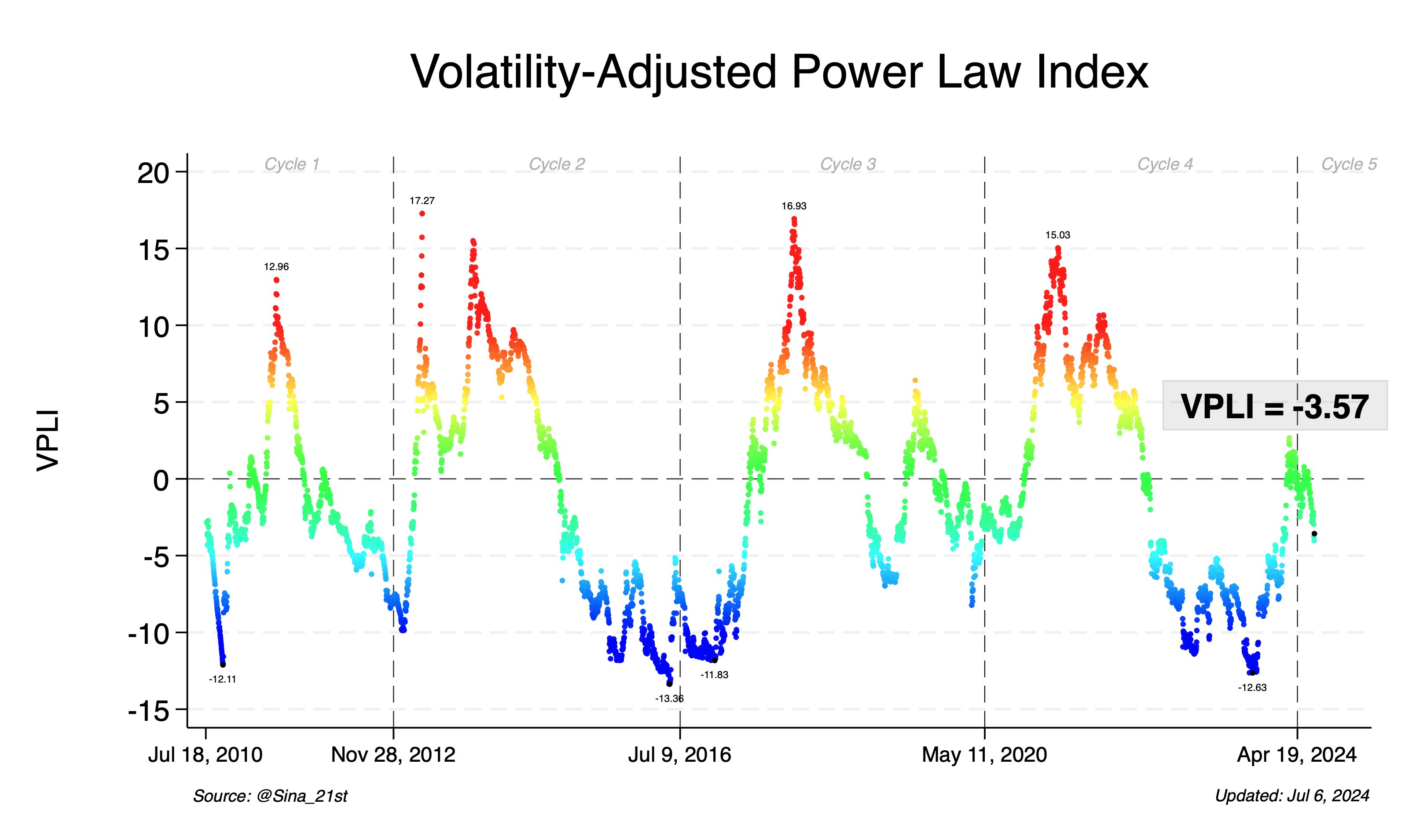

To see if Bitcoin is currently undervalued, Sina turned to the Volatility-Adjusted Price Level Index (VPLI), a proprietary measure developed by 21st Capital. “Currently, our VPLI stands at -3.57, which indicates that Bitcoin is significantly below the fair price,” Sina said. He further clarified that historically, a VPLI score of -10 corresponds to a bear market low, putting the current reading into context that suggests Bitcoin may be undervalued.

“This puts us in the 41st percentile of values – i.e. Bitcoin has only spent 41% of its value below this VPLI value (most of it during the bear markets). So the risk-return balance is favourable,” he added.

Looking ahead, Sina highlighted two crucial short-term indicators that could dictate Bitcoin’s immediate price movements: the continuation of Bitcoin sales by the German government and the behavior of perpetual swap funding rates. “Lately the funding rate has been negative, which is typically a bearish signal. This suggests that many traders are taking short positions in anticipation of further declines, which could paradoxically indicate that the market is close to bottoming out,” he concluded.

At the time of writing, BTC was trading at $55,835.

Featured image created with DALL·E, chart from TradingView.com