- Bitcoin speculators were reluctant to bid due to the stagnation of Open Interest.

- Funding rates were only slightly positive and BTC may not be ready for a recovery yet.

Bitcoin [BTC] held at the $67k support level and defended the previous week’s gains, and the bulls looked to build on that. At the time of writing, the price stood at $68.9k, and the $71.4k-$71.6k is the next resistance zone.

The decline in trading volume posed a threat to the bulls. Short-term holders’ profitability also grew. The value of the coin days destroyed has recently skyrocketed, which could cause Bitcoin’s volatility.

Assessing speculator sentiment

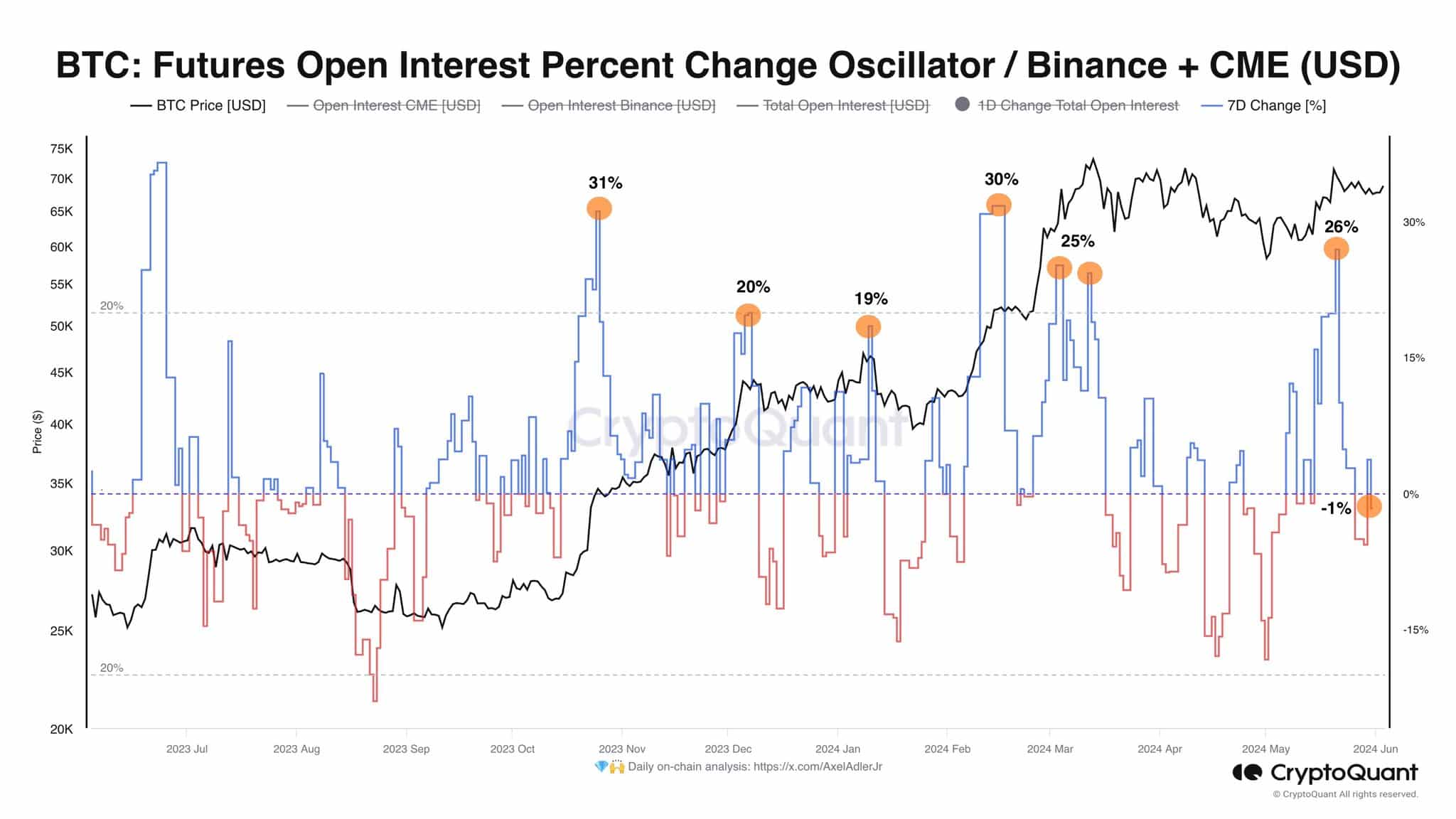

In a message on X (formerly Twitter) crypto analyst Axel Adler noted that the weekly change in Open Interest was neutral at -1%. This happened despite the fact that BTC had turned around the $67k level to support and was aiming to move higher.

The lack of speculative interest this past week indicated that most market participants were sidelined. They were unwilling to bet on price movements and had no bullish conviction. This could allow BTC to reach a range between $67,000 and $71.5,000 in the short term.

The analyst also believed that this would have to change before Bitcoin could embark on its next trend.

The bulls’ lack of dominance indicated a lethargic market

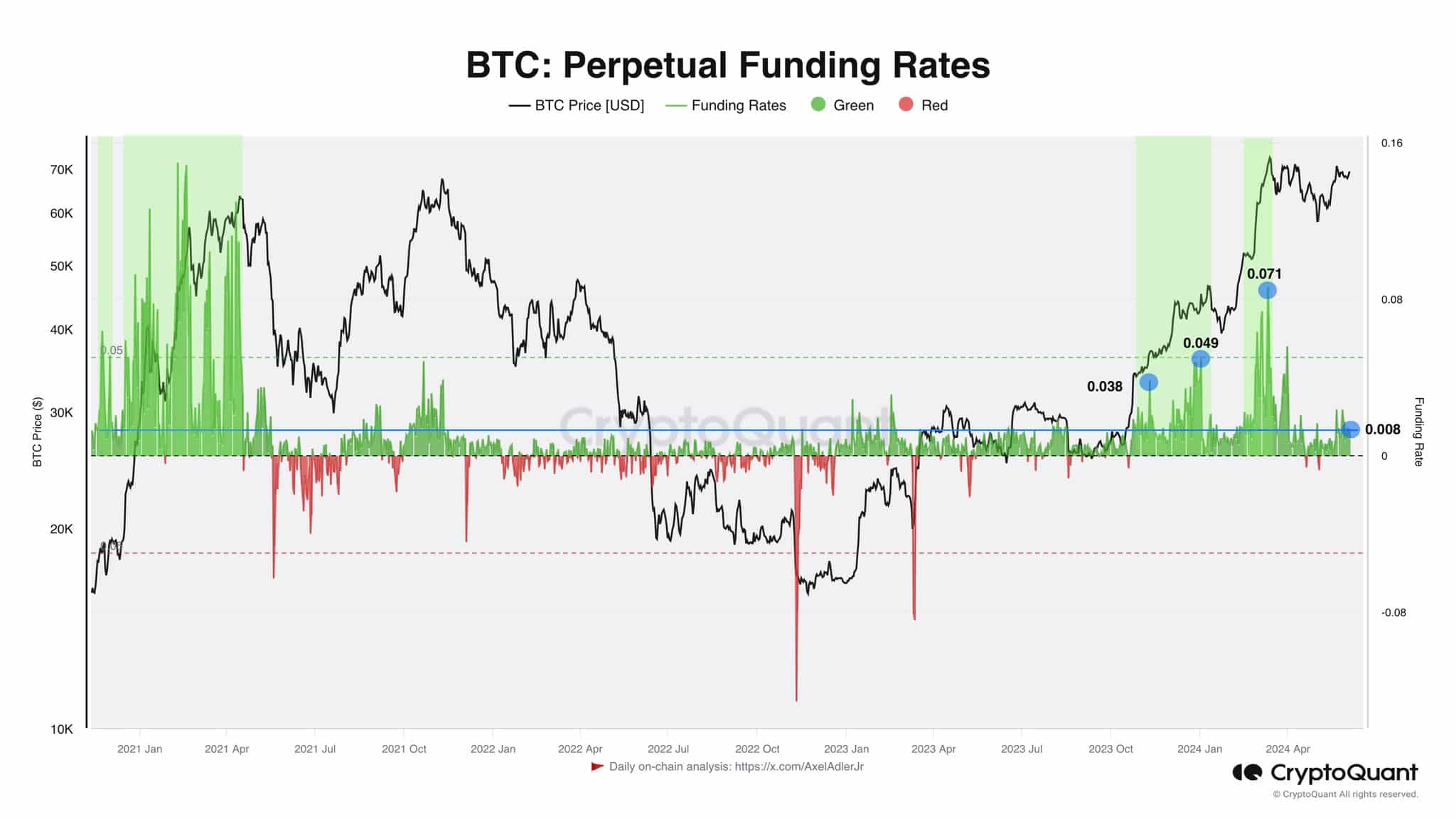

In another messageThe analyst also showed that dramatic price increases have been accompanied by spikes in financing rates. In late 2020 and early 2021, the massive $20,000 rally was accompanied by periods of high financing rates that reached +0.15.

During the rally since October 2023, the financing rate also rose above +0.03. However, at the time of writing it stood at +0.008.

Is your portfolio green? Check the Bitcoin Profit Calculator

This showed a lack of bullish conviction. Combined with the decline in weekly trading volume, the evidence strongly suggested that Bitcoin is not yet ready to break past the $72k area.

Investors and traders should be prepared for more price action in the coming weeks.