Since its inception, Bitcoin has (almost) always been the poster child for volatility. Still, the Bitcoin price is barely moving in any direction at the moment. But the latest data suggests a surprising twist in the story.

According to a recent report by on-chain data provider Glassnode, “Bitcoin markets are experiencing an incredibly calm period, with several measures of volatility collapsing to all-time lows.” This begs the question: are we entering a new era of Bitcoin price stability, or is the market misinterpreting the signals?

Historical context for Bitcoin volatility

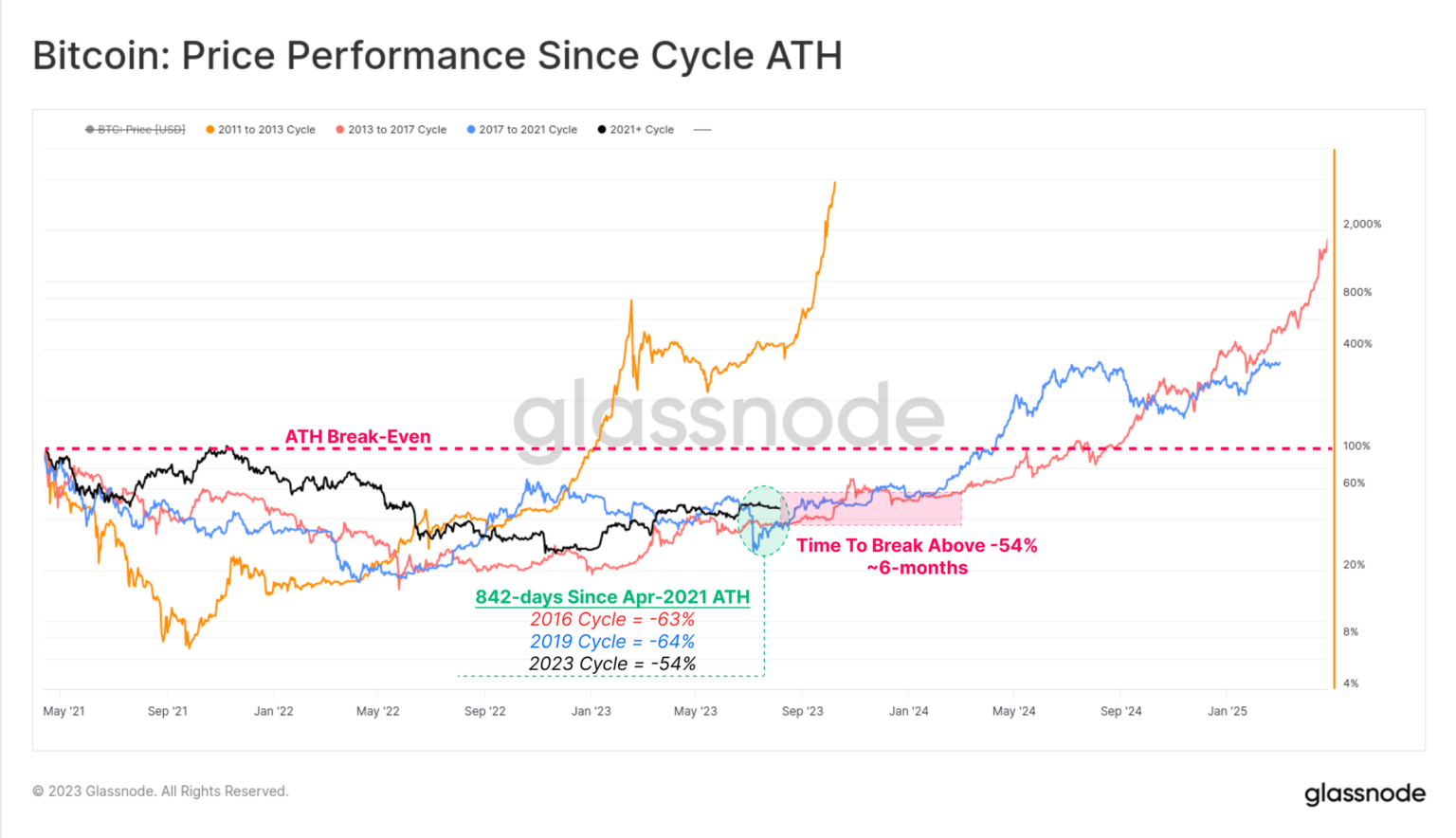

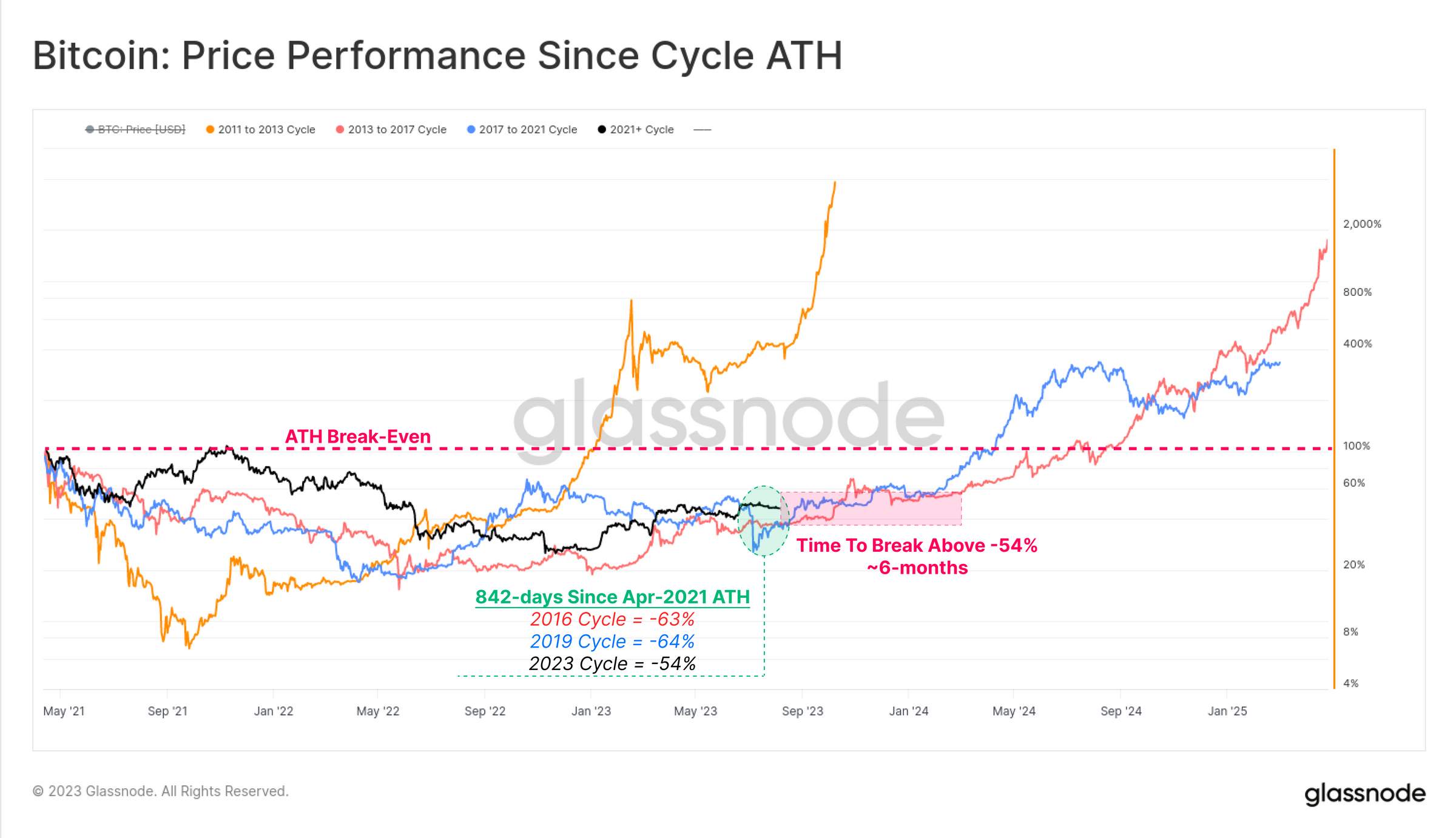

To really understand the current state of the market, it is essential to dive into the historical context. The Glassnode report notes, “It has been 842 days since the peak of the bull market in April 2021.” During this period, Bitcoin’s recovery has been more robust than in previous cycles, trading at -54% below its all-time high (ATH), compared to a historical average of -64%.

Drawing parallels to previous cycles, the report highlights that both the 2015-16 and 2019-20 cycles experienced a “6-month period of lateral boredom before the market accelerated above the -54% withdrawal level.” This could be indicative of a similar “boredom” phase in the current cycle.

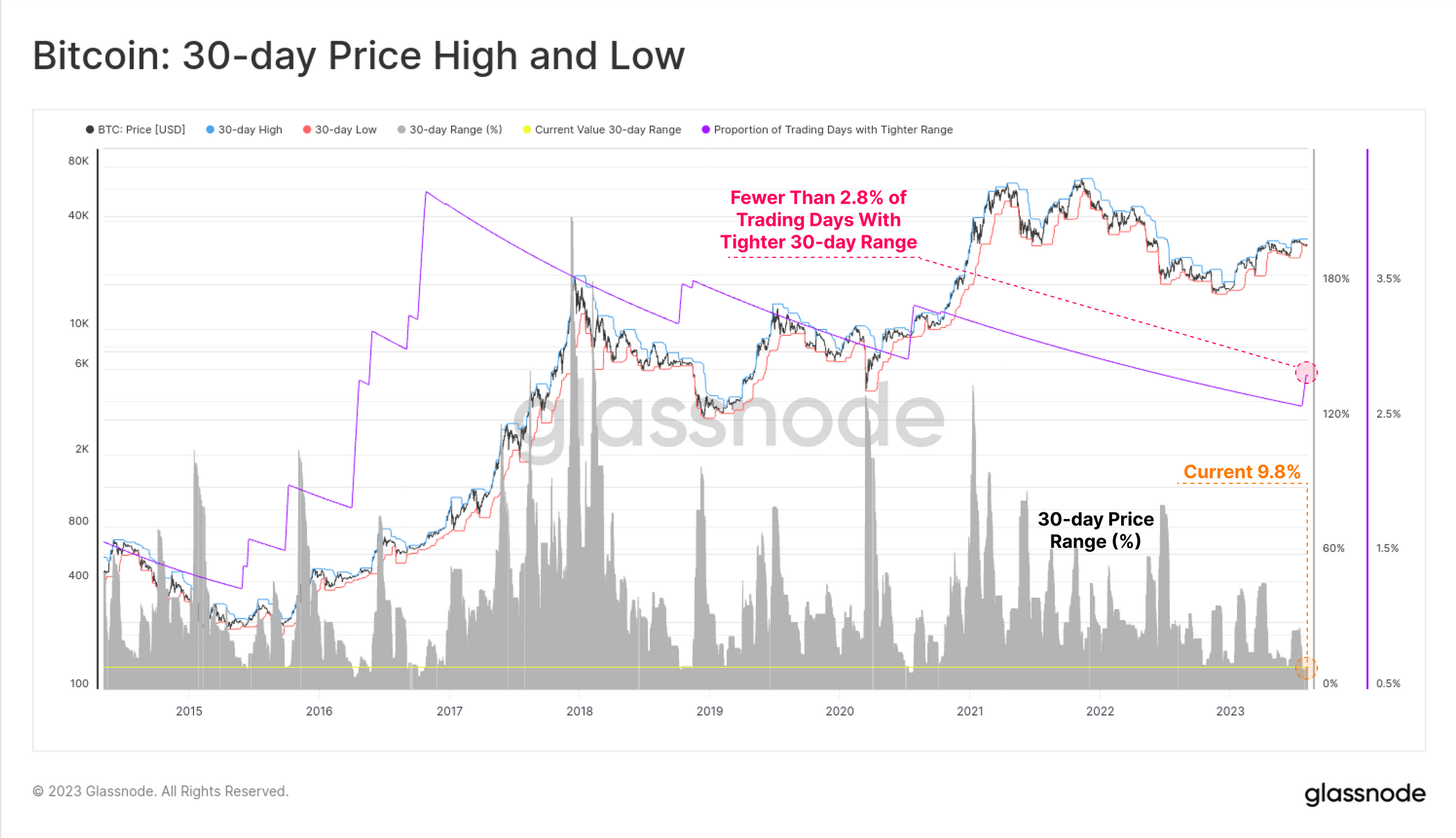

One of the most notable revelations from the Glassnode report is the extreme volatility compression Bitcoin is currently undergoing. “Bitcoin’s realized volatility, ranging from 1-month to 1-year observation windows, dropped dramatically in 2023, hitting a multi-year low.” This is reminiscent of four different periods in Bitcoin’s history, including the late phase of the 2015 bear market and the post-March 2020 consolidation following the outbreak of COVID-19.

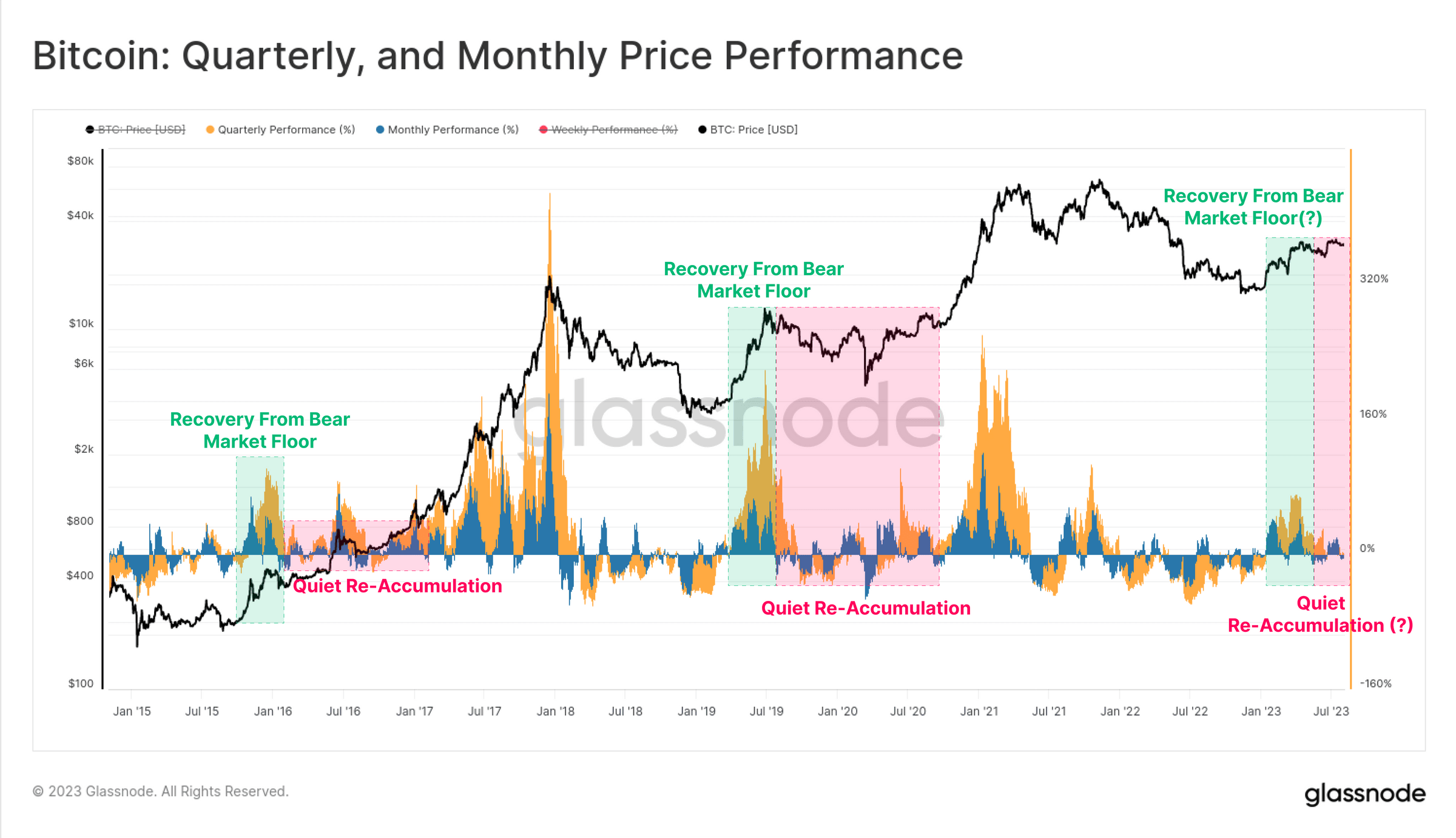

After the furious rally at the start of 2023, price performance on both a quarterly and monthly basis is subdued. This mirrors Bitcoin’s previous cycles, where the initial rise from the lows is robust, but then transitions into a prolonged phase of uneven consolidation, a phase of re-accumulation.

Further, the report states, “The price range separating the 7-day high and low is only 3.6%. Only 4.8% of all trading days have ever experienced a tighter weekly trading range.” The 30-day price range is even more extreme, capping the price at just 9.8%, and tighter by only 2.8% of all months in BTC’s history. Such levels of price compression are rare for Bitcoin, indicating an anomaly or a possible harbinger of significant market movement.

Derivatives Market Insights

The derivatives market, often seen as a barometer of underlying asset sentiment, also reflects this calm period. “The combined trading volume of Futures and Options for [BTC and ETH] are at or near an all-time low,” the report notes. This is further emphasized by the fact that “BTC currently sees $19.0 billion in total derivatives trading, while ETH markets only have $9.2 billion per day.”

Interestingly, the options market is showing signs of a significant volatility crush. According to Glassnode, “Options are pricing in the smallest volatility premium in history, with IV between 24% and 52%, less than half of its long-term baseline.” This is further confirmed by the historically low Put/Call Ratio and the 25-delta skew metric, suggesting net bullish sentiment in the market.

The crux of the matter lies in the interpretation of these signs. The report rightly asks the question, “Given the context of Bitcoin’s notorious volatility, has a new era of BTC price stability dawned, or is volatility mispriced?” Historically, periods of low volatility in Bitcoin have often been followed by significant price movements. Whether this is a calm before a storm or a genuine shift towards a more stable Bitcoin remains to be seen.

But as Tony “The Bull”, the chief chart technician at NewsBTC, pointed out yesterday, the technical indicators also point to a prolonged period of re-accumulation, meaning that the low volatility phase is likely to continue for some time. come.

At the time of writing, the BTC price stood at $29,277.

Featured image from iStock, chart from TradingView.com