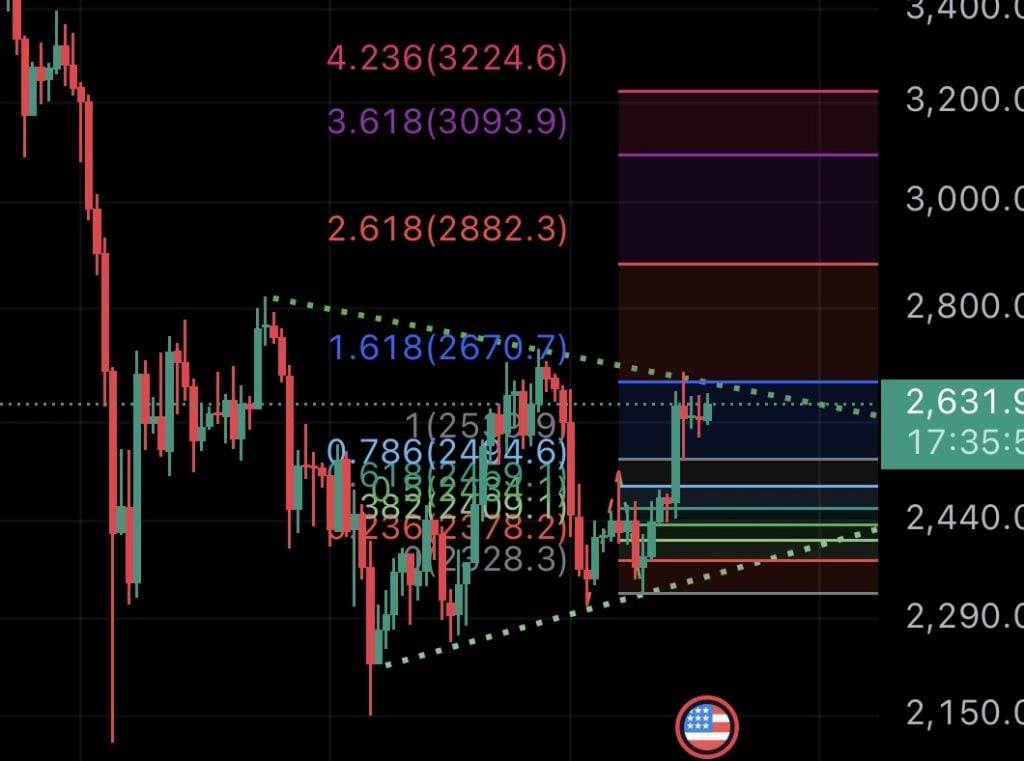

As the price of Bitcoin (BTC) threatens to rise above the crucial support/resistance level around $68,000, Ethereum (ETH), the largest altcoin with a fully diluted valuation of around $316 billion and a daily average trading volume of around $15, approached 1 billion, a crucial resistance level around $2,626.

Over the past week, Ether’s price has risen more than 9 percent, approaching the upper limit of a symmetrical triangular consolidation. Consequently, speculation about Ether’s next move has resulted in a spike in Open Interest (OI), with more traders betting on a bullish breakout.

Ethereum whales are back

After shying away from the Ethereum market in recent months, as evidenced by significant cash outflows from US Ether ETFs, on-chain data shows whale investors are now buying more ETH.

Over the past two days, US spot Ether ETFs have recorded net cash inflows of over $62 million, led by BlackRock’s ETHA.

Meanwhile, Ether’s supply on centralized exchanges has fallen by almost 3 million in the past 24 hours, led by Binance, Kraken and OKX.

On the other side

According to savvy crypto analyst Benjamin Cowen, the outlook for the Ethereum market is heavily affected by the macroeconomic changes, especially as the Fed is set to initiate its quantitative easing (QE) program.

In particular, Cowen highlighted that ether supply has increased by about 60,000 per month over the past six months. As a result, Cowen emphasized that it would only take three to four months for Ether’s supply to reach pre-merger levels.

However, Cowen noted that the trend has changed dramatically since the Fed initiated the 50 basis point rate cut.

“Monetary policy has more influence on this than many of us want to admit. But more rate cuts will likely increase demand on the ETH network,” Cowen said.