- With major institutions betting on its future, Bitcoin is increasingly seen as a store of value

- Huge amounts of USDT are flooding the market, indicating signs of liquidity

Investors switched from traditional stocks to Bitcoin [BTC] because they consider the latter as an asset with lower risk and high potential.

The aforementioned trend was highlighted by Bitcoin’s 10% gain on the weekly charts, pushing it to a new all-time high of $77,000. This is against the backdrop of increasing uncertainty about Trump’s fiscal policy – in particular the Chinese tariffs and growing national debt.

With the new administration focused on positioning the United States as a crypto capital, Bitcoin’s position as a safe haven could be reconsidered.

Major institutions are betting on the future of Bitcoin

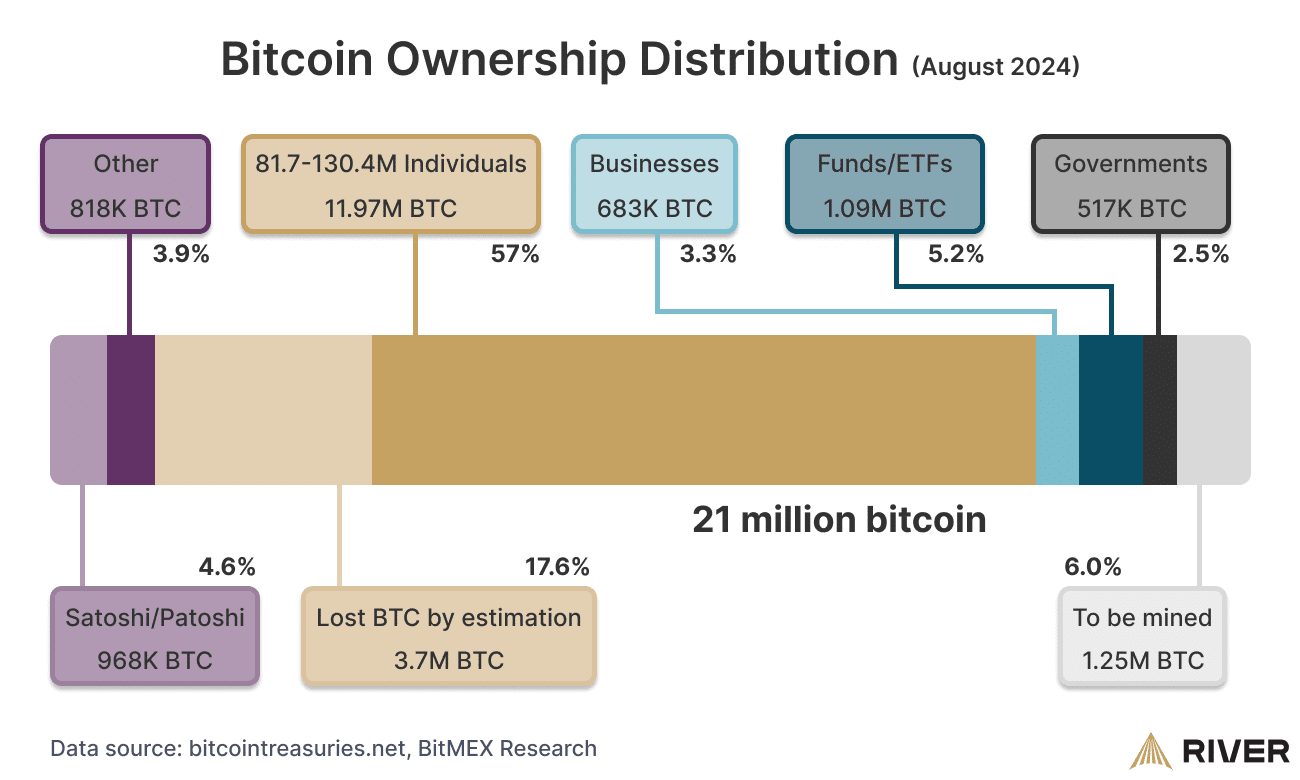

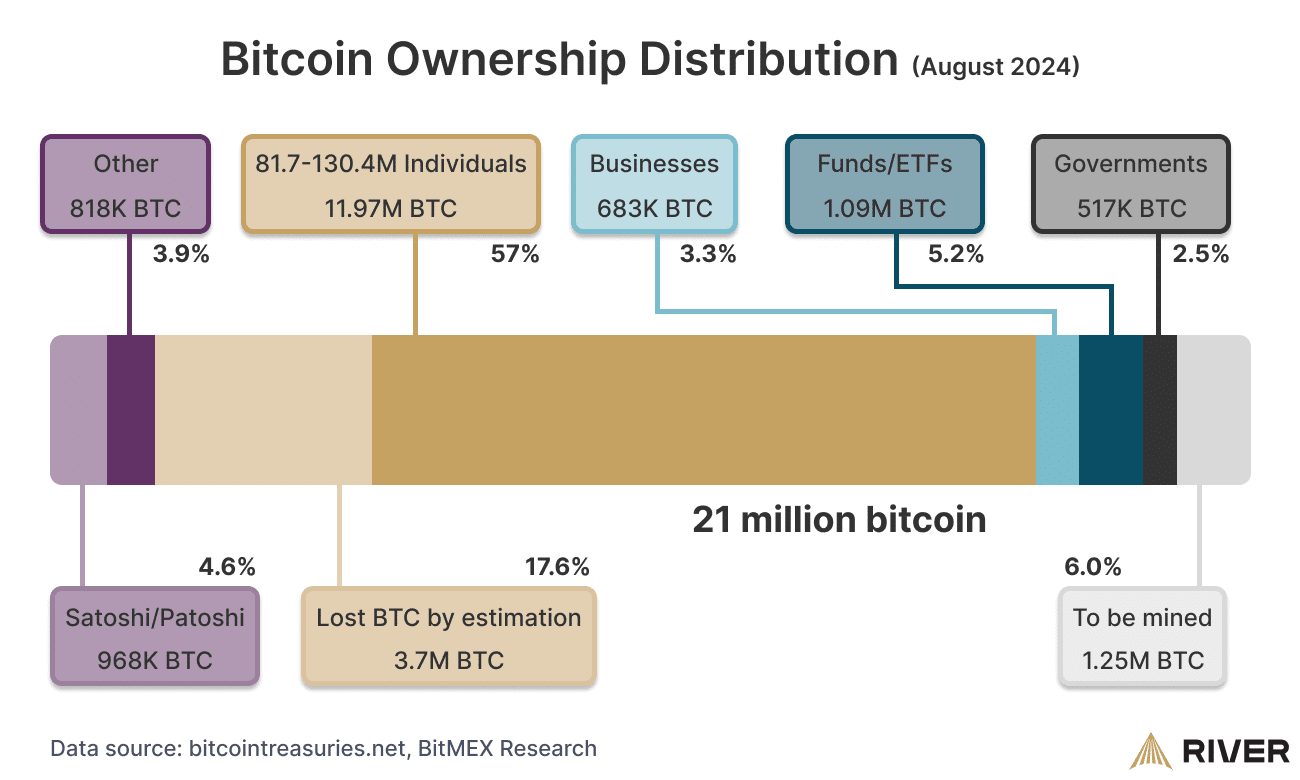

With Bitcoin’s fixed supply of 21 million coins, investors are increasingly piling on BTC as a true store of value. In fact one report from financial intelligence agency River highlighted BTC’s engagement with key stakeholders.

Source: River

This support was crucial, especially as derivatives markets have developed since the last presidential election, with Open Interest (OI) reaching record lows. file $45 billion.

The growing institutional interest provides long-term certainty and helps to absorb speculative fluctuations. As a result, there have been $36.28 million in liquidations in the last 24 hours occurredclosing $25.20 million in short positions.

Furthermore, BTC ETFs have broken records by sheer numbers inflowjust a day after the election results. This has put retail investors in a strong position as they view the current price as a high-risk, high-reward dip.

If this momentum continues, BTC could reach $80,000 by the end of the last trading days of November. This can also be confirmed by another set of bullish factors.

There will be enormous liquidity, but…

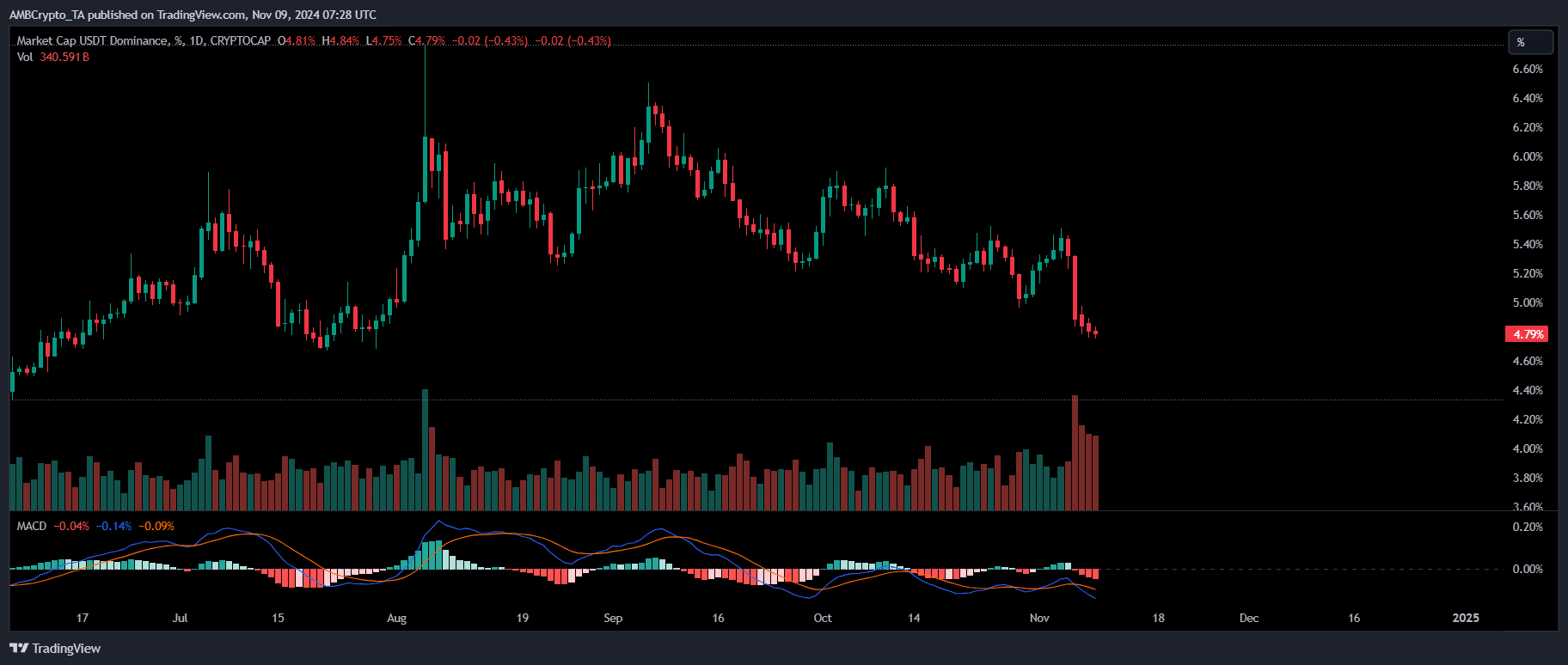

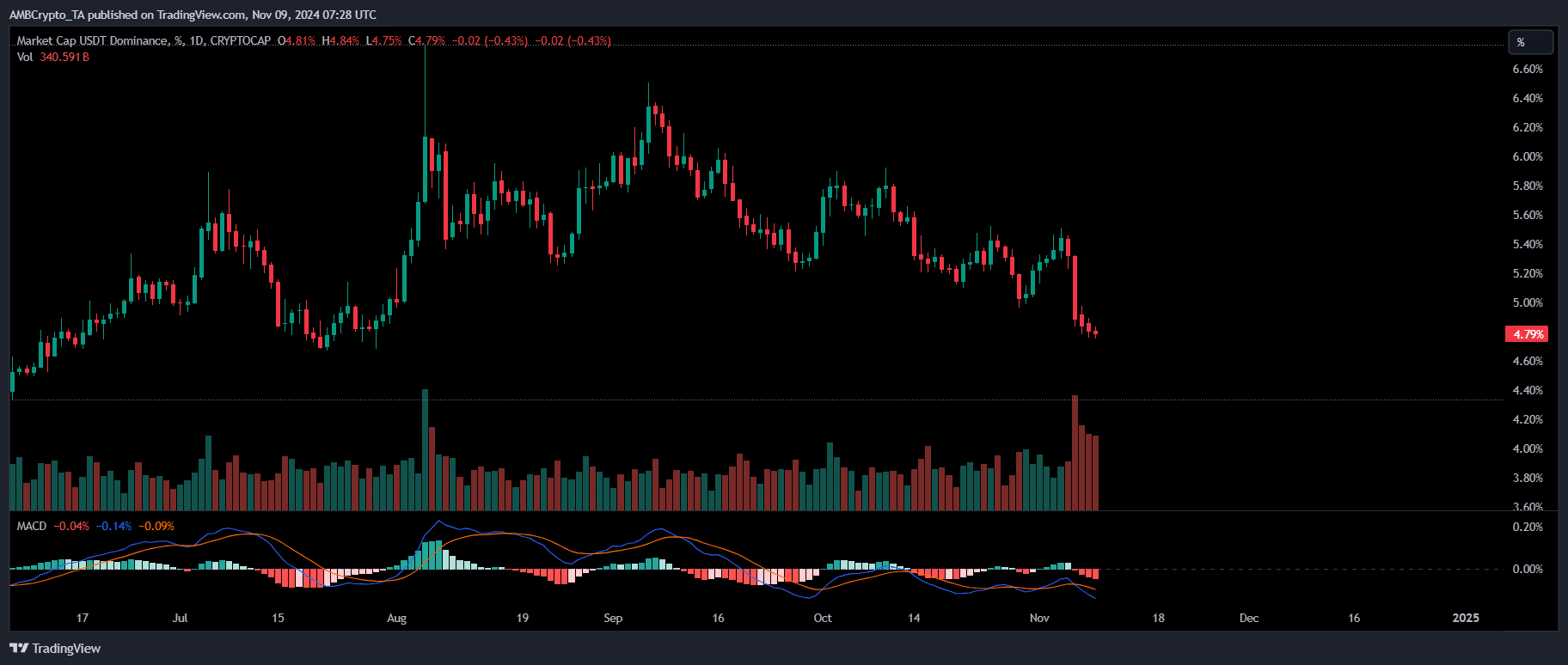

Unlike previous cycles where USDT market dominance waned but rebounded, this time it has steadily declined. Despite entering a risk zone, its dominance showed consistent red bands, reaching a daily low of 6% on Election Day.

Source: TradingView

A low USDT market share typically indicates that BTC is nearing a market bottom as investors move stablecoins back into assets. They see the current price as an attractive entry point.

Tether’s Treasury recently minted 1 billion USDT tokens, given the current market conditions where Bitcoin emerged as a safer asset.

Despite bullish signals, the market may now overheat. The RSI indicated an overbought situation, with 74% of price movements being upwards over the past two weeks.

Weak hands can pay out, causing a small reversal. Monitoring large addresses is therefore essential, as their support will be crucial in absorbing this pressure. So Bitcoin was at a crossroads at the time of writing.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Short-Term Holders (STHs) could sell their gains, causing a small pullback. However, overall market sentiment still pointed to a rally to $80,000 before the end of the month.

A major factor supporting this trend is the increasing uncertainty surrounding “Trump transactions.” This makes Bitcoin a safer bet than stocks, boosting institutional interest.

While a small dip seemed possible, BTC’s bull rally looked poised to continue at the time of writing.