- At the time of writing, AAVE was up more than 7% in the past 24 hours

- Altcoin appeared to form a double bottom as longs turned shorts accounts

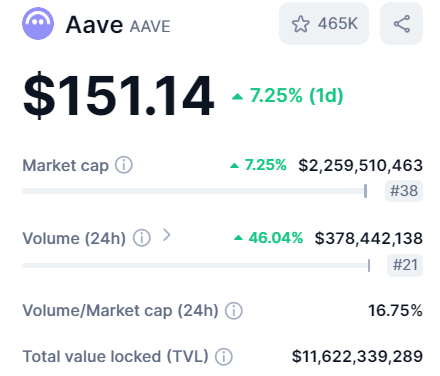

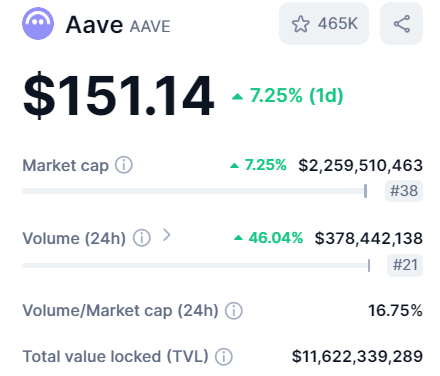

Aave (AAVE) is one of the best decentralized finance (DeFi) platforms on the market and has shown significant strength lately. Earlier this year, AAVE even broke out of range and was among the biggest gainers at the time of writing, up more than 7% in the past 24 hours.

This surge also pushed the market cap by the same percentage. Furthermore, trading volume increased by 46%, leading to a volume to market capitalization ratio of 16.75%.

This ratio indicates a strong investment opportunity, especially since it suggests that AAVE has sufficient liquidity to avoid frequent price fluctuations. The total value (TVL) on the platform was also impressive, with $11 billion in assets secured within Aave.

Source: CoinMarketCap

The potential bottom and forecast of AAVE

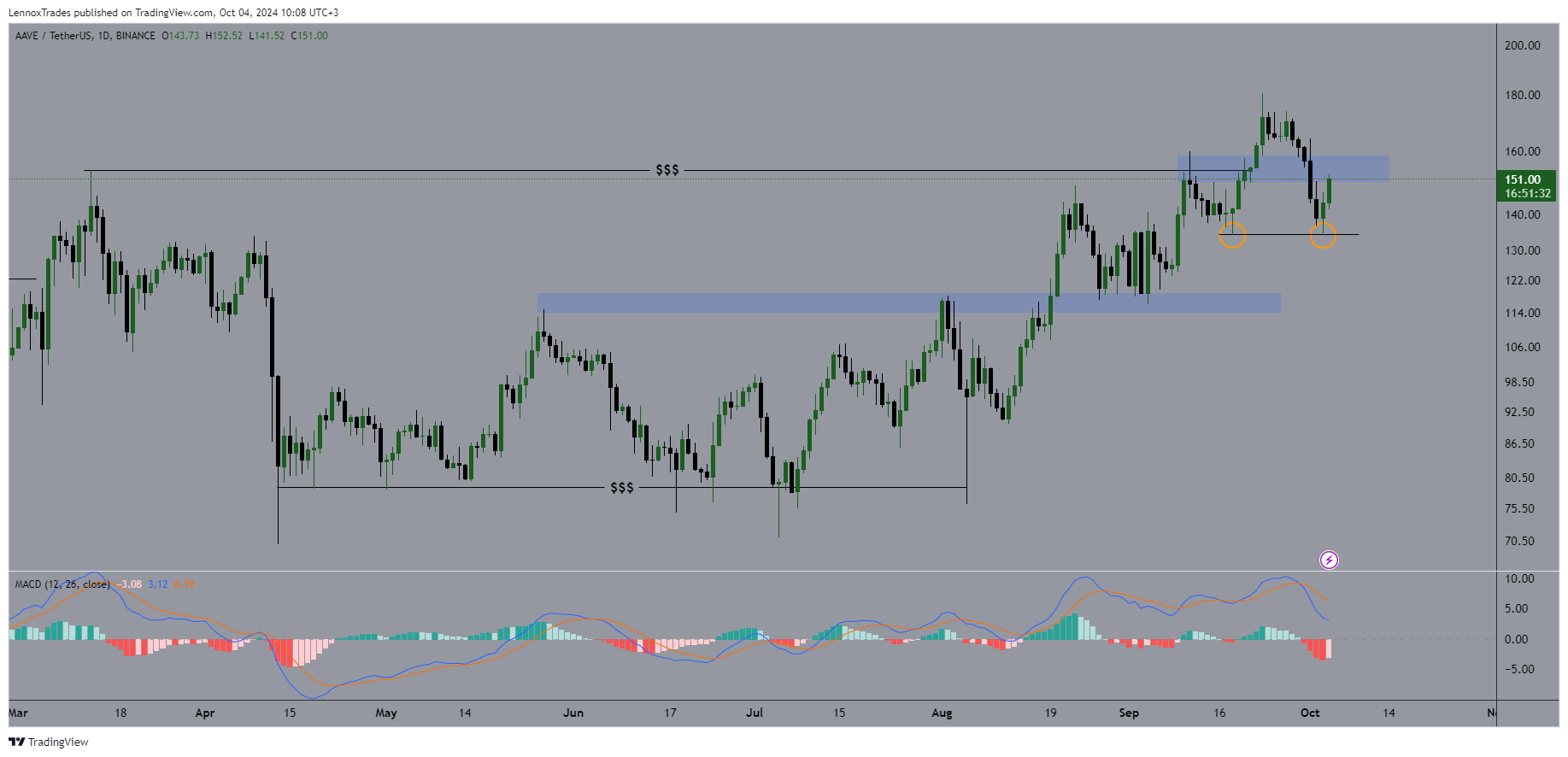

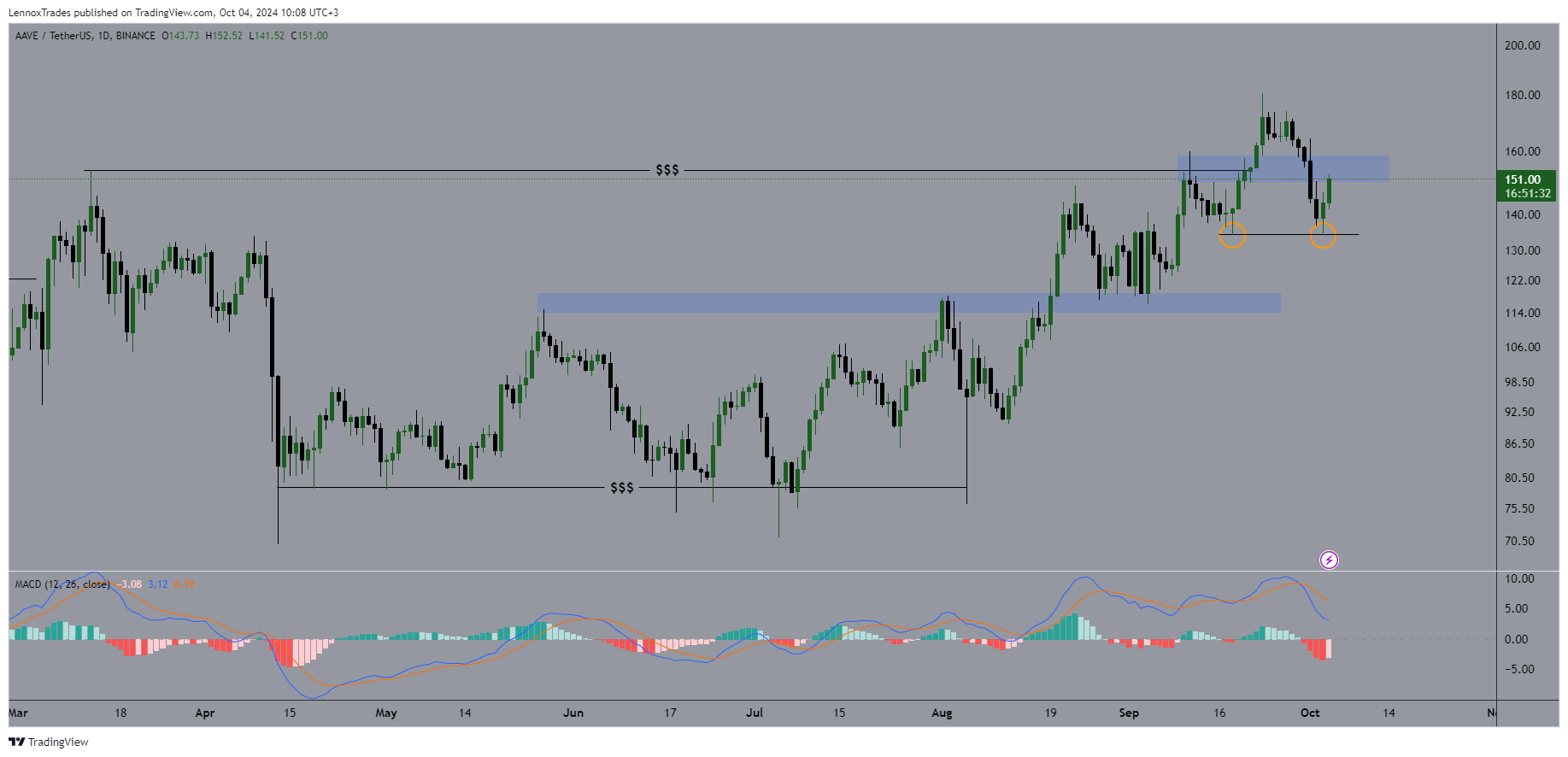

In light of these developments, examination of the price movement of AAVE/USDT revealed a bullish trend throughout the year. The altcoin’s price has consistently hit higher highs and higher lows since breaking out from its previous range.

A double bottom formed at the $140 price level, indicating that the crypto could post further gains. It could potentially regain the $200 mark in the last quarter (Q4) of the year.

Traders were trading above the $150 level at the time of writing and are now bullish on closing above recent highs. This close could increase the chances of reaching the $200 target as overall market conditions continue to improve.

Source: TradingView

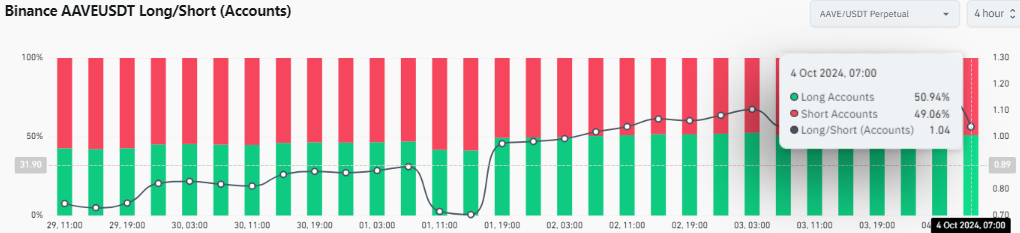

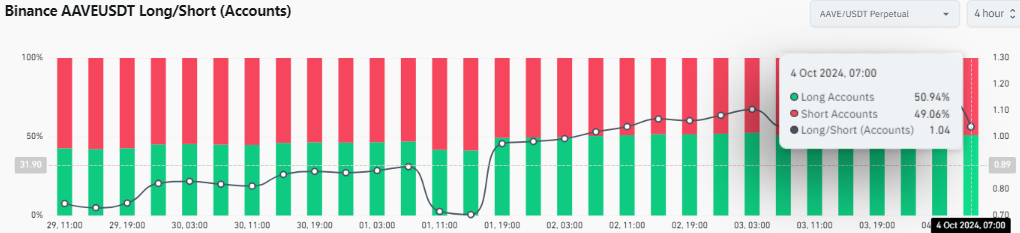

AAVE’s Long/Short account turns bullish

To further analyze the altcoin’s potential, we can examine its long and short account statistics. At the time of writing, the percentage of long accounts had risen to almost 51%, while short accounts stood at 49%.

This shift indicated that buyers are regaining control after a period when short positions dominated during market corrections.

As shorts begin to lose influence, the ratio will likely continue to favor longs, reinforcing the idea that AAVE is on track to hit the $200 target the next time it rises.

Source: Coinglass

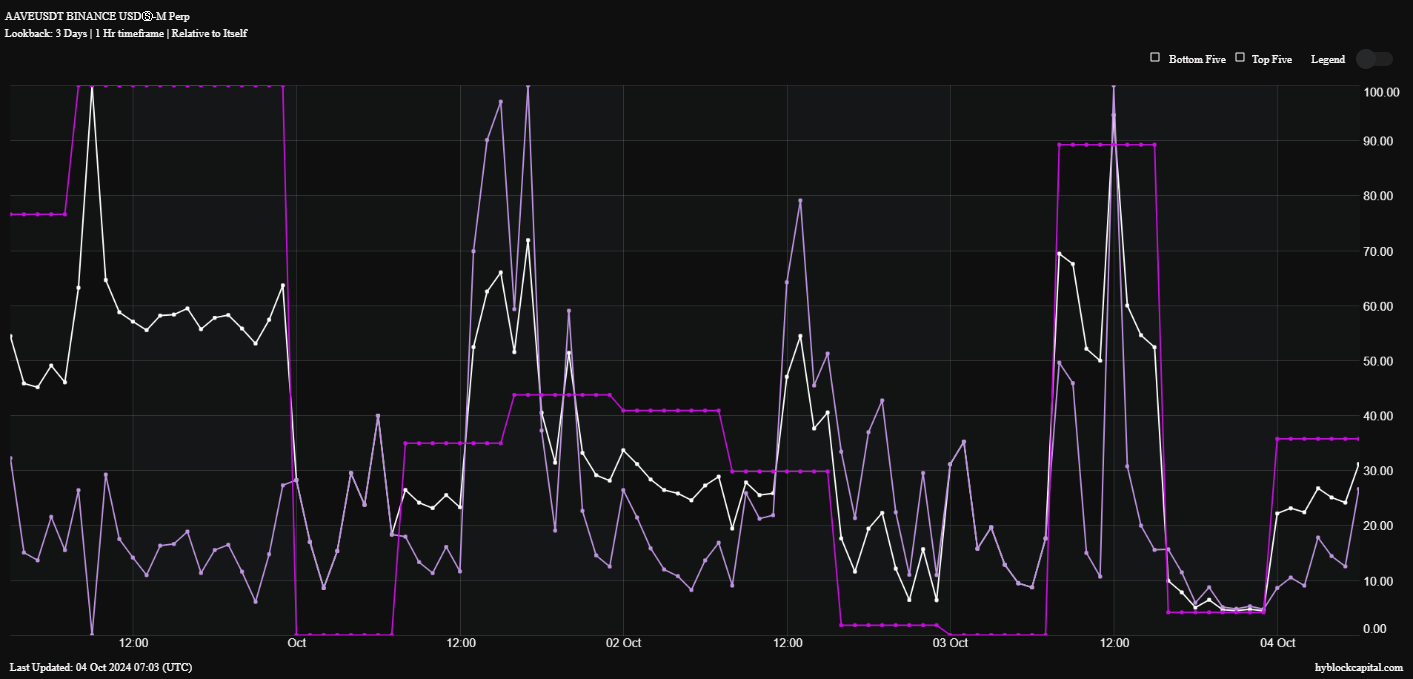

Buy volume and financing rates in recovery

Finally, observing purchasing volume and financing rates revealed that both measures are starting to rise from previous lows caused by market corrections. These figures appeared to approach the 30th percentile and contributed to a global average of 30%.

The improvement in these metrics further supported the idea of an upward move, one that could lead to AAVE regaining the $200 level. The cryptocurrency’s recent performance and key indicators together mean that the cryptocurrency may be in a strong position for future growth.

Source: Hyblock Capital

With ample liquidity, bullish price action, and positive long-short account dynamics, AAVE could be well-equipped to reach higher price targets in the near future.

As always, investors should remain cautious and monitor market conditions and broader trends to make informed decisions.