- In the current cycle, BTC market movements mimic the recovery phase of a major bear market from 2016 and 2019.

- There is a strong presence of long-term holders in the market.

In his latest reporton-chain data provider Glassnode has discovered that Bitcoin’s [BTC] The current market structure resembles the recovery phase of a major bear market similar to 2016 and 2019.

Read Bitcoin’s [BTC] Price forecast 2023-24

This is based on a model that measures the difference between the wealth of the long-term and short-term investors in the currency and the pattern of currency rotation between both cohorts of investors.

Long-term holders and their unwavering resilience

According to Glassnode, Bitcoin’s market cap has historically exceeded its realized capitalization. However, this may not be the case during severe bear markets such as the second half of 2022, where BTC’s market capitalization fell below its realized capitalization.

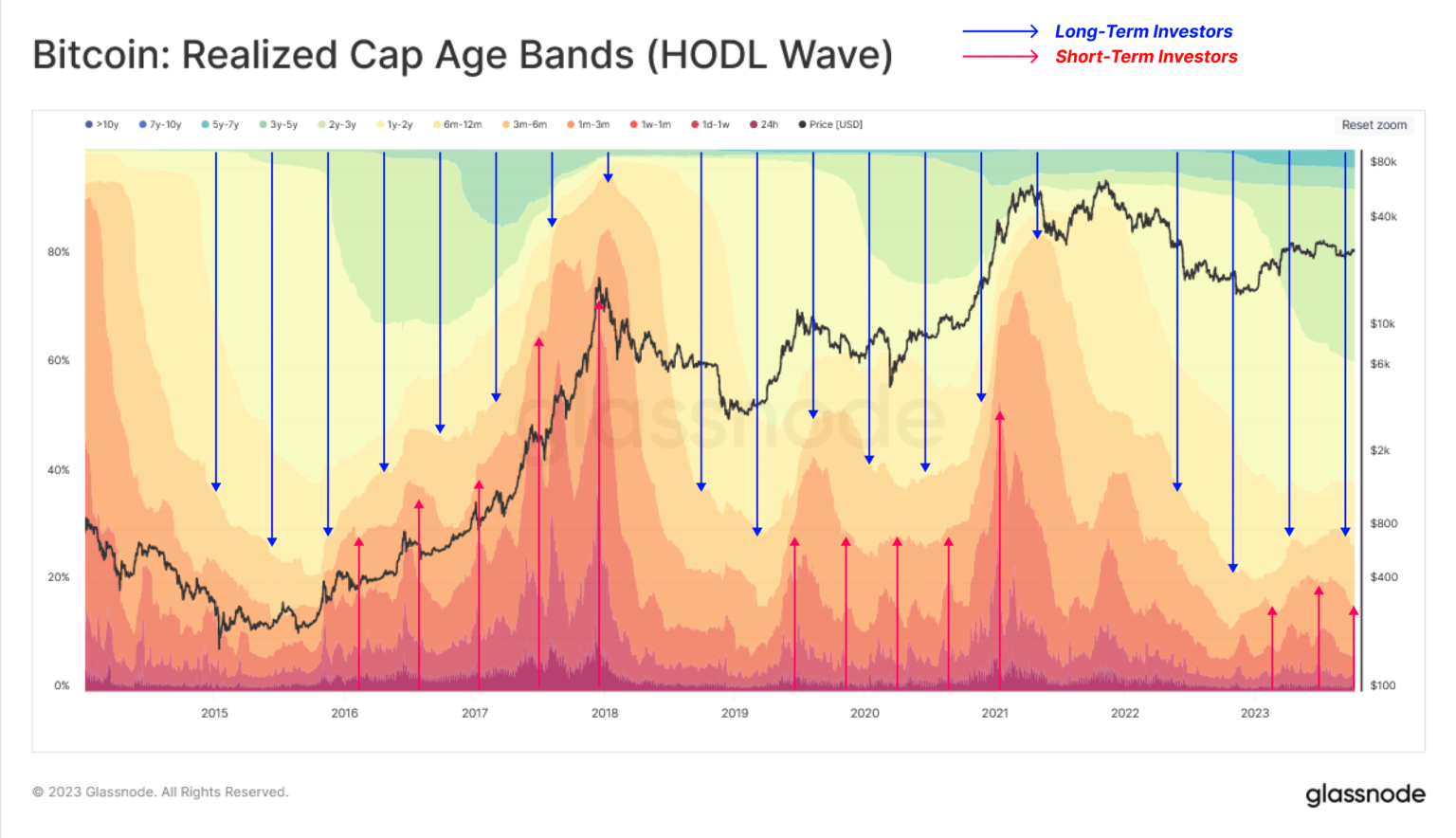

BTC’s Realized HODL Waves metric, which tracks this trend, shows that BTC’s realized capitalization “tends to stagnate or retreat slightly” during bear markets, due to coin transfers and revaluation to lower acquisition prices.

When the BTC market is in an uptrend, coins long held by long-term investors are transferred to newer investors due to the influx of new demand. Conversely, during periods of downtrend, “paper hands” and speculators transfer coins to longer-term holders.

According to Glassnode, in the current cycle:

“The market has reached a balance between these two groups of investors, with a slightly positive inflow of newer investors entering the market (demand side). This resembles conditions in 2016 and 2019, when the market attempted to recover from a significant bear market decline.”

Source: Glassnode

Glassnode assessed the behavior of BTC investors based on the age of their holdings. For long-term holders who have held their coins for more than twelve months, their holdings peak during bear markets, indicating accumulation during market lows.

This cohort of investors represents price-insensitive investors who built up during the bear market and held their ground there.

According to Glassnode, BTC’s long-term investors own more than 15% of the coin’s total capital during bear market cycles.

Source: Glassnode

As for short-term investors who have held their coins for less than 30 days, their activity is closely linked to market demand. It rises during uptrends and falls during bear markets.

“This cohort closely matches the demand side, including new investors deploying new capital to the market,” the report said.

To understand capital turnover in today’s market, Glassnode deployed the Inter-Cycle Capital Rotation Ratio metric, which measures the difference between the two cohorts of investors.

Is your portfolio green? Check the BTC profit calculator

BTC’s Inter-Cycle Capital Rotation Ratio was set at 13%, which was similar to the levels observed in 2016 and 2019.

Per glass junction:

“This indicates that Bitcoin supply remains heavily dominated by the HODLer cohort, with a supermajority of coins now older than 6 months.”

Source: Glassnode