- INJ is up 10.99% in the last 24 hours.

- Injective is experiencing strong positive market sentiment, pointing to further gains.

Since the Fed’s rate cuts a week ago, crypto markets have posted significant gains. As the market reawakens, Bitcoin [BTC] has shown the way.

Normally, Bitcoin’s recovery means profits for the altcoins. That’s why altcoins have seen significant gains, with AI-themed coins seeing a massive revival.

Amid this resurgence of AI coins, injective [INJ] has shown enormous resilience.

In fact, at the time of writing, INJ was trading at $23.23. This represented an increase of 10.99% compared to the previous day.

During the same period, Injective’s trading volume increased by 45.27% to $174.4 million. Also, the altcoin’s market capitalization increased by 10.74% to $2.3 billion.

This trend continued throughout the month. As such, the INJ has risen 13.55% over the past week, completing an uptrend of a long month, with an increase of 13.14% on the monthly charts.

What INJ’s chart says

According to AMBCrypto’s analysis, INJ was experiencing continued upward momentum at the time of writing.

Since hitting a monthly local low of $15.56, Injective has warned against breaking away from a months-long consolidation. This upward trend shows a continued change in market sentiment and investor preference.

These prevailing market conditions could therefore see INJ making further gains on its price charts.

Source: TradingView

For example, Injective’s Relative Strength Index (RSI) has remained stable over the past two weeks, rising from 47 to 68 at the time of writing.

This shows that demand for the altcoin has increased, which is further explained by a previously observed increase in trading volume. INJ therefore experienced stronger buying pressure than selling.

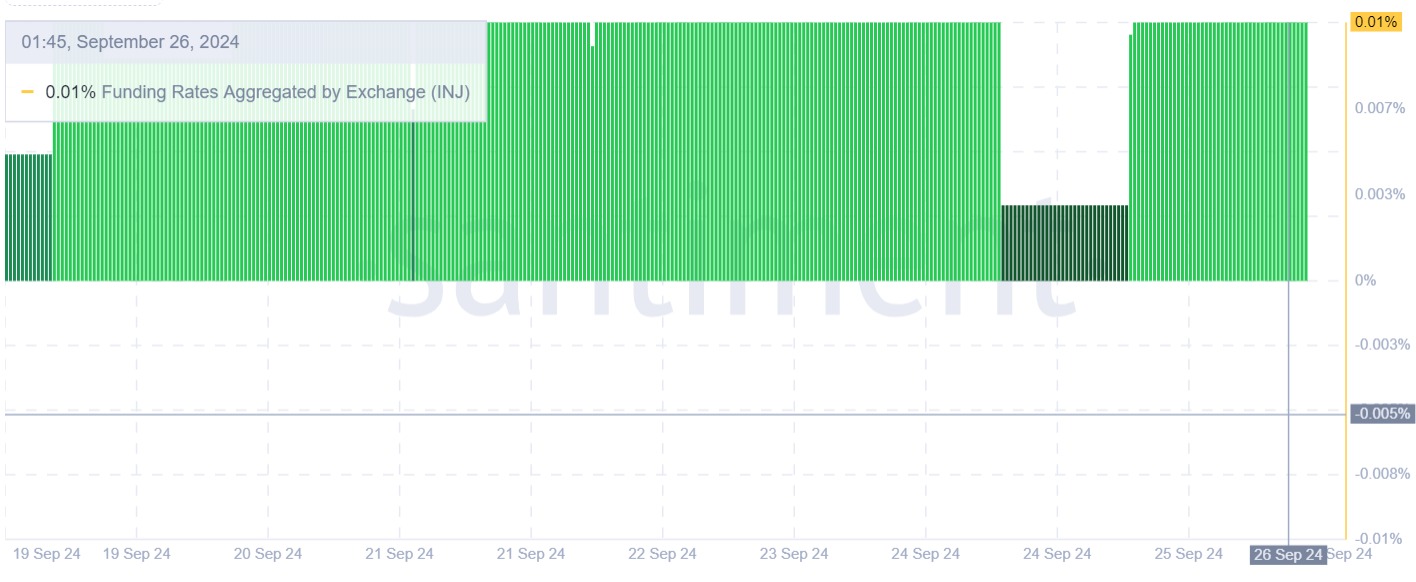

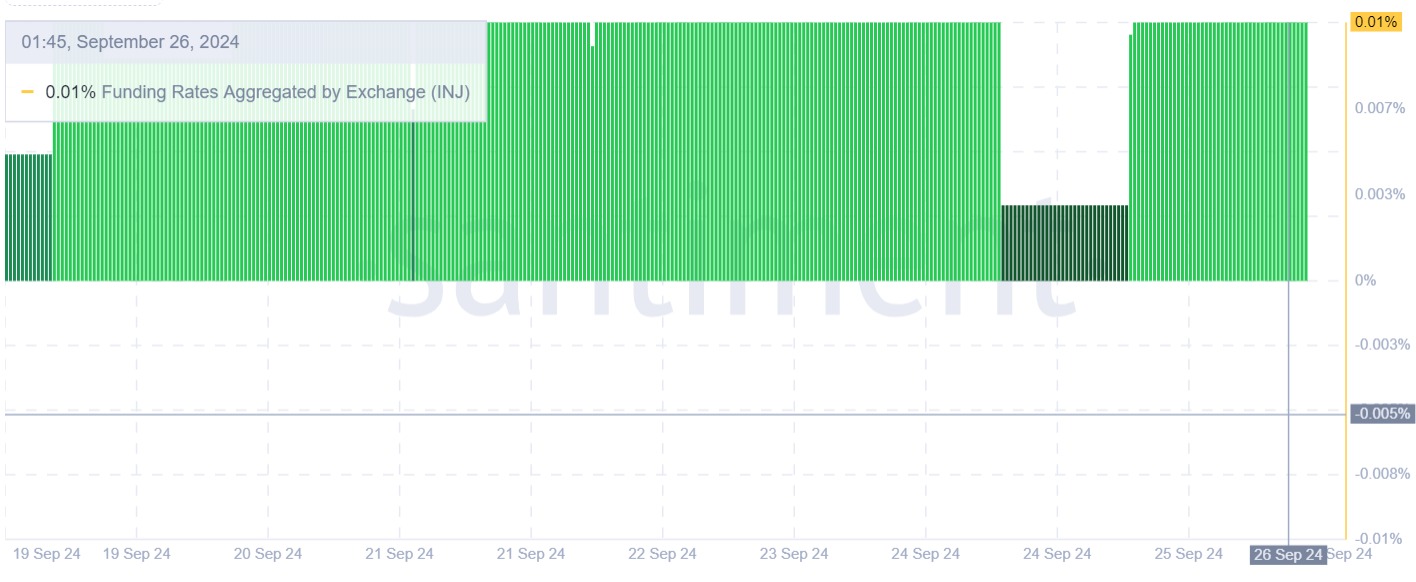

Source: Santiment

Additionally, Injective’s funding rate aggregated by Exchange has remained positive over the past week.

Typically, a positive funding rate, aggregated by exchange rate, indicates that long positions are paying short positions. This indicates that most investors are bullish and expect prices to rise.

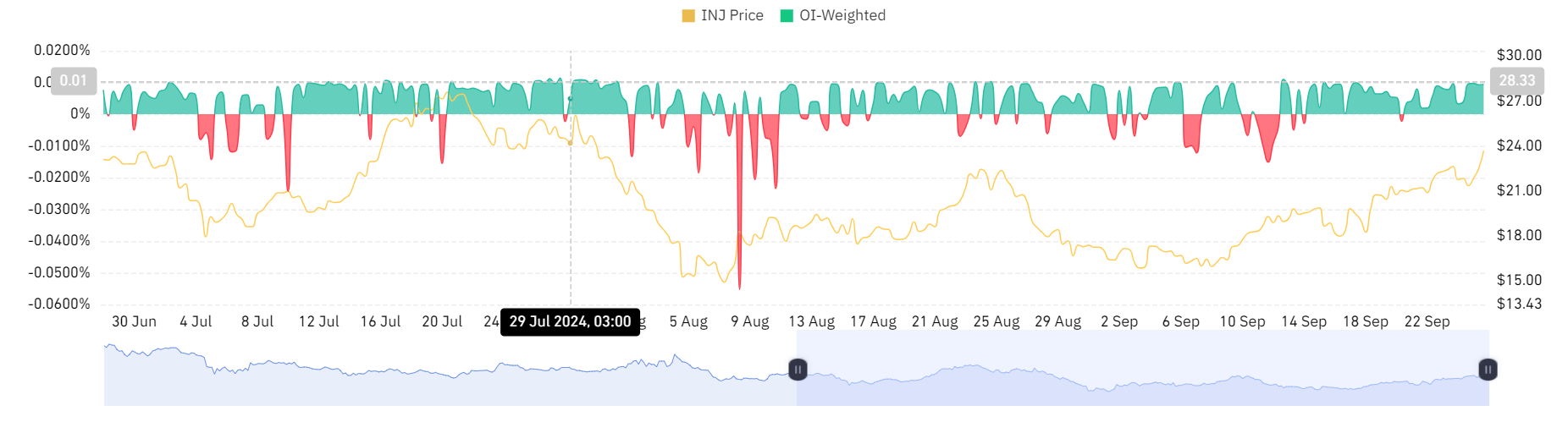

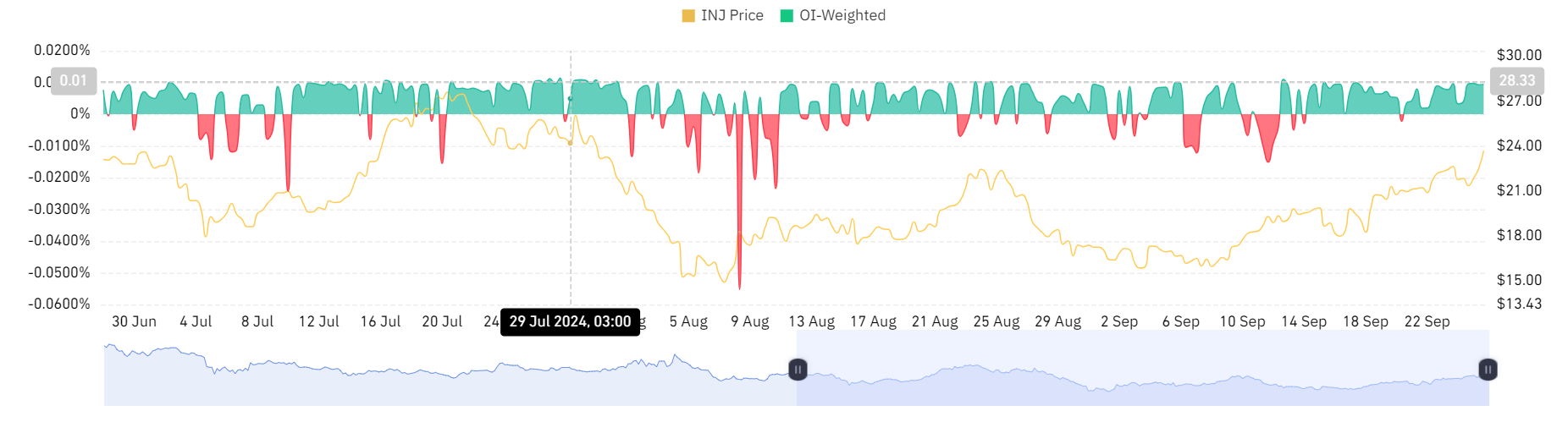

Source: Santiment

Looking further, the Open Interest in USD per Exchange has been on a sustained upward trend over the past week. As such, it has increased from $33.4 million to $41.18 million.

Since the price rises as Open Interest increases, this usually confirms the strength of an uptrend. This means that traders take positions in the direction of the price movement, which confirms the credibility of the trend.

Source: Coinglass

Finally, the demand for long positions is further strengthened by a positive OI-weighted financing rate. This suggests that long position holders are optimistic about paying a fee to maintain their positions.

Read Injective [INJ] Price forecast 2024–2025

Simply put, Injective is currently experiencing upward momentum. Thanks to positive market sentiment, INJ is well positioned for further gains.

So, if prevailing market conditions persist, INJ will break the next significant resistance level at $25.8. If this level is broken, Injective will reach $29.3.