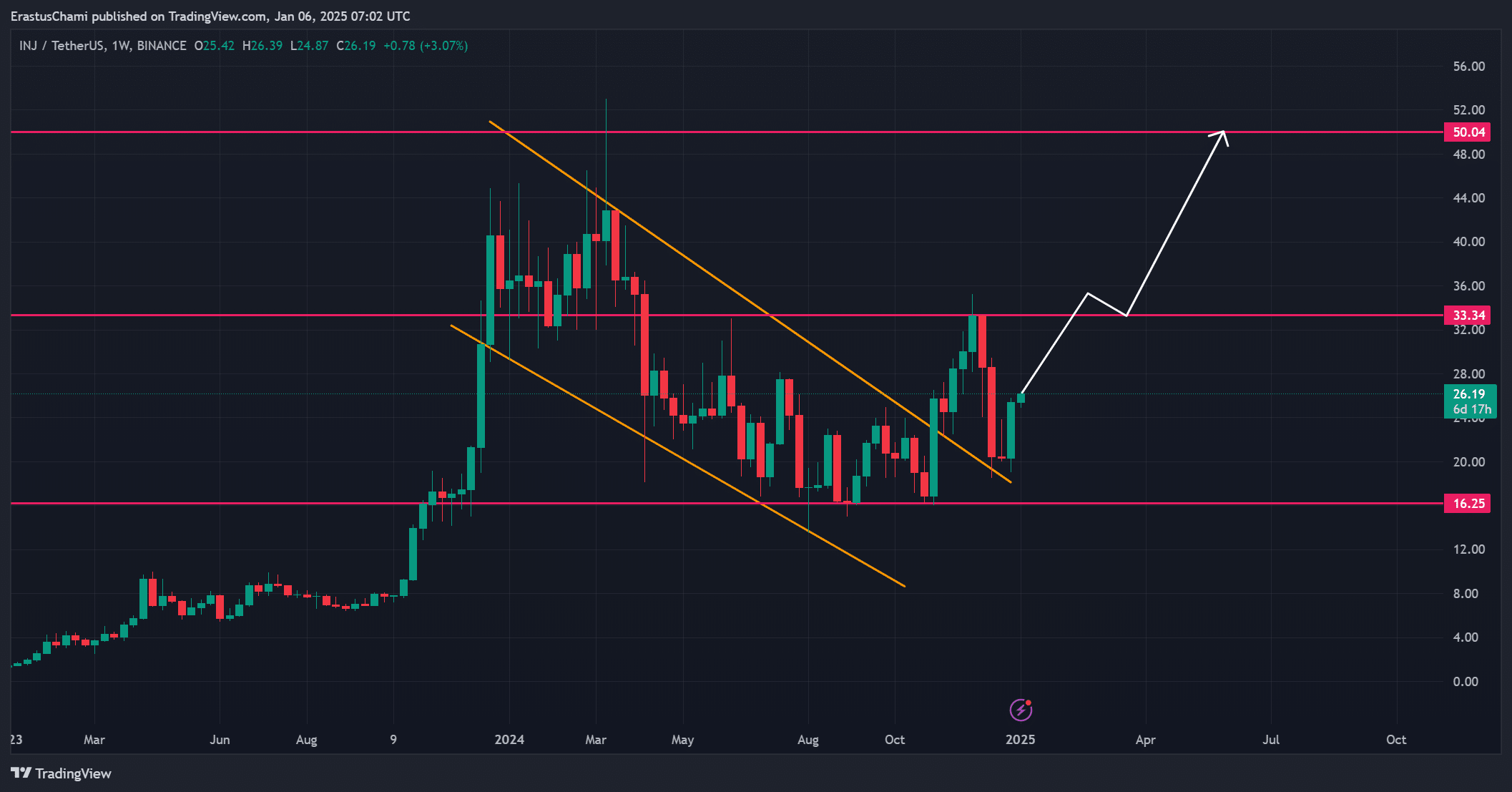

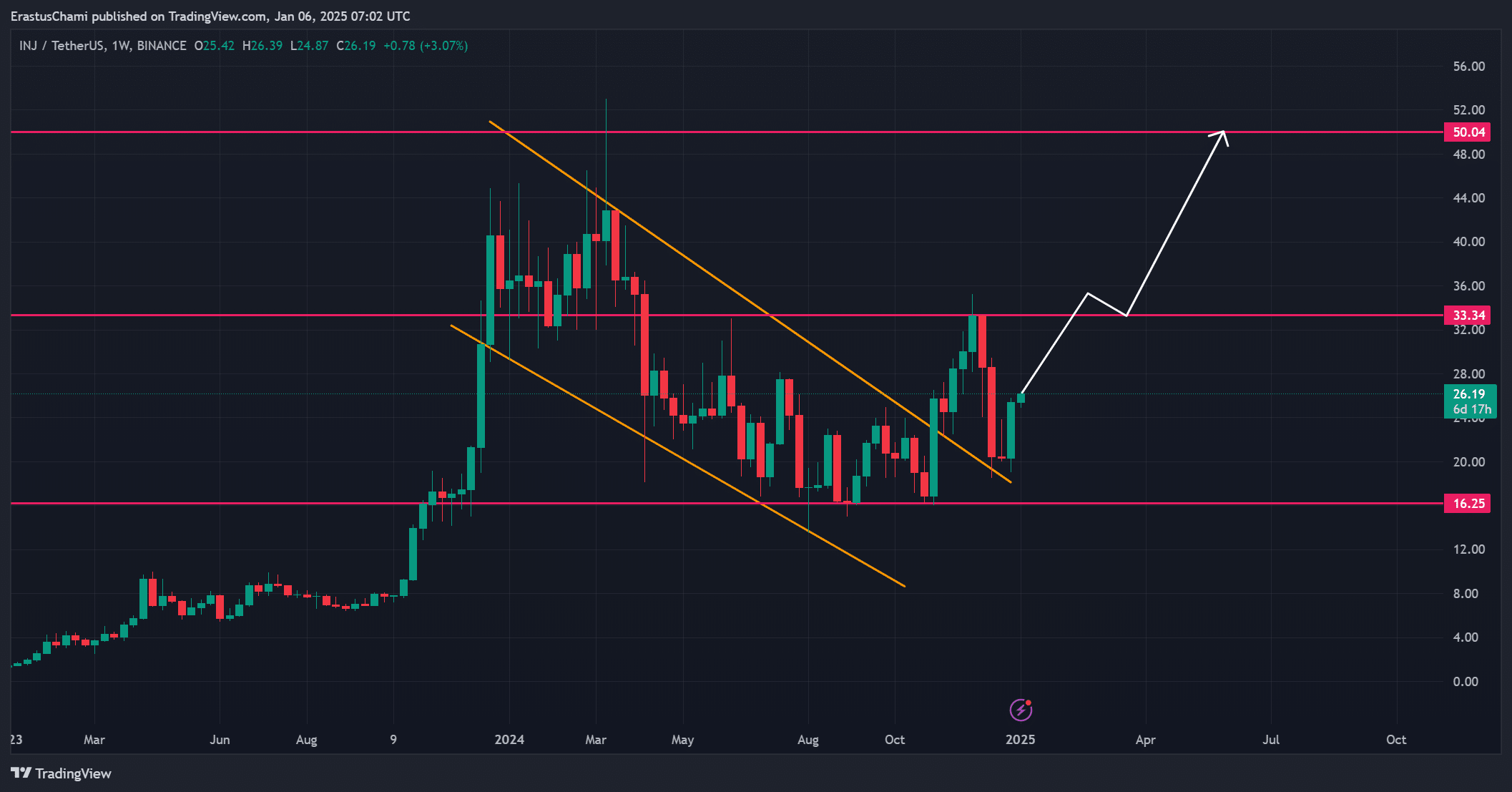

- Injective is targeting $33.34 and $50 after a bullish flag breakout, indicating strong momentum.

- Market sentiment remains bullish, with rising RSI, MA cross and increasing Open Interest.

injective [INJ] has made a significant breakout from the bullish flag pattern on the weekly term, creating renewed excitement among investors.

INJ was trading at $26.18 at the time of writing. After gaining 12.42%, the cryptocurrency has set its sights on key resistance levels.

The question remains whether Injective can maintain its bullish momentum or succumb to resistance along the way.

INJ Price Analysis: A Steady Climb or Resistance Ahead?

The breakout from the descending channel highlights INJ’s potential for continued upside momentum. The first target at $33.34 serves as a critical resistance level. Crossing this level could pave the way for a rally towards $50.

However, the token needs to maintain strong buying pressure to consolidate its position above USD 33.34. As the market gains confidence, these resistance zones will test whether the rally can sustain itself or enter a retracement.

Source: TradingView

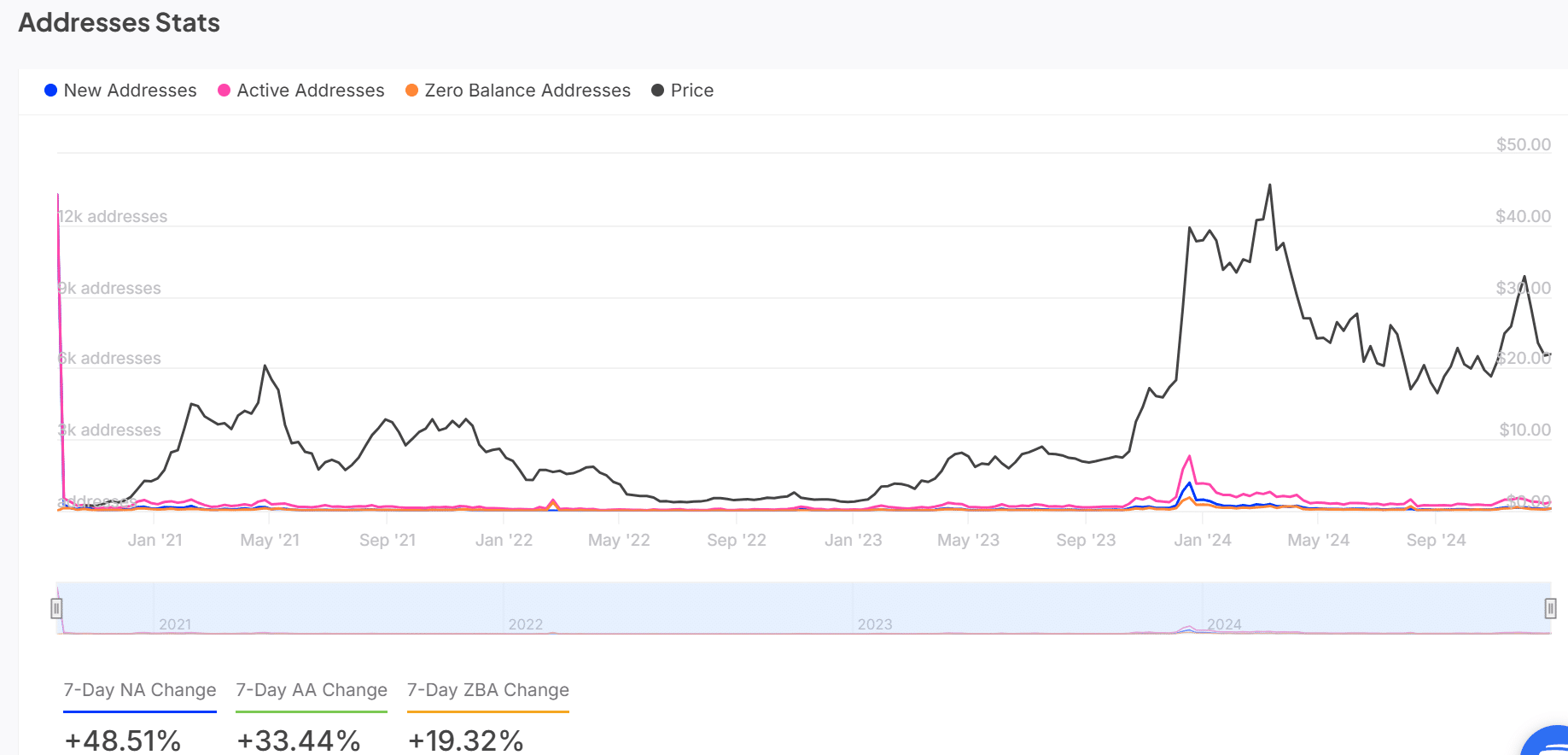

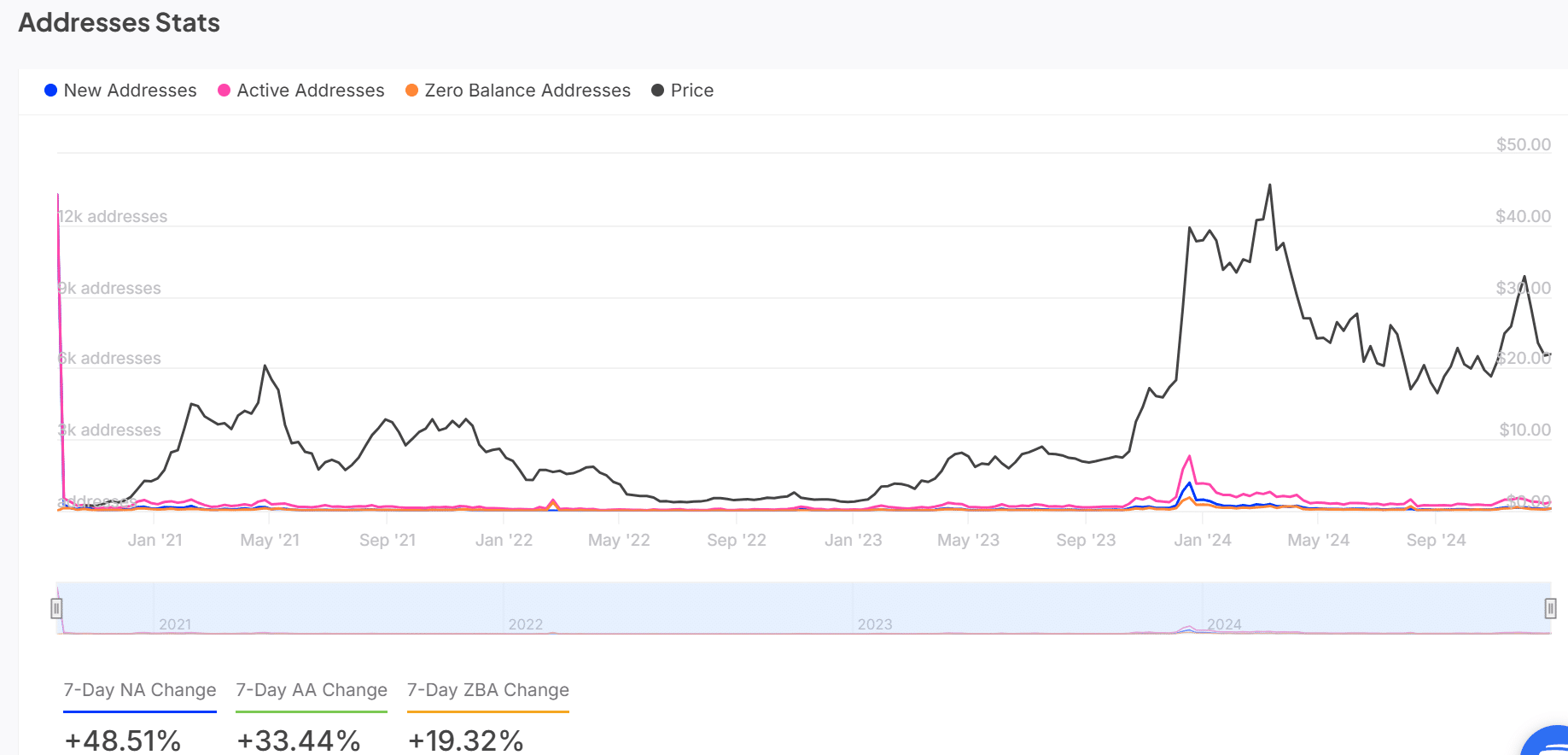

The growth of injective addresses is accelerating

Injective’s ecosystem is experiencing significant growth, with a 48.51% increase in new addresses and a 33.44% increase in active addresses in the past week. These statistics suggest increased interest from new participants and greater engagement from existing users.

Furthermore, this growth reflects strengthening fundamentals that could fuel further price action. However, sustainable adoption will be critical to ensure long-term momentum.

Source: IntoTheBlock

Traders are betting big on the upside of Injective

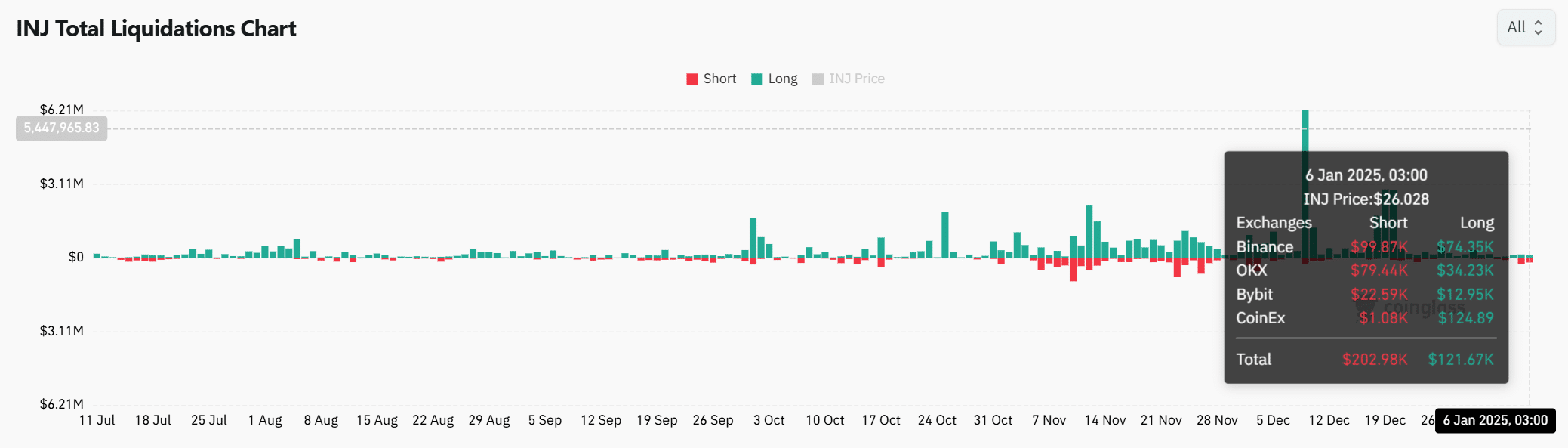

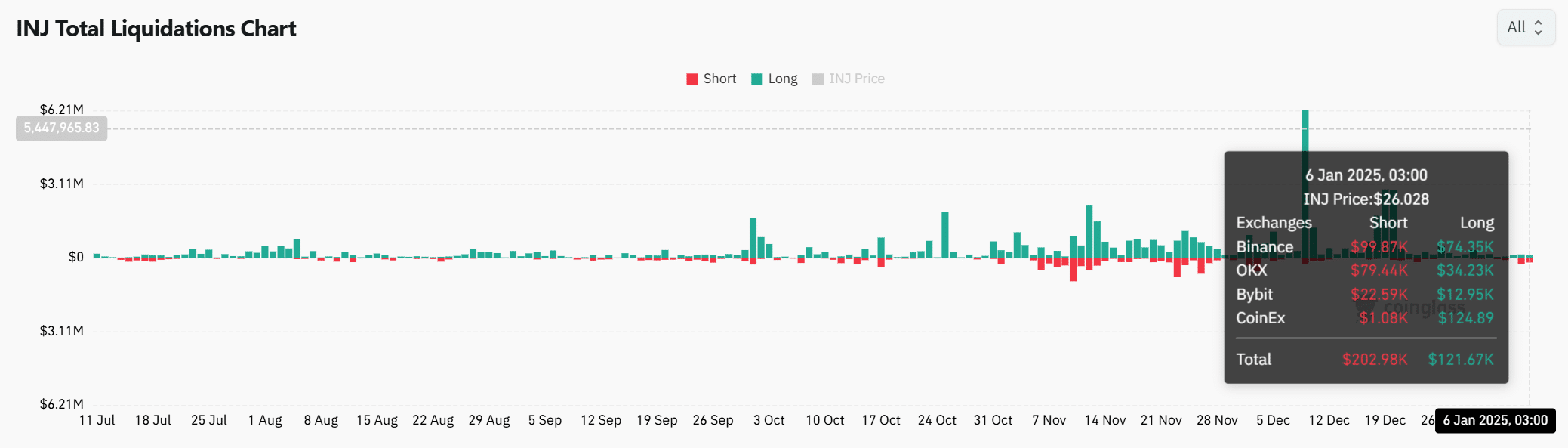

The liquidation data reinforces the bullish sentiment: $202.98K of short positions liquidated, compared to $121.67K of long liquidations. This indicates that traders are predominantly betting on price increases.

Moreover, the liquidation trend is consistent with the recent breakout, showing confidence in INJ’s upside potential. However, market volatility can still pose a challenge for traders aiming for higher price targets.

Source: Coinglass

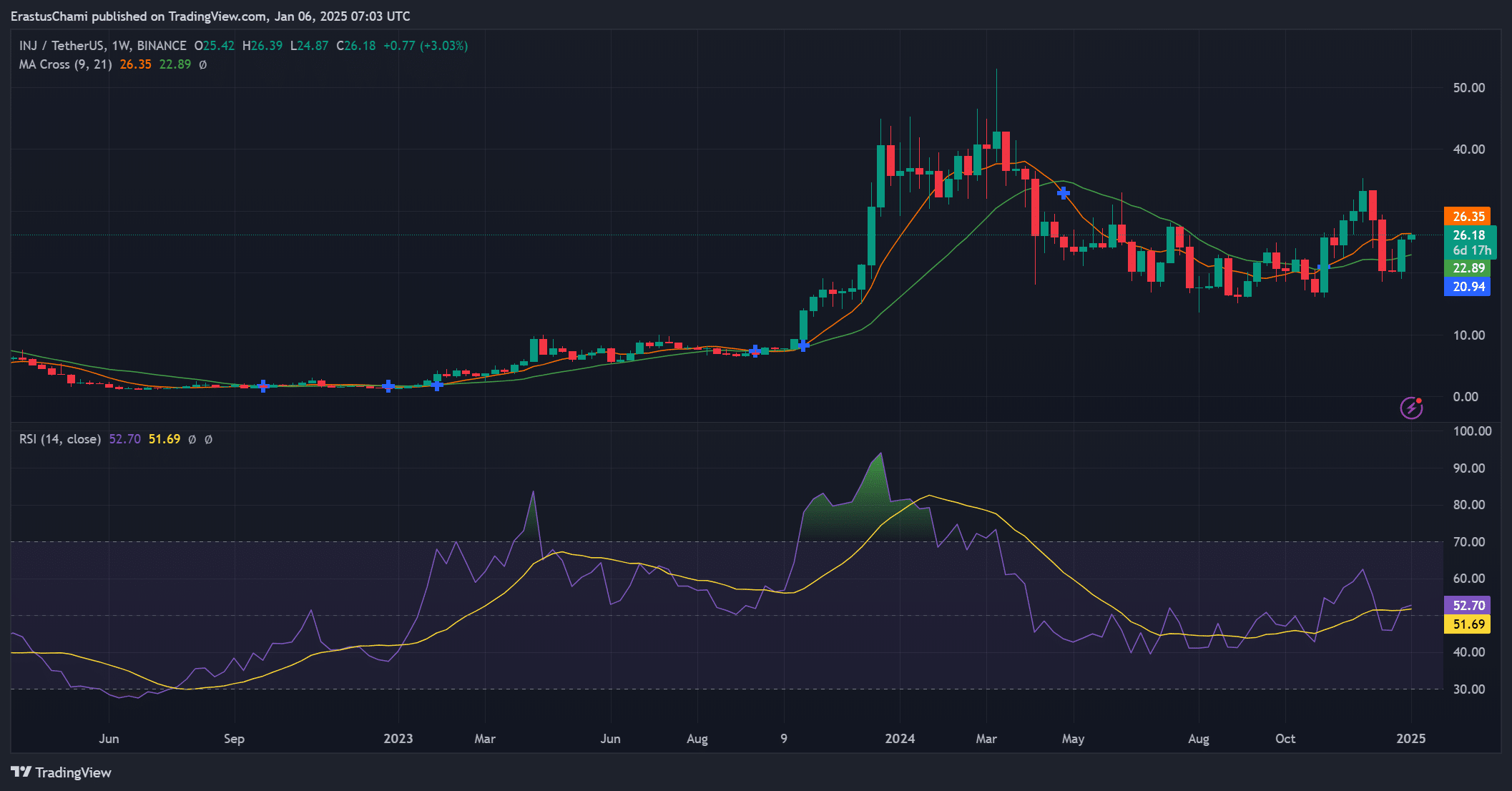

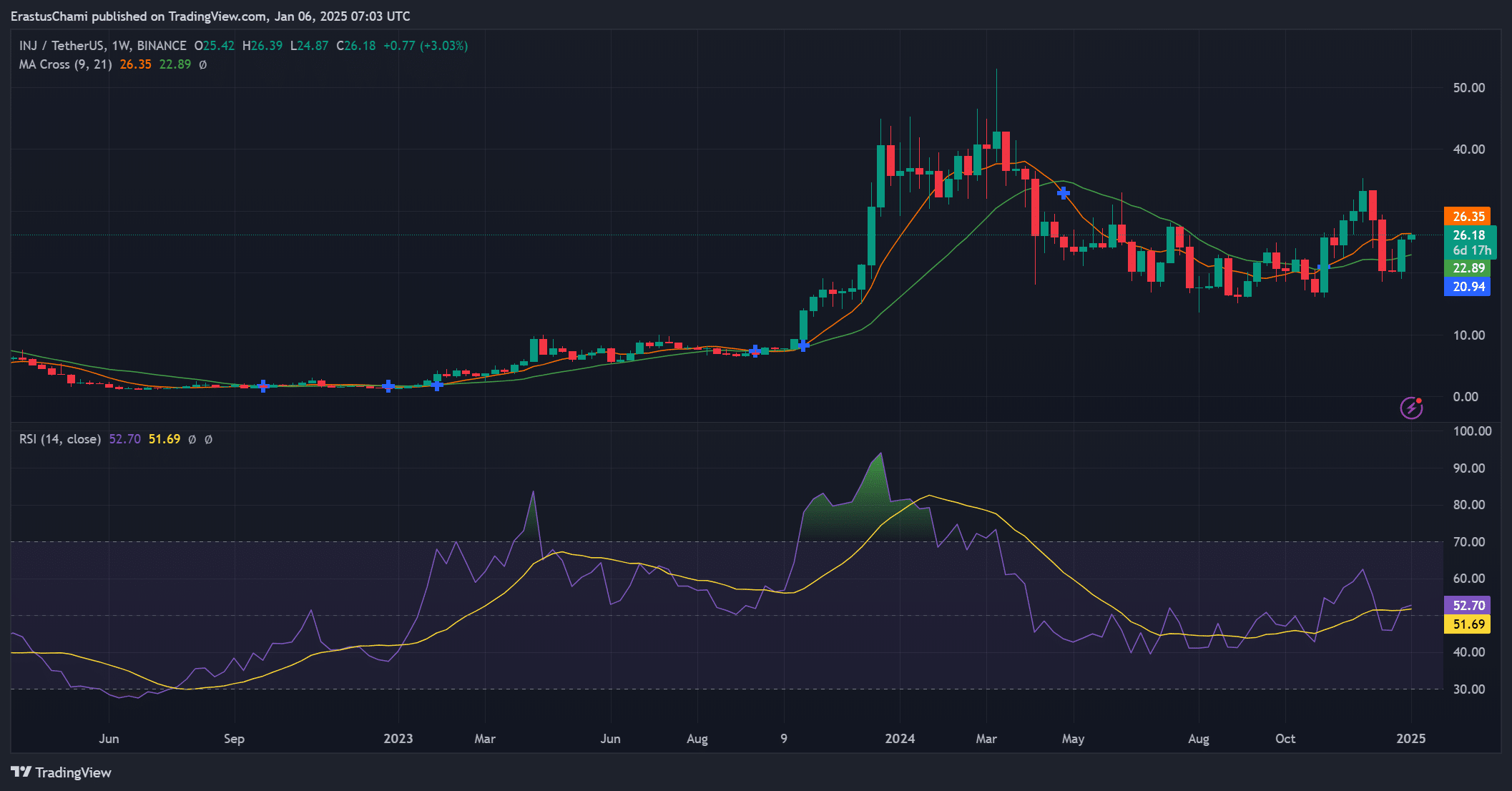

RSI and moving averages support bulls

The relative strength index (RSI) on the weekly time frame stands at 52.70, suggesting that Injective has room to grow before reaching an overbought environment.

Additionally, the bullish Moving Average (MA) crossing between the 9- and 21-period lines provides further confirmation of a strengthening trend. Therefore, these indicators point to a continuation of the rally, assuming market conditions remain supportive.

Source: TradingView

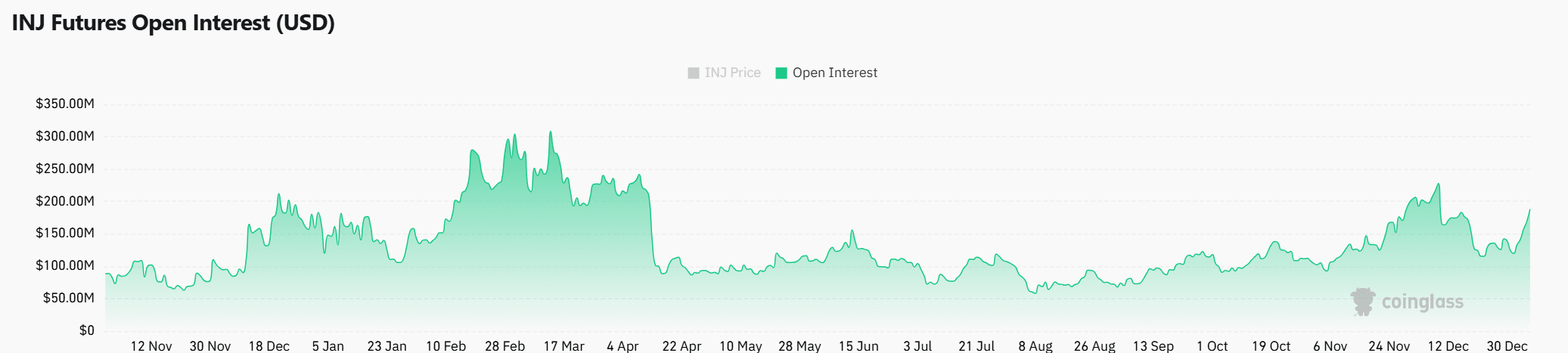

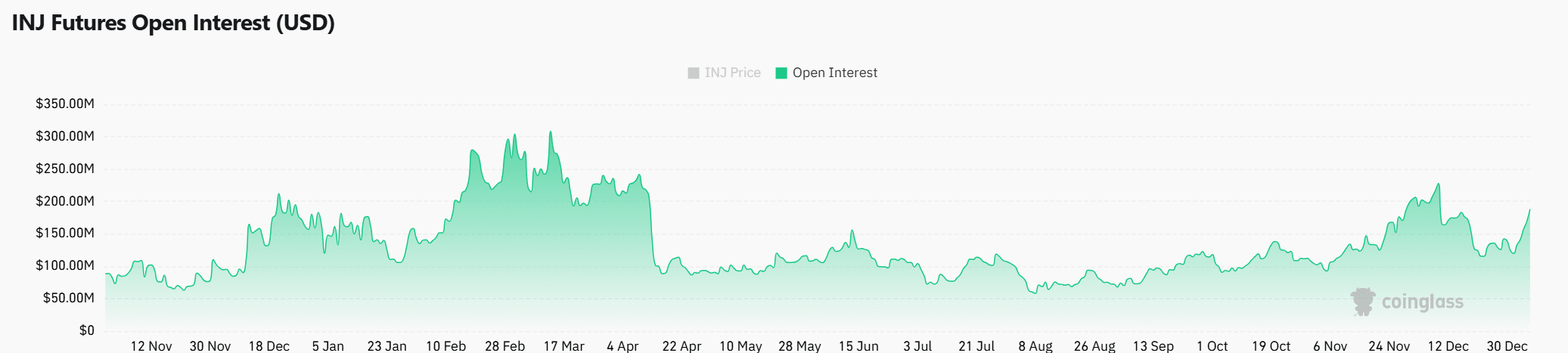

Sentiment and open interest: The bullish outlook is strengthening

Market sentiment is clearly optimistic as Open Interest (OI) increased 13.38% to $195.42 million. This indicates greater participation and confidence in INJ’s pricing trajectory.

Therefore, the combination of rising OI and strong technical indicators strengthens the case for a climb towards $50. However, traders should remain cautious of possible pullbacks along the way.

Source: Coinglass

Read Injective [INJ] Price forecast 2025–2026

Conclusion: INJ is on track to reach $50

Injective’s breakout, supported by strong technical indicators and rising network activity, positions it well to clear $33.34 and target $50. With current momentum, the bullish case for INJ remains strong.

It looks like the token will continue its climb to reach the $50 milestone, provided market conditions remain favorable.