- Bitcoin recovered to $96,000 after falling to $89,000, with limited whale activity impacting momentum

- Key figures, including open interest and whale trades, underscore mixed signals for Bitcoin’s short-term prospects

Bitcoin (BTC) started the year with promising momentum, reaching a high of $102,000 on January 7. However, this initial rally was short-lived as the cryptocurrency soon underwent major corrections, falling below $100,000 soon after.

At the time of writing, Bitcoin was at $96,556, after a partial recovery from a dip to $89,000 earlier this week. The price drop below $90,000 highlighted concerns among market participants, with some analysts delving into the underlying factors shaping the move.

In fact, a CryptoQuant analyst noted the ‘stop chasing’ pattern, where price declines temporarily breach key support levels before picking up again. Needless to say, this activity has raised questions about Bitcoin’s ability to sustain a trend reversal without the involvement of key market players.

Whale activity and market sentiment

CryptoQuant’s analysis indicated that whale inactivity is a major contributor to Bitcoin’s limited recovery. The Coinbase Premium Gap (CPG) data showed significant selling activity from whale entities, but no corresponding buying action to offset the decline.

Source: CryptoQuant

When whales step in to buy Bitcoin during a decline, the market typically sees increased volatility. However, this was not the case during the last price move.

The analyst emphasized the importance of activity on major exchanges, especially Binance, where whale participation often leaves a mark on market-purchase ratios.

In this case, no evidence emerged of substantial purchases by Binance whales, indicating a cautious approach by large-scale investors. While the daily candlestick pattern indicated potential for a trend reversal, the lack of involvement from major players leads to uncertainty about Bitcoin’s trajectory in the near term.

Bitcoin’s statistics send mixed signals

In addition to whale activity, other Bitcoin metrics shared additional insights into the asset’s performance.

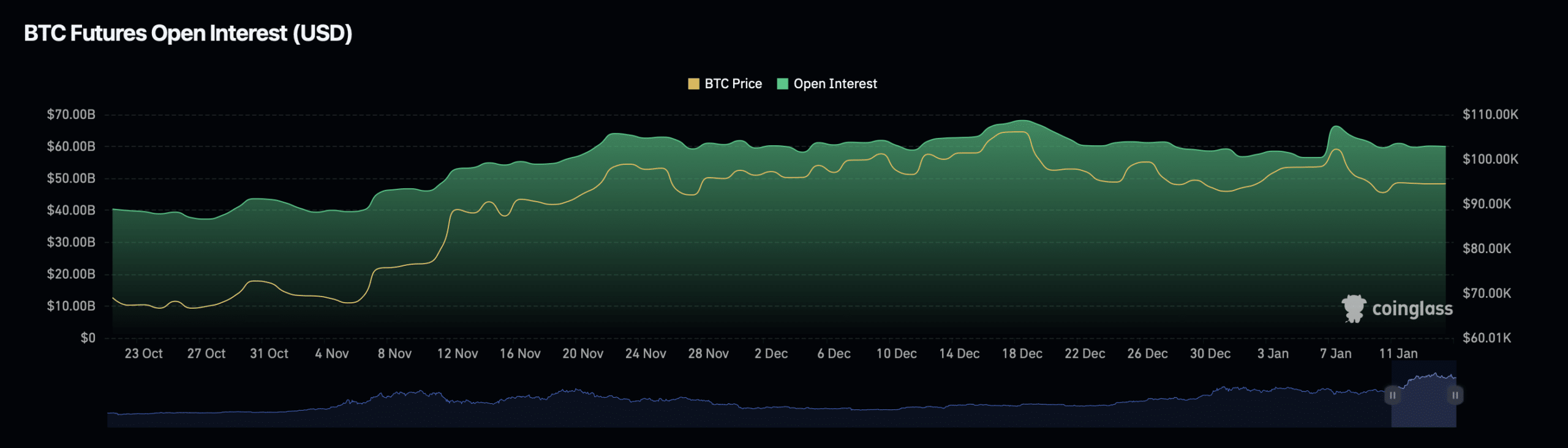

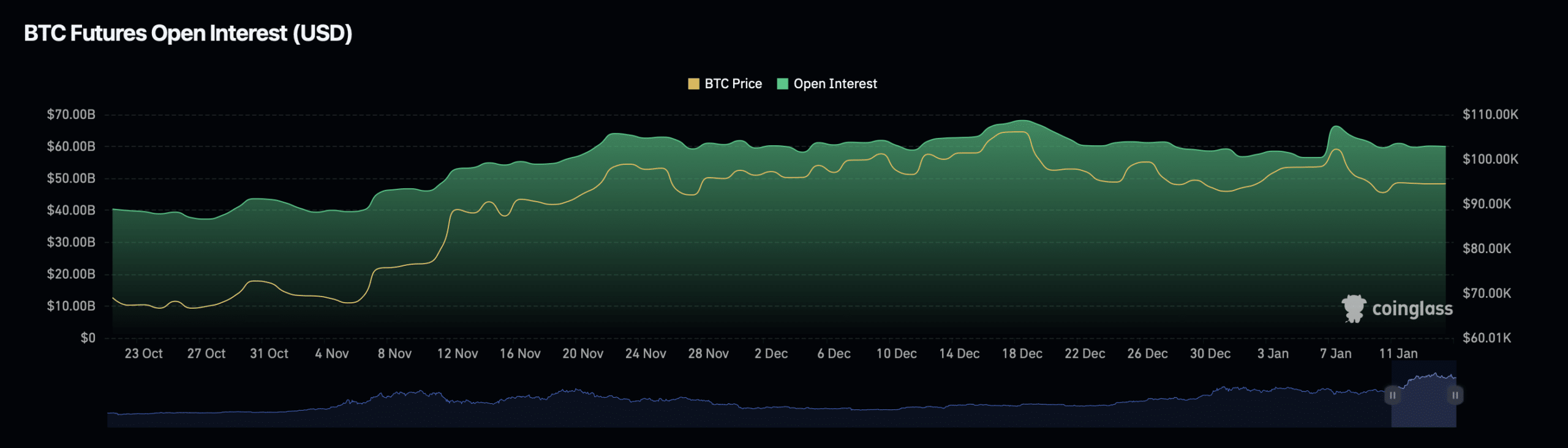

For example – Open interest, a measure of the total number of outstanding derivative contracts, rose by 2.09% in the last 24 hours to $61.88 billion.

Source: Coinglass

This increase in Open Interest hinted at a renewed interest in trading activity and could indicate more speculation about Bitcoin’s future price movements. Furthermore, Open Interest volume increased by 213.18% over the same period – a sign of increased market engagement.

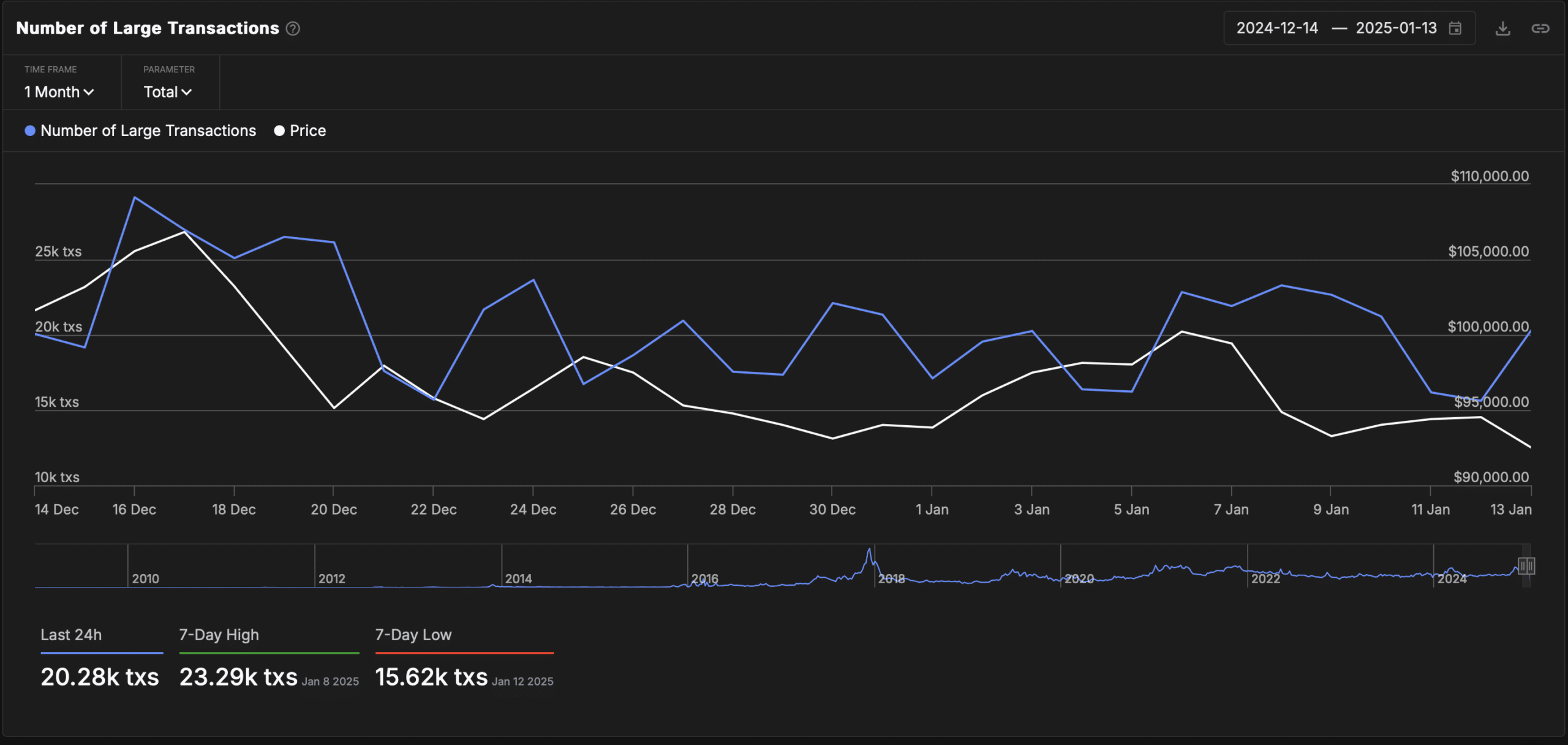

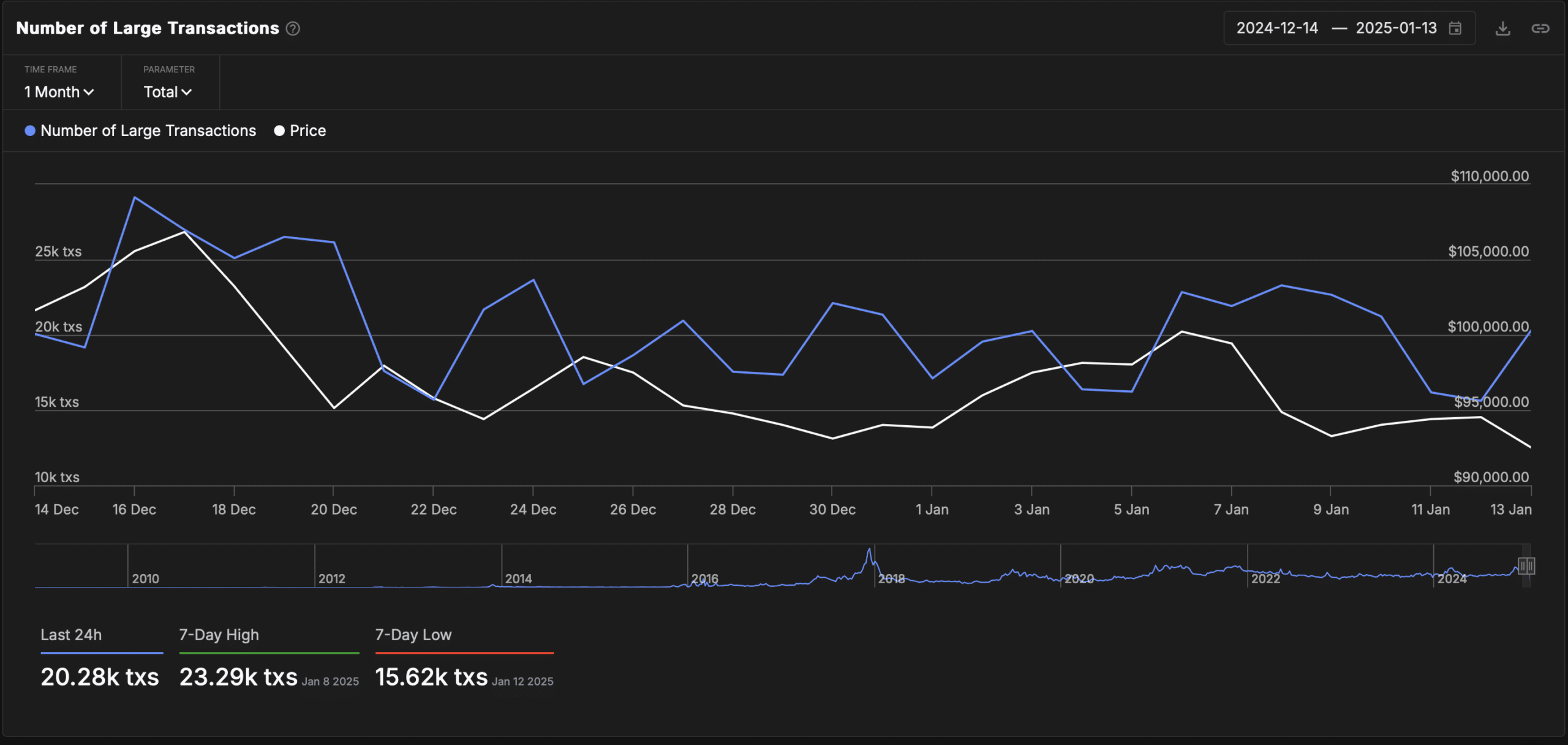

In the meantime, facts from IntoTheBlock highlighted fluctuations in whale transactions, defined as transfers of more than $100,000. Over the past month, the number of these transactions fell from 26,000 on December 16 to 15,000 on January 12.

Source: IntoTheBlock

However, there has been a remarkable recovery: more than 20,000 transactions were registered on January 13. This resurgence in whale activity could mean renewed interest in Bitcoin among major investors, potentially impacting market momentum in the coming weeks.