- Bitcoin’s NVT signal hit a one-month low on August 25.

- The King Coin’s foreign exchange reserves fell, and other metrics turned bullish as well.

After the last price correction on August 16 Bitcoins [BTC] the price fluctuated around $26,000. While several investors remained bearish on market conditions, BTC could be planning a quiet exit from the current price trend.

Read Bitcoins [BTC] Price Prediction 2023-24

We may be on a market floor

According to CurrencyMarketCapThe price of BTC has fallen by more than 1.5% in the past 24 hours. At the time of writing, it was trading at $26,090.91 with a market cap of over $507 billion.

However, the bearish price trend could end soon. Tedtalksmarco, a popular crypto influencer, recently posted a tweet highlighting an interesting development.

Looks like Binance is doing the old TUSD trick.

Note the correlation with Bitcoin here… TUSD sees the biggest supply increase in the major USD-denominated stables (delta MoM) 👇 pic.twitter.com/jdSkwLjHxh

— tedtalksmacro (@tedtalksmacro) August 25, 2023

According to the tweet, TrueUSD’s [TUSD] The market capitalization has increased recently. This happened while the market cap charts of most other stablecoins remained relatively flat. Historically, when TUSD’s market cap has risen, BTC‘s price has followed suit.

Such episodes took place earlier this year in January, March and July, which also gave hope for a price increase this time.

Furthermore, Glassnode’s data revealed that BTC’s NVT signal just hit a one-month low of 1,292,206. A low NVT signal indicates that investors have priced Bitcoin at a discount.

📉 #Bitcoin $BTC NVT signal (7d MA) just hit a one-month low of 1,292,206

View statistics:https://t.co/NIjFezJMgN pic.twitter.com/WffkFJdmGP

— Glassnode Alerts (@glassnodealerts) August 25, 2023

Also, the low NVT signal suggested a possible market bottom, indicating that now was the right time to accumulate Bitcoin. In fact, the whales are already gathering, a sign that they expected the price of the coin to rise in the coming days.

Recently there are addresses between 10 and 10,000 BTCs has added about 11,629 coins to their existing supply since the August 17 crash.

A Bitcoin bull rally is imminent

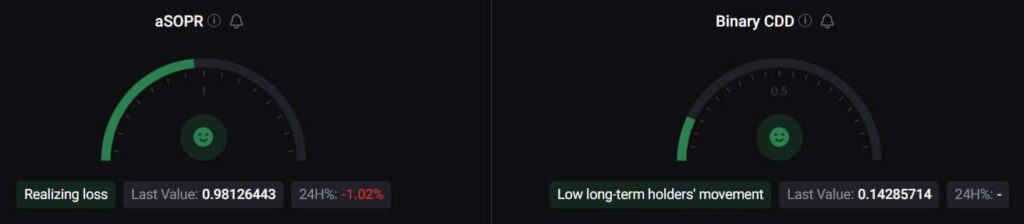

Not only the aforementioned updates, but several other statistics also supported the possibility of a price hike. For example, BTC’s foreign exchange reserve declined. BTC’s aSORP was also green.

Is your wallet green? Check the BTC Profit Calculator

This meant that more investors sold at a loss. However, in the middle of a bear market, it could indicate a market bottom.

Another bullish measure was Bitcoins BThe inary CDD was green, indicating that long-term holders’ movements have been lower than average over the past seven days. In addition, according to Mint glassBitcoin’s Open Interest had decreased, increasing the likelihood of an upcoming trend reversal.

Source: CryptoQuant