Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

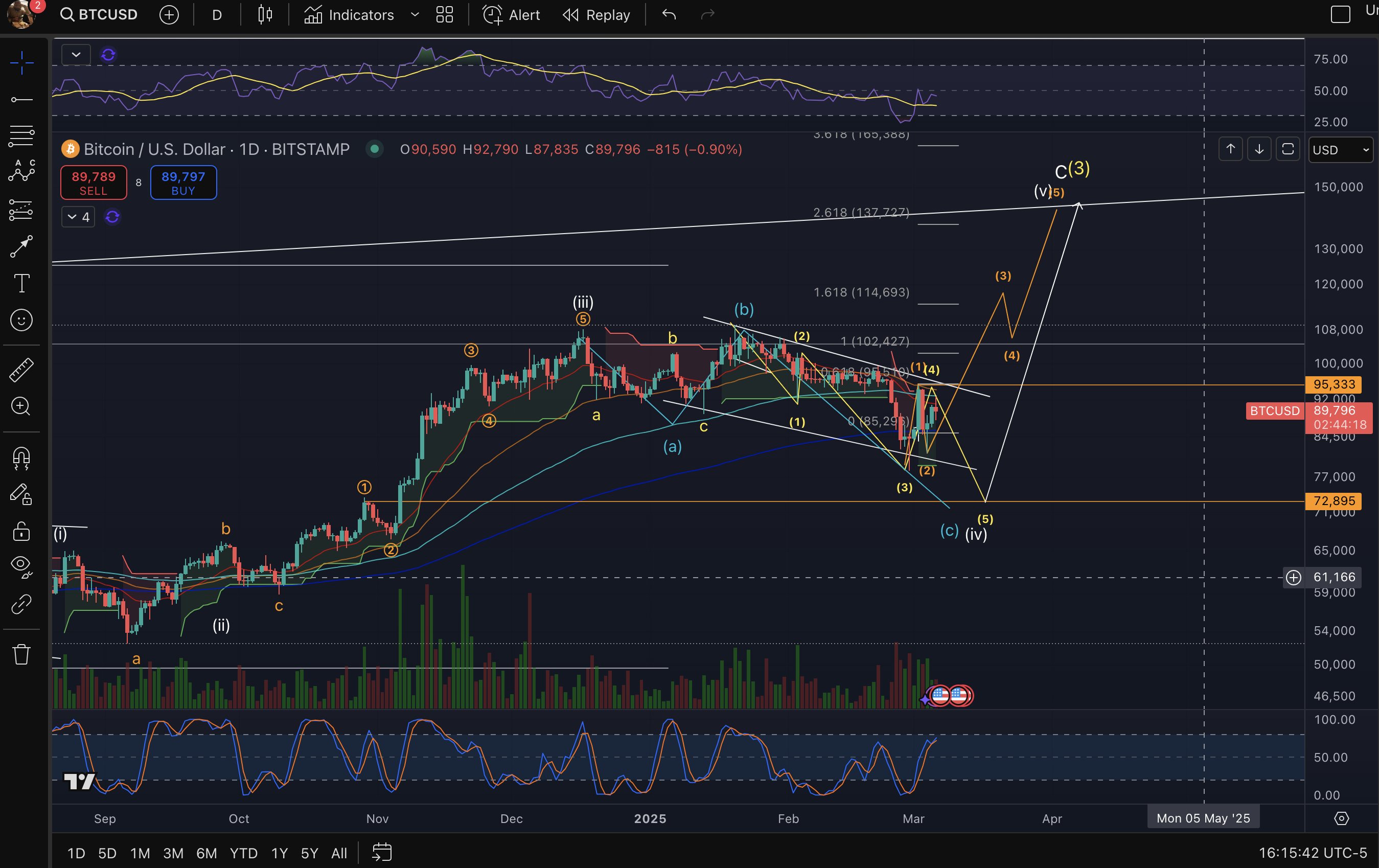

In a newly published graph, Elliott Wave -Specialist and Crypto Analyst Big Mike (@Michael_ewpro) sketches a precise route map for the Bitcoin price action, indicating that a break above $ 95,000 – or a bounce of lower support almost $ 72,000 – can put on. His analysis builds on detailed golf counts, several Fibonacci expansion goals and critical advanced averages, and offers a detailed view of the BTCs nearly and medium term options.

What is the next step for Bitcoin?

Big Mike’s Chart displays A complex Elliott wave structure consisting of five main impuls waves and alternating corrective sub-waves. An important area with the label near $ 72,895 corresponds to Golf (C) (C) (IV), which represents an important potential soil when the market breaks under $ 78,000 and remains lower.

Remarkable corrective waves from approximately $ 85,000 to $ 95,000 seem to have formed a larger consolidation phase, which he regards as a precursor to the next directional movement. The graph also locates an upward route of around $ 95,000 and projects impulse waves (3), (4) and (5) that extend to the $ 100,000 – $ 140,000 zone.

Related lecture

Fibonacci extension goals appear at around $ 114,693 (1.618 extension), which could be the target for Golf (3), followed by a corrective movement up to $ 102,000 before the Golf 5 starting to $ 137.727 (2,618 extension), or even a end bone near almost $..

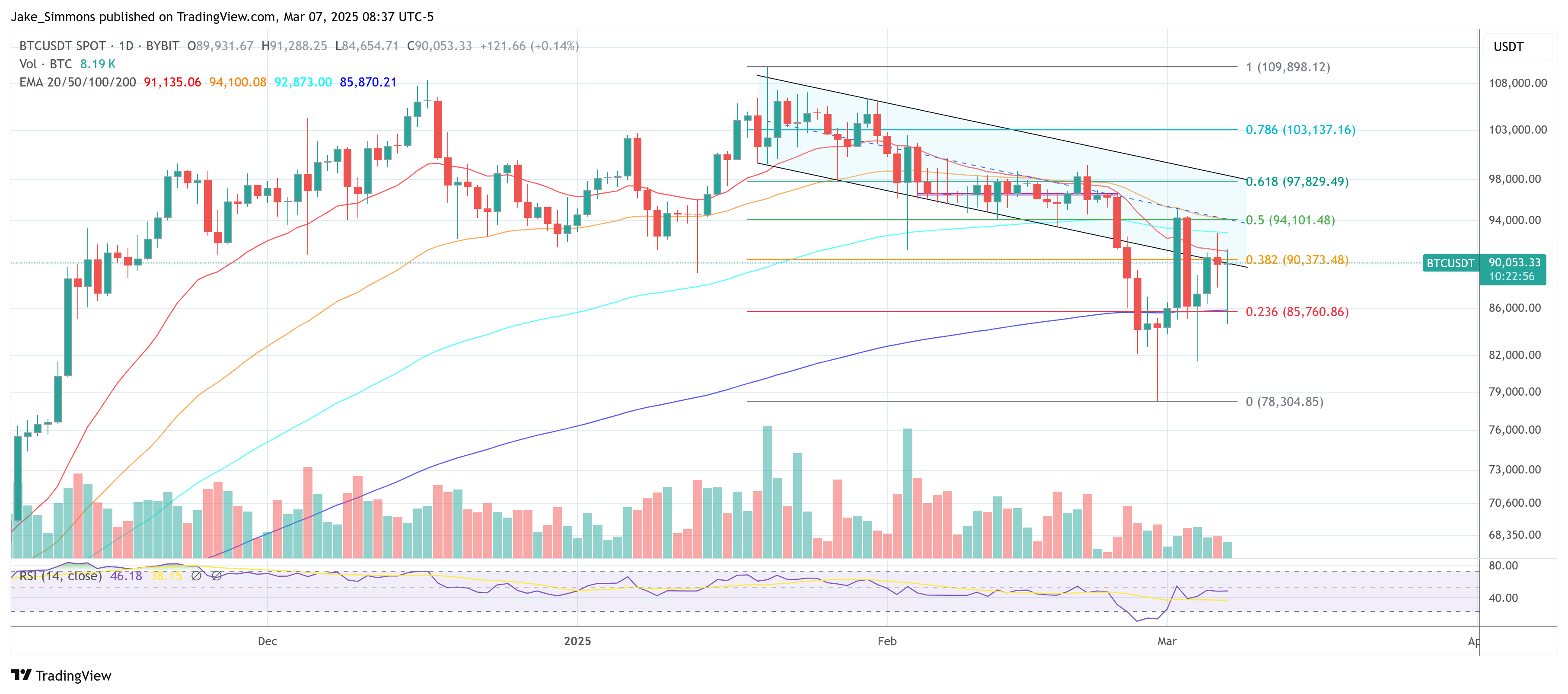

Collection averages in the range of $ 72,000 – $ 90,000 underline the importance of support in the vicinity of $ 78,000 – $ 72,895, while an upper tire of around $ 90,000 – $ 95,000 represents a crucial resistance corridor. The analyst observes a falling wig formation from mid -February to the beginning of March, with $ 95,000 to $ 85,000, and notes that an upward outbreak could herald a renewed push in the territory of six digits.

Related lecture

Volume profiles indicate modest participation during recent corrective phases, in addition to a neutral stochastic RSI lecture that suggests that the momentum can shift decisively, depending on which price threshold makes room first.

Big Mike emphasizes two critical lines in the sand: “BTC above $ 95K will quickly activate the movement to my goal of $ 130- $ 140k. Below $ 78k and we test $ 72k and then walk to $ 140k. “From his perspective, both a direct break above $ 95,000 as a deeper dip up to $ 72,895, ultimately on the same upward target near $ 130,000 – $ 140,000.

At the time of the press, BTC traded at $ 90.053.

Featured image made with dall.e, graph of tradingview.com