In a recent one wire on X (formerly Twitter), renowned on-chain analyst Checkmate provided analysis on Bitcoin’s future trajectory. Currently, the leading cryptocurrency is hovering around $60,000, a pivotal moment that reflects historical patterns within the Bitcoin market cycle.

What will the next 6 months bring for Bitcoin?

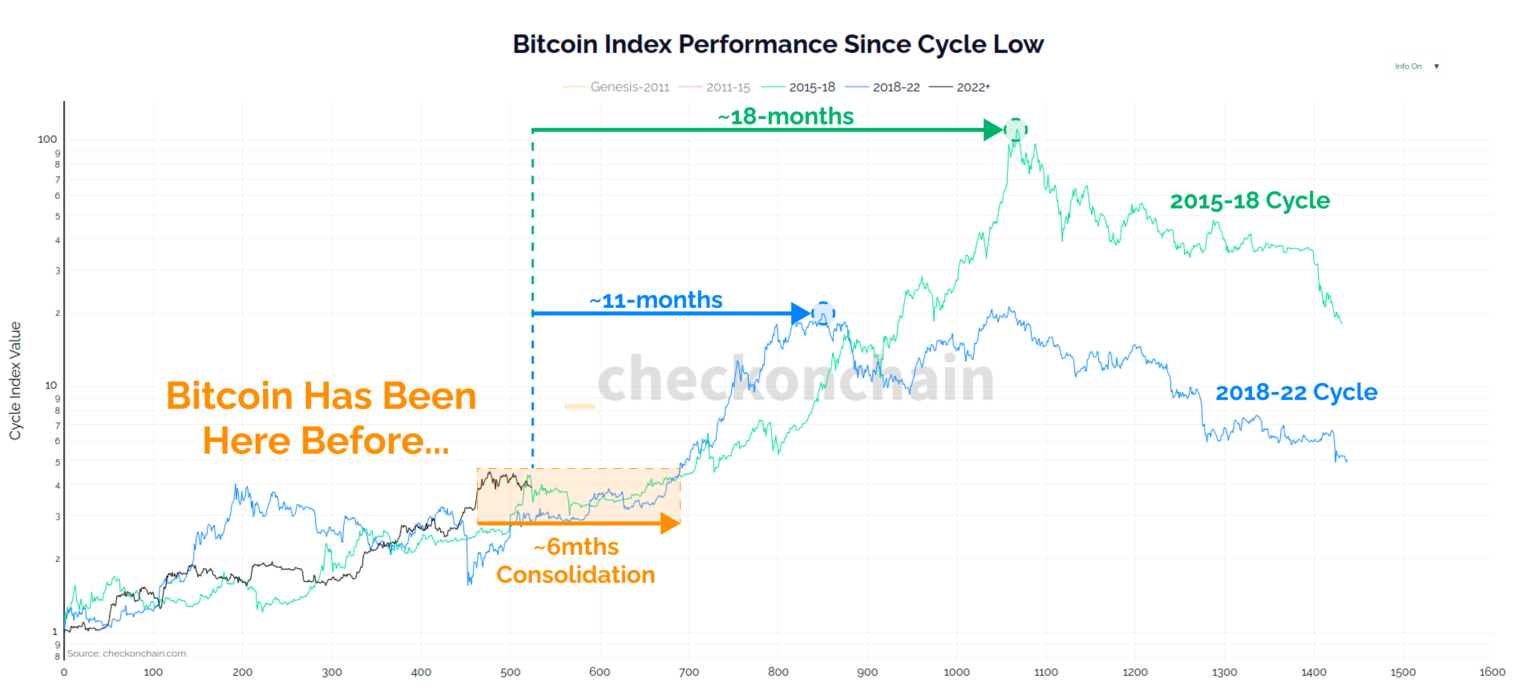

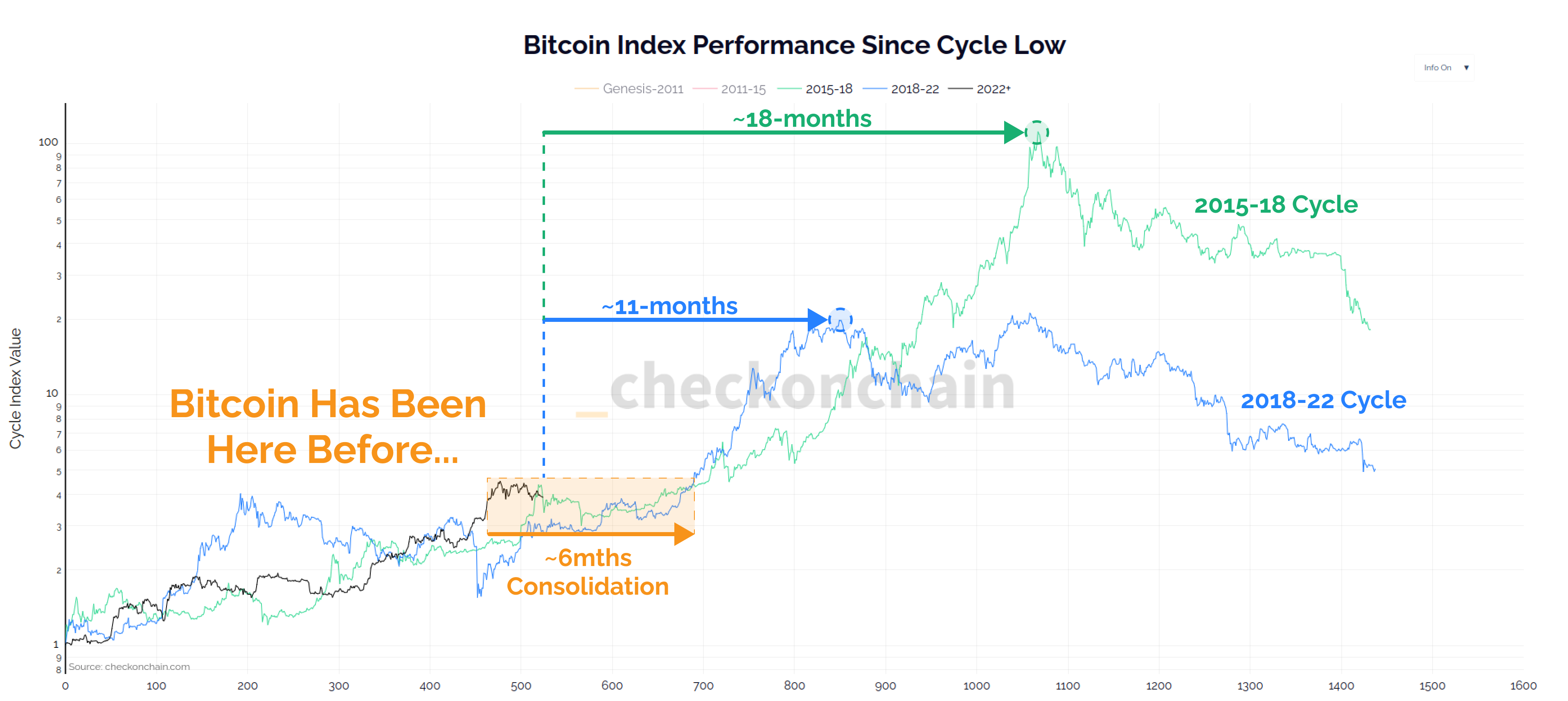

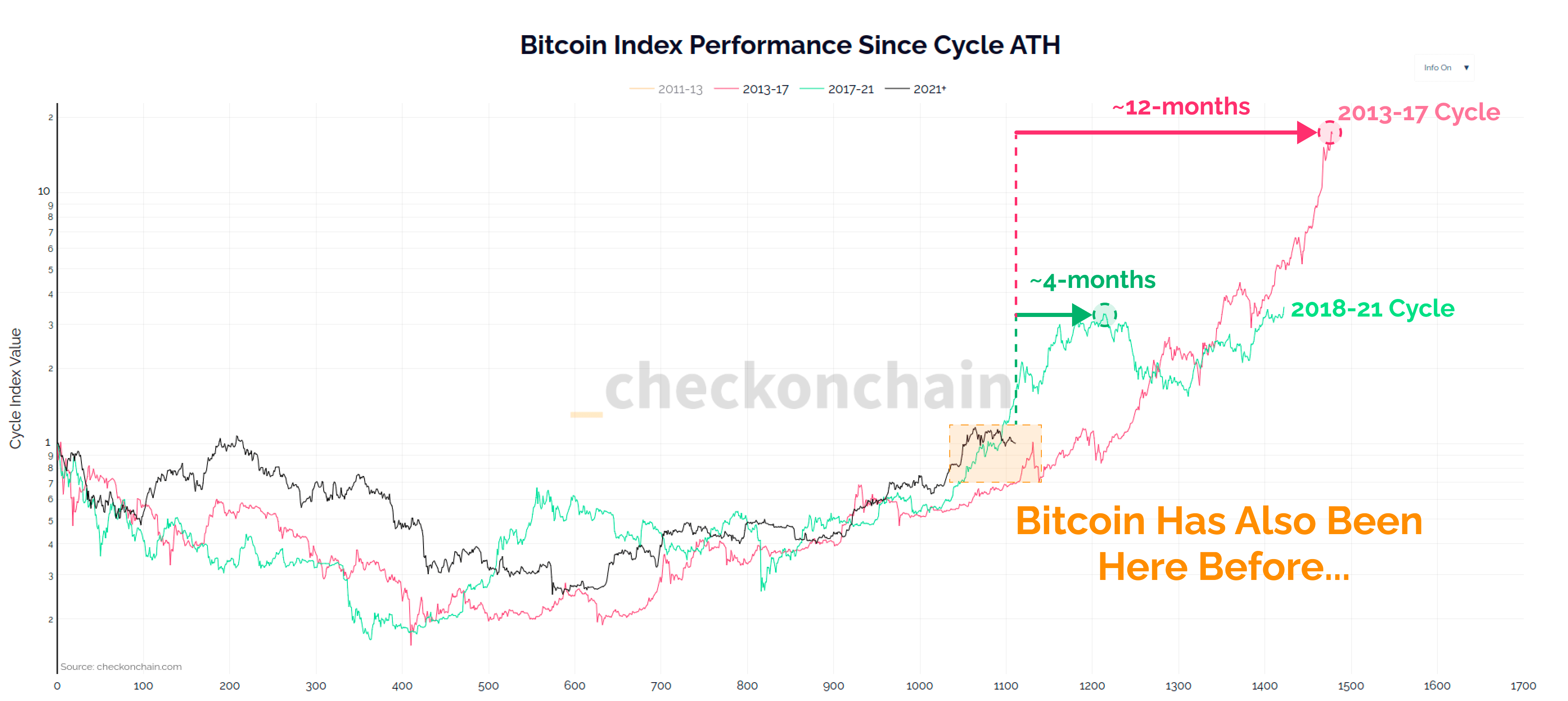

Checkmate states that Bitcoin is in a ‘chop solidation’ phase – a term coined to describe a stagnant yet volatile period. He suggests this could last about six months, based on previous cycles, and could potentially usher in a period of parabolic growth that could last between six and 12 months. “Bitcoin history tends to rhyme, and so far this cycle is no different,” Checkmate noted. “The song sung during the last two cycles paints about six months of chop consolidation for us, followed by six to twelve months of parabolic progress.”

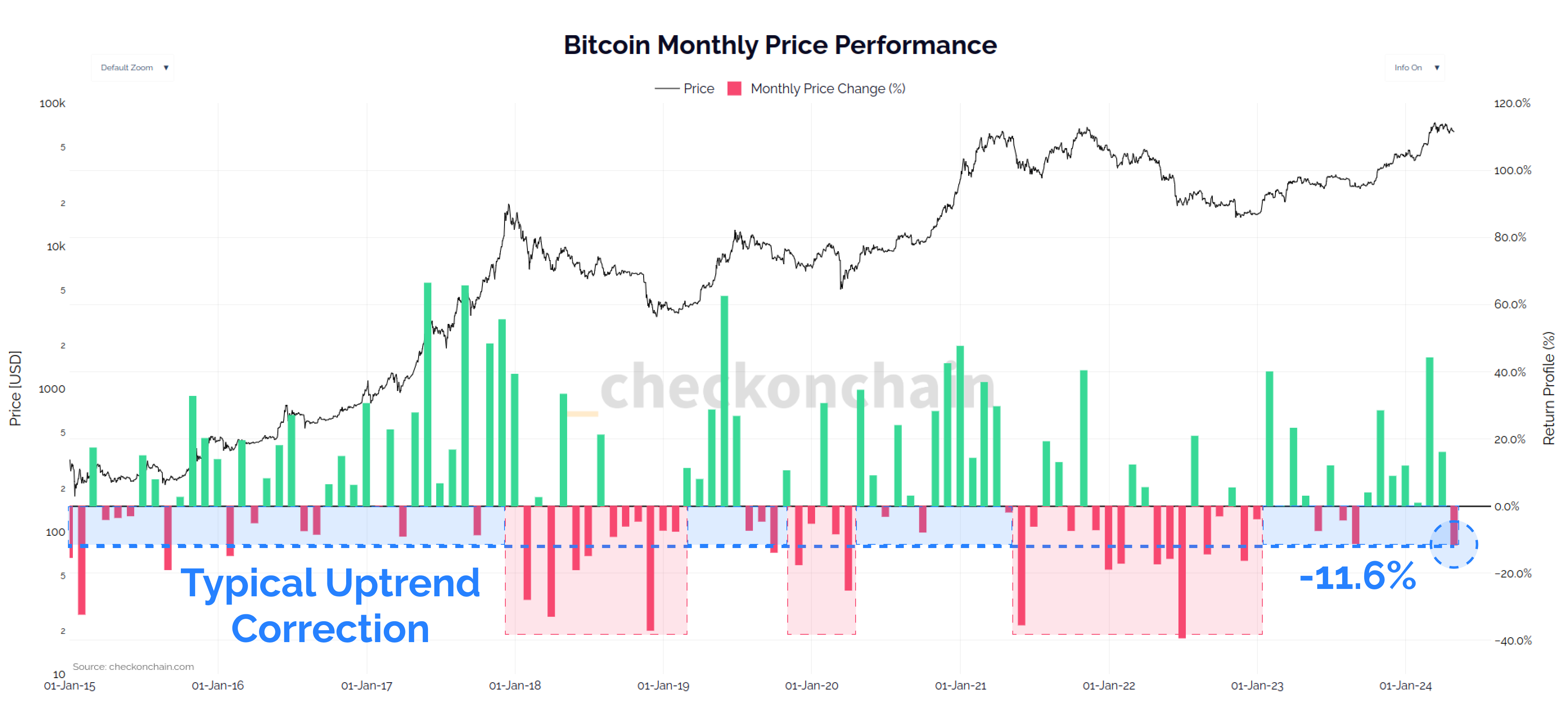

In support of its analysis, Checkmate points to April 2021 as a major high for Bitcoin for “many good reasons,” noting that despite a significant monthly decline of over $8,250 in April, such moves are typical and often indicate healthy market corrections. “It is a monthly pullback of -11.2%, and is very common during uptrends, and corrections are healthy and necessary,” he stated, reinforcing his confidence in Bitcoin’s resilience and recovery potential.

Further statistical support comes from historical data focusing solely on Bitcoin’s half-lives (2012, 2016, 2020 and 2024), which Checkmate used to illustrate that such month-to-month corrections are not outliers, but rather common occurrences within the cyclical trends of the digital asset. . The end of each year after the halving has historically seen strong performance, supporting the idea that the current price level could be a harbinger of significant gains.

Sell in May and move away?

Checkmate also retweeted a message from Charles Edwards. The founder of Capriole Investments commented on the unprecedented bullishness of the market, implying that a deeper correction is to be expected.

“This is getting ridiculous. Bitcoin hasn’t had a run like this since its inception. We are now one day behind the 2011 record for days without a significant dip [more than 25%]. If you’re not willing to accept a downside in this asset class, you shouldn’t be here. Especially now,” Edwards said. His comment highlights the unusual lack of serious downturns in the market, suggesting investors should be prepared for potential volatility.

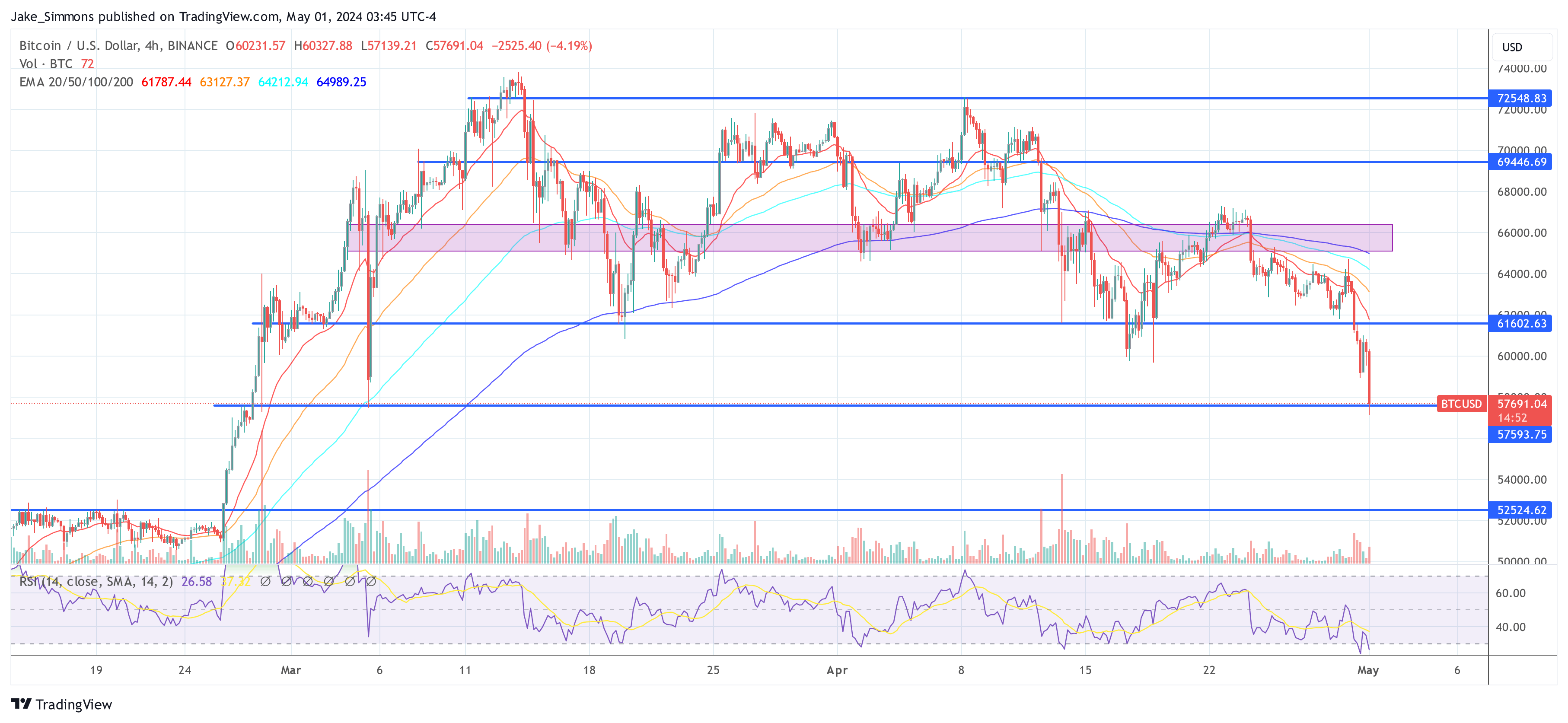

In another post on X, Edwards added a cautious note to the otherwise optimistic outlook. He advised: ‘Sell in May and get out. This seems like distribution to me. As long as we trade below $61.5K, scenario (1) is technically more likely. A strong recovery of $61.5K would give the bulls some hope for scenario (2). A flush would also be good for continuing the bull market; the sooner we get one, the better the long odds.”

This perspective suggests that a short-term strategic pullback may be wise, implying that current market conditions could be more bearish than they appear and that a significant correction could potentially strengthen the market’s long-term prospects.

At the time of writing, BTC plummeted to $57,691.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.