- Chainlink is breaking out with strong momentum.

- Historical correlation and upcoming trading season will drive LINK’s bull run.

Chain link [LINK] recently breached a crucial resistance level of $10.6 in a four-hour time frame and delivered an impressive return on investment of 18.58%.

This breakout was characterized by strong momentum, with no immediate retest, signaling potential strength in the price action.

Source: Ola Wealth/X

However, challenges remain in the medium-term downward trend that has persisted since March. The next major resistance levels to watch are at $13.1 and $16.8. The key question now is whether this strong rally will continue.

Weekly forecasts

Over the past week, LINK/BTC has shown resilience and pushed towards the $12 price level. However, to maintain this momentum, LINK must break the 2100 sats level.

If LINK can overcome this hurdle, it could follow other DeFi projects and target the 4400 sats level. The recent increase in weekly liquidity further supports the potential for upside.

Source: TradingView

Chain link [LINK] appears to have completed a mini cycle, with a clear weekly divergence between price action and the RSI.

This divergence indicates that the current upward move could mark the start of a new LINK bull run. The fact that many altcoins are showing similar patterns adds even more confidence to this expected uptrend.

Source: TradingView

Incoming high season

The broader altcoin market is showing signs of repeating the patterns we saw in 2017 and 2021, when altcoins rebounded strongly after the halving.

The market capitalization of altcoins is currently in consolidation, similar to previous cycles, which often preceded significant rallies.

Source: TradingView

This suggests that an altseason could be on the horizon, which LINK may benefit from along with other altcoins.

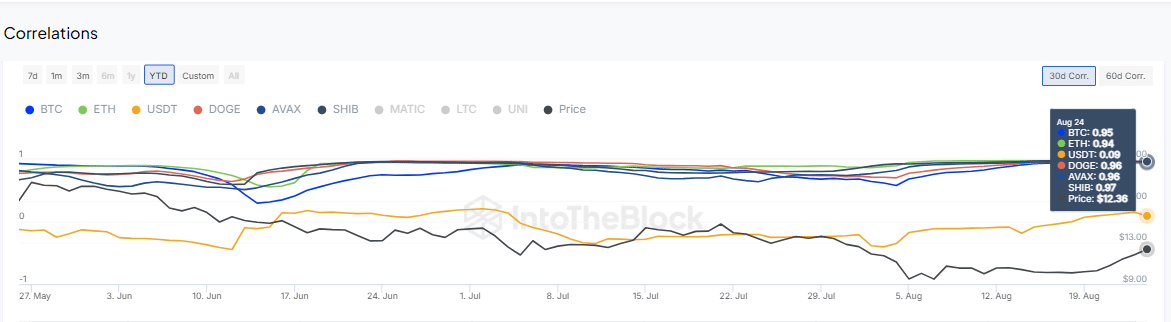

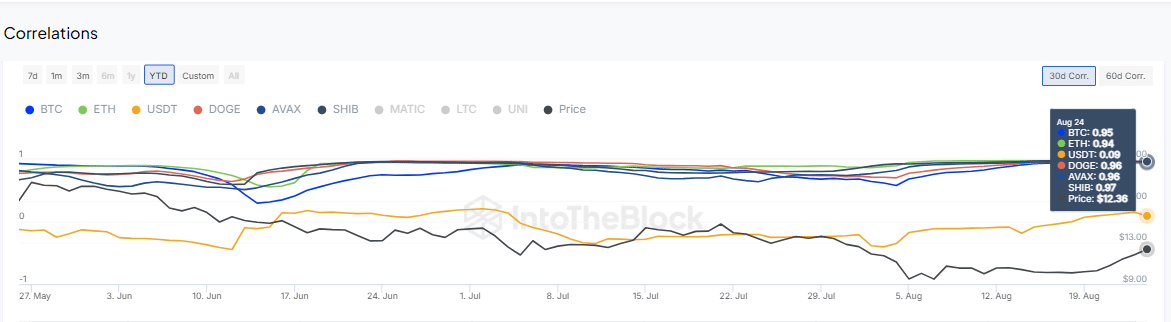

Historical correlation

Chainlink’s correlation matrix reveals a strong relationship with major crypto assets: 0.95 with Bitcoin, 0.94 with Ethereum, 0.96 with Dogecoin and 0.97 with Shiba Inu.

This means that any upward movement in these assets will likely be mirrored by Chainlink. With the Federal Reserve expected to initiate interest rate cuts in mid-September, leading to a weaker US dollar, this scenario could further push Chainlink’s price higher.

InTheBlok

Considering that the USD has a negative correlation of 0.09 with Chainlink and other crypto assets, a weak dollar would likely be bullish for LINK.

Is your portfolio green? View the LINK Profit Calculator

With key resistance levels being tested and strong correlations with other leading crypto assets, the outlook for Chainlink appears positive.

The upcoming offseason and a potential weakening of the USD provide additional support for a continued upward trajectory in LINK’s price.