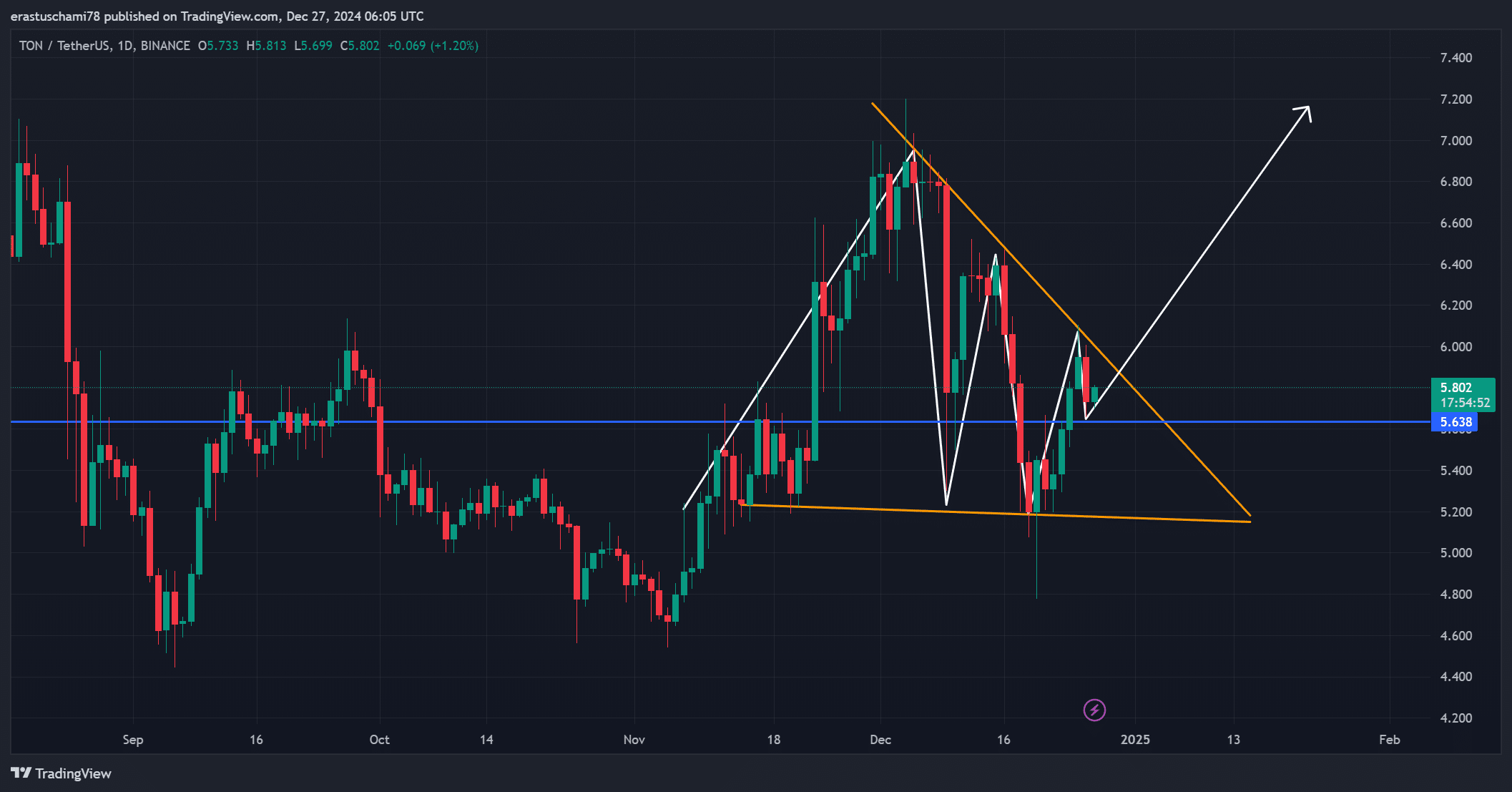

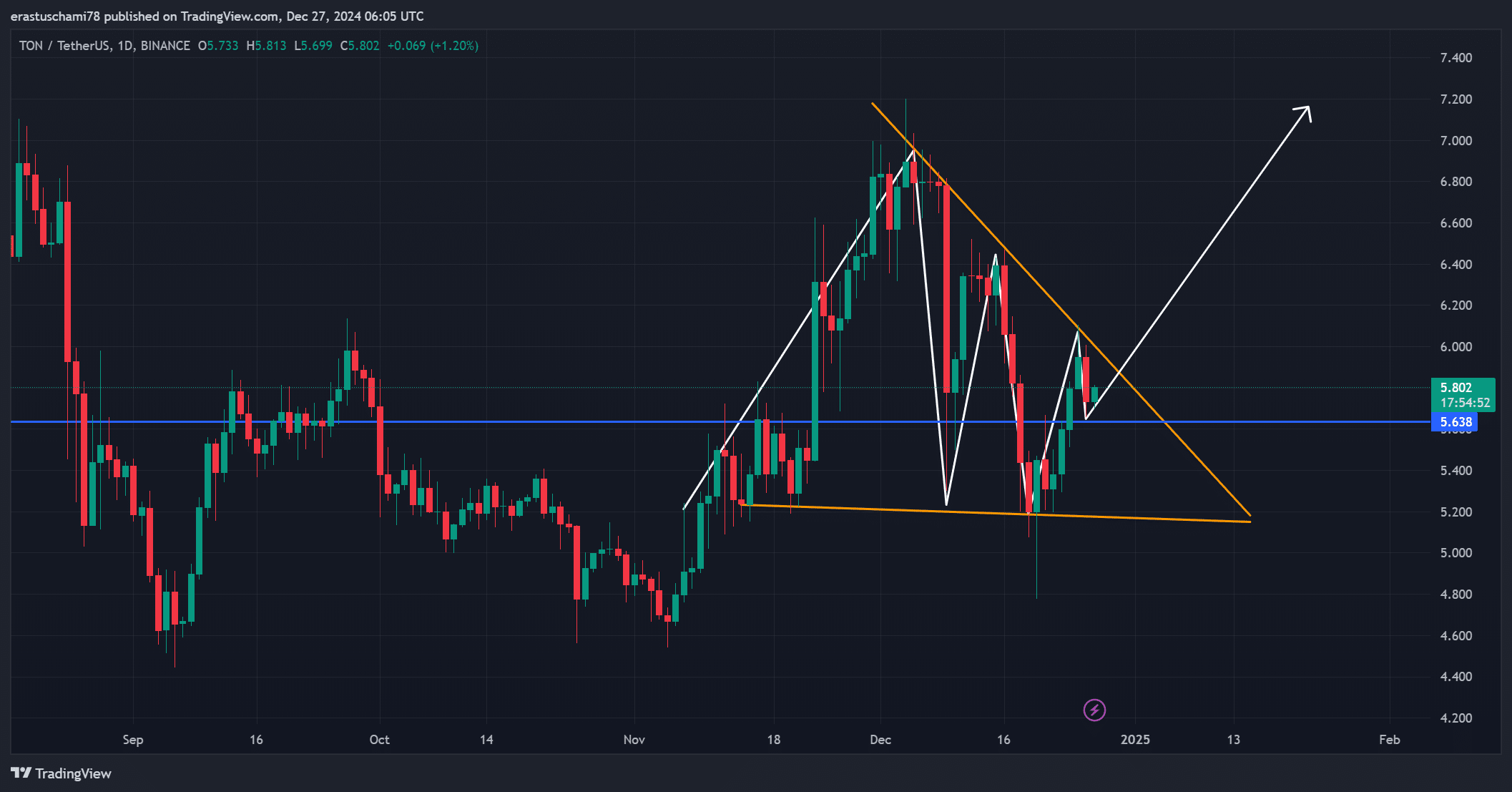

- The bullish pennant pattern indicated a potential breakout, with a price target of $7.2

- On-chain metrics and technical indicators were in line with each other, showing strong momentum and increasing adoption

Toncoins [TON] The market has been heating up lately, with the altcoin gearing up for a possible breakout from the bullish pennant flag pattern. At the time of writing, TON was trading at $5.79, down 1.21% in the past 24 hours, with the token still above the critical resistance level of $5.6.

This technical setup has caught the attention of traders as a successful breakout could push the price towards $7.2. With strong on-chain metrics supporting the bullish outlook, the momentum behind TON also appears to be steadily increasing.

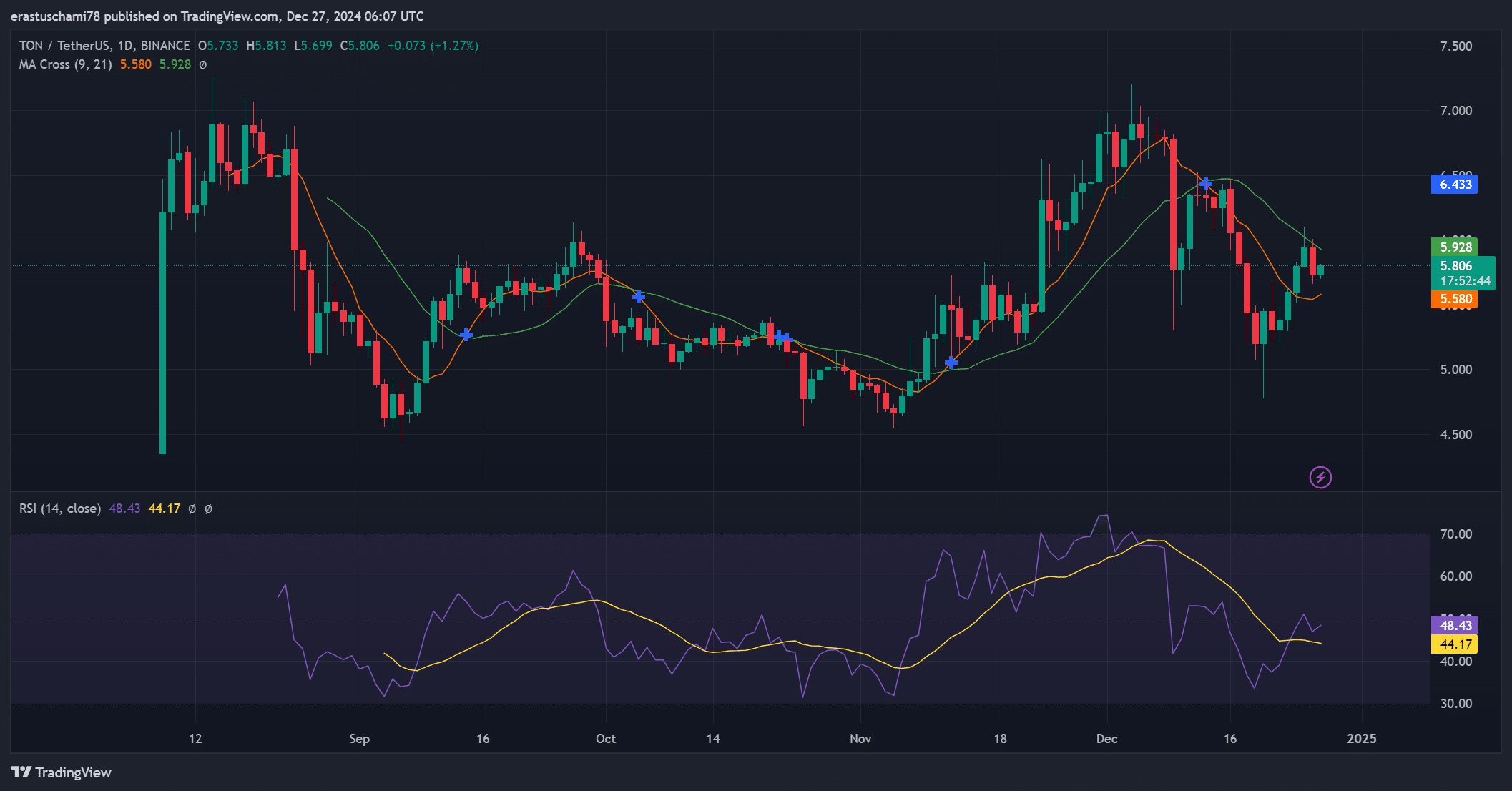

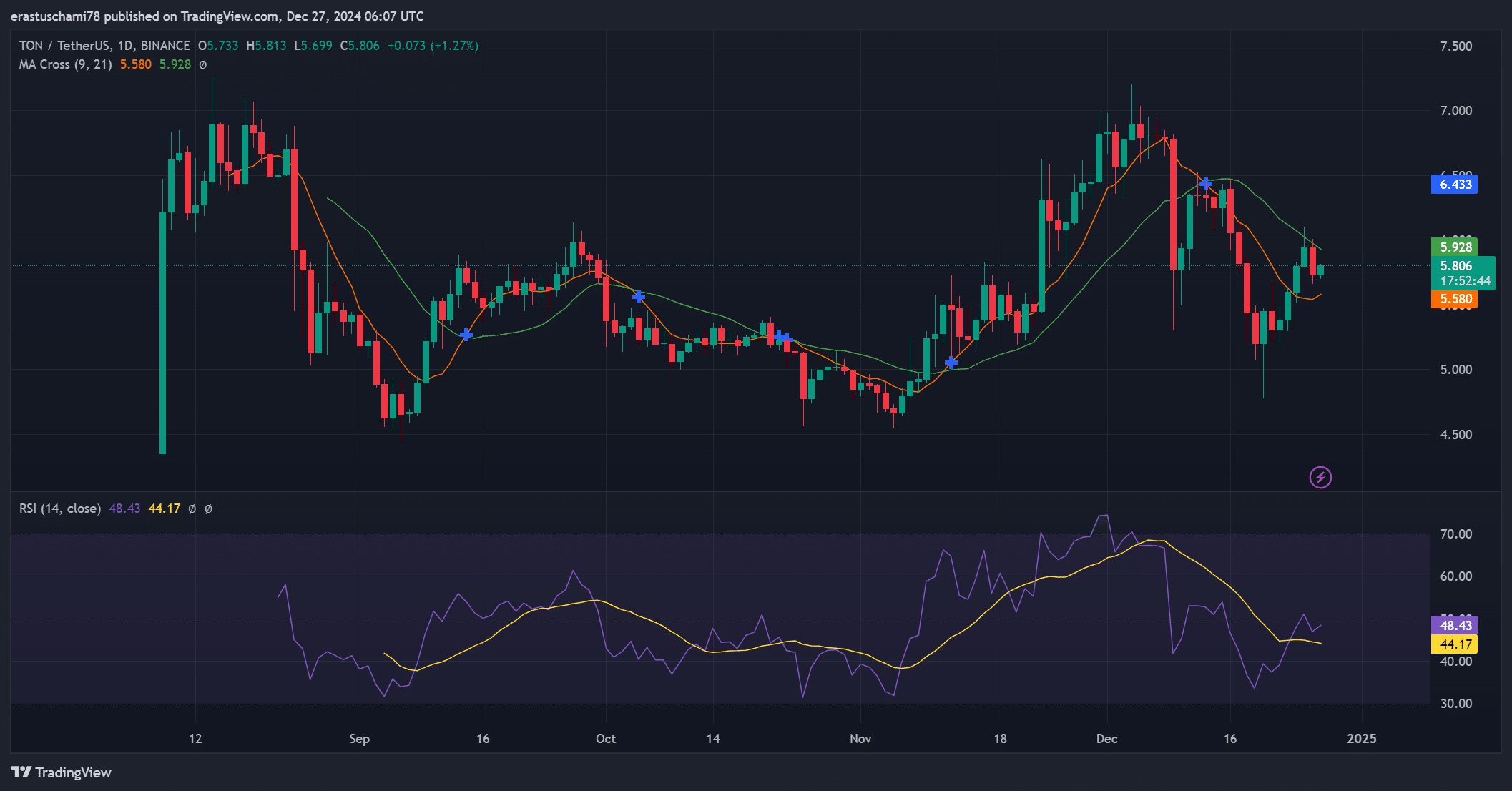

Analysis of the price movement and breakthrough potential of TON

TON’s price action revealed a clear bullish pennant flag pattern, indicating consolidation ahead of a likely upward move. The $5.6 resistance level has served as a critical threshold, and the recent successful retest has strengthened the case for a breakout.

If TON climbs above this level with significant buying pressure, the next target could be the $7.2 range, which would yield significant returns. However, traders should look for volume and momentum to confirm the breakout, as failure to maintain this could reverse the trend.

Source: TradingView

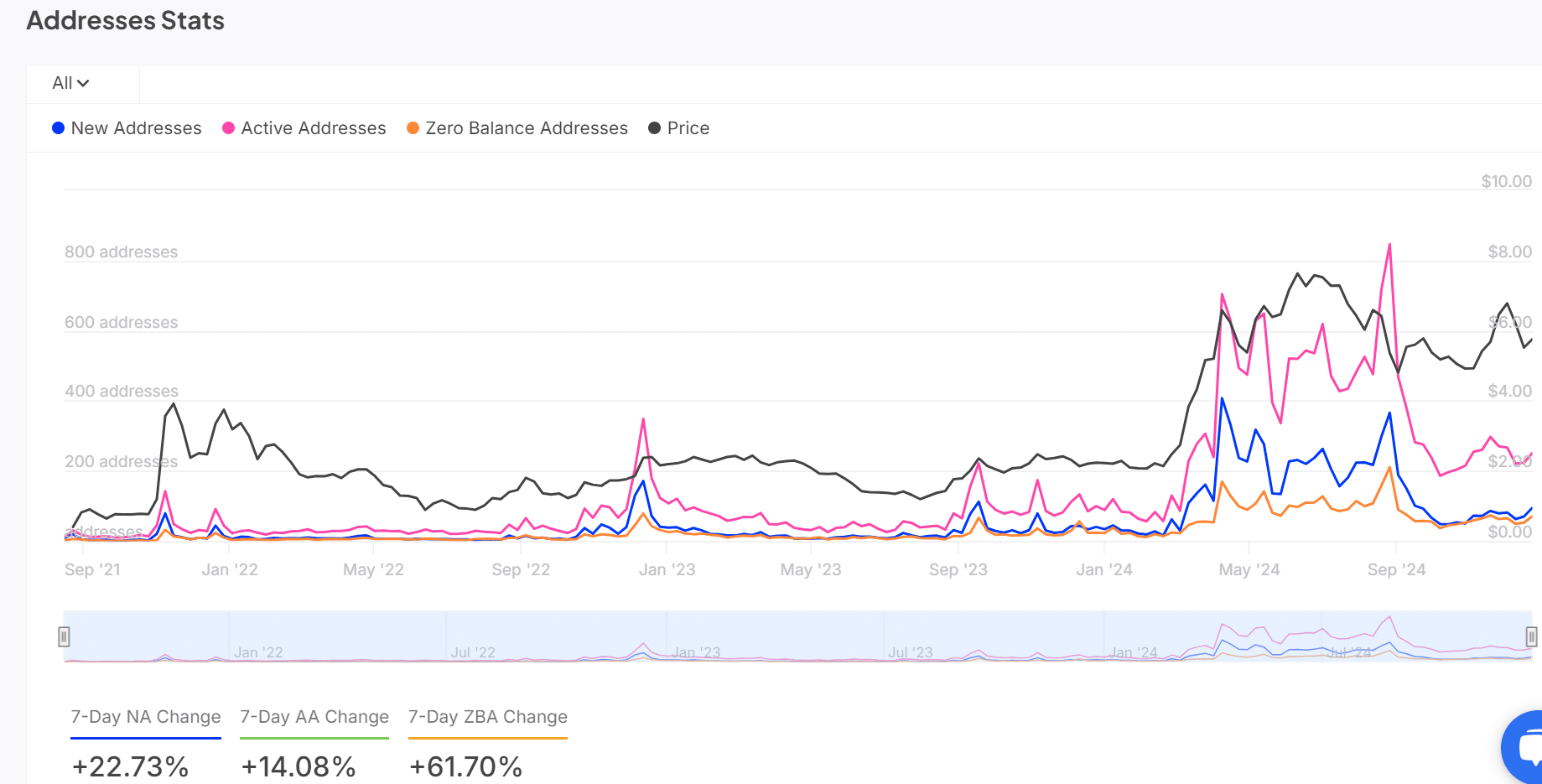

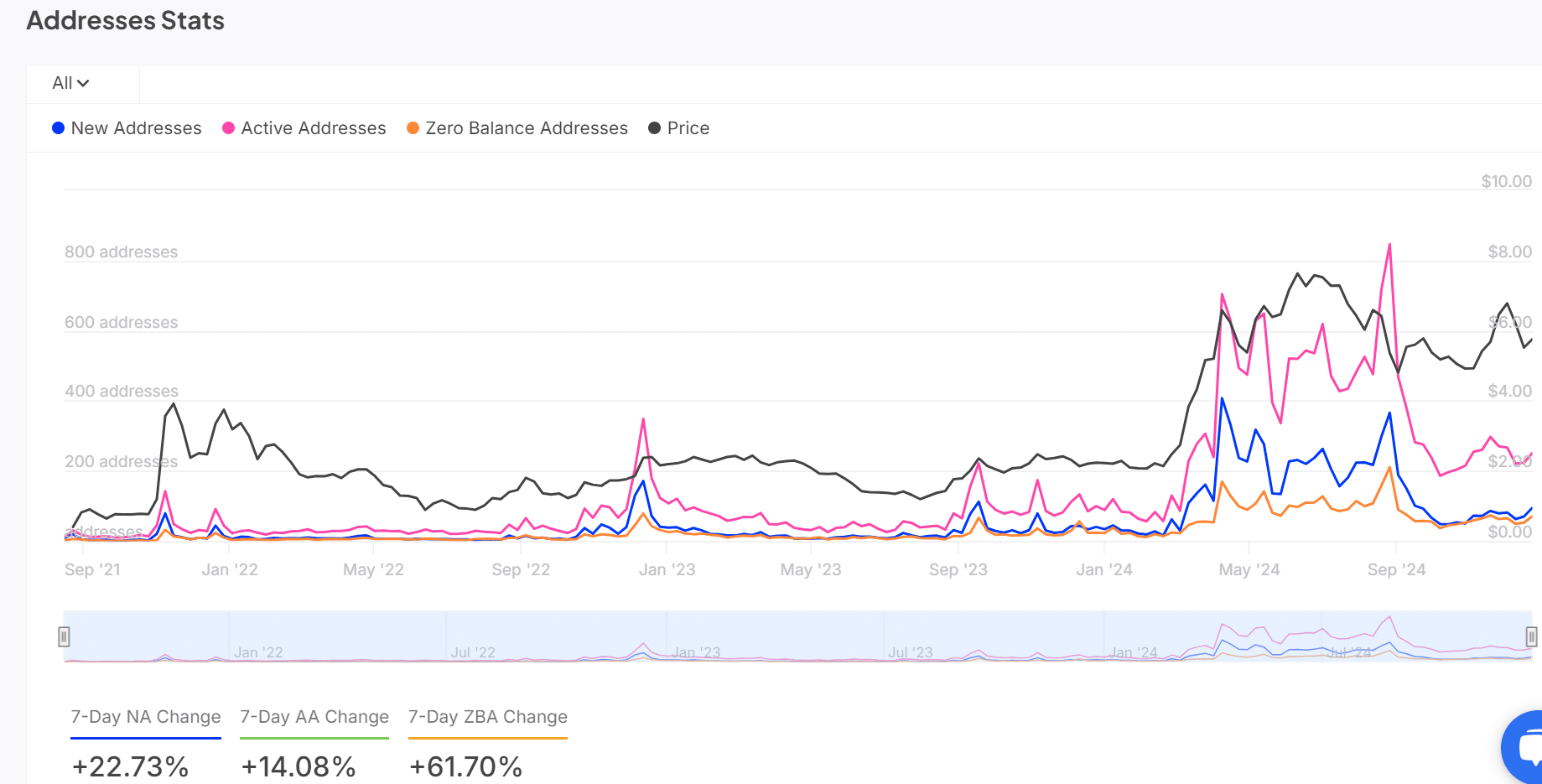

Statistics on the chain show growing network activity

Data from the chain pointed to increasing activity within the TON network. Over the past week, new addresses have increased by 22.73%, from 167 to 205, while active addresses have grown by 14.08% – from 178 to 203.

Furthermore, zero-balance addresses saw a huge spike of 61.7%, rising from 330 to 534 – a sign of an influx of new participants.

These statistics suggested that TON adoption has accelerated. However, continued growth will be essential to maintain investor confidence and support further share price growth on the charts.

Source: IntoTheBlock

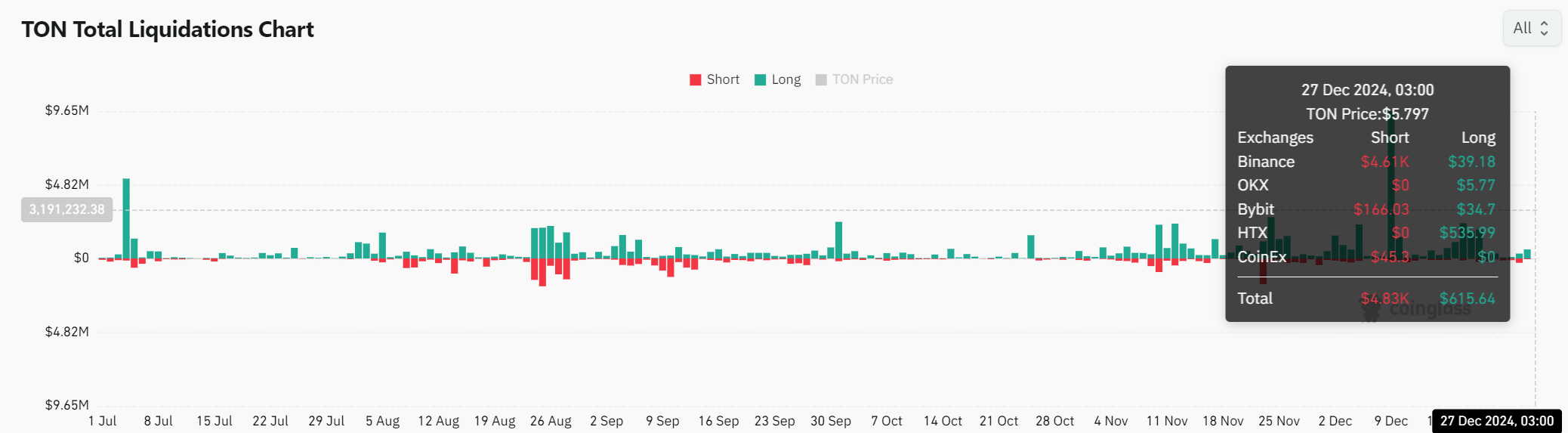

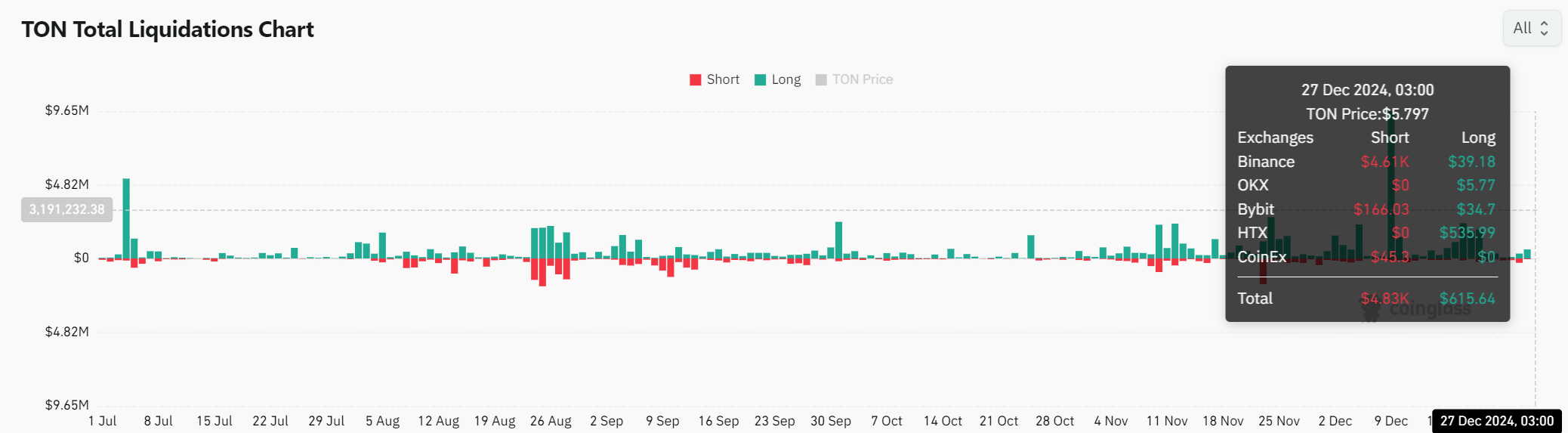

TON’s liquidation data suggests cautious optimism

The liquidation trends revealed cautious but optimistic sentiment among traders. Short liquidations totaled $4.83k, compared to $615.64 in long positions, showing that market participants are hesitant to heavily leverage long positions.

However, a confirmed breakout above $5.6 could trigger a cascade of short liquidations, which could strengthen upside momentum. Therefore, traders should keep a close eye on these liquidation levels as a key indicator of market shifts.

Source: Coinglass

Technical indicators indicate bullish momentum

Technical indicators supported the bullish case for TON. The RSI read 48.43, indicating neutral momentum but with room for growth. Furthermore, the 9-day moving average of $5.80 was above the 21-day moving average of $5.58 – a sign of a favorable trend.

Combined with the pennant flag setup, these indicators seemed to point to a market primed for a breakout. However, consistent buying pressure will be key to maintaining this momentum.

Source: TradingView

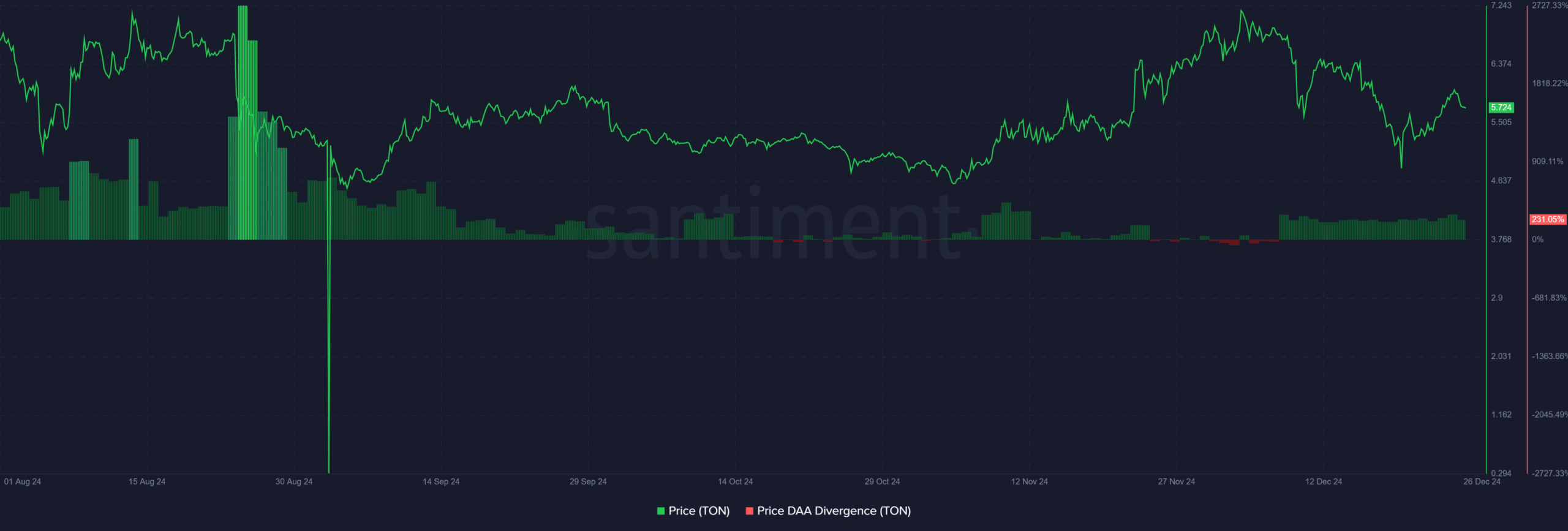

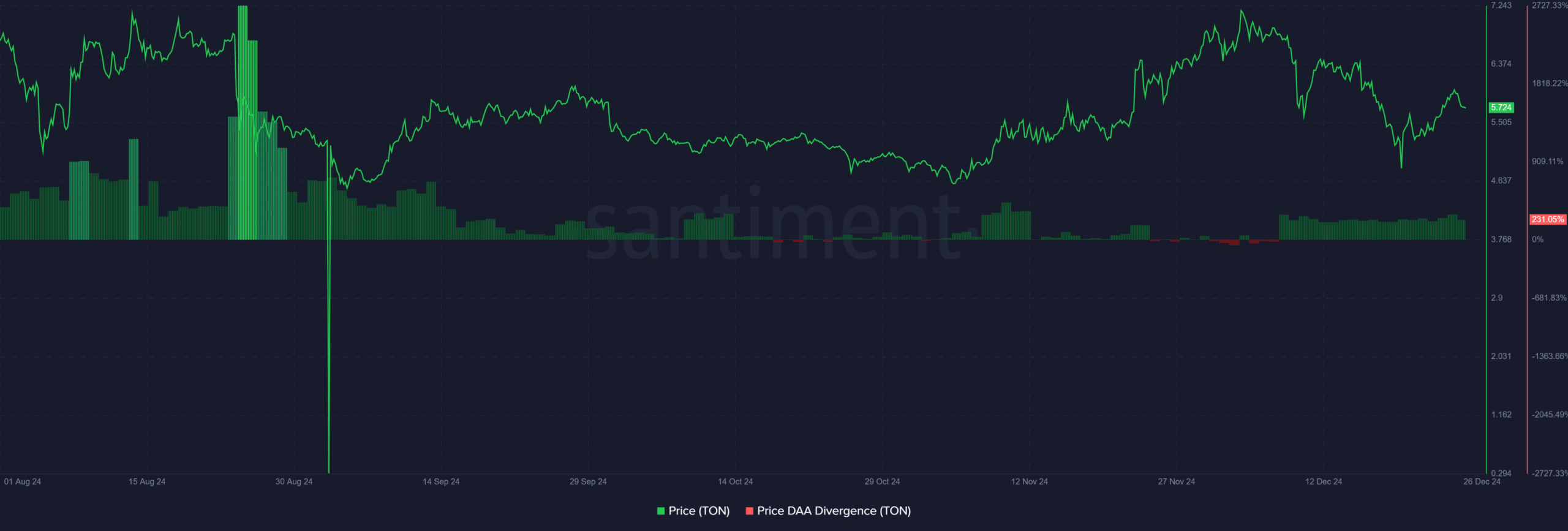

Daily active address divergence reflects strength

The differences in price and daily active addresses (DAA) offered some additional optimism. In fact, the DAA closely matched TON’s price action at $5.7 at 231%.

This narrowing divergence highlighted improving fundamentals, suggesting that TON’s network could strengthen alongside price movements.

Source: Santiment

Read Toncoin’s [TON] Price forecast 2024–2025

TON is well positioned for a breakthrough, with strong technical indicators and rising activity in the chain. A decisive move above $5.6 would likely push the price towards $7.2, confirming the start of a strong rally.

Simply put, TON’s prospects remain promising as it continues to gain momentum.