- BlackRock’s IBIT saw a remarkable inflow of half a billion, and record demand has sent IBIT shares up 20% in two weeks.

- If BTC fails to maintain the crucial USD 66,200 demand zone, we could see a price drop towards the USD 64,000 level.

After the approval of the spot Ethereum [ETH] Exchange-Traded Fund (ETF) in the United States, the overall cryptocurrency market turned red and experienced selling pressure.

Despite this continued selling pressure, Bitcoin remains [BTC] ETF has experienced massive inflows of over $534 million, according to data shared by an on-chain analytics firm Spotonchain.

BlackRock’s total IBIT inflows are almost $20 billion

With this, Bitcoin ETF inflows have remained positive for the past twelve consecutive trading days.

During this record inflow, BlackRock’s iShares Bitcoin Trust (IBIT) has received tremendous attention as it saw a remarkable inflow of half a billion.

TIt is the first time since March 13 that IBIT has experienced such a remarkable influx.

With these record inflows, total inflows for IBIT since launch have exceeded $19.5 billion. Moreover, IBIT holdings have also increased to 325,000 BTC worth $22.5 billion, and the stock price up 2.56%.

When we look at IBIT’s performance, we see a price increase of more than 20% over the past two trading weeks. While IBIT saw a price increase of more than 15% in the last 30 days, following increased interest from investors and traders.

Excluding BlackRock’s IBIT, asset manager VanEck (HODL) saw outflows of over $38.4 million, which is the largest single-day outflow since the ETF’s inception.

Meanwhile, Grayscale’s GBTC saw $0 inflows.

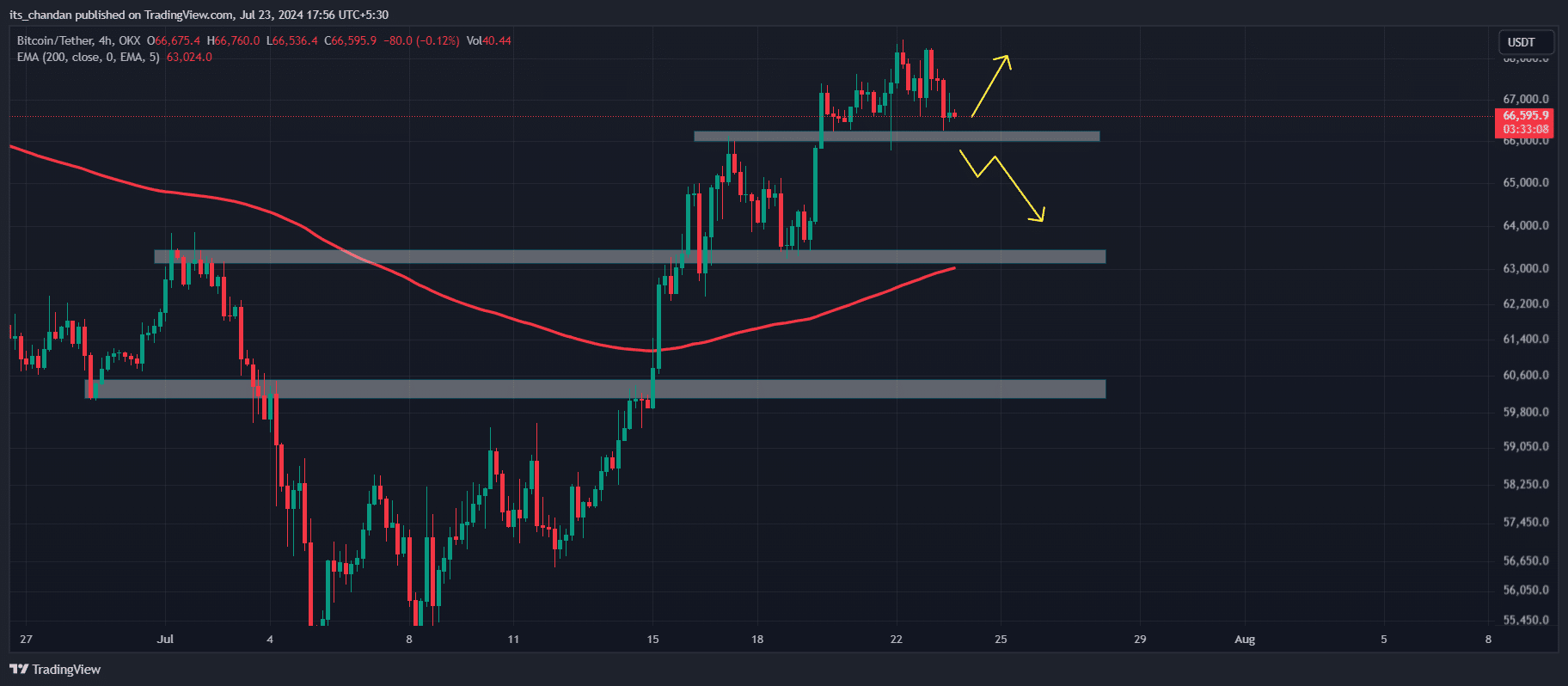

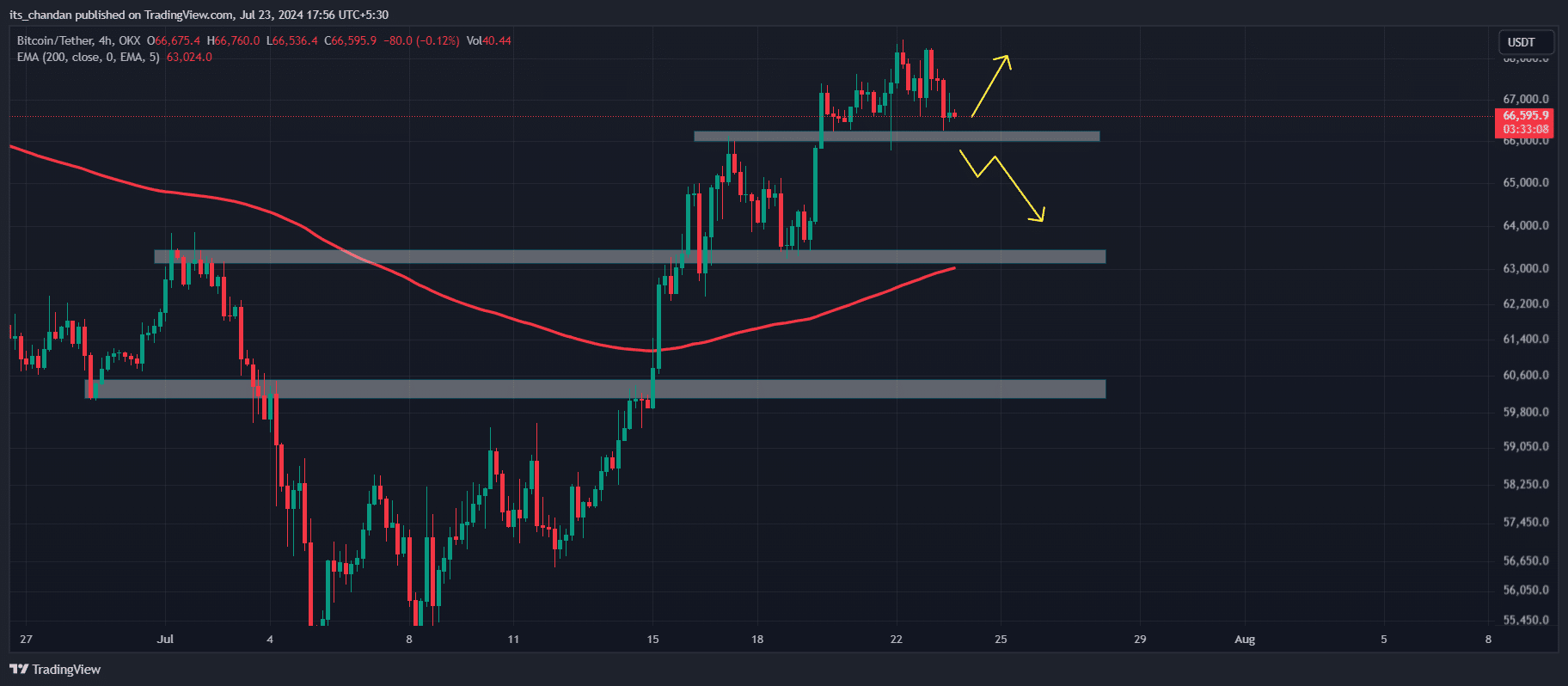

Technical analysis of Bitcoin and upcoming levels

According to expert technical analysis, Bitcoin remained bullish and was in a crucial demand zone of $66,200 at the time of writing. In a span of four hours, BTC has visited this demand zone several times since July 19.

The ongoing price retest towards the USD 66,200 level could weaken this demand zone. If BTC fails to hold and break off this level, we could see a price drop to $64,000 in the coming days.

Source: TradingView

Additionally, BTC was still above the 200 Exponential Moving Average (EMA) in both the daily and 4-hour time frames. The price of all assets above the 200 EMA indicated bullishness in the chart.

Is your portfolio green? Check out the BTC profit calculator

At the time of writing, BTC was trading around the $66,700 level and has experienced a price drop of over 1.5% over the past 24 hours.

Despite the price drop, investor and trader participation has increased by 45%, indicating their interest. While BTC has gained 4.7% in value over the past 30 days.