The widespread power failure that recently dived in the dark Portugal and Spain shed light on the lasting value of cash during critical situations. This event also led to questions about the truly decentralized nature of cryptocurrency, given the dependence on centralized electricity infrastructure.

Beincrypto spoke with representatives of Certik, Brickken, Wanchain and Money at the chain to learn what this means for public confidence in crypto and what the sector needs to offer the entire clock financial services, even when centralized distribution channels fail.

Digital finance Malmen to a halt

A significant power disturbance last week left millions in the dark over Spain and Portugal, with knock-on effects in parts of France and Morocco.

According to research by the Baker Institute, Spain lost around 15 Gigawatt capacity in just five seconds, equal to 60% of its national electricity demand. The malfunctions lasted approximately 18 hours.

Without internet and electricity, daily financial instruments such as home bank services, digital portfolios and ATMs were outdated.

“When electric griders fail, the entire ecosystem behind these systems grinds to a standstill: mobile phones cannot connect, cash machines are closed and on the internet-based wallet become inaccessible. At such times the digital economy sets an important vulnerability-without electricity, the ease of technically driven financing crashes,” S

During those hours, cash won the throne of the preferred payment.

“This is the reason why access to physical money remains critical, not only in developing countries, but also in developed countries-as during recent disruptions in Europe. Digital systems, centralized or decentralized, are ultimately dependent on power and connectivity. Cash offers a reliable fallback in scenarios where digital tools failed,” fellow-mosage of money, told.

The episode also raised questions about the usability of crypto in times of crisis.

Is Cryptos decentralization useless without access and strength?

The demonstrated need for paper currency during infrastructure disruptions suggests that although Crypto is a modern financial innovation, it still falls short of its predecessors during challenging circumstances.

Even with its core principle of decentralization, blockchain technology is considerably dependent on centralized infrastructure.

“For example, most blockchain nodes are hosted on a small number of centralized cloud providers such as AWS. This not only creates separate failure points, but also reveals blockchain networks to external controls. The entire network can influence, “Wanchain CEO Temujin Louie told Beincrypto.

The same limitations apply to the applications that manage crypto assets and process transactions.

“The blockchain can be decentralized, but the access to that is not. Most users depend on internet providers, centralized trade fairs and mobile devices – all of which are bound by national energy retalions and telecom systems. Without these tools, the decentralized promise of Cryptevant is practically irrelevant.

Cryptocurrency could weaken the public in their possibilities by not functioning as a real alternative financial solution when needed.

Black -outs as a test of public trust

Suppose that cryptocurrency cannot offer a functional financial alternative, exactly when traditional systems falter due to events such as power outages. In that case it runs the risk of losing the public trust in his ability to be a viable and superior financial system in the long term.

“Public Trust depends on observed reliability. If crypto is seen as something that fails under stress, users can hesitate to trust it. This is especially true for people who are still new in space,” Felipe d’Onofrio, Chief Technology Officer at Brickken, told Beincrypto.

Trust in payment methods is growing from their ease of use, so if crypto portfolios become inaccessible during emergencies, individuals can be reluctant to use them as their most important way to pay.

However, experiencing these problems can now clear the way for future improvements.

“These events can also emphasize weaknesses that lead to better solutions. Just as early internet disruptions had to overcome, Crypto is still evolving to meet the requirements of the real world,” D’Anofrio added.

Existing functions within Crypto technology make some offline applications possible, and expanding these can offer a clear direction for development.

Offline Crypto -Potential offers a glimpse of resilience

Certain existing cryptocurrency systems have already included some design characteristics that reduce their dependence on a stable electric grid.

“Some hardware portfolios with a long battery life and offline possibilities offer a glimpse of resilience, especially in peer-to-peer transfers,” said Newson.

While d’Onofrio pointed to other available tools, he clarified that they miss the widespread acceptance and user -friendliness that is needed for wide use.

“There are some interesting developments that are there, such as satellite junctions, mesh networks or ultra-low-power portfolios. These systems are working on more resilience, but they are not yet generally assumed. At the moment most of the crypto eco-system are still built on traditional infrastructure.

Similar considerations arose when discussing the potential of decentralized physical infrastructure networks (Depins) to reduce the overall dependence on centralized electricity networks.

Can Depins make crypto networks more resilient?

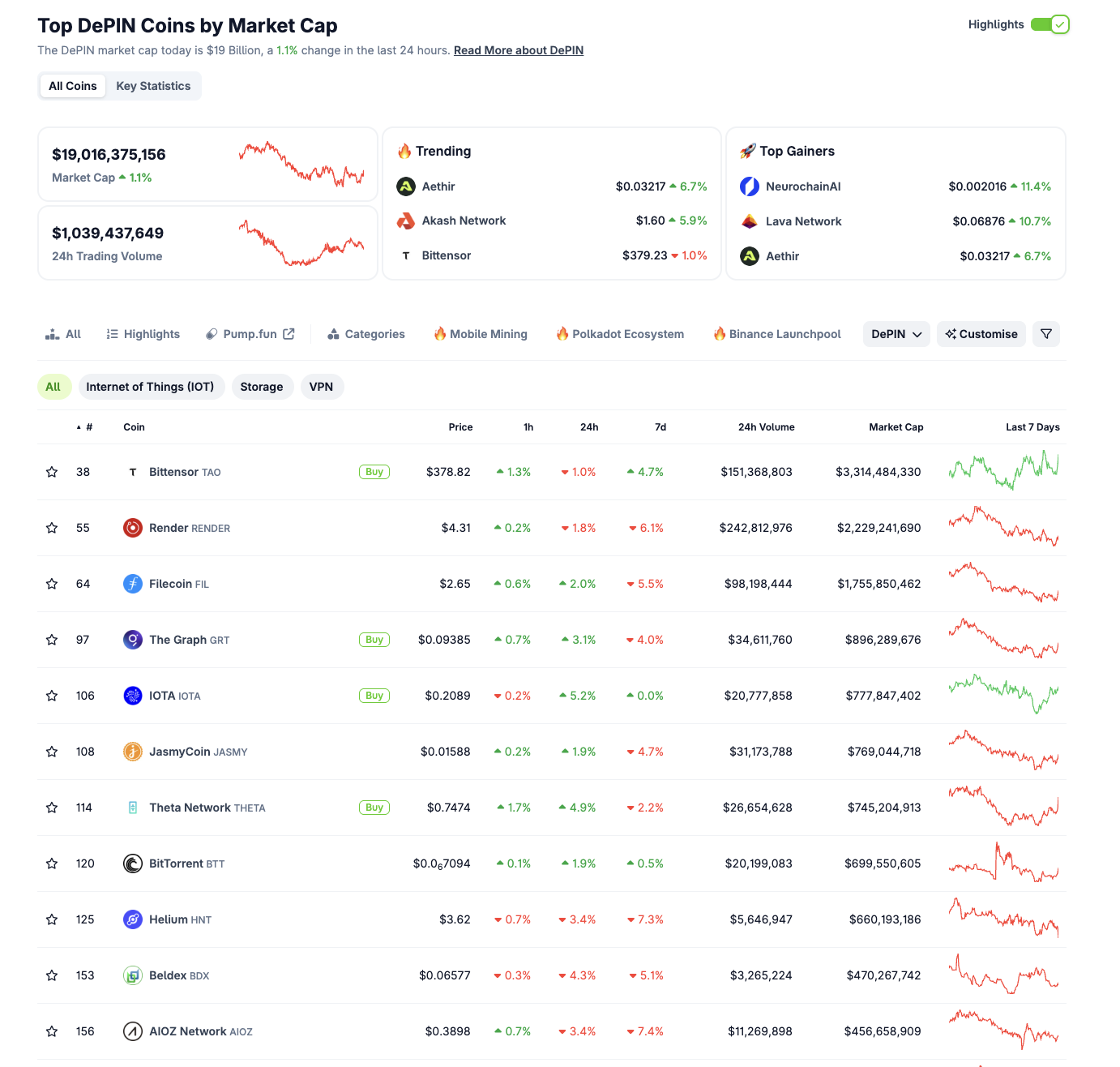

Depins have received a considerable traction in the Crypto sector in the past year because of their potential to decentralize various services using blockchain and token rewards to manage, possess and exploit infrastructure. Today, the Depin industry has a market capitalization of more than $ 19 billion and more than $ 1 billion in trade volumes.

Top Depin coins through market capitalization. Source: Coingecko

These networks are increasingly facilitating network connectivity and access to electricity based on the community. Some experts suggested that this technology could help reduce the impact of loss of centralized distribution channels.

“Depins can in theory improve the resilience of the network, which may reduce the chance of national power outages. They introduce a level of flexibility and programmability that could theoretically facilitate demand response programs or encourage people to adjust their energy consumption during peak times,” said Louie.

At the same time, he pointed out that only Depins cannot offer a complete solution for massive problems such as widespread power outages.

“However, it is much too early to consider the depins as an extensive solution that can solve the problems of the power stability of a country. The focus should be more on the intended integration of depins in existing grid infrastructure to illuminate the stress on the grid and demonstrated the Louie setting in a real-world setting.

From his perspective, D’Onofrio stated that Depins could offer a more complete solution in combination with other tools that reinforce the local resilience against these threats.

“We will probably see more integration with decentralized infrastructure, such as the mesh networks run by the community or solar energy-driven nodes. In combination with tools such as delayed Bradcast portfolios or peer-to-peer communication protocols, these systems can even be in crypto activities.

Despite their differences, crypto and traditional finances ultimately struggle with many of the same underlying problems during working during infrastructure disruptions.

Policy solutions for a resilient digital economy

Last week’s power failure on the Iberian Peninsula underlined the lasting importance of cash as a financial lifeline in times of crisis. With global economic systems, increasingly, depending on digital financing, experts emphasized the needs of policymakers to develop sustainable solutions that ensure infrastructure farm and readiness of emergency situations.

“Policy makers must treat the resilience of infrastructure as the foundation of digital financing. This includes diversification of energy sources, supporting local microgrids, stimulating offline crypto solutions, and ensuring that regulatory frameworks are tackled.

In the future, the strength of the digital economy will be determined by the physical infrastructure, and prioritize this could position this crypto for long -term success.