- Hype conquered a major resistance level in the last 24 hours, but has more obstacles ahead.

- Hyperliquid dominated various statistics in chains, including the growing TVL, costs and perpetual volume.

Hyperliquid [HYPE] has seen a significant climb in the last 24 hours and has won more than 16%. This remains its weekly profit of 14.29%.

According to ambcrypto analysis, Hype, despite the current obstacles, has a great chance of getting a new market high because the sentiment starts to run for the bulls.

Obstacles for the hype: where the next?

The important meeting of Hype in the last 24 hours was marked by a Fibonacci level at the graph at $ 25.08 after a major resistance level, with the price that is now on its way to his January High at $ 27.05 .

If the current market momentum is sustainable, Hype would probably cross his monthly high while it concerns higher levels.

However, it would experience a certain resistance on the graph, in particular at $ 27,115, $ 29,148 and $ 32.043, because it comes together higher.

Assuming that the trend bullish remains, these levels would be small withdrawals before a continuous upward movement.

Source: TradingView

To determine whether the current market sentiment Hype would retain to establish new market highs, Ambcrypto has looked at other statistics, which suggests a major likelihood.

Liquidity inflow and use is growing

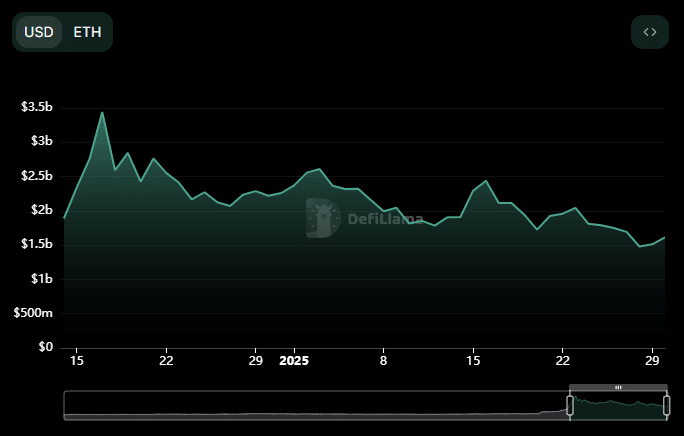

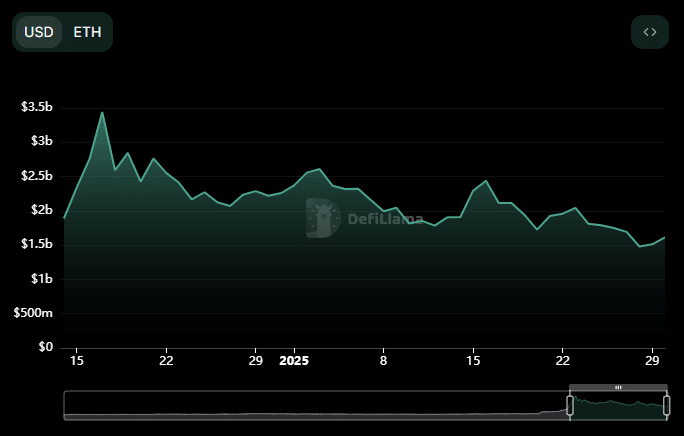

Insight on Defillama shows that over the days there is a consistent decrease in the growth in the total value of hype (TVL), determining new lows and maintaining that level.

TVL measures the liquidity flow in protocols. It usually reflects the market sentiment to an active one. An increase in the trust of TVL signals, while a decline indicates a potential decrease.

In the last 48 hours, however, a directive shift has occurred and Hype’s TVL is looking for a new high, which now reaches $ 1.651 billion from a low of $ 1.48 billion on January 28.

Source: Defillama

Similarly, an increase in reimbursements has been generated in the last 24 hours and is growing from $ 1.5 million to $ 2.0 million. When costs grow, this indicates high use of protocols in the ecosystem, which now benefits.

More use tends to positively influence the price of an active positively and indicates the potential to consistently rise even higher.

Hype remains dominant

According to the ranking of Artemis of the top 10 eternal protocols on the market, Hype takes the lead, which runs for others.

Read hyperliquid’s [HYPE] Price forecast 2025–2026

In the past seven days, the total trade volume in this best eternal protocols reached $ 43.6 billion, with Hyperliquid contributing 56.0%, with a trade volume of $ 24.2 billion in this period.

If this trade volume continues to rise, in addition to transaction costs and TVL, hype is well positioned for a continuous upward movement in the market and it may possibly exceed the most important obstacle on the graph.

![Hyperliquid [HYPE] Sucked 16% within 24 hours – is this the start of a larger rally?](https://bitcoinplatform.com/wp-content/uploads/2025/01/Editors-58-1000x600.webp)