- BTC saw a massive sell-off amid tensions between Israel and Iran.

- BTC showed strong sensitivity to US stocks, making it vulnerable to geopolitical tensions.

After defying negative seasonal expectations in September with decent profits, Bitcoin [BTC] and the crypto markets are off to a rocky start in ‘Uptober.’

BTC, the world’s largest crypto asset, rejected almost 4% on October 1, bringing weekly losses to around 10%.

It fell from a high of $65,000 to a low of $60.1,000 amid the escalations between Israel and Iran.

BTC’s plunge caused a wild sell-off in the crypto market, turning the entire sector red over the past 48 hours.

Source: CoinMarketCap

Tensions between Israel and Iran

Tensions between Israel and Iran have been going on for years, albeit through allies such as Hezbollah and the Yemen-based Houthis.

But the opponents have since opted for direct confrontation, which reached a boiling point on October 1 when Iran reportedly launched a barrage of missiles at Israel. This was in retaliation for the Israeli ground offensive in Lebanon.

Investors quickly adopted risk-off mode, perhaps fearing that the escalations could spiral into a devastating regional war.

US stocks, led by technology stocks, caused a massive sell-off. The tech-heavy Nasdaq Composite fell 1.5%, while the S&P 500 Index lost 0.93%.

BTC followed suit with a plunge of almost 4%, dragging it to a low of almost $60,000.

Ethereum [ETH] saw the most sell-off among major crypto assets at the time of writing. It dropped 6% on the daily charts, followed by Solanas [SOL] Decrease of 5.8%.

On October 1, US spot BTC ETFs also recorded daily outflows of $242.5 million, the highest since early September.

This further underlined the risk-off approach of crypto investors switched to gold.

The sell-off was not surprising given BTC’s value risk-on status and recent strong positive correlation with US equities.

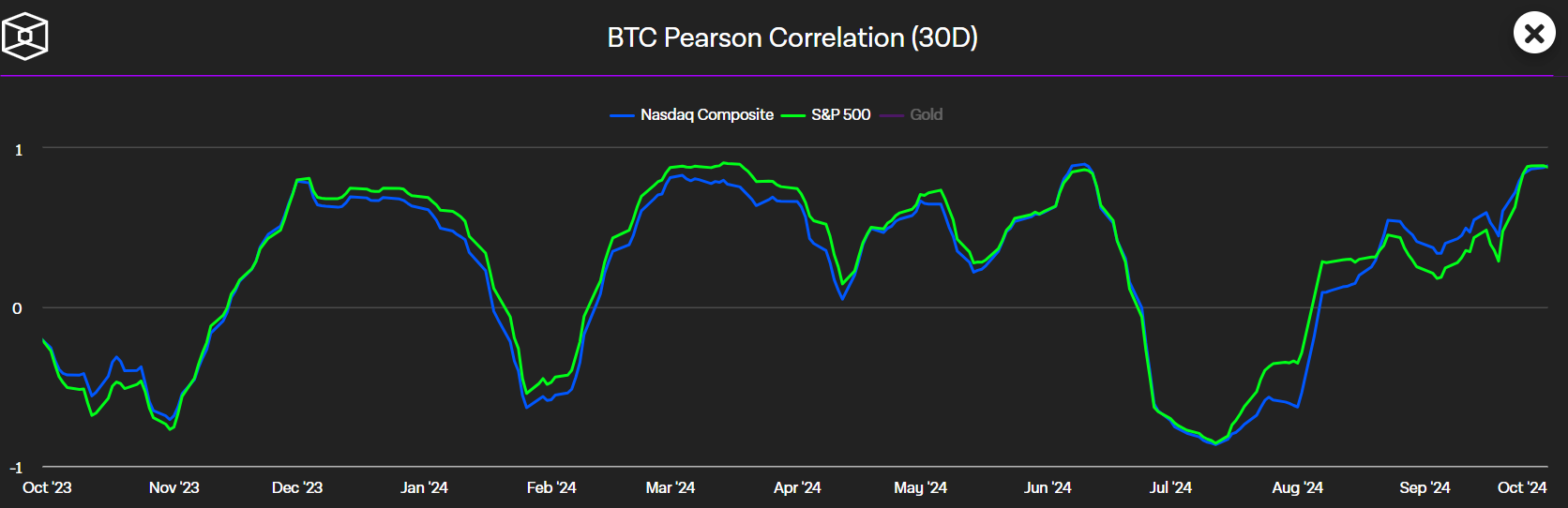

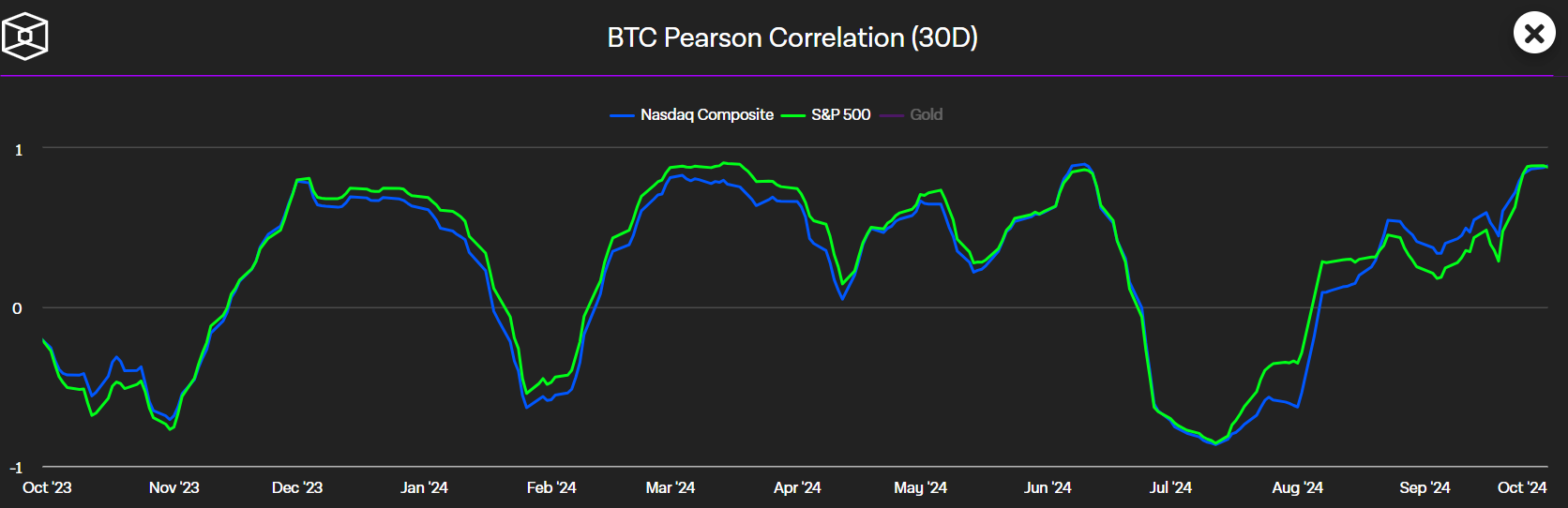

According to BTC Pearson Correlation, BTC has shown increasing sensitivity to US stocks since July.

Source: Het Blok

That said, Quinn Thompson, founder of macro-focused crypto hedge fund Lekker Capital, claimed the escalation was a complex process. play that could influence the US elections. Nevertheless, he believed that tensions would ease in the short term.

“But if I had to bet on it, I would guess that today’s situation will blow over in the short term with a lot of sabre-rattling and barking, similar to the past few months.”

QCP Capital echoed a similar potential impact of the tensions in the short term. It said:

“Middle East geopolitics will take center stage for now, but the superficial sell-off suggests the market remains good at bidding for risky assets.”

If Thompson’s projection comes true, BTC and the market as a whole could recover quickly.

In the meantime, $58K was an important level to track if the sell-off would deepen and BTC break below $60K.

Source: BTC/USDT, TradingView