- Bitcoin -Walvissen Shifting from sales to buying, which is signing a potentially bullish momentum

- Whale accumulation is resumed after a month of selling, making it possible for a rally

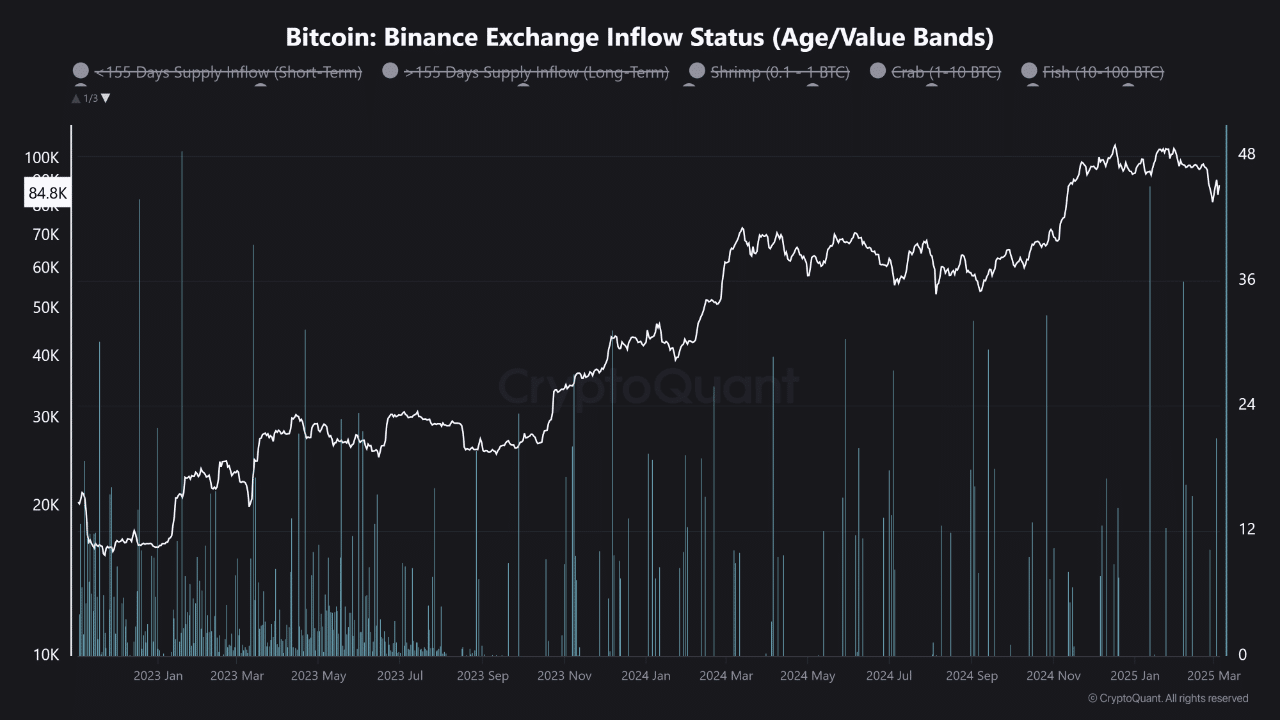

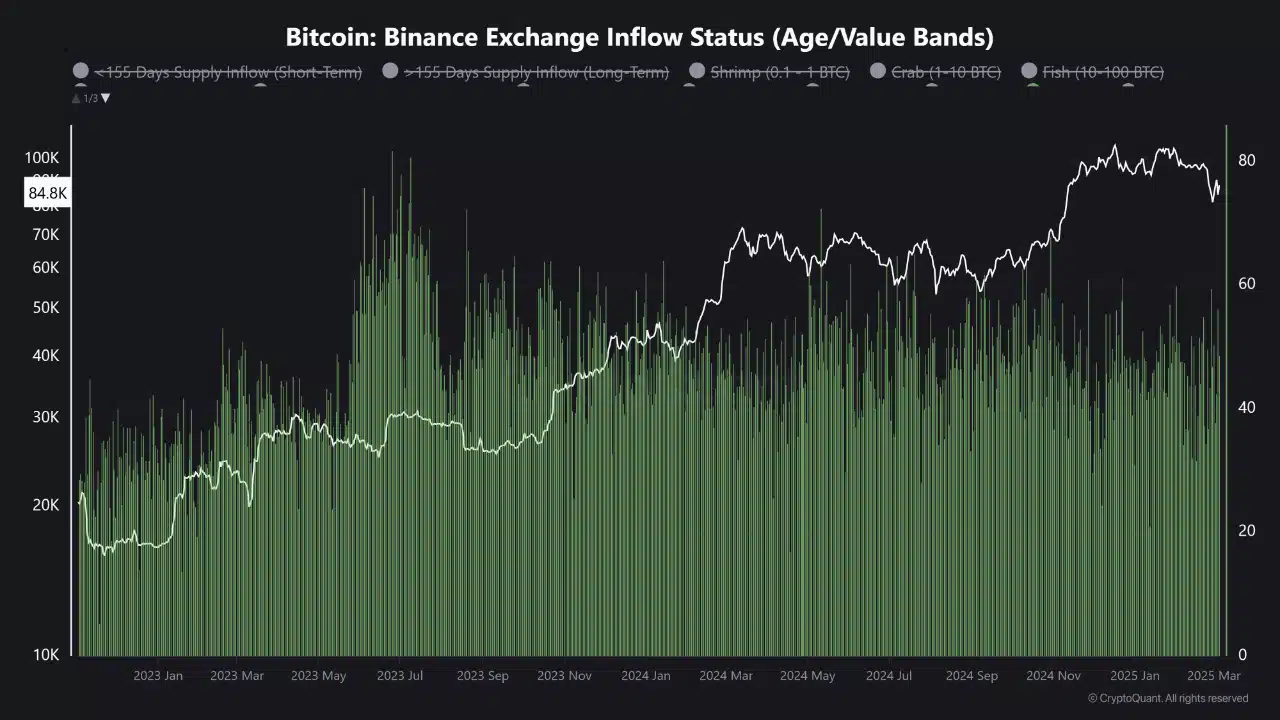

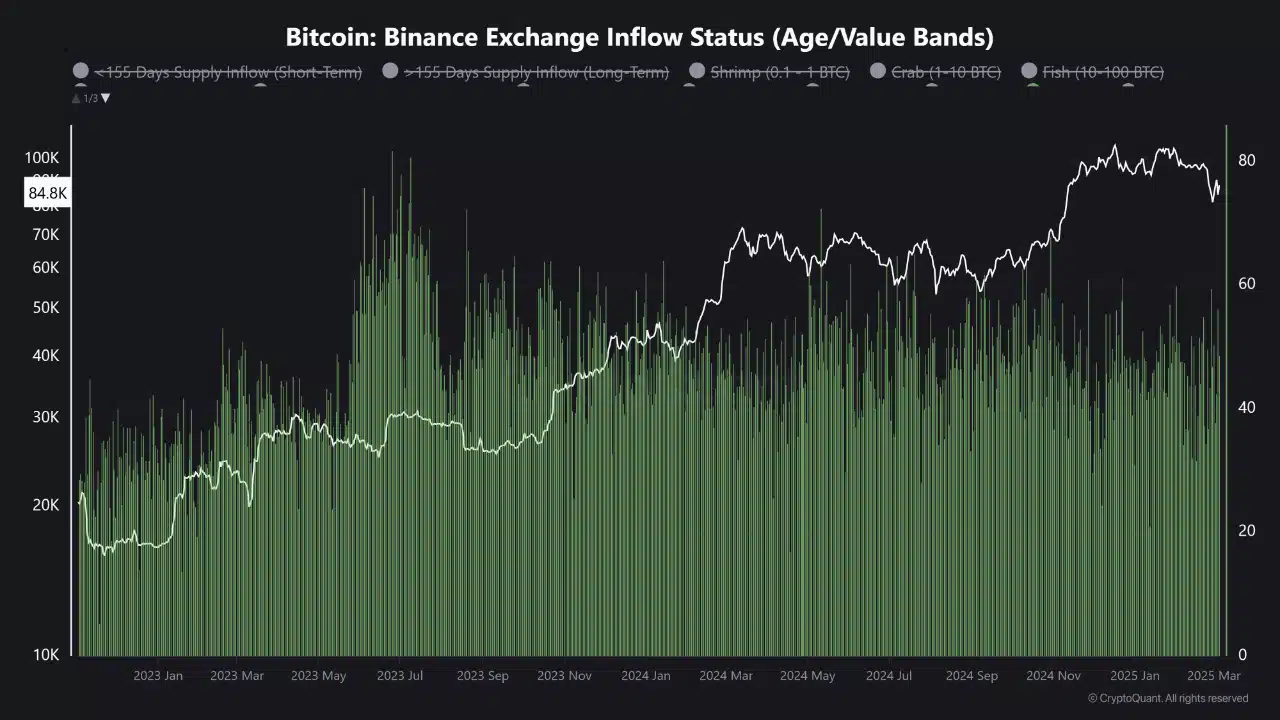

The past month, Bitcoin’s [BTC] has confronted with consistent sales pressure of whales. Binance, one of the world’s largest crypto exchanges, plays a crucial role in shaping the liquidity of the market and price discovery.

Data on chains reveal a considerable shift, while large holders of net sales accumulate. The monthly percentage change in whale companies has become positive, which indicates a possible bending point.

If this accumulation trend continues, it can clear the way for renewed bullish momentum in the market.

Bitcoin whale activity: sales pressure for accumulation

Source: Cryptuquant

For more than a month, the data from Binance reflected Persistent Bitcoin inflow, mainly from large holders. Historically, such inflow on sales pressure indicates because whales move BTC to exchange for possible distribution.

However, fluctuations in this inflow suggest that sales can make way for strategic accumulation.

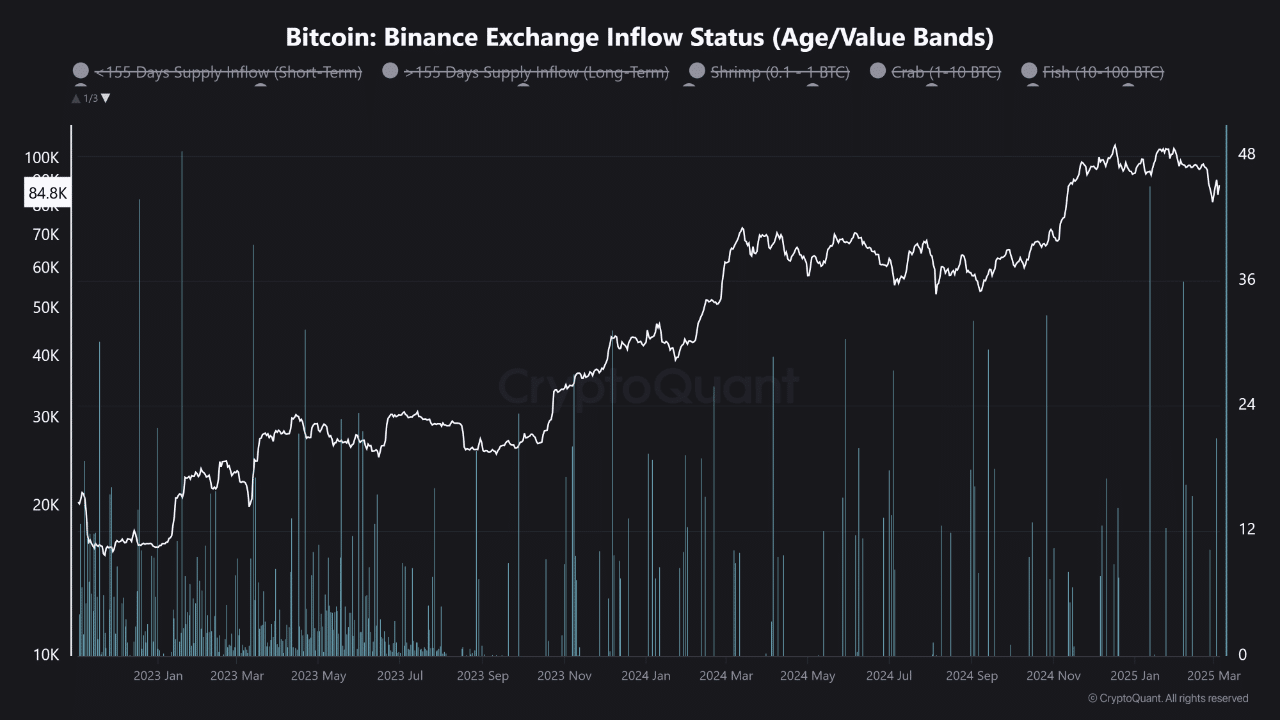

The latest figures confirm this shift. Binance inflow now shows signs of fresh accumulation with larger holders.

Source: Cryptuquant

Moreover, the rise in the inflow of younger coins suggests renewed trust, while increased whaling deposits indicate a transition from the distribution.

With the monthly percentage change in whale companies now in a positive area, this can mark a turning point in market sentiment.

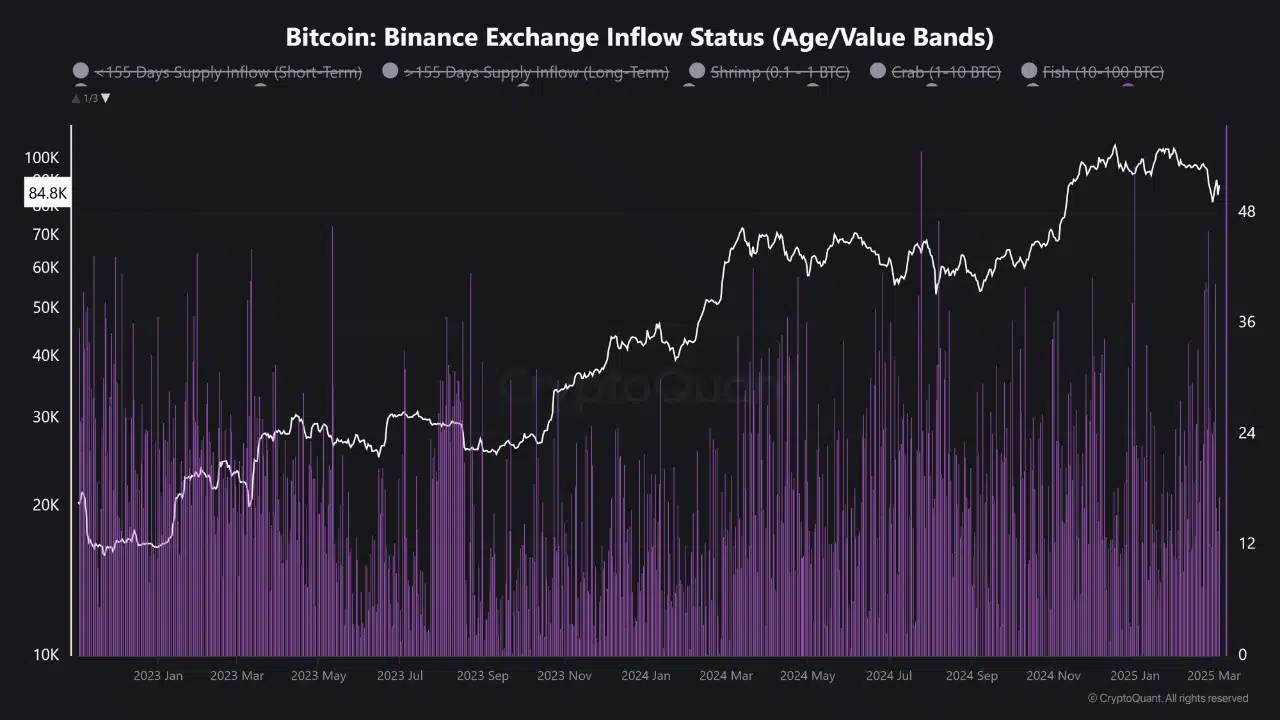

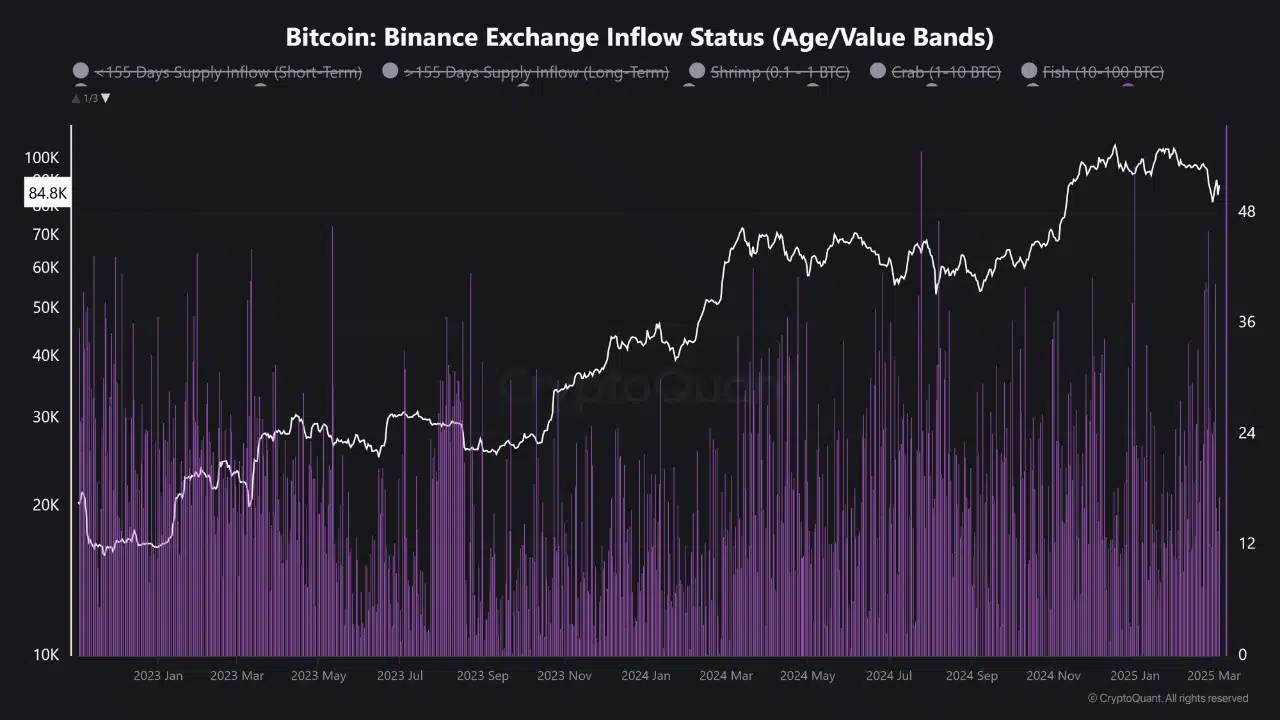

Source: Cryptuquant

Whales are back!

Source: X

After the longest phase of WhaleNet in a year, Accumulation has resumed. Large holders increase their positions and turn the previous downward trend.

This indicates that whales may prepare for the next phase of the market cycle. And CDeputy purchasing pressure can cause widespread bullish sentiment.

However, it is uncertain whether this trend is supported or simply a repositioning in the short term.

Bitcoin: Will accumulation drive a rally?

Source: TradingView

The price promotion of Bitcoin remains uncertain despite renewed whale accumulation. At the time of the press, BTC is traded at $ 88,227, a decrease of 1.92%, because the market adapts to this shift.

At the time of writing, the RSI was 43.43, which indicates a weak momentum without clear signs of over -sold circumstances. Although the sales pressure seems to be reduced, buyers still have to take the lead.

ObV remained negative and reflected a low question. Continuous accumulation could relieve liquidity restrictions and support a stronger price recovery.

An outbreak above $ 90,000 would indicate a bullish reversal, while not holding the current levels can lead to further decreases.

Bitcoin’s price process depends on whether whales continue to accumulate or return to a profit.

Whales take the lead if the retail stays careful

The market witnesses a clear divergence: Retail investors remain offside, while whales and institutional players control the story.

Data on chains suggest that smaller holders have not significantly increased their positions, which emphasizes persistent caution. The whales, on the other hand, gather and shift market dynamics to their advantage.

Will fresh accumulation be sufficient to compensate for the distribution of the past? If institutional players continue to buy, Bitcoin can establish strong support, which means a continuing meeting.

Also don’t forget that macro -economic conditions, changes in the regulations and the general sentiment will play a crucial role in determining Bitcoin’s trend.

If the retail trade returns after growing institutional interest, BTC can recover upward impulse. However, renewed whale rags can cause a new wave of sale, which may prevent recovery.