- Uniswap is hit by the impact of Curve exploit.

- The price drop raised concerns about Uniswap’s market dynamics.

The recent attack on the Curve protocol sent shock waves through the DeFi sector, leaving no stone unturned. This breach not only reverberated within the Curve ecosystem, but also had an unexpected impact on another prominent player, Uniswap[UNI].

Read Uniswap’s price forecast for 2023-2024

The domino effect

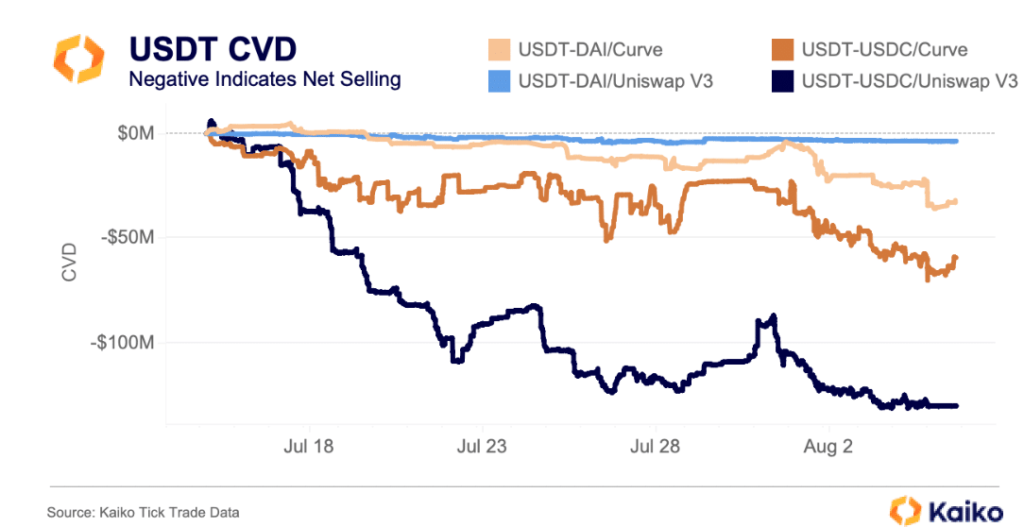

In the days leading up to the weekend, Curve’s 3pole and Uniswap V3’s main USDT-USDC pool experienced unusual activity due to escalated USDT sales.

Notably, this trend emerged in mid-July, when Uniswap posted approximately $100 million in net sales from July 15 to July 22. Although net sales declined towards the end of July, it saw a resurgence on July 31, coinciding with the Curve exploit.

Uniswap faced net sales of about $40 million, while Curve witnessed a similar pattern with about $35 million. Currently, the Curve pool is unbalanced and dominated by 60% USDT.

USDT in particular also experienced a small dip below its dollar peg on centralized exchanges in recent days, raising questions about market dynamics and influencing factors.

Source: Dune analysis

The impact on Uniswap becomes more apparent when looking at recent trends. Despite a 22.8% increase in activity on Uniswap over the past month, revenue generated fell 12.2%, according to Token Terminal. This paradox led to concerns about the sustainability of the increased activity and the factors affecting profitability.

In addition to the story, the activity of Miner Extractable Value (MEV) bots on Uniswap increased dramatically. At the time of writing, Uniswap hosted 27% of all sandwich attacks orchestrated by MEV bots. These bots manipulate trades for financial gain, often at the expense of regular traders.

Source: Dune analysis

How is UNI doing?

This sequence of events can potentially affect the performance of the UNI token. In the past week, the token faced a drop from $6.60 to $5.84. The drop was a reflection of the broader uncertainty permeating the DeFi space.

Is your wallet green? Check out the Uniswap Profit Calculator

In addition, Uniswap’s declining rate, as measured by trading frequency, indicates reduced trading interest among users. A similar pattern is evident in the declining network growth, indicating a diminishing appeal for new addresses to buy UNI.

Interestingly, the supply of top addresses grew, indicating an increased interest from whales compared to private investors. Whale interest could drive UNI prices up in the future.

Source: Sentiment