- The Tron Network dominates USDT payments, with second quarter settlement volumes of $1.25 trillion.

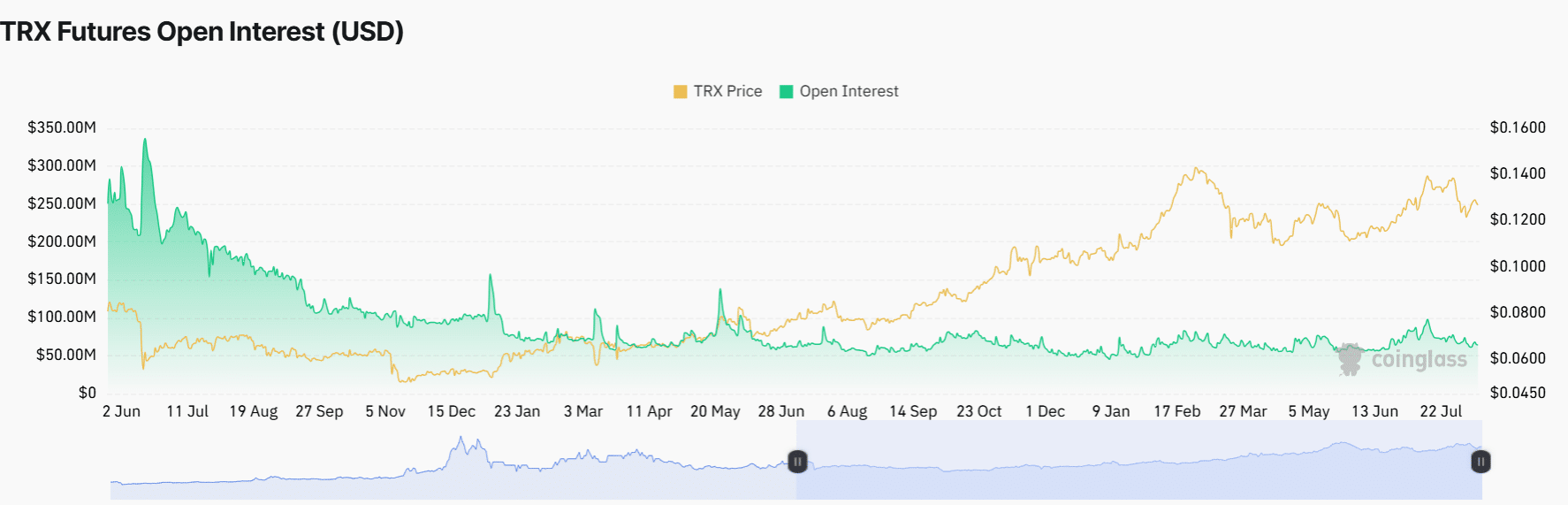

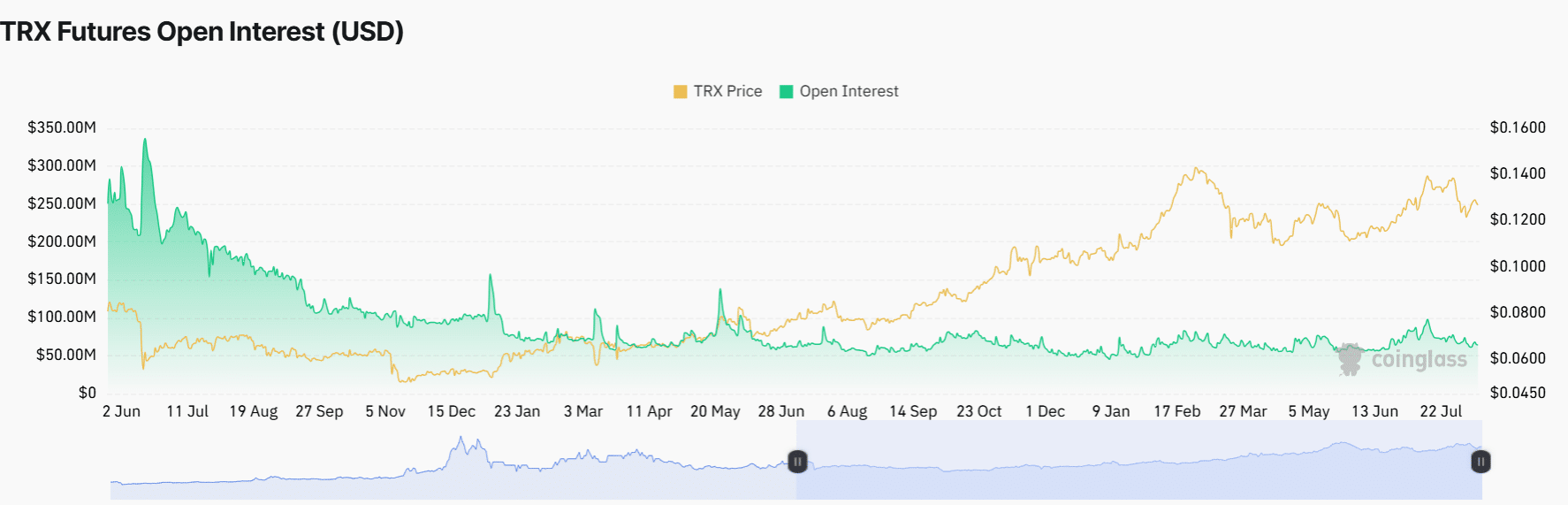

- TRX has seen relatively stable volatility this year amid declining open interest.

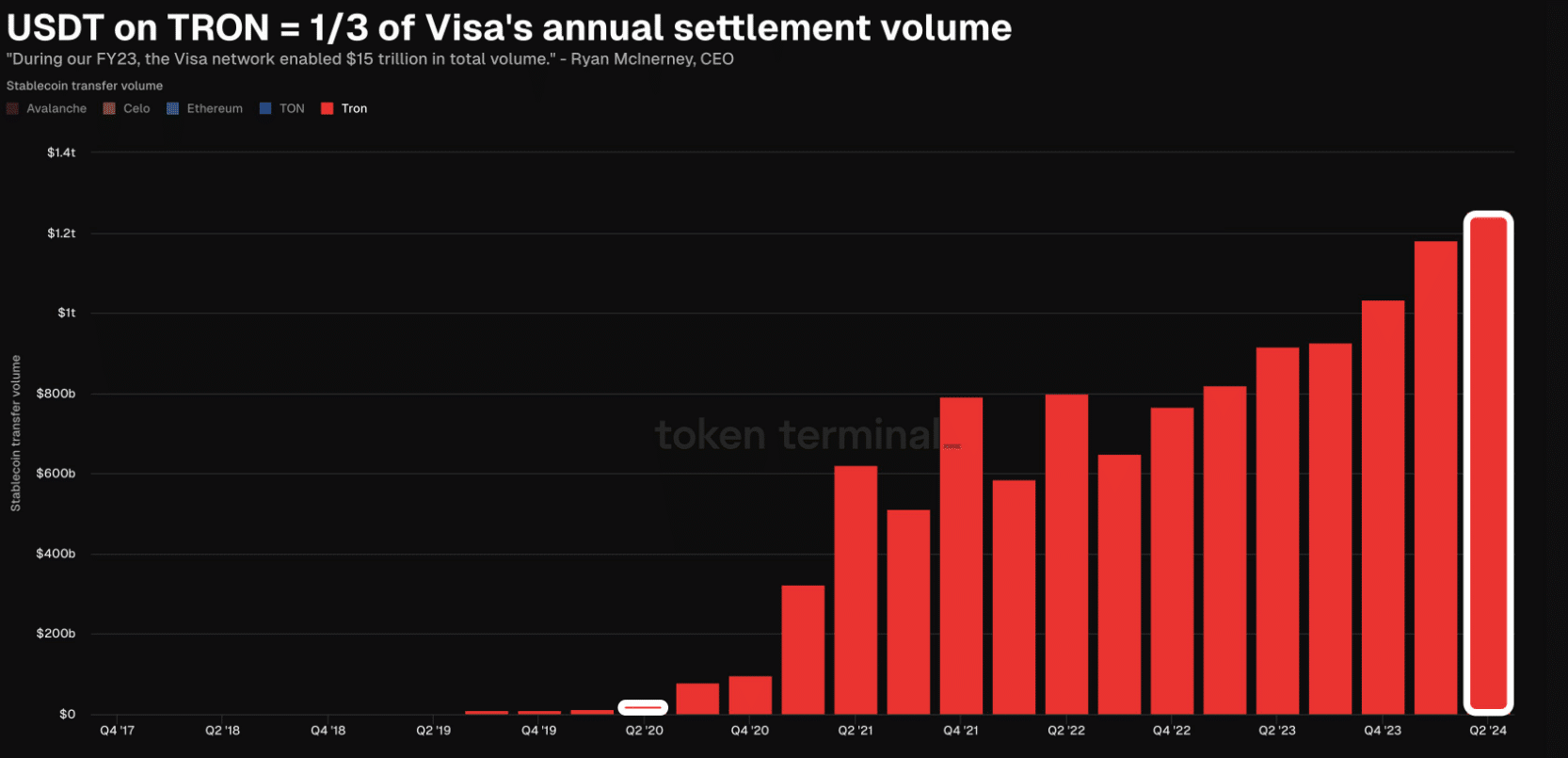

Tron [TRX] is emerging as a major competitor to digital payments giant Visa, with USDT settlement volumes on the network reaching $1.25 trillion in the second quarter of 2024.

According to Token Terminal, USDT volumes on the Tron blockchain reached one-third of Visa’s annual settlement volumes. USDT transactions on the network have increased fivefold, from approximately $25 billion in 2020.

Source: Token terminal

Tron’s increasing network activity

USDT volumes on Tron rose from $4.2 billion to $16 billion in 2023, according to AMBCrypto’s look at Dune Analytics facts.

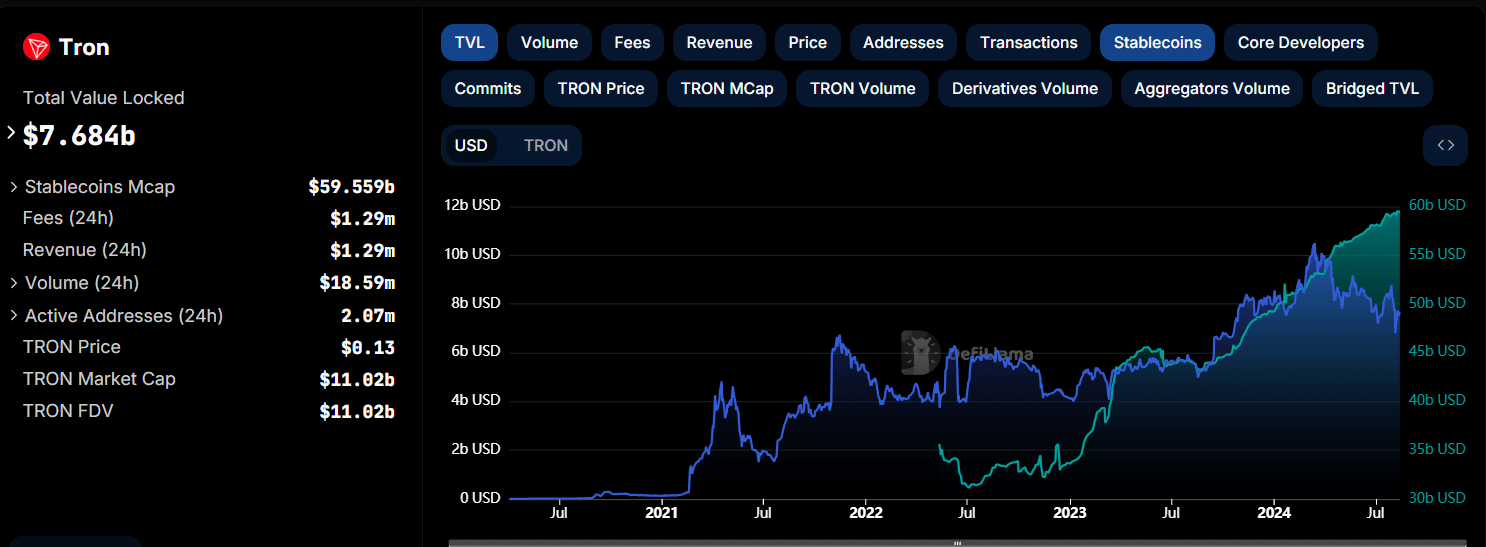

The total market cap for stablecoins on the network also reached $60 billion, according to DeFiLlama, indicating that the blockchain has become the de facto settlement network for USDT.

Source: DefiLlama

Besides being the most preferred network for transactions, Tron also emerged as a formidable rival in the decentralized finance (DeFi) industry.

Tron is the largest blockchain after Ethereum [ETH] based on total value locked (TVL). According to DeFiLlama, TVL has increased from around $5 billion in August 2023 to $7.68 billion at the time of writing.

However, Tron’s network growth pales in comparison Solana [SOL]whose TVL has increased more than tenfold to $4.76 billion at the time of writing, compared to approximately $300 million last year.

Does TRX reflect Tron’s growth?

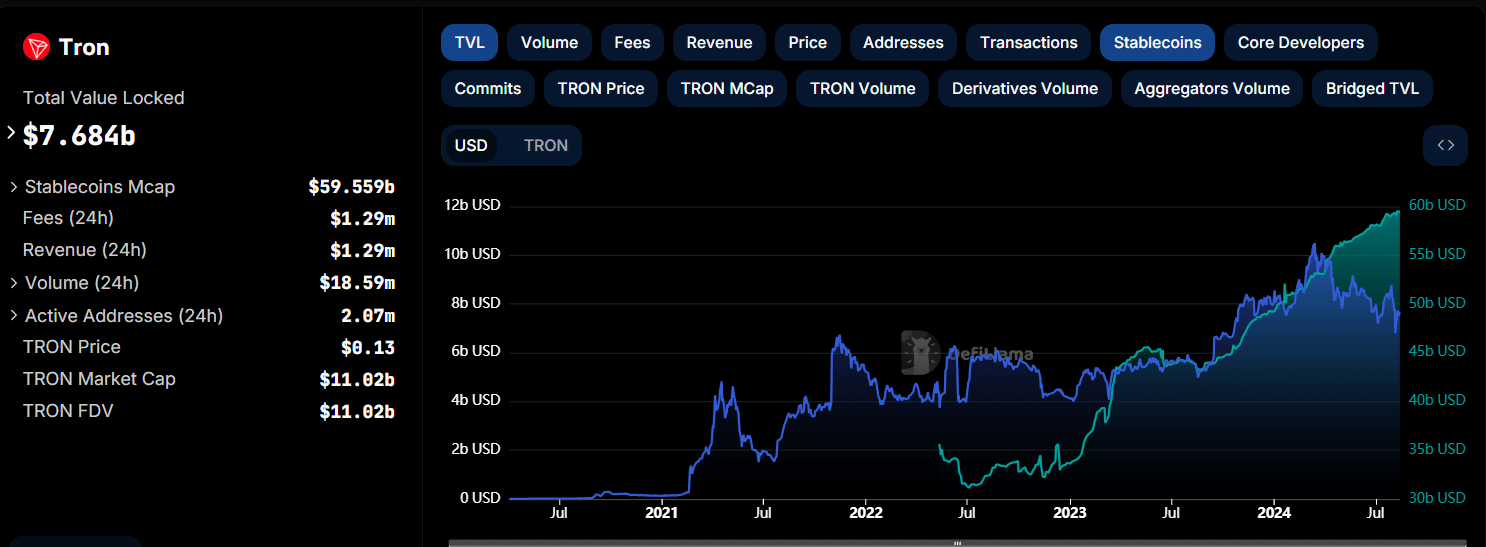

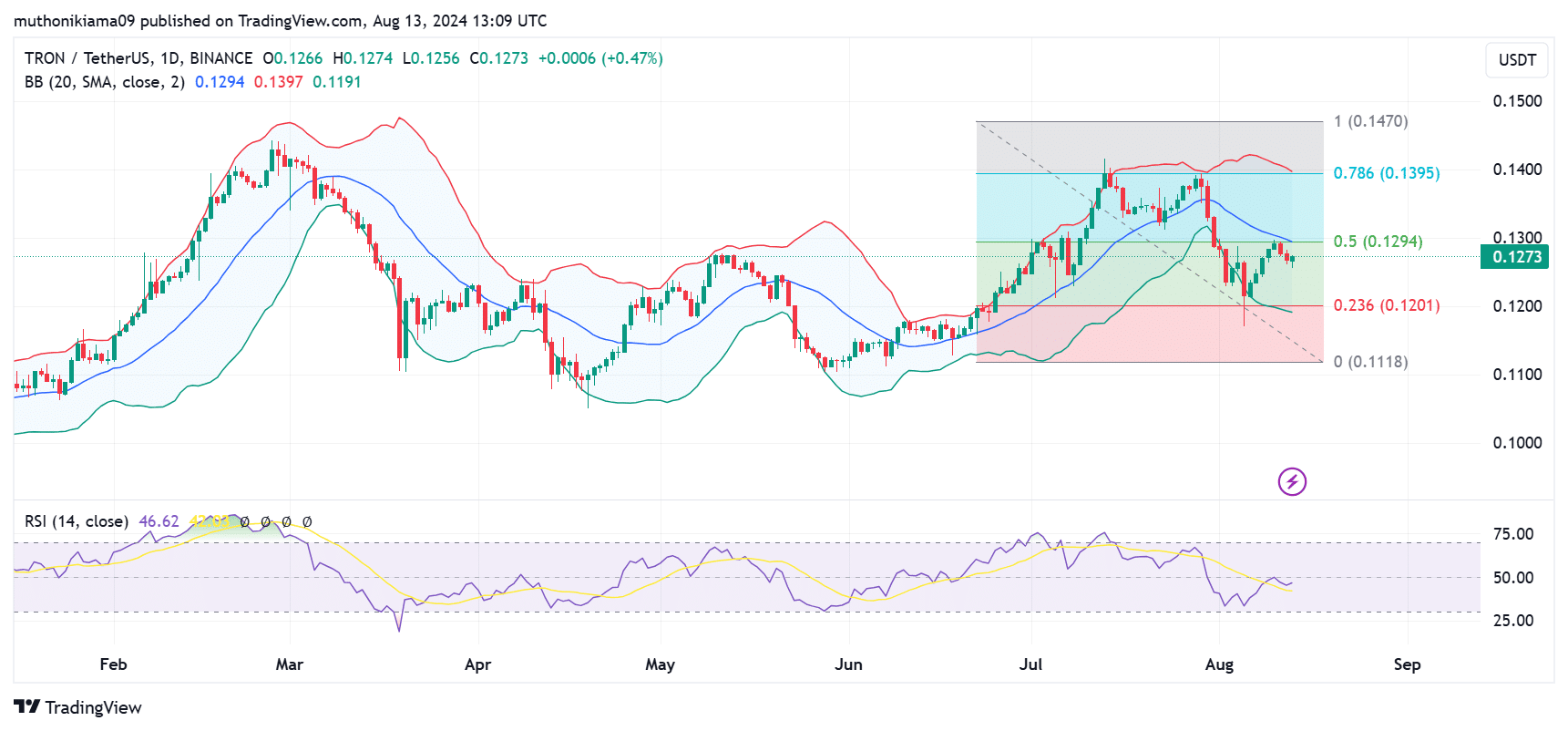

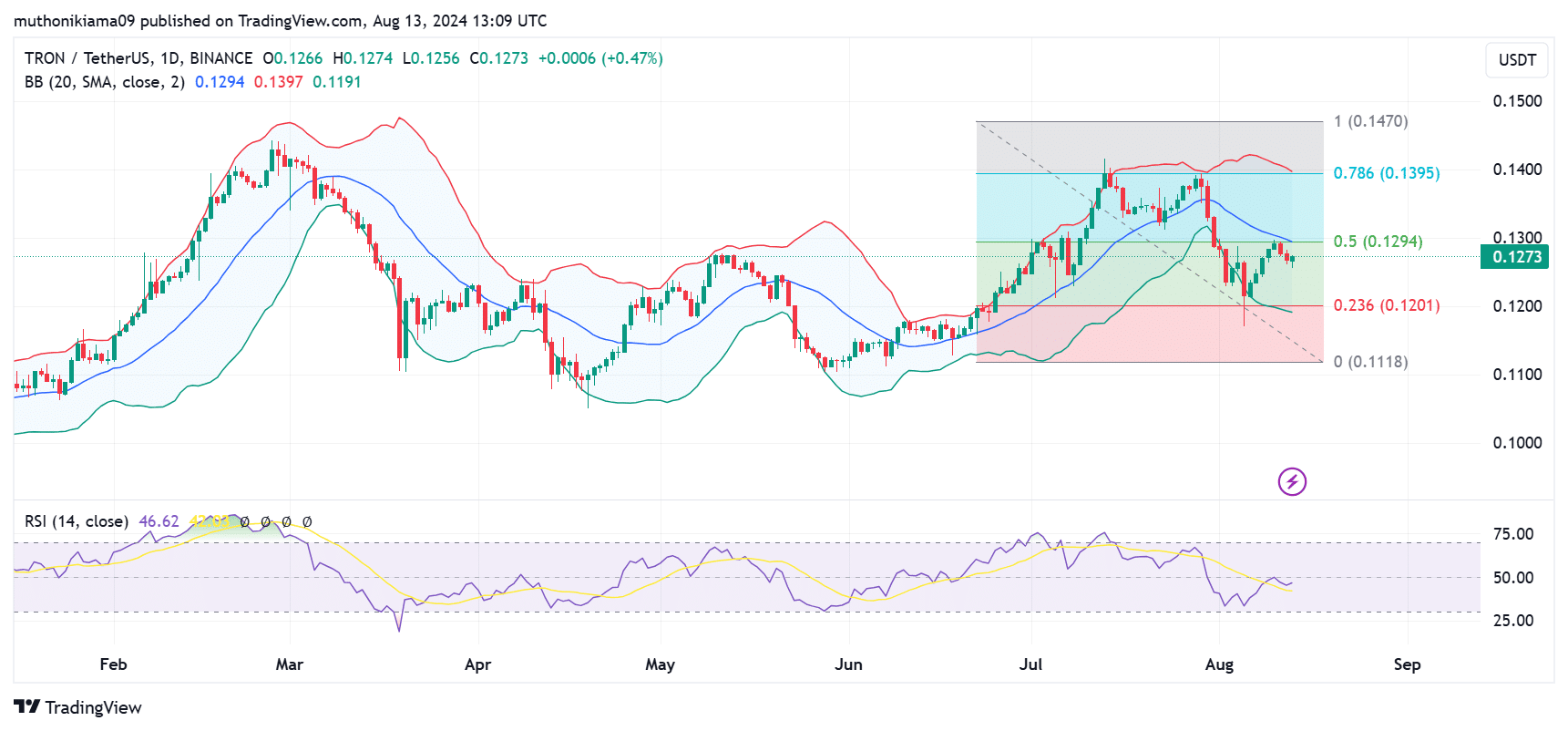

At the time of writing, TRX was up about 20% this year, after trading within the $0.14 and $0.10 range for most of the year. The price also moves within the Bollinger bands, indicating relatively stable volatility.

Source: TradingView

Buying behavior also showed moderate interest, with few instances of TRX being overbought or oversold.

A look at the short-term price action showed that the Relative Strength Index (RSI) has reached a higher high and recovered, pointing to further gains.

A key resistance level is at $0.139, also the Fib level of 0.786. If this goal is achieved, it will pave the way for a rally to record highs.

Realistic or not, here is the market cap of TRX in terms of BTC

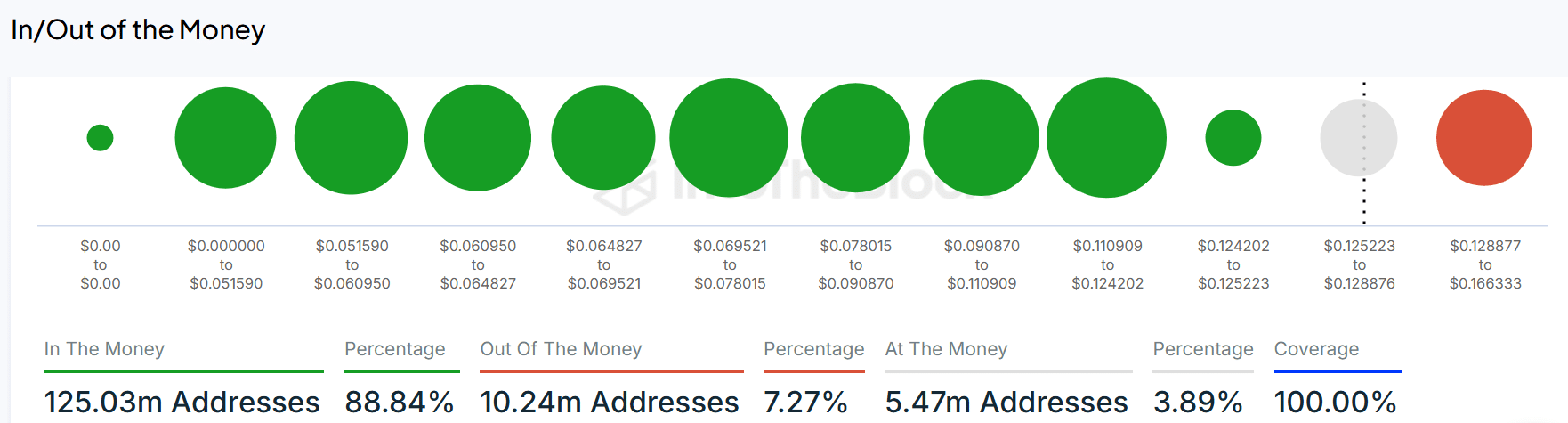

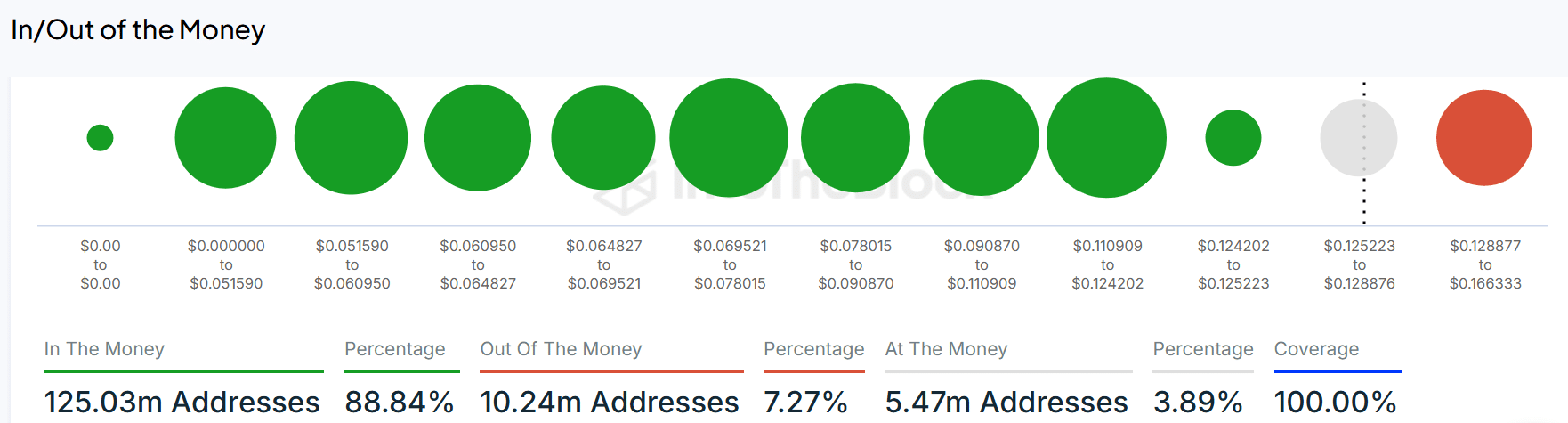

Data from IntoTheBlock showed that 88% of TRX holders, equivalent to 125 million addresses, were ‘In the Money’ at the time of writing, indicating overall bullish sentiment.

Source: IntoTheBlock

However, the futures market showed distorted sentiment around TRX. Declining Open Interest explained the mild price volatility and a decline in overall market participation.

Source: Coinglass