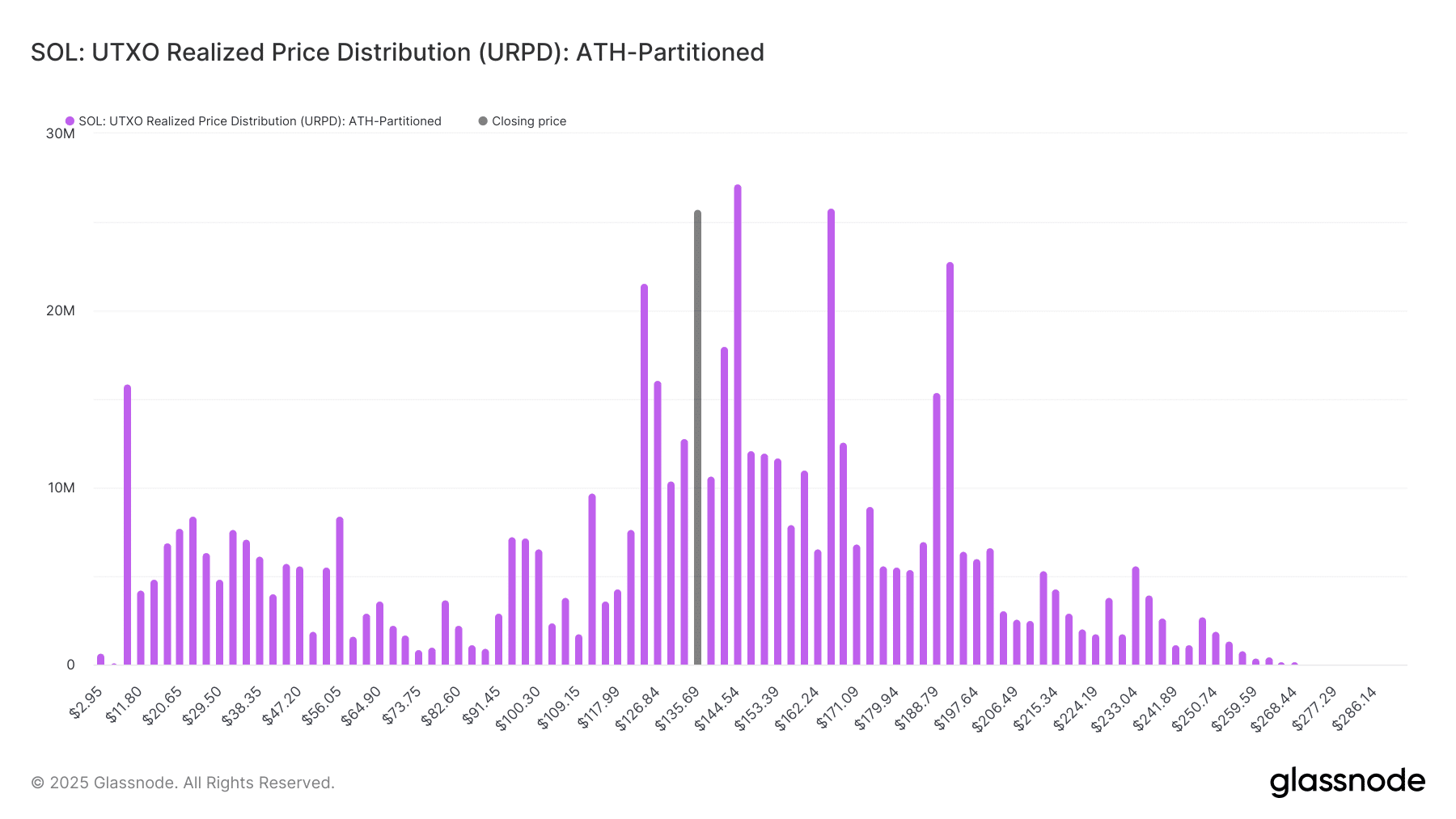

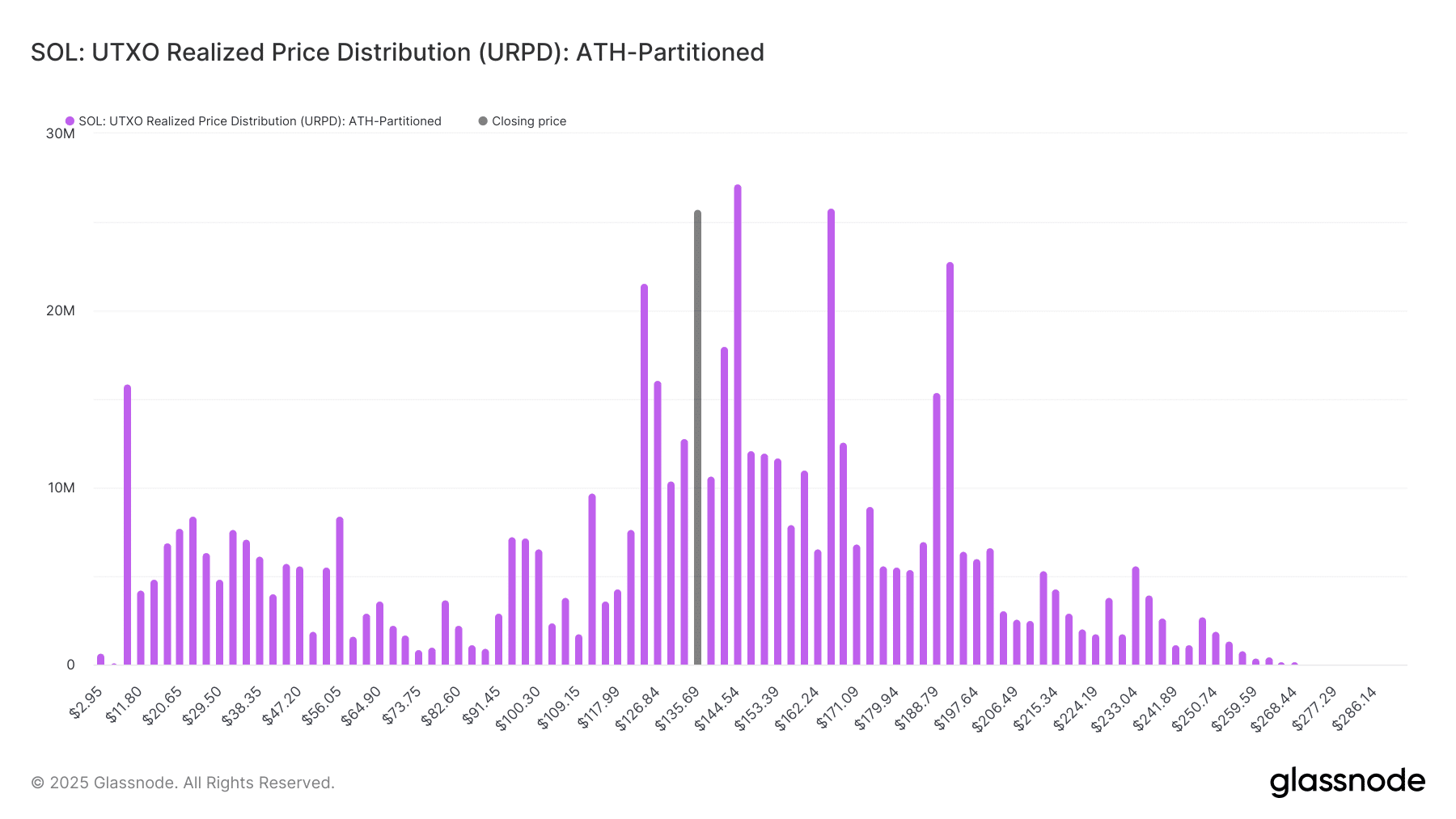

- Solana was confronted with a large resistance at $ 135 and $ 144, where almost 5% of the total stock is concentrated.

- Main support for $ 112 and $ 126 could stabilize the price decrease, but a break under $ 94 can cause a sharp decrease.

Solana [SOL] Traders and investors carefully view the latest data on the chain while the actively navigates crucial price levels.

The UTXO Realized Price Distribution (URPD) emphasizes significant nutritional concentrations at various price points and offers insights into potential support and resistance zones.

Insight into these critical levels such as SOL attempts to stabilize can help predict the next step.

Solana -accumulation and support zones

One of the most important battery zones for Solana Is around $ 112.10, where around 9.7 million SOL, or 1.67% of the total offer, are concentrated.

From January 19, this level already had around 4 million SOL, indicating that investors have strengthened their positions in the long term.

Historically, such accumulation zones often act as strong support, because investors try to protect their admission prices and to limit further falls.

Extra support levels are around $ 94, $ 97 and $ 100, which together account for nearly 21 million SOL or 3.5% of the circulating offer. If Sol experiences downward pressure, these levels can serve as critical price floors.

Under this reach, Concentration Is at least to around $ 56. This lack of significant liquidity suggests that breaking less than $ 94 can lead to a sharp sale.

Resistance and sale

On the resistance side there are significant nutritional concentrations at $ 135 and $ 144.

The level of $ 135 has around 26.6 million Solana in Holdings, while $ 144 has nearly 27 million SOL, making it look almost 5% of the offer.

Source: Glassnode

These levels were previously important accumulation zones, where many investors can sell at break-even prices. This can lead to the formation of strong resistance.

In addition, the URPD data emphasizes the recent accumulation at $ 123 and $ 126, which is a reflection of holdings of 16.2 million Sol (2.7% of the offer) and 19 million Sol (3.2% of the offer), respectively.

As a result, these levels can offer stability in the short term and act as resistance points, especially if the upward momentum weakens.

How Sol could trend

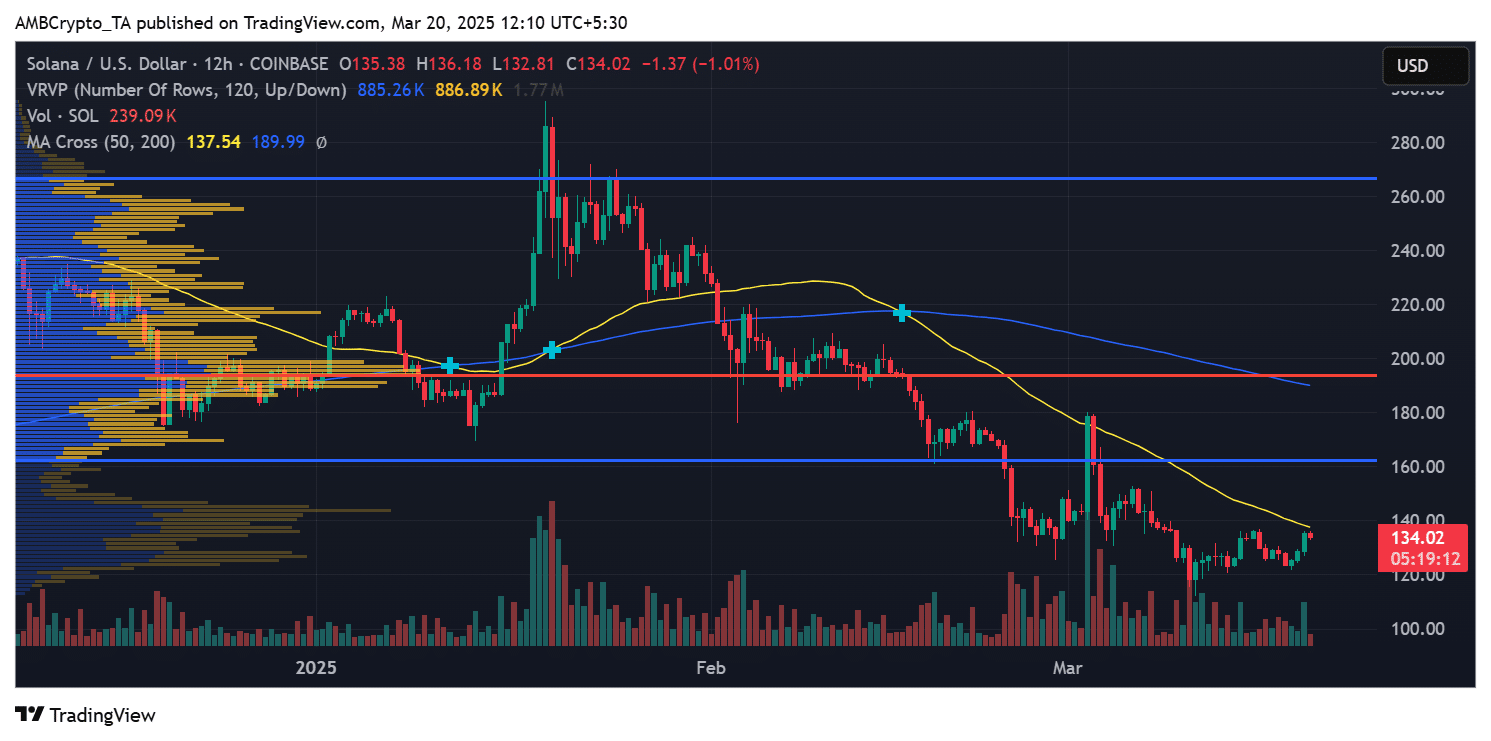

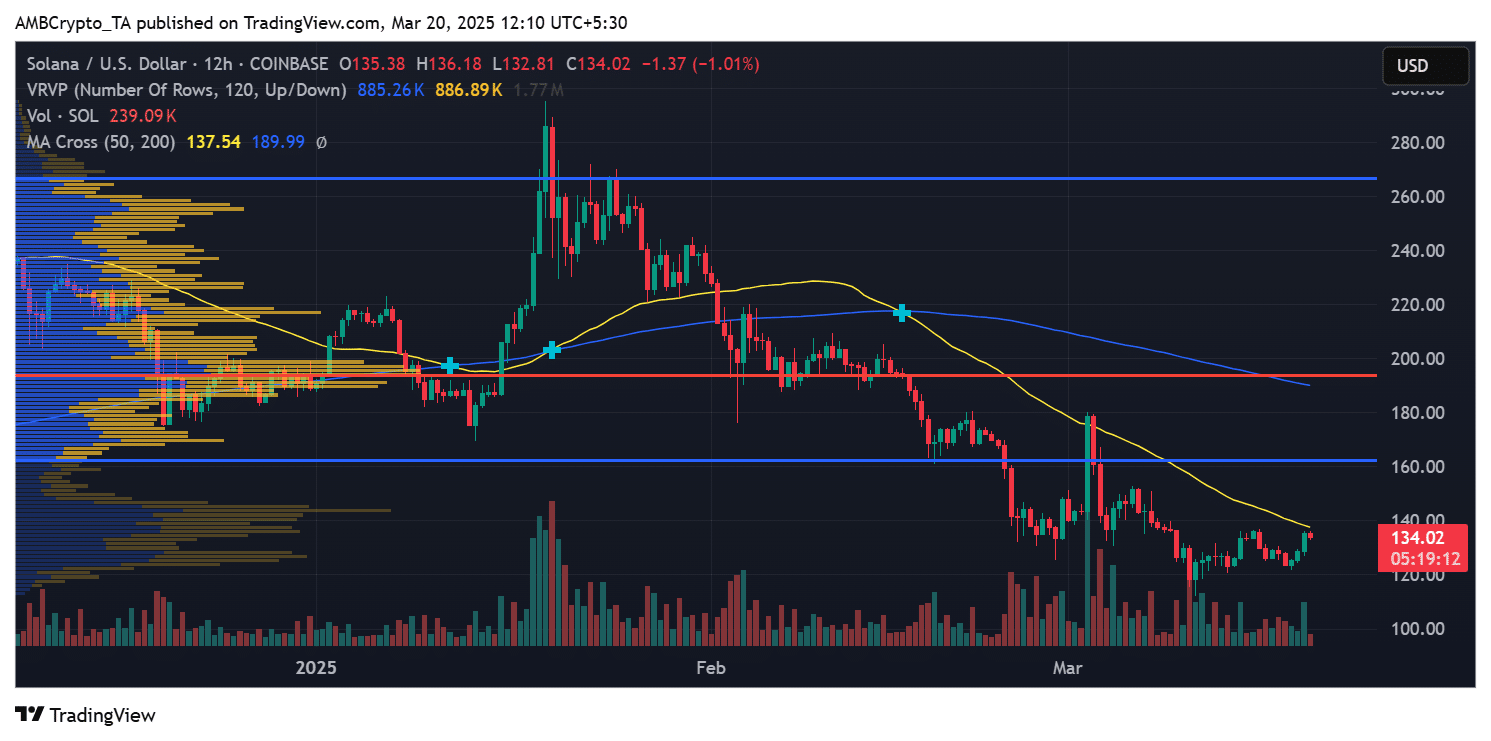

The current price promotion of Solana suggests a battle between bulls and bears in these crucial food zones. If buying interest rates around the identified support levels, Sol can try to push the past resistance near $ 135- $ 144.

Source: TradingView

However, not holding above $ 94 can actively expose it to an increased downward risk. Traders must carefully check volume trends and liquidity zones to measure the next important movement of the active.

With these delivery concentrations that define potential market behavior, in the coming days it will determine whether Solana can regain higher price levels or further retracement can be confronted.