- Solana witnessed a tumultuous second quarter with declining activity and fees on the network.

- Strikers are starting to lose interest in the network.

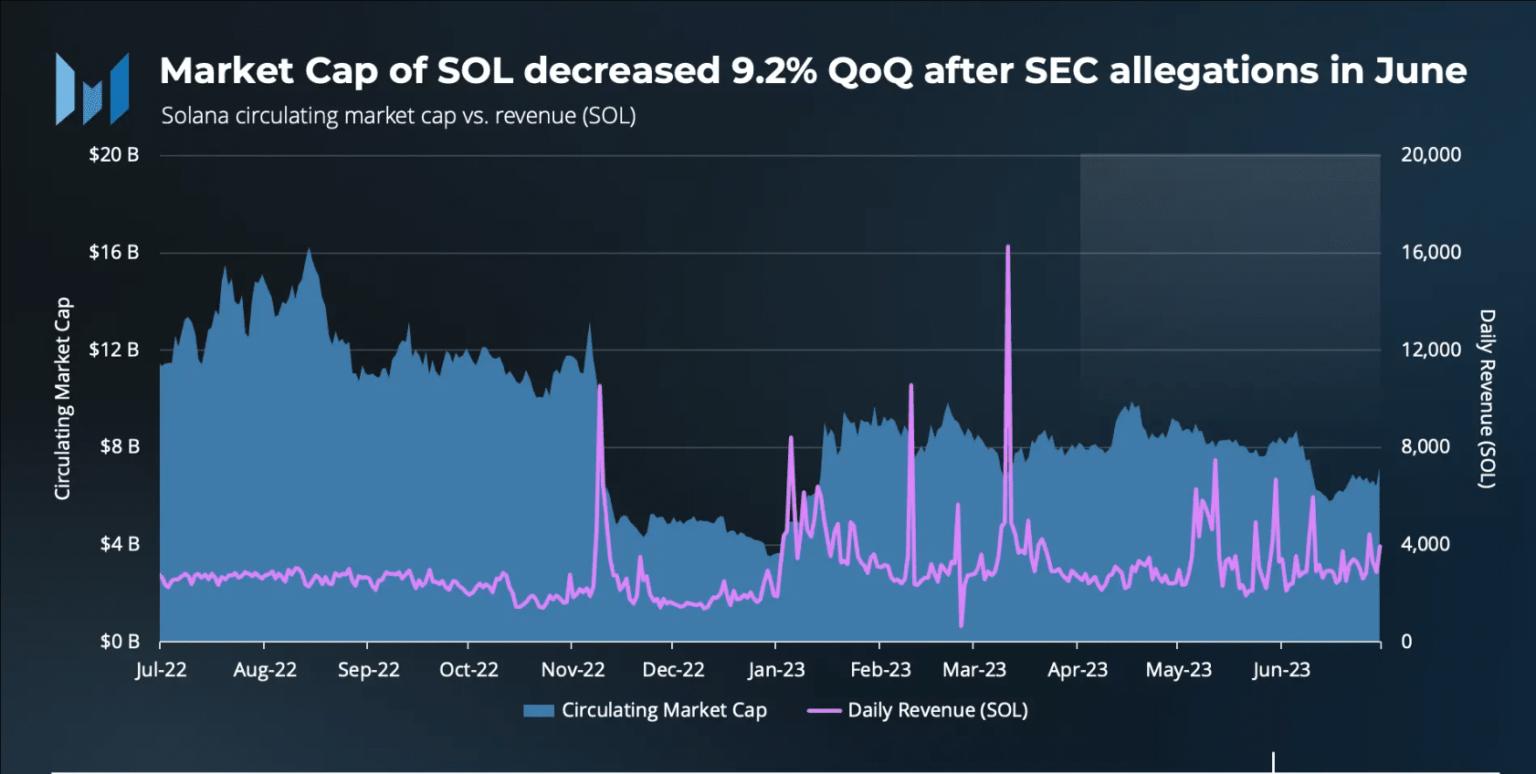

After facing major challenges such as the FTX debacle and network outages, Solana[SOL] tried to recover. Solana managed to gain some momentum in the first quarter of 2023. However, the growth trajectory was hampered in the second quarter by lawsuits filed by the Securities and Exchange Commission (SEC).

Realistic or not, here is the market cap of SOL in terms of BTC

The highs and lows of Q2

Following the SEC complaint and associated delisting, exchanges including Robinhood revealed their intentions to remove SOL from their platforms. This series of events was accompanied by a downward impact on the value of SOL. Prices fell 9.2% compared to the broader market’s modest 1.3% quarter-on-quarter (QoQ) increase.

At the end of the quarter, Solana was ranked 10th by market capitalization, with a value of $7.2 billion, according to Messari data.

Source: Messari

In Q1 2023, revenue was supported by higher priority fees paid by users. However, SOL’s revenue in the second quarter was down 15.0% compared to the previous quarter, mainly due to a decrease in the share of daily fees paid.

The implementation of priority fees played a critical role in reducing past network downtime problems due to inefficient transaction processing and discouraging spam activity. During the second quarter in particular, on average about 40% of daily costs were paid by users who prioritized their transactions.

This represented a decrease from about 50% in the previous quarter. The reduction in the number of users opting for priority rates contributed to a decrease in the network’s average transaction costs and subsequently impacted Solana’s revenues.

Source: Token Terminal

In terms of strike, a sharp drop was observed on the Solana network. According to Staking Rewards data, the number of strikers on the Solana network has dropped 21.43% over the course of the past 30 days.

Source: Staking Rewards

Is your wallet green? Check out the Solana Profit Calculator

SOL sees green

Despite the decrease in the number of strikers, the price of SOL has gained positive momentum in recent weeks. After testing the $13.29 support level on June 10, the price of Solana is up 65.29%. At the time of writing, SOL was trading at USD 22.32.

The RSI and CMF for the currency were relatively high, suggesting a bullish outlook for Solana going forward.

Source: Trade View