- Movement token has a bearish technical bias in the near term and is facing selling pressure at $1

- On-chain statistics suggested bulls may be hopeful of a recovery

Movement [MOVE] saw a 5% increase in Open Interest in the 24 hours before going to press. This was accompanied by a price gain of 3.3%. During this time, Bitcoin [BTC] rose 0.04%, while OI also fell 0.09%.

Despite Bitcoin’s bearish price, the realized figures on the limits and the supply distribution showed that MOVE may be preparing for a recovery.

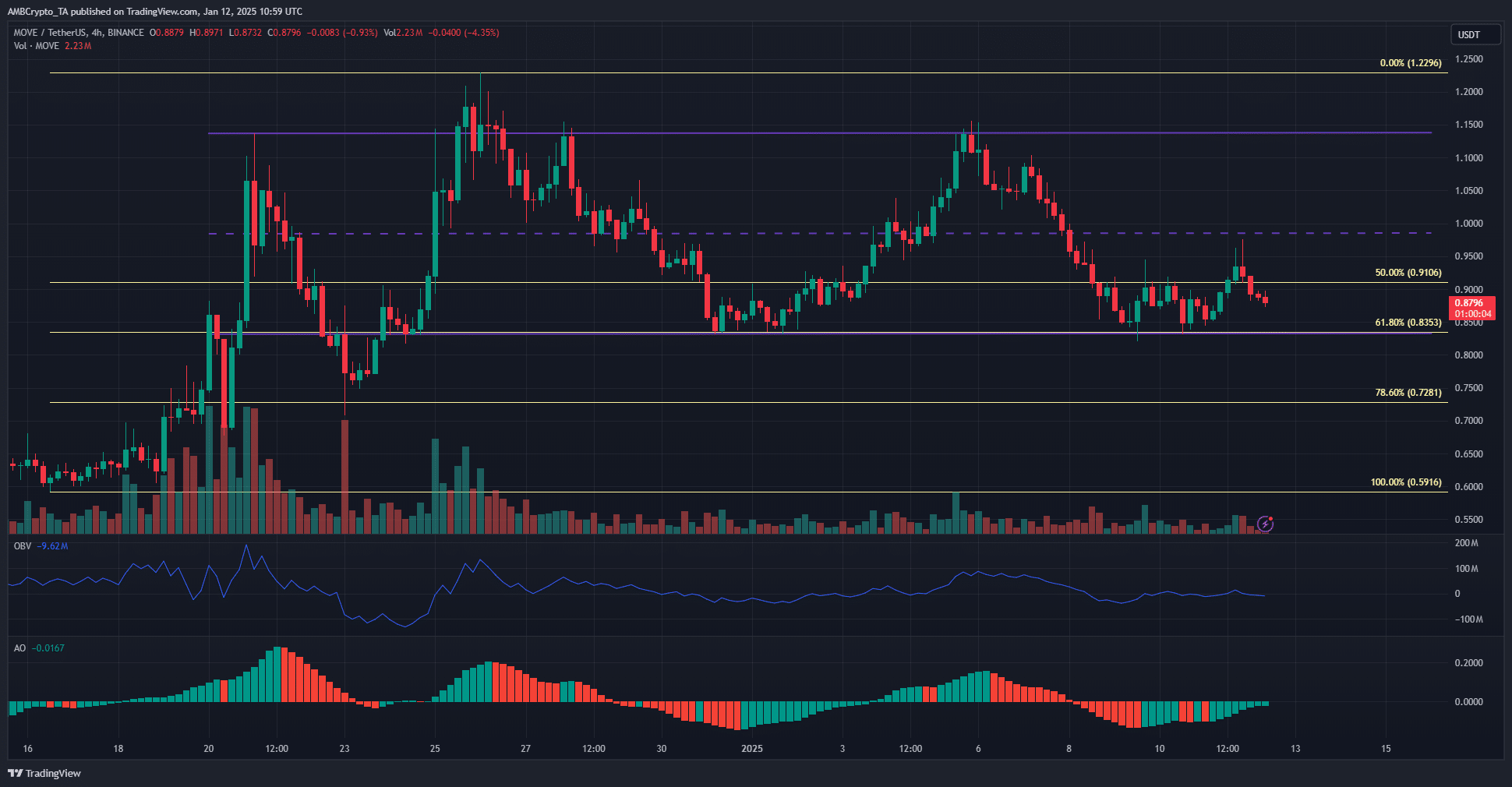

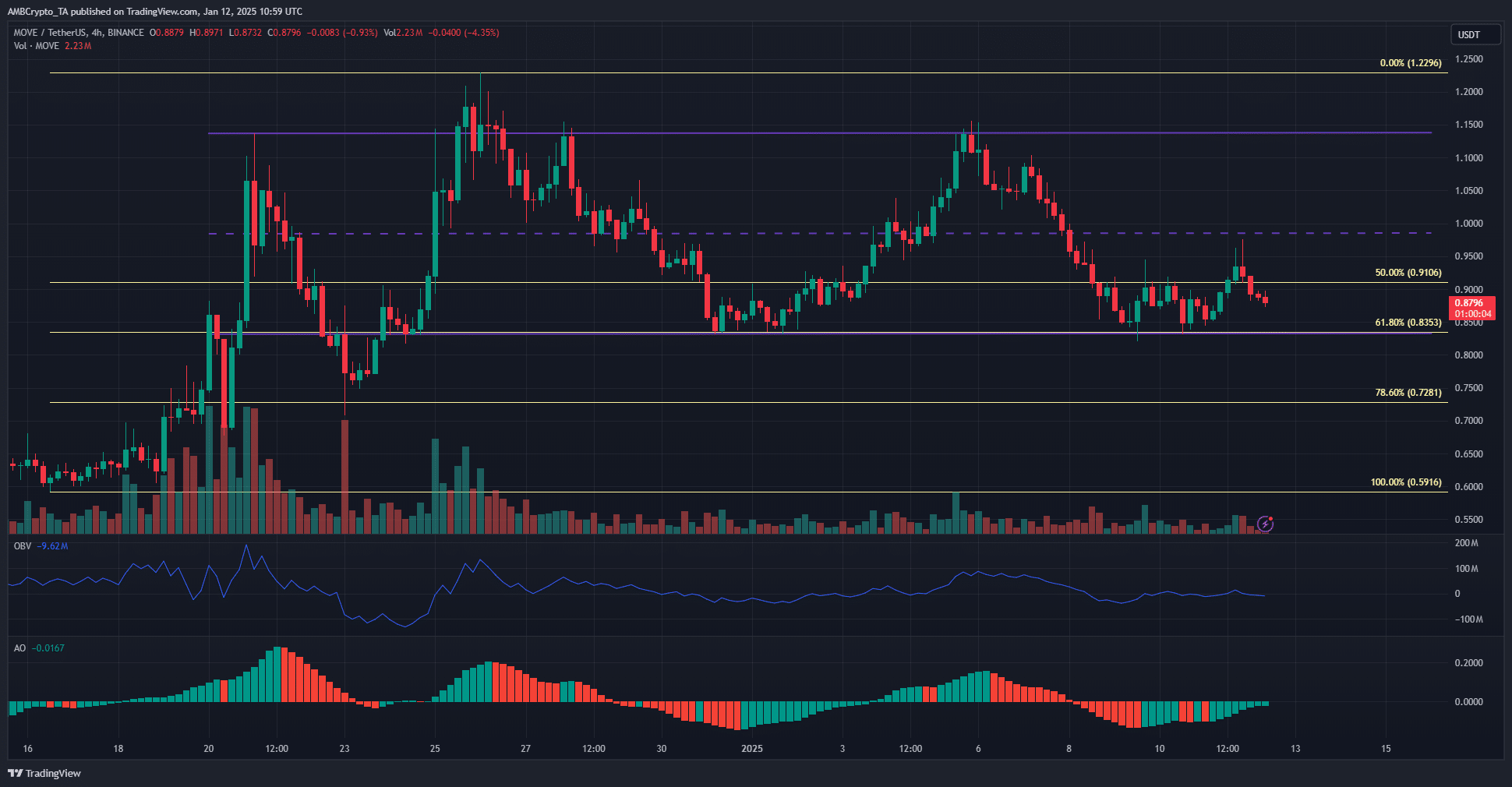

MOVE range formation outlines crucial support and resistance levels

Source: MOVE/USDT on TradingView

Over the past month, the movement token has been trading within a certain range. It rose from $0.83 to $1.13, with a mid-level of $0.98. Over the past five days, the mid-market has resisted bullish attempts at recovery. It also aligned with the psychological $1 level, making it a more difficult challenge for buyers to overcome.

The area from $0.8-$0.83 is a support zone. The OBV has not made any new lows in the past two weeks – an encouraging sight. The sales volume wasn’t overwhelming either. The Awesome Oscillator showed that bearish momentum has been the norm in recent days, but also appeared to be on the verge of forming a bullish crossover.

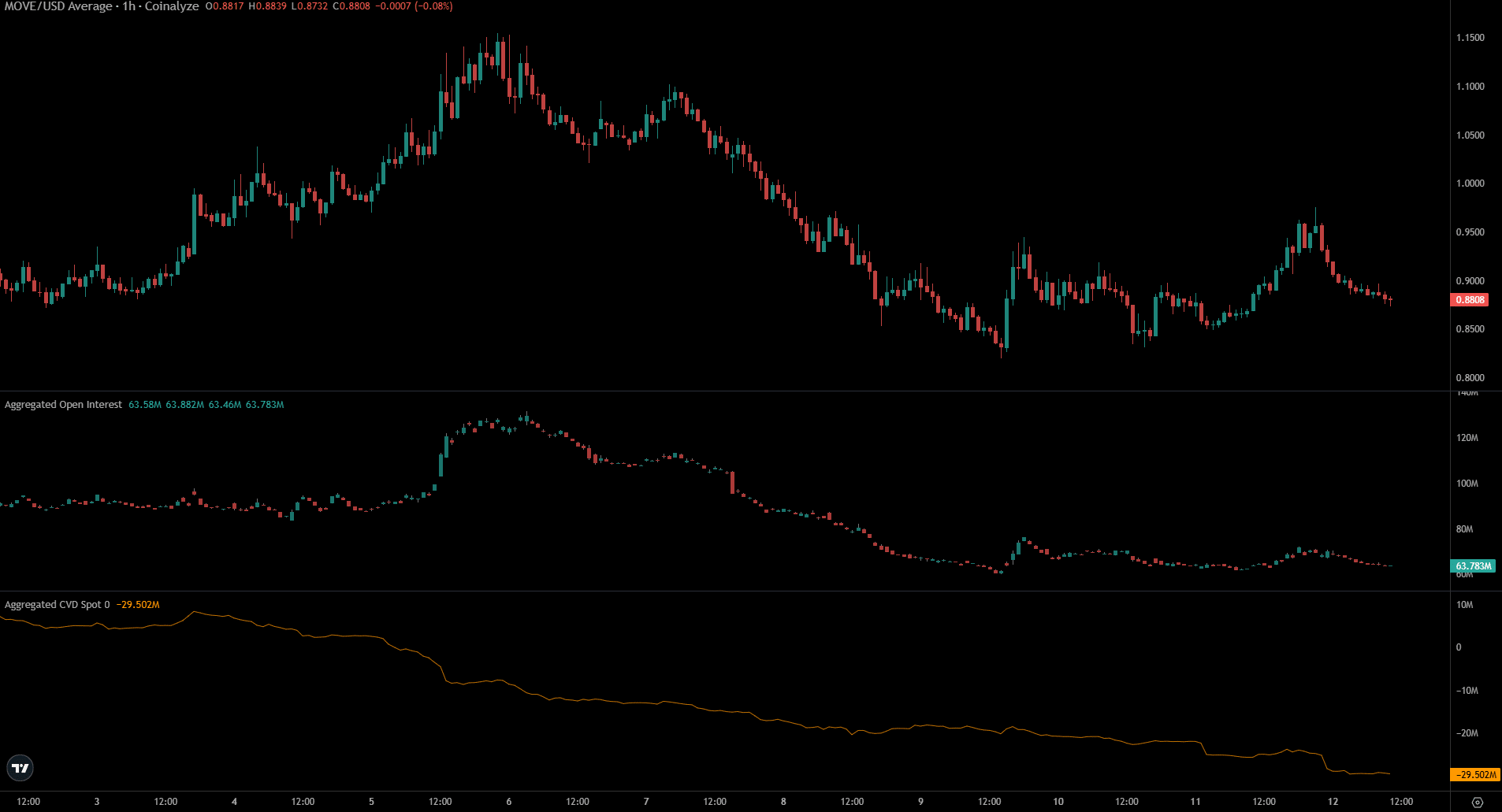

Meanwhile, data from Coinalyze indicated strong bearish sentiment in the short term.

The Open Interest shows a downward trend next to the spot CVD. The 5% gain over the past 24 hours was not enough to counter the prevailing selling sentiment.

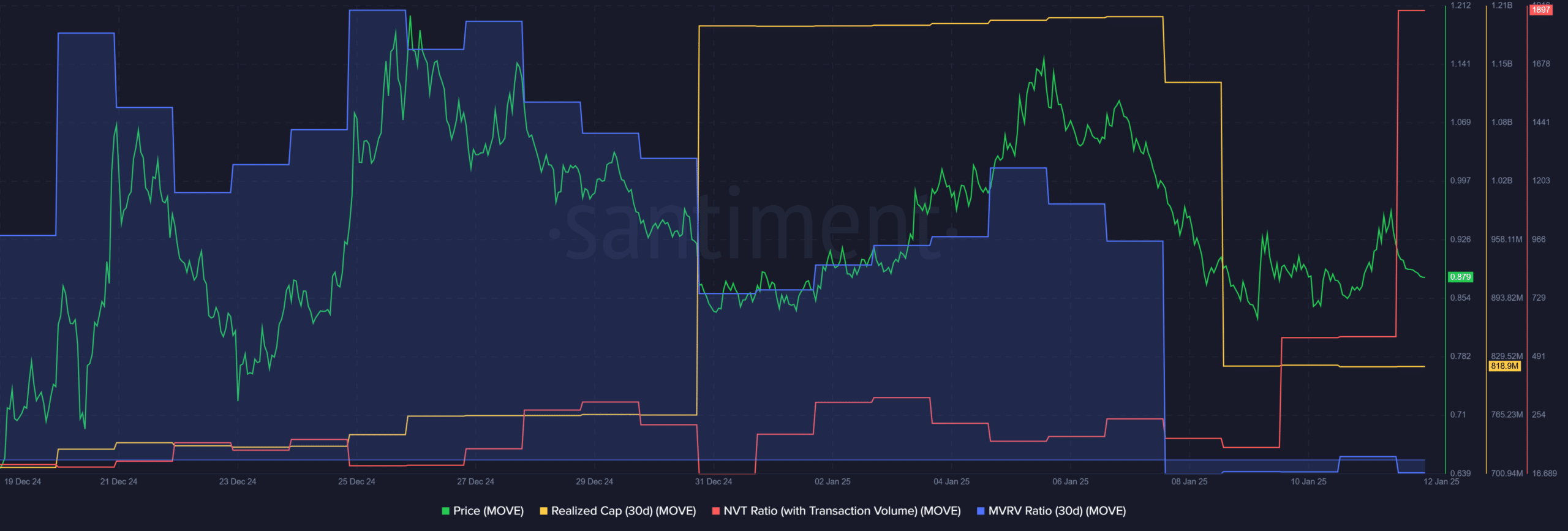

The realized limit in the short term underlines the distribution trends

The NVT ratio recently experienced a sharp increase. This indicated a potential overvaluation of the token, relative to transaction volume. The 30-day MVRV ratio was -4%, highlighting that MOVE holders suffered a small loss.

The realized limit over a 30-day period saw a sharp decline last week, in addition to the falling price. Because the realized cap calculates the value of an asset based on the price at which each token was last moved, this meant that participants moved the token at lower prices.

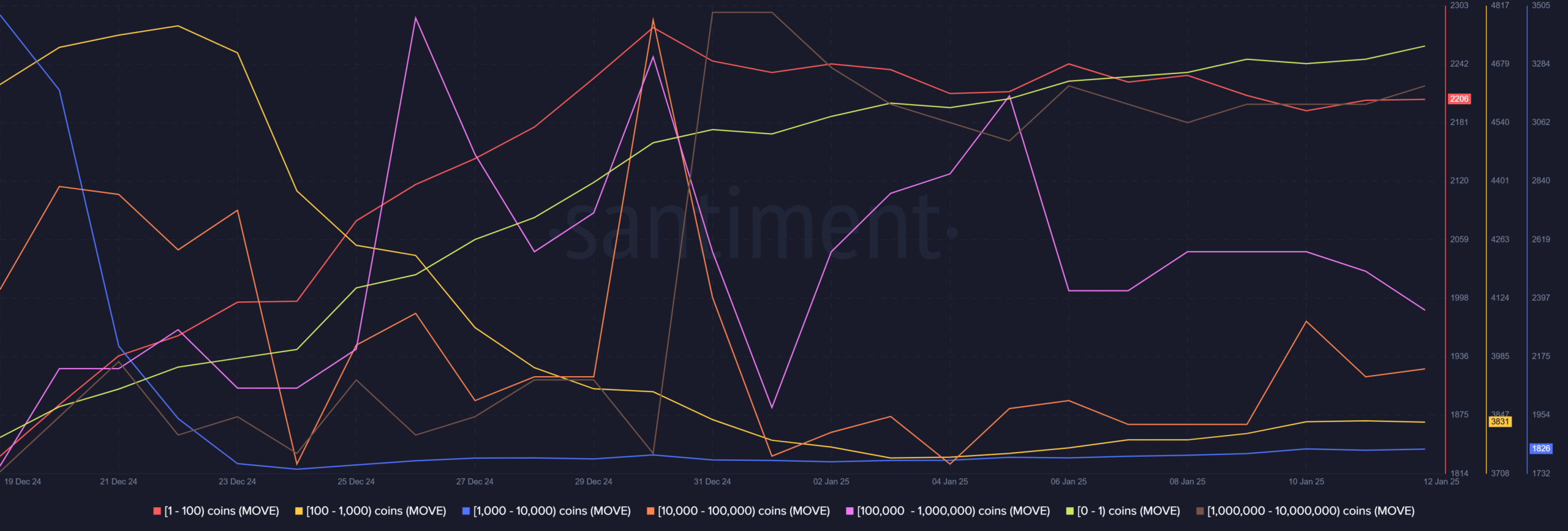

Finally, the supply distribution analysis showed that, apart from the wallets with 100,000 to 1 million MOVE, most other market participants bought more. This whale cohort is perhaps one of the most important holders. Despite last week’s decline, their numbers were still higher than before Christmas.

Read Movement [MOVE] Price forecast 2025-26

Overall, the short-term price was bearish and the OI change was not enough for MOVE to recover. This allows traders to keep an eye on the realized cap metric.

A sudden spike would be a buy signal. Meanwhile, the steady accumulation of some cohorts of property owners also implied a conviction.