- Morgan Stanley plans to pave the way for the adoption of BTC ETFs

- Only aggressive risk-tolerant customers with more than $1.5 million are eligible

Asset management firm Morgan Stanley will now allow select clients to purchase US spot Bitcoin ETFs (exchange traded funds).

According to a CNBC reportOn Friday, the company instructed its financial advisors to offer the products from August 7. Quoting people familiar with the matter, the report states:

“The company’s approximately 15,000 financial advisors can request eligible clients to purchase shares of two bitcoin exchange-traded funds starting Wednesday.”

Is there a second wave of BTC ETF adoption?

At this time, Morgan Stanley will only offer BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). However, only customers with an aggressive risk tolerance are eligible.

“Only clients with a net worth of at least $1.5 million, an aggressive risk tolerance, and a desire to make speculative investments are suitable for bitcoin ETF requests.”

This means it would be the first major asset manager on Wall Street to offer BTC ETFs to clients. By extension, this would mark the beginning of the long-awaited second wave of adoption.

For perspective, the huge demand in the first half of 2024 came mainly from individual retail investors, hedge funds, asset managers and venture capitalists (VCs).

Bitwise CIO Matt Hougan called the first wave adoption a “deposit‘ before wire houses join in. Large wirehouses deal with wealthy individuals and institutional investors. Morgan Stanley is one of them. Others include Wells Fargo, UBS, JPMorgan, Goldman Sachs and Credit Suisse.

So says Bloomberg ETF analyst James SeyffartThese wirehouses control $5 trillion in customer assets and could be perhaps the most positive signal for BTC ETF adoption.

A ‘playbook’ for ETF adoption?

After completing their due diligence, these major companies are now expected to offer BTC ETFs in the third or fourth quarter. Robert Mitchnick, BlackRock’s head of digital assets, even predicted that most of them would start offering the products this year.

“If you think about the big wirehouses and private banking platforms, none of them have really opened them up to their advisors yet… But this year, that’s certainly likely.”

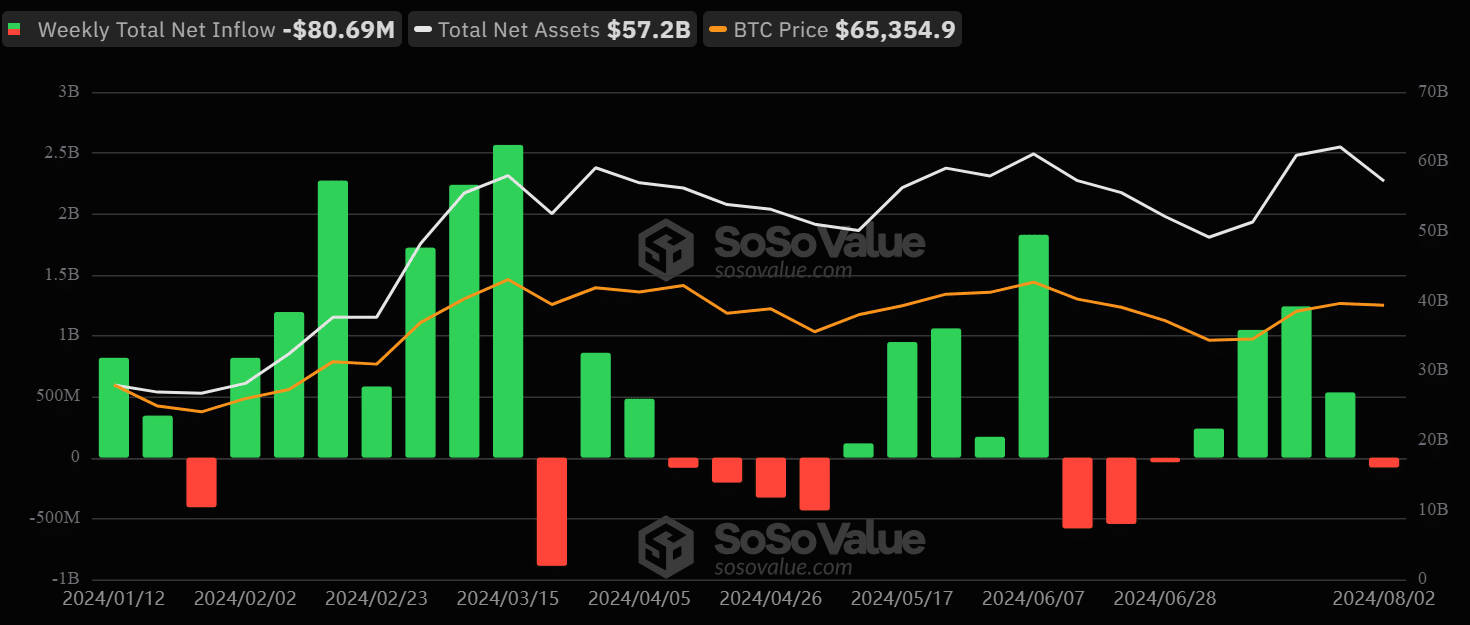

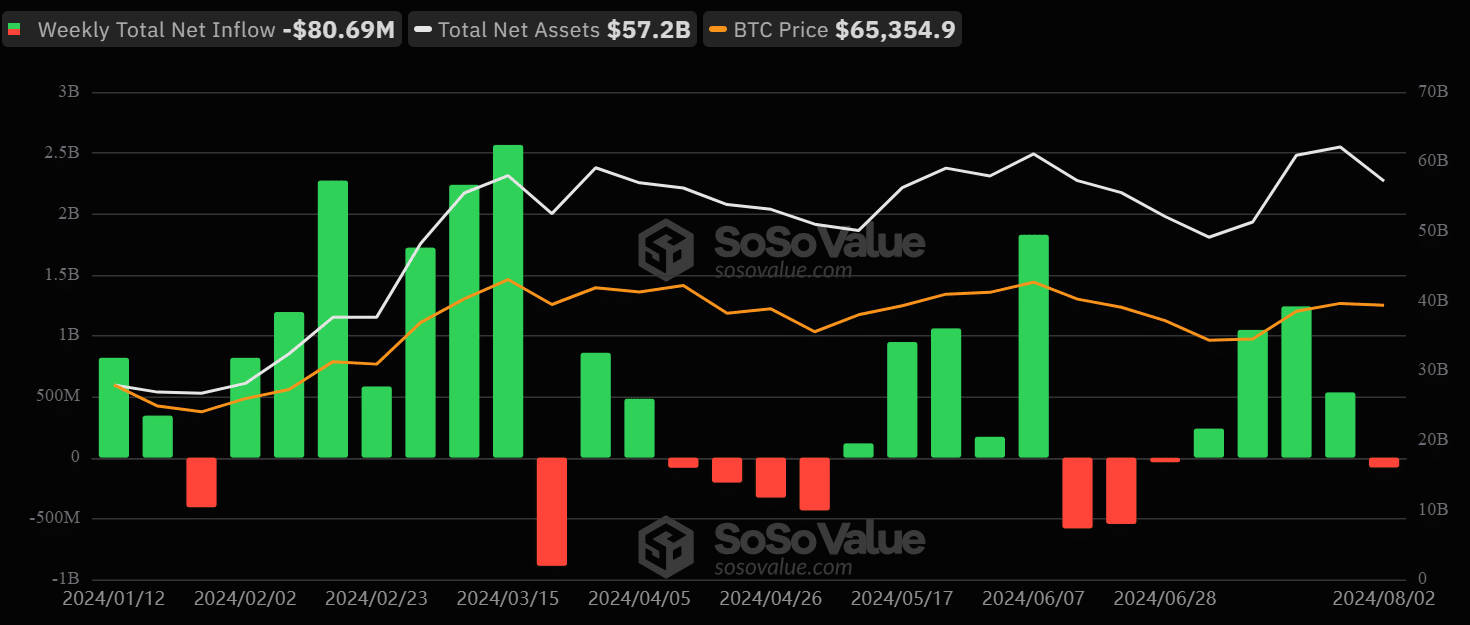

From May Bitwise facts showed that professional investors accounted for approximately 7% to 10% of the AUM (assets under management) of BTC ETFs, which at the time amounted to $50 billion. That’s about $3-$5 billion. It meant that private investors dominated the AUM, but that could change if wirehouses join the party, Hougan said.

“Many companies begin to allocate across their entire customer portfolio approximately six months after the initial allocation, with allocations ranging from 1-5% of the portfolio.”

This is the playbook to look for when wirehouses join the party.

At the time of writing, total assets under management stood at $57.2 billion, with weekly net outflows of $80.69 million, underlining that investors are generally taking risks this week. It remains to be seen whether the influx of wirehouses will change the current market trend and help the price of BTC.

Source: Sosowaarde