- Over the past two months, the MKR supply sent to exchanges has steadily increased

- DAI’s circulating supply registered the highest growth since the banking crisis in March

MakerDAO [MKR]colloquially referred to as the decentralized central bank, has gained prominence in recent months with carefully calibrated business moves.

By effectively controlling the supply and demand dynamics of its popular stablecoin offering, DAI, the lending protocol has attracted users again. As expected, the MKR native utility token has been one of the biggest beneficiaries.

Read Creators [MKR] Price forecast 2023-2024

‘Maker’ of fortunes

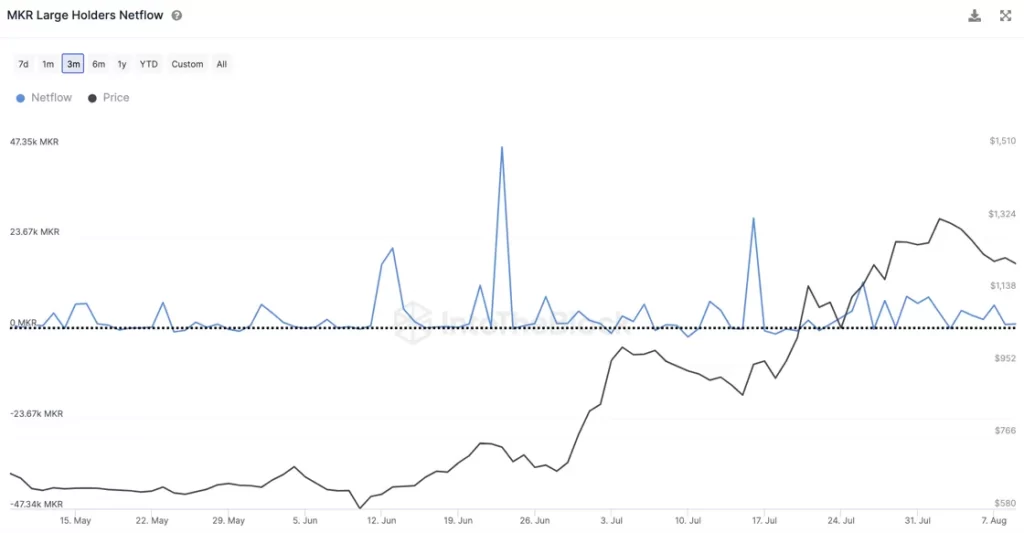

According to data from on-chain research firm IntoTheBlock, MKR has been one of the best performing crypto tokens in the market lately, almost doubling its value in the past three months. At the time of publication, MKR was exchanging hands at $1,228, with its market cap having crossed the $1 billion ceiling.

Source: IntoTheBlock

The data also revealed significant inflows into the wallets of major investors, indicating interest in MKR is starting to pick up.

This price increase prompted these investors to unload their bags for profit. As a result, MKR stock sent to exchanges has risen steadily over the past two months, while illiquid stock has fallen.

Source: Sentiment

MakerDAO’s recent efforts to drive demand for DAI are at the root of MKR’s growth. But then the question arises: what value does MKR get from the adoption of DAI?

MKR depends on the adoption of DAI

As is well known, MakerDAO offers lending services through its crypto-collateralized stablecoin DAI. Users lock crypto assets into smart contracts, known as collateralized debt positions (CDPs). Then new DAI tokens are released to them in exchange for the collateral.

Like conventional banks, Maker charges an interest called a stability fee that users must pay back when they withdraw locked collateral. This is where MKR’s utility comes into play.

The stability fee may only be paid in MKR tokens, and once paid, the MKR will be destroyed and withdrawn from circulation. This basically means that as the adoption and demand for DAI increases, the demand for MKR will also grow. It goes without saying that scarcity is a major contributor to driving MKR growth.

Now that the link between the two ecosystem tokens is well understood, it is important to analyze the main event that has boosted DAI over the past week.

DAI back in action

According to IntoTheBlock, DAI transaction volumes hit their highest numbers since the unfortunate de-pegging episode in March, which saw the value drop to just 97 cents.

Source: IntoTheBlock

Recall that the de-peg resulted after USD Coin [USDC], which made up a significant portion of DAI’s collateral reserves, became entangled in the whirlwind of the US banking crisis. Note how DAI’s circulating supply shrank as investors scrambled to buy back their DAI holdings, according to data from Glassnode.

However, cut to the present and we can see a sharp rise. Ergo, the question – What has DAI stimulated?

Source: Glassnode

MakerDAO allows savers to earn interest on the DAI they hold with the DAO’s bank. Based on the DAI savings rate (DSR), tokens continuously build value. Thus, DSR acts as a powerful monetary policy tool for Maker to influence the demand and supply of DAI.

MakerDAO recently increased the DSR to 8%, incentivizing users to lock down their DAI holdings for better rewards. The results were instant. The amount of DAI sent to the DSR contract has increased by $1 billion in the past week.

How much are 1,10,100 MKRs worth today

The wider impact on the DeFi landscape

The prospect of a yield-bearing stablecoin could help open up new avenues for DeFi growth. Popular lending protocol Aave [AAVE] recently floated one proposal to list liquid DSR deposit tokens (sDAI) as collateral. This could give users the dual benefit of earning DSR returns while using their assets as collateral.

Most of the proceeds were funded by the protocol revenues. In addition, according to data from MakerburnMaker’s annualized fee income was $165 million at the time of publication, representing 236% growth over the past three months.

Source: Makerburn

Much of the revenue was also earned from US Treasury bonds.

Lately, Maker has been trying to give real-world assets (RWAs) a bigger role in DAI’s collateral reserves, evidenced by proposals to increase holdings of US Treasuries. These strategic moves are designed to avoid the dangers associated with crypto reserves that came to light during the USDC crisis.