- After recovering from the $0.06 support, HBAR broke out of its bearish pattern on the daily chart

- HBAR’s long/short ratio indicated a slightly bullish edge

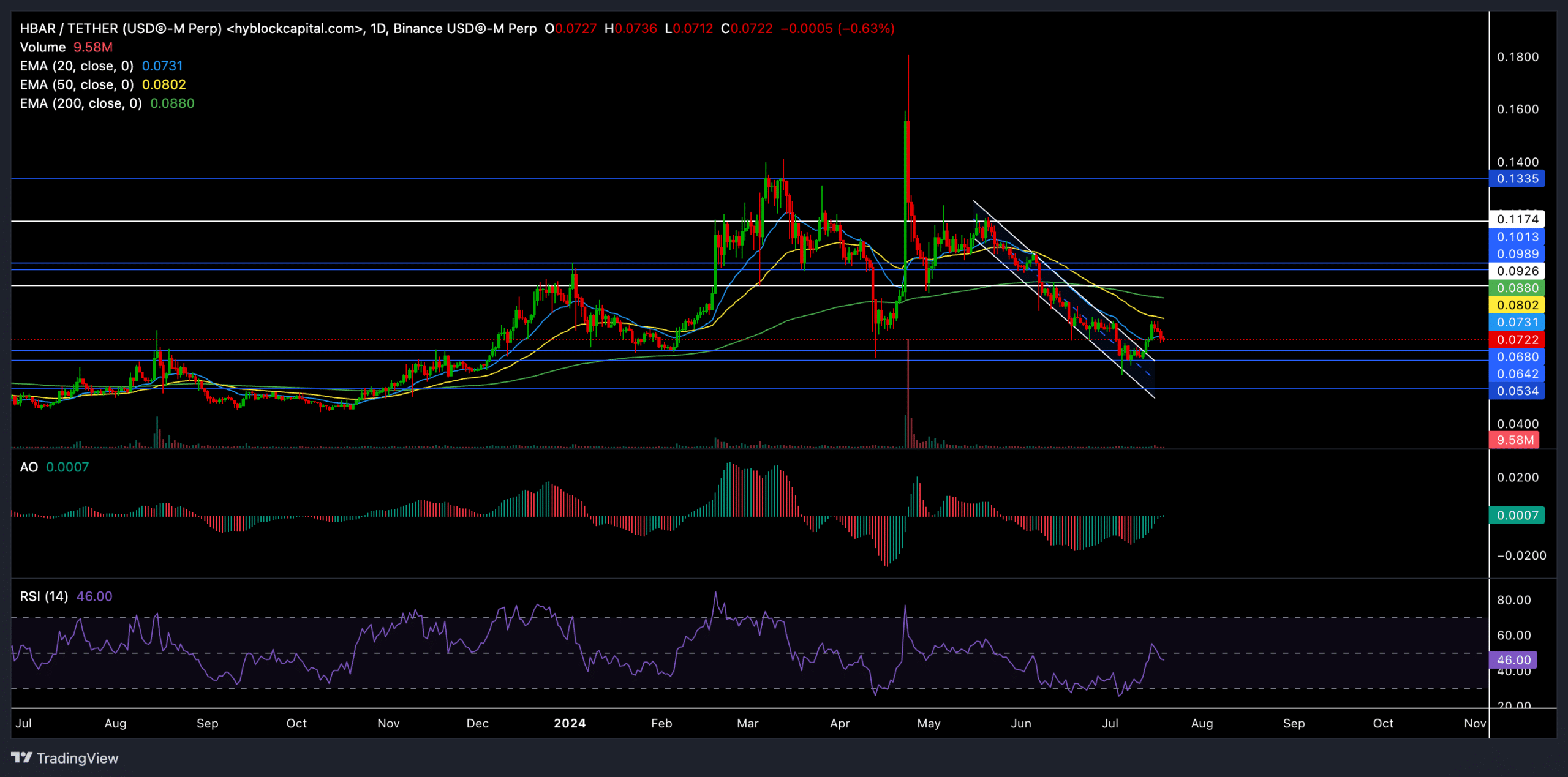

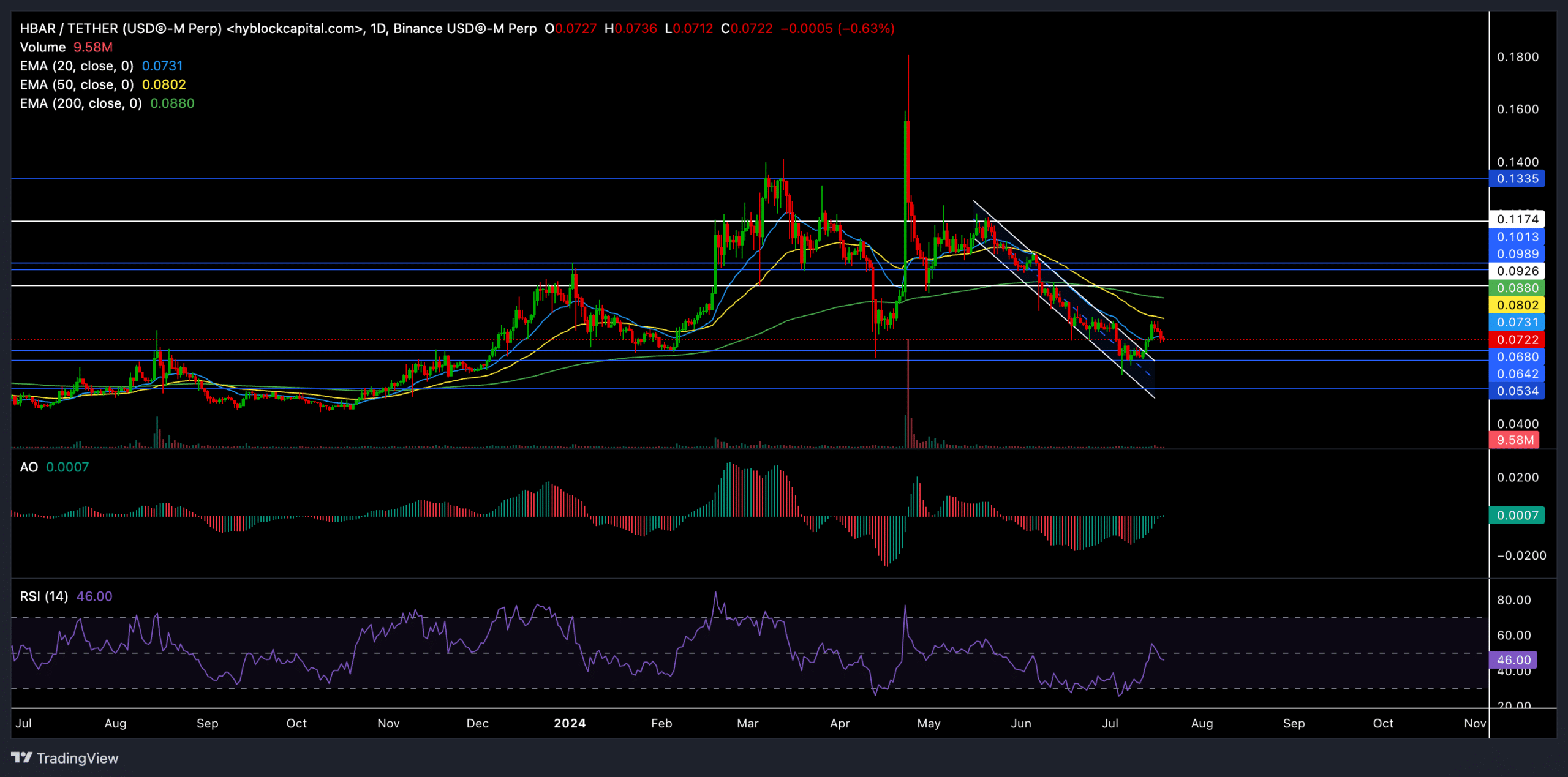

from Hedera [HBAR] the recent reversal from the $0.06 support level set the stage for the bulls to end their bearish rally. As a result, the altcoin finally broke out of its bearish pattern. Over the past week, it saw a few green candles on the daily chart as it tried to break above its short-term EMAs.

Can the bulls trigger another rally from the $0.06 support level if the sellers trigger a near-term pullback? At the time of writing, HBAR was trading around $0.0722.

Can HBAR Buyers Trigger a Bull Run?

Source: TradingView, HBAR/USDT

From a relatively long-term perspective, HBAR has been in a consistent uptrend after jumping above its 200-day EMA (green) in October 2023. The altcoin continued to record higher lows and highs, growing over 164% over the next five months. .

However, after losing the crucial resistance level (and subsequently support) at $0.09 on the daily chart, HBAR registered a steep downtrend. As a result, it fell by more than 23% last month.

After witnessing an increasingly bearish edge, the price dropped below the crucial 200-day EMA and formed a descending channel during this downtrend.

The recent revival in buying from the $0.06 support level helped the buyers break the streak of red candles. Bulls sparked a 20% rally in four days, but the 50-day EMA (yellow) remains a strong hurdle.

Nevertheless, this resulted in a break in the descending channels, which could set the stage for buyers to spark a near-term rally.

Should the bears retest the $0.06 level, buyers are likely to trigger an uptrend and aim to rise above the short-term EMAs. In this case, buyers would want to test the $0.088 level near the 200-day EMA.

A decline below the $0.06 support could significantly delay recovery efforts in the short term. Here, sellers would aim to pull the price towards the $0.05 level before a likely reversal would occur.

Interestingly, the Awesome Oscillator marked two consecutive higher peaks, with another peak trying to find a spot above the ‘0’ level. A sustained uptrend on this indicator could confirm bullish twin peaks, reaffirming our bullish bias.

However, at the time of writing, the RSI had fallen below the 50 level and a bullish edge had yet to be confirmed. A hidden bearish divergence on this indicator will reveal a bearish edge.

HBAR in a critical spot

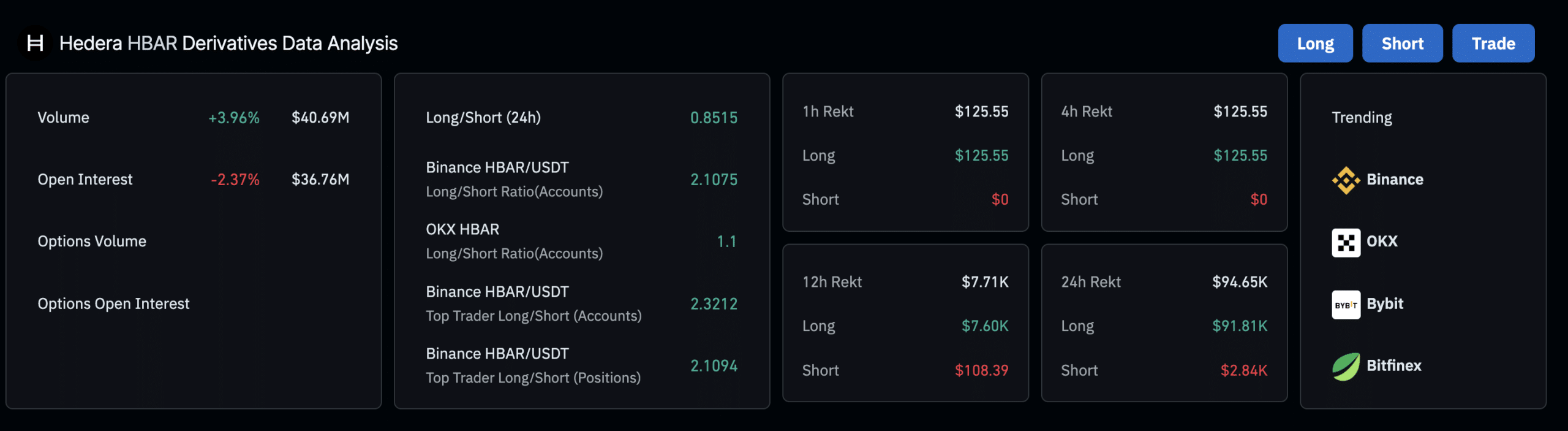

Source: Coinglass

According to Coinglass data, the 24-hour Long/Short Ratio had a value of 0.8515. This indicated a higher proportion of short positions compared to long positions. However, the HBAR/USDT long/short ratio on Binance significantly highlighted a bullish edge and stood at 2.1.

Finally, most altcoins share a strong correlation with Bitcoin. So it is crucial to take Bitcoin’s movements into account and assess the overall sentiment before making a purchasing decision.

![How Hedera [HBAR] Bulls can benefit from the breakout of this pattern](https://bitcoinplatform.com/wp-content/uploads/2024/07/News-Articles-FI-Editors-7-1000x600.webp)