- On October 16, Binance was removed 2.14 million BNB coins out of circulation.

- Demand for BNB has increased in recent days.

Binance completed its 25th quarterly burn of Binance Coin (BNB), removing 2.14 million BNB coins from circulation on October 16. The burned tokens were worth approximately $450 million at the time of the event.

#Binance completes the 25th quarter report #BNB Burn!

🔥2.14m #BNB has been burned 🔥 pic.twitter.com/3KtkE1y6f5

— Binance (@binance) October 16, 2023

Is your portfolio green? View the BNB Profit Calculator

Binance’s quarterly coin burns are part of the entity’s commitment to ensuring BNB’s deflationary model, which preserves its value over time.

The 2.14 million BNB coins destroyed made up 1.38% of the coin’s circulating supply. According to data from CoinMarketCapBNB’s current circulating supply was over 151 million.

BNB bulls have the upper hand

At the time of writing, BNB was trading at $213.01 per coin, having risen 3% over the past two days.

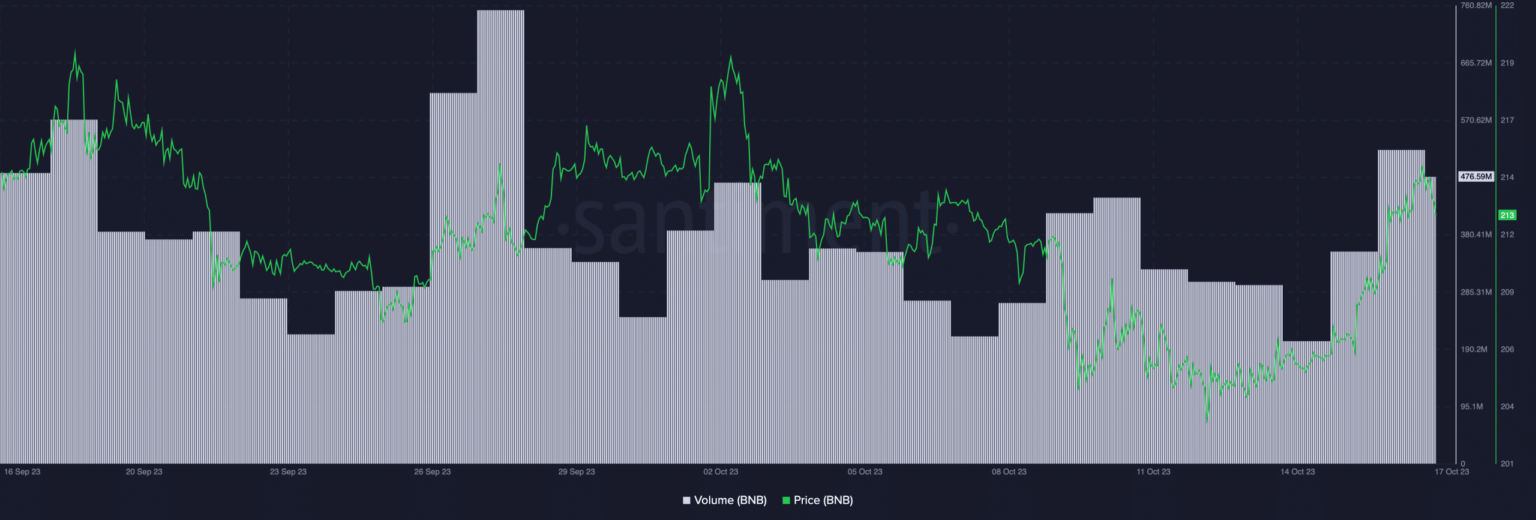

During the intraday trading session on October 16, daily trading in the coin rose to the highest level in the past two weeks, according to data from Santiment.

Source: Santiment

This confirmed the increased activity around the popular altcoin in recent days.

According to the values of the coin’s Moving Average Convergence/Divergence (MACD) indicator observed on a daily chart, the coin started a new bull cycle on October 15, hence the price growth.

On that day, BNB’s MACD line crossed above the trend line. When the MACD line crosses the signal line, it is often considered bullish. It suggests that the asset’s momentum is shifting upward, indicating a potential buying opportunity.

There has also been a rise in BNB accumulation among daily traders. The coin’s key momentum indicators were above their respective center lines at the time of printing.

The Relative Strength Index (RSI) stood at 52.39, while the Money Flow Index (MFI) stood at 51.55. These values suggested that spot traders preferred to buy more BNB than sell it.

Additionally, the alto’s Aroon Up Line (orange) was 92.86% at the time of writing. When an asset’s Aroon Up line is close to 100, it indicates that the current uptrend is strong and that the most recent high was reached relatively recently.

Source: BNB/USDT on TradingView

Be careful

Although BNB accumulation has outpaced distribution in recent days, readings from the coin’s Bollinger Bands indicator suggested a correction may be underway. At the time of writing, the price of BNB was approaching the upper band of this indicator.

How much are 1,10,100 BNBs worth today?

When the price of an asset approaches or touches the upper band of the Bollinger Bands, it is often a signal that the asset may be overbought. It is taken as a sign of a possible reversal or slowing of upward momentum.

Despite the price growth in recent days, BNB’s Chaikin Money Flow (CMF) continues to produce negative values. This has created a bearish divergence, which occurs when the price of an asset reaches new highs while the CMF falls. It often precedes a decline in the value of the asset.

Source: BNB/USDT on TradingView