- A looming US recession and the BoJ’s rate hike were responsible for the recent market losses.

- The outcome of the US recession presents a contradictory scenario for crypto markets.

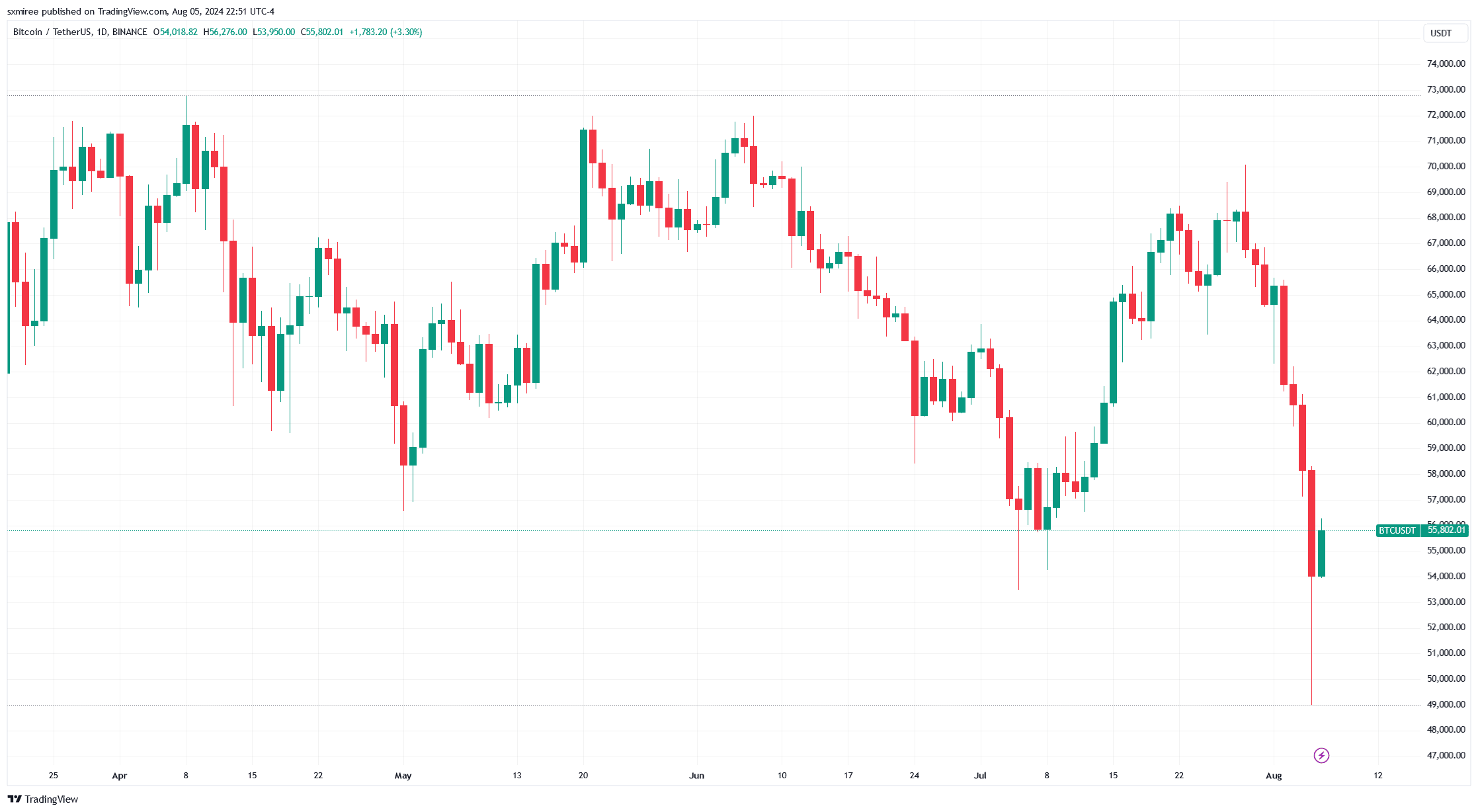

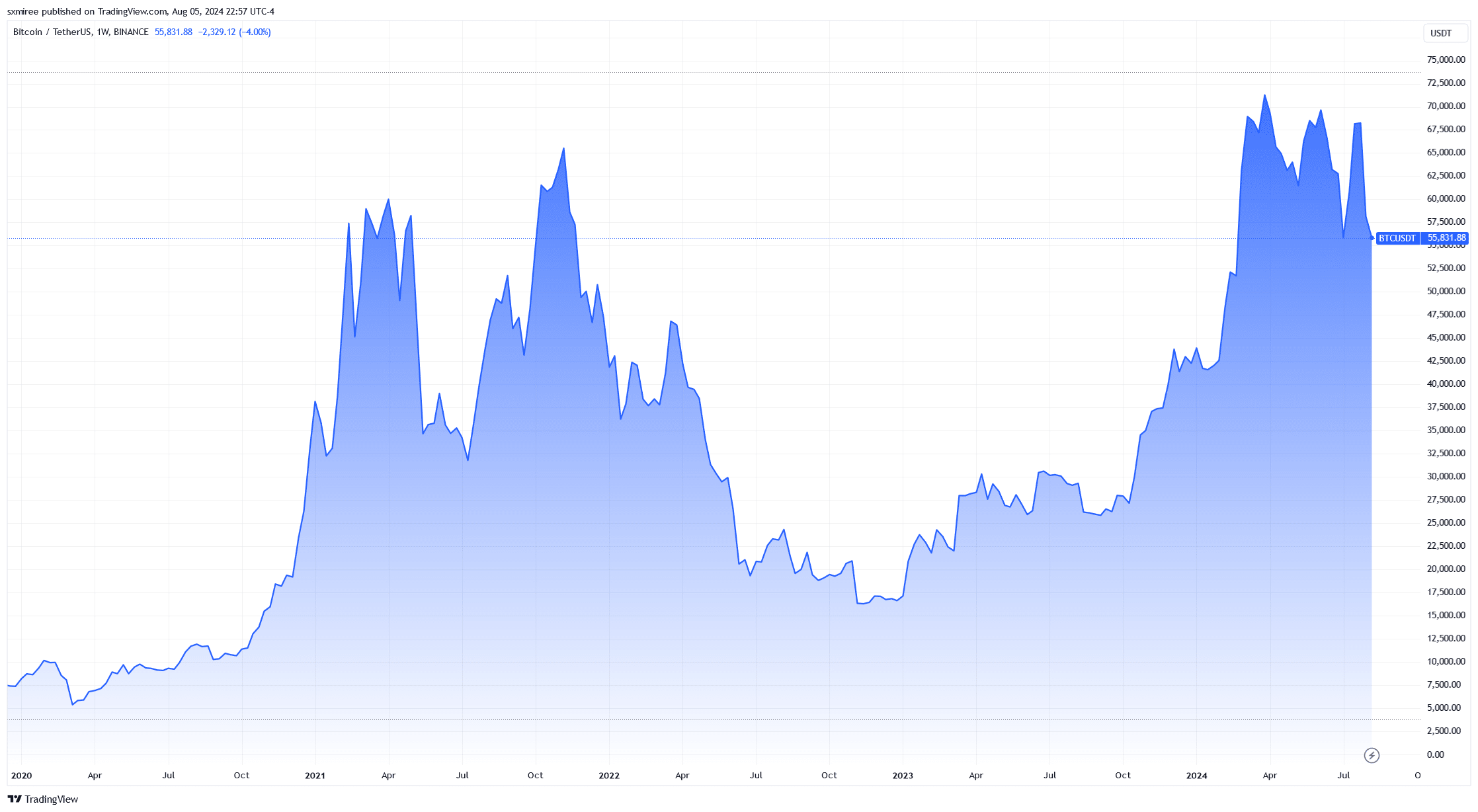

Bitcoin [BTC] and other altcoin prices fell sharply on Friday, August 2, with losses continuing throughout the weekend. The flagship crypto plummeted through $60,000 over the weekend before dipping below key support levels on Monday, August 5.

Source: TradingView

Friday’s market pullback, which extended across global stock markets, was driven by a weaker-than-expected U.S. jobs report released after market hours.

It is understood that the three-day sell-off lasted less than a week since Bitcoin traded close to its all-time high in March on July 29, highlighting the influence of macroeconomic factors on crypto assets.

Impact of a US recession on the Bitcoin price

The story of an American recession has been doing the rounds over the past year mixed opinions about the state of the economy.

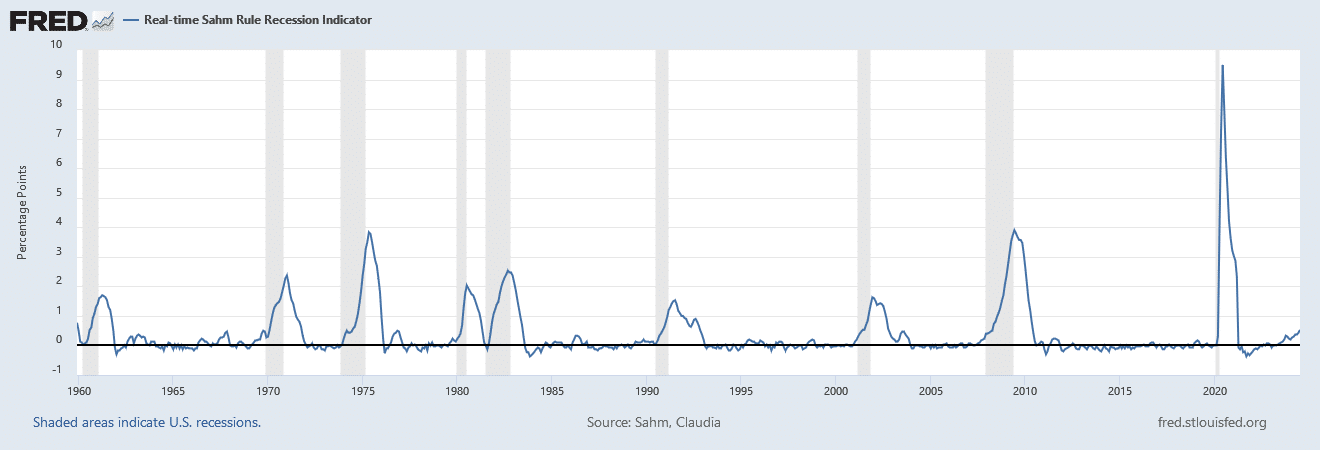

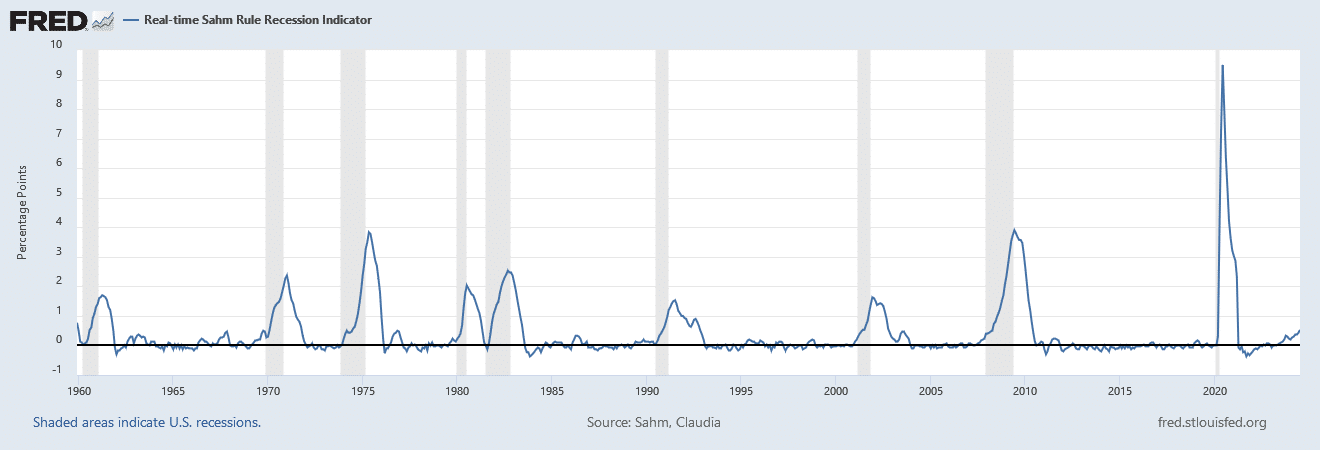

Friday’s disappointing employment data has further spooked investors in US stock markets concerns reignited of an economic downward trend.

Source: Sahm, St. Louis Fed

It hasn’t helped that geopolitical tensions have fueled economic uncertainty on the global stage. The ongoing conflicts in the Middle East and Ukraine have contributed to the delicate economic landscape for the US, which is intertwined in both.

Here’s how a potential recession would impact the Bitcoin price in the current cycle.

Investor sentiment

Investor sentiment generally shifts to risk aversion in times of recession. Risk-averse market participants mainly adopt a conservative asset allocation, preferring low-risk instruments over volatile assets such as cryptocurrencies.

Shifting sentiment among investors choosing to retreat to traditional safe assets would likely increase pressure on the Bitcoin price, despite the appeal of the steady supply.

Some market commentators also believe that a recessionary environment would pave the way for Bitcoin disconnect of stocks in the current cycle.

Recessions typically limit liquidity, creating tighter conditions as market participants prioritize capital preservation. A recessionary environment would result in limited inflows into crypto assets, putting downward pressure on their prices.

Governments and financial regulators may decide to tighten controls and implement new policies in response to economic contraction. In the past, the crypto market has shown sensitivity to regulatory developments, and any new restrictions would likely cause more volatility.

Conversely, a recession can also give rise to monetary easing and budgetary stimulus measures such as lower interest rates. Market confidence is growing, just as the Fed will now do lowered its benchmark interest rate with a guaranteed 0.5% in September instead of the original projection of 0.25%.

Given the current market dynamics, a rate cut would provide more liquidity, with Bitcoin poised to benefit from such a supportive macroeconomic situation that would result in a weaker US dollar.

Historical context

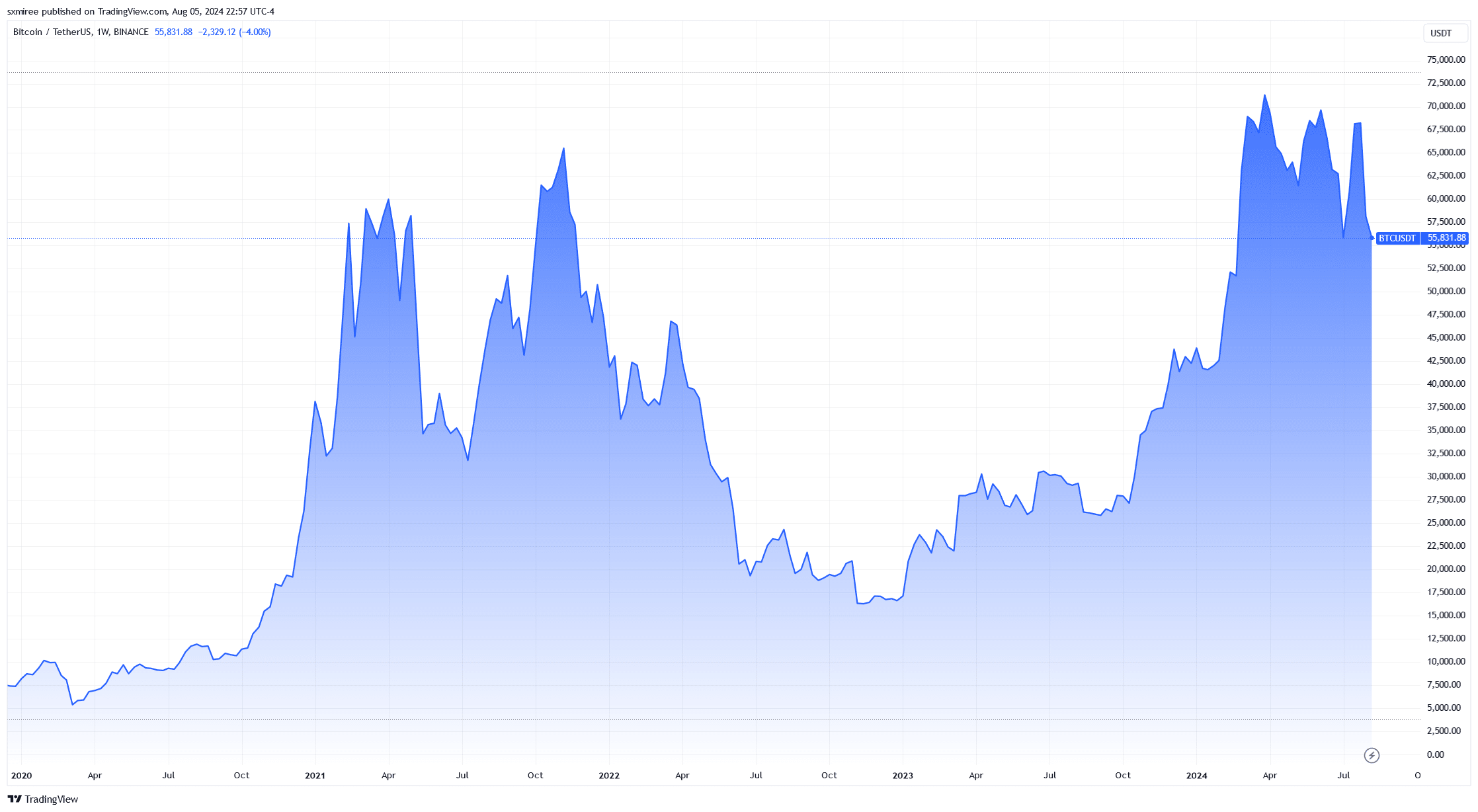

Past data indicates mixed Bitcoin market performance during periods of economic downturn, reflecting its concurrent speculative and store-of-value attributes.

Source: TradingView

When the Fed last cut rates in March 2020, Bitcoin was trading below $7,000, rising to $60,000 the following year.

In contrast to the Fed’s decision on July 31 to leave interest rates unchanged at a 23-year high, the Japanese central bank tightened its monetary policy on August 5.

The Bank of Japan (BoJ) has raised its key interest rate from almost zero to 0.25%.

Path forward

While the immediate reaction to recession fears was bearish, it does not indicate a long-term negative trend. Most of this week’s economic releases are light, focusing market observers’ attention on next week’s July CPI inflation report.

The biggest question is whether the US can weather the prevailing economic challenges without falling back into a major depression. That said, market participants should keep a close eye on economic indicators and policy responses in the coming weeks.