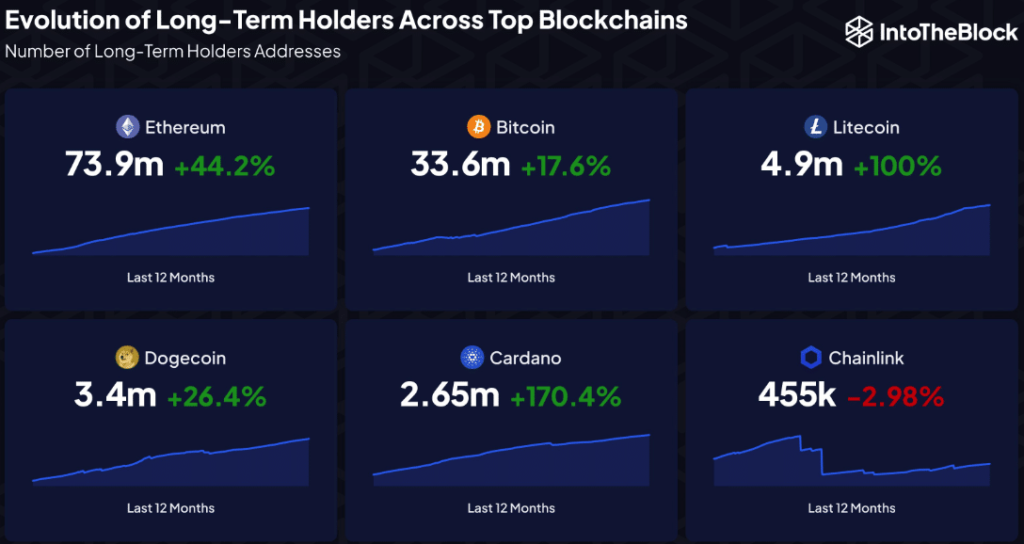

- The number of long-term ETH holders surpassed BTC by more than 40 million.

- Bitcoin’s inability to offer a plethora of use cases contributed to the move.

As the two most valuable cryptocurrencies, Bitcoin [BTC] And Ethereum [ETH] have not faced strong competition to tear them off the leaderboard. However, there has been a change in the way market participants view both assets.

Realistic or not, here it is The market cap of ETH in BTC terms

Bitcoin, the leading cryptocurrency, was at one point the asset with the most long-term holders. However, according to a recent infographic by IntoTheBlock, Ethereum has flipped the king coin with a difference of more than 40 million.

IntoTheBlock noted that Ethereum has 73.9 million long-term holders. Bitcoin, on the other hand, has 33.6 million HODLers. While both cryptocurrencies recorded year-over-year (year-over-year) increases in metrics, Ethereum led again with a 44.2% increase.

Source: IntoTheBlock

But how did this happen? Well, there are a number of reasons for the change. And at the top of the list should be the fundamentals, use cases and development paths of both projects.

BTC stays true to the core, ETH evolves

For Bitcoin, it has maintained its position as a peer-to-peer payment network and store of value for its holders. However, Ethereum has continued to evolve since Vitalik Buterin’s 2013 white paper. At the time, the founder of Ethereum c0 only explained the blockchain as a model for building decentralized applications (dApps).

While dApp development largely took place on the Ethereum mainnet, the advent of creating other layers on the blockchain increased interaction with ETH.

For example, Ethereum has also solidified its position as a building block of Decentralized Finance (DeFi), game development, and Non-Fungible Tokens (NFTs).

While the second largest blockchain has not yet scaled as much as Bitcoin in terms of transaction fees, the development of scalable solutions below that, it has been able to attract more holders of ETH.

When it comes to price action, BTC has clearly been the favorite better asset because it existed long before the advent of ETH. According to CoinMarketCap, ETH’s performance was once up 61,363.72%. However, BTC could boast an all-time high of 44.22 million.

Source: CoinMarketCap

Attract holders with their desires

Lately, however, cryptocurrency adoption has not been limited to price action alone, especially in seasons when market conditions are less than favorable.

At the same time, developments in line with the wishes of market participants have played a role, and Ethereum seems to have won in this regard. Notable examples are the Merge and the Shapella upgrade that validators were given access to deploy and deploy in a certain period.

In terms of NFTs, the Ethereum blockchain proved to be the star of the season during the 2021 bull cycle. You have to admit, these collectibles are impacting the adoption that ETH has seen so far.

This year, some developers of the Bitcoin network tried to make NFTs mainstream on the blockchain. But after a period of impressive adoption through Bitcoin Ordinals, the hype died down.

How many Worth 1,10,100 ETHs today?

And at the time of writing, Ethereum NFT sales are completely up outclassed its Bitcoin counterpart, based on CryptoSlam’s data.

Source: CryptoSlam

As it stands, it may be challenging for the number of Bitcoin holders to flip Ethereum. However, the possibility may not be gone yet. But it can depend on a number of factors including retail and institutional adoption, regulatory policy and no doubt price action.