- EigenLayer’s latest partnership has delivered the liquid BTC withdrawal feature.

- The TVL was over $10 billion at the time of writing.

EigenLayer, Ethereum’s [ETH] largest reprisal platform recently announced its latest Bitcoin[BTC] resume options.

The option offers return opportunities for holders of wrapped Bitcoin (WBTC).

The platform has announced new features including revenue payouts from node operator P2P.org. It also announced staking options for uniBTC, a wrapped BTC variant.

These developments align with a broader trend of increasing demand for Bitcoin return-generating alternatives as BTC holders seek diversification through staking.

The demand for resuming Bitcoin on EigenLayer is increasing

EigenLayer will take place on November 4 has announced that ARPA network would soon start rewarding uniBTC depositors on its platform.

The development will allow BTC holders to earn returns while contributing to Ethereum’s decentralized ecosystem.

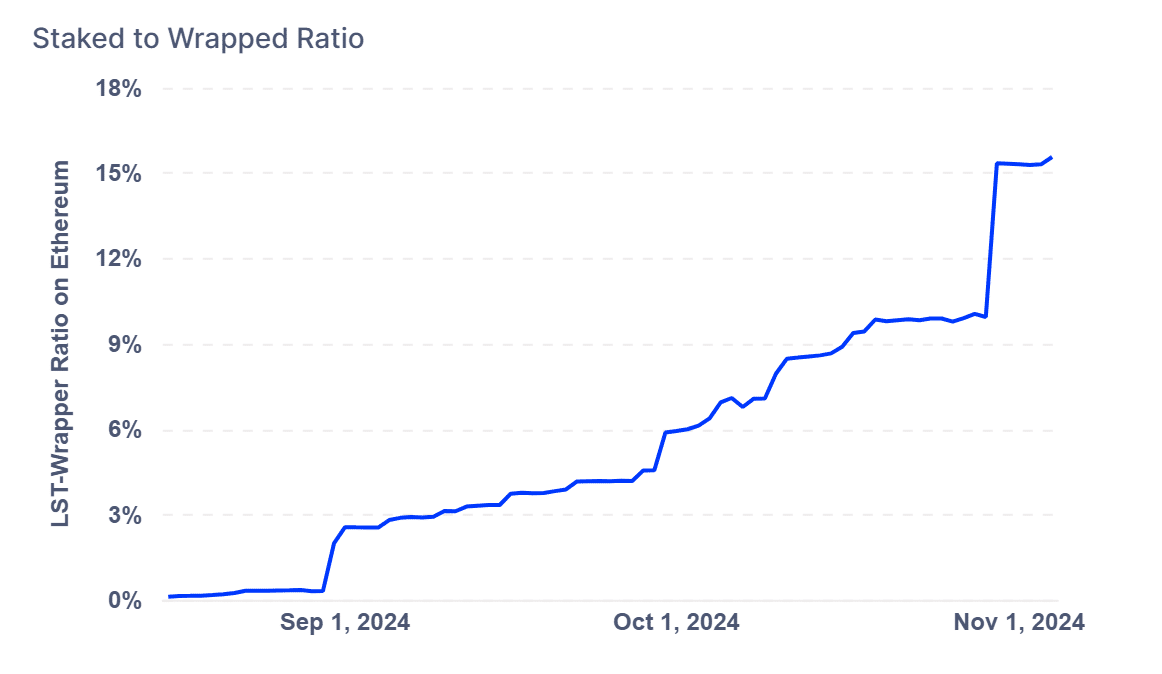

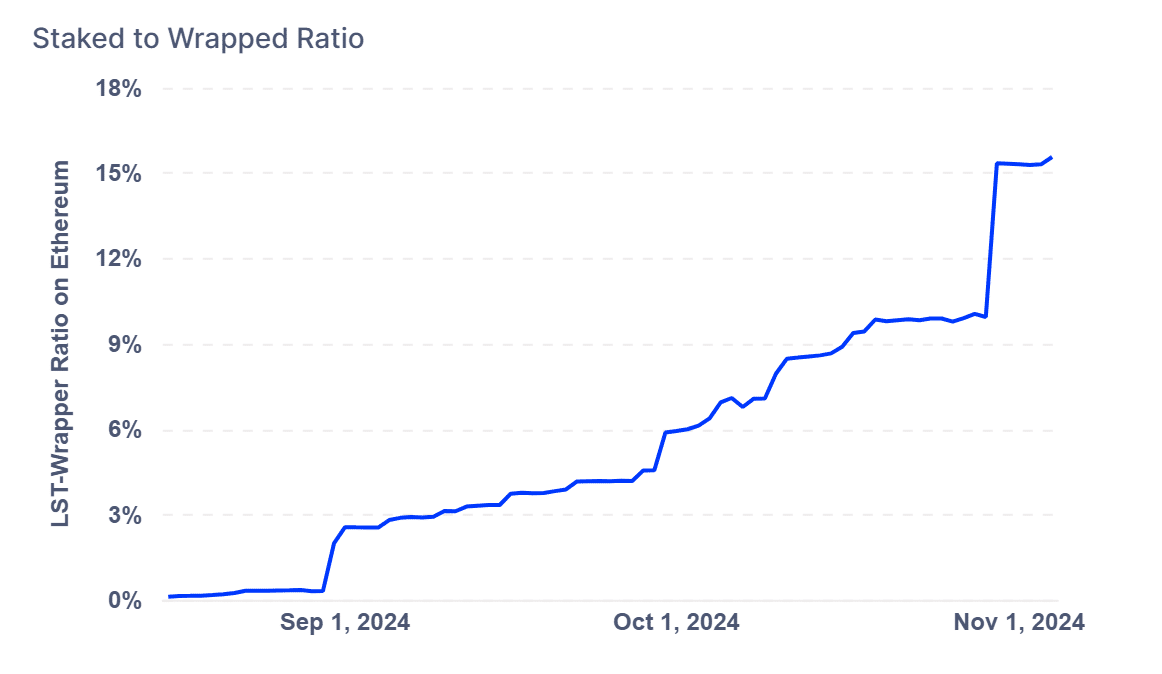

This move is part of a broader trend, as more than 15% of all WBTC is now actively staked on various platforms.

This growth highlights the increasing desire for Bitcoin staking options as DeFi continues to expand, with BTC holders eager to leverage decentralized asset maximization protocols.

Source: IntoTheBlock

Recent charts underline this shift, with a marked increase in the number of reoccupied BTC transactions since early August.

The rising weekly transaction numbers for WBTC and other wrapped Bitcoin assets reflect the growing appeal of yield-generating opportunities for BTC. This indicated that alternatives to staking and returns are increasingly seen as viable options for Bitcoin holders.

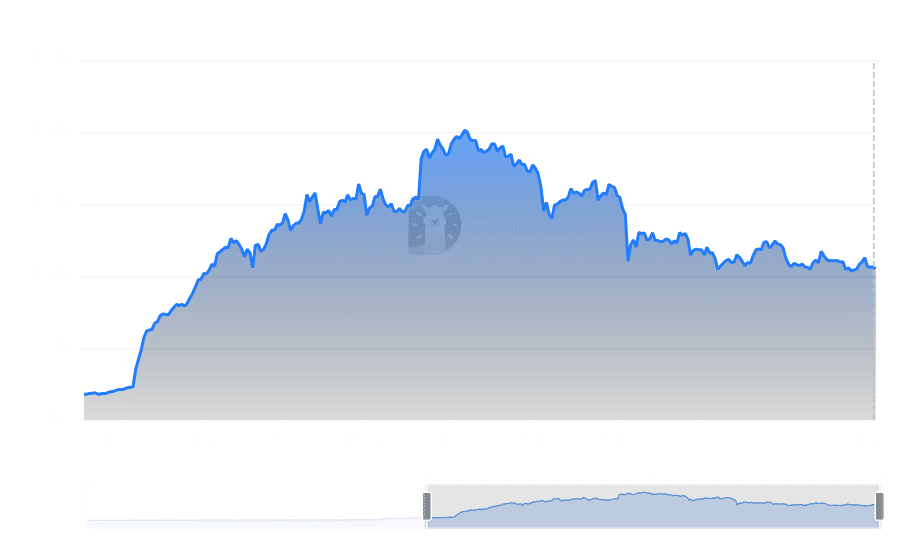

EigenLayer’s TVL maintains considerable momentum

EigenLayer’s Total Value Locked (TVL) has shown steady growth, as reported by DefiLlama.

This increase reflects the increased adoption of Bitcoin staking solutions, which allow BTC holders to undertake staking activities without liquidating their assets.

Source: DefiLlama

EigenLayer bridges a gap for those looking to earn returns on Bitcoin ownership. This strategy supports the platform’s upward trajectory in terms of total assets locked.

Price Analysis: OWN Token Prospects

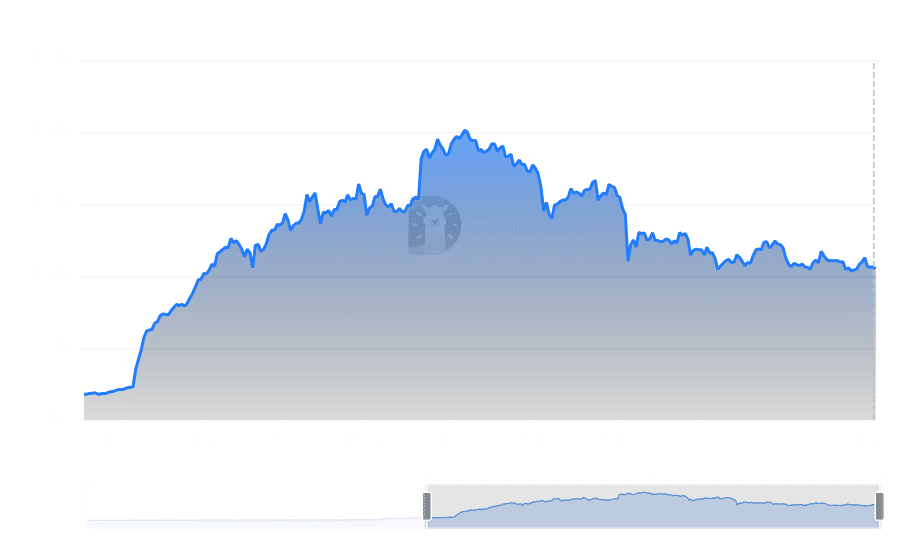

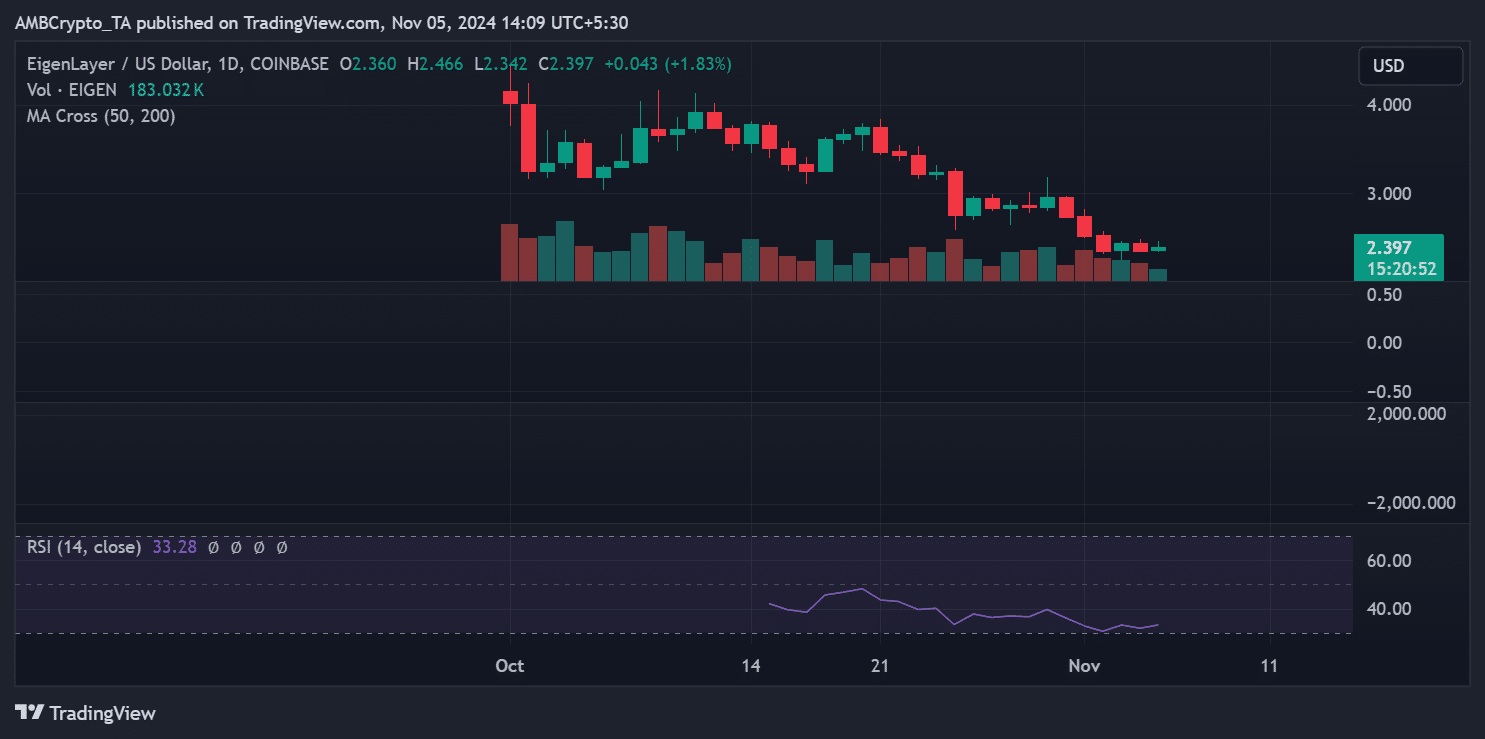

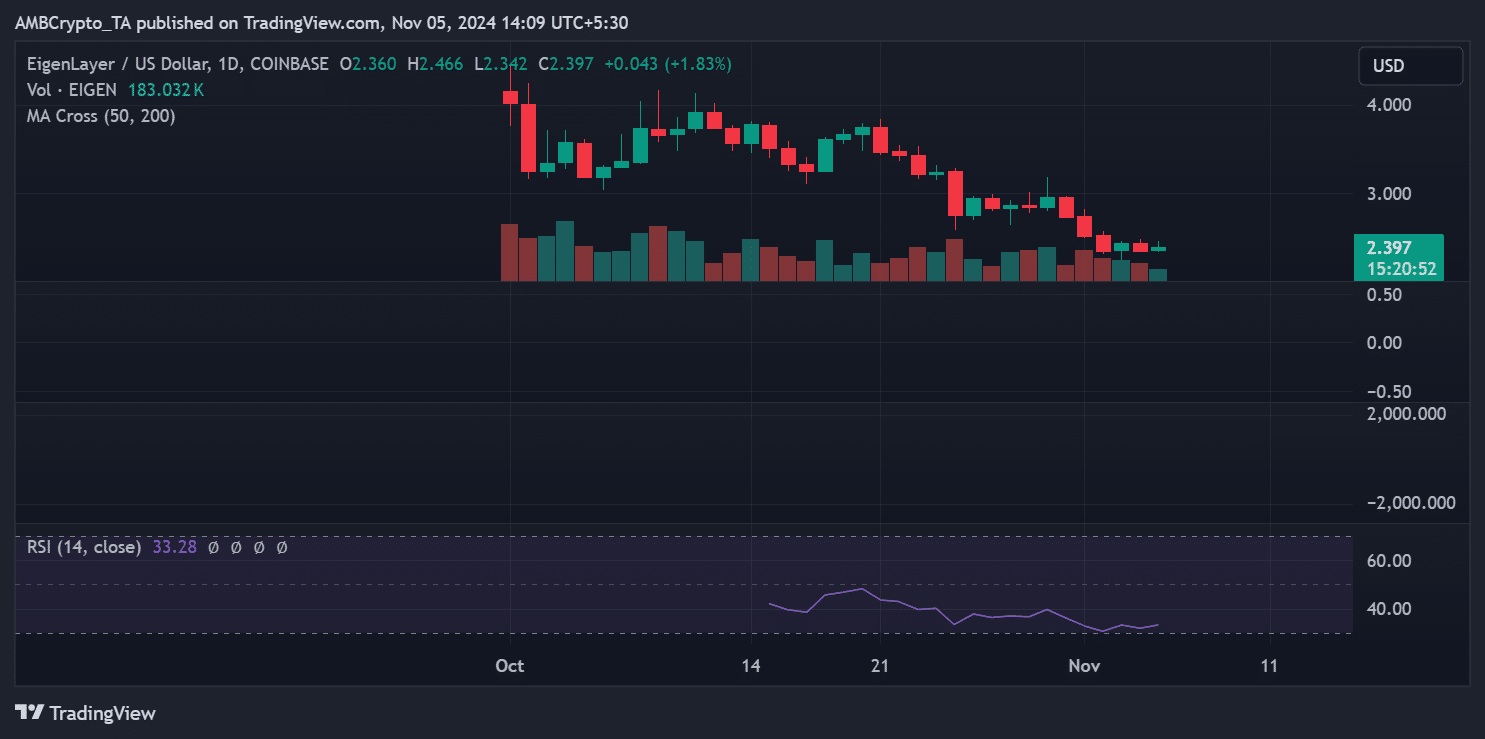

As for EigenLayer’s native token, EIGEN, recent activity has pointed to price consolidation.

At the time of writing, the coin was trading around $2.39. EIGEN’s price movements reflect both market sentiment and platform-specific growth.

At the time of writing, the Relative Strength Index (RSI) for EIGEN was near 33, indicating it is close to the oversold level.

This could potentially provide a buying opportunity if downside pressure stabilizes.

Source: TradingView

Trading volume for OWN has seen modest fluctuations, but remains generally stable.

If EigenLayer’s expanded Bitcoin withdrawal capabilities attract more BTC holders, EIGEN’s value could see upward pressure.

This could potentially surpass the resistance level around $2.50.

Is your portfolio green? View the EigenLayer Profit Calculator

The platform’s recent updates offer Bitcoin holders new ways to explore return-generating options without parting with their holdings. With possible further adoption, the coming months could determine whether these improvements will translate into sustainable growth for EIGEN.

This could strengthen EigenLayer’s role as a key player in deploying Bitcoin within the DeFi ecosystem.