- On-chain statistics suggested that Kortkopperers could feed the sales pressure

- The $ 343 and $ 365 levels represented areas with sales pressure for the Aave price

Waves of significant market volatility have almost randomly moved in both directions almost randomly in both directions. In this context, Aave (Aave) received considerable attention from holders of long -term holders, investors and whales. Especially since they seem to collect token now.

Million to Aave’s accumulation

According to popular Crypto -expert Ali’s last post on X (formerly Twitter), Crypto Whales bought $ 62 million in Aave -Tokens in the last three days. In addition to this accumulation, a blockchain-based transaction tracker, look monchain, also revealed that a single whale has collected 11,663 Aave value of $ 3.93 million.

Looking at these figures, it seems that this can be an ideal chance to buy a tokens.

Bearish bets of traders

In addition to the recent activity of the whales, intraday traders seem to take advantage of the current market sentiment, because they bet strongly on the short side.

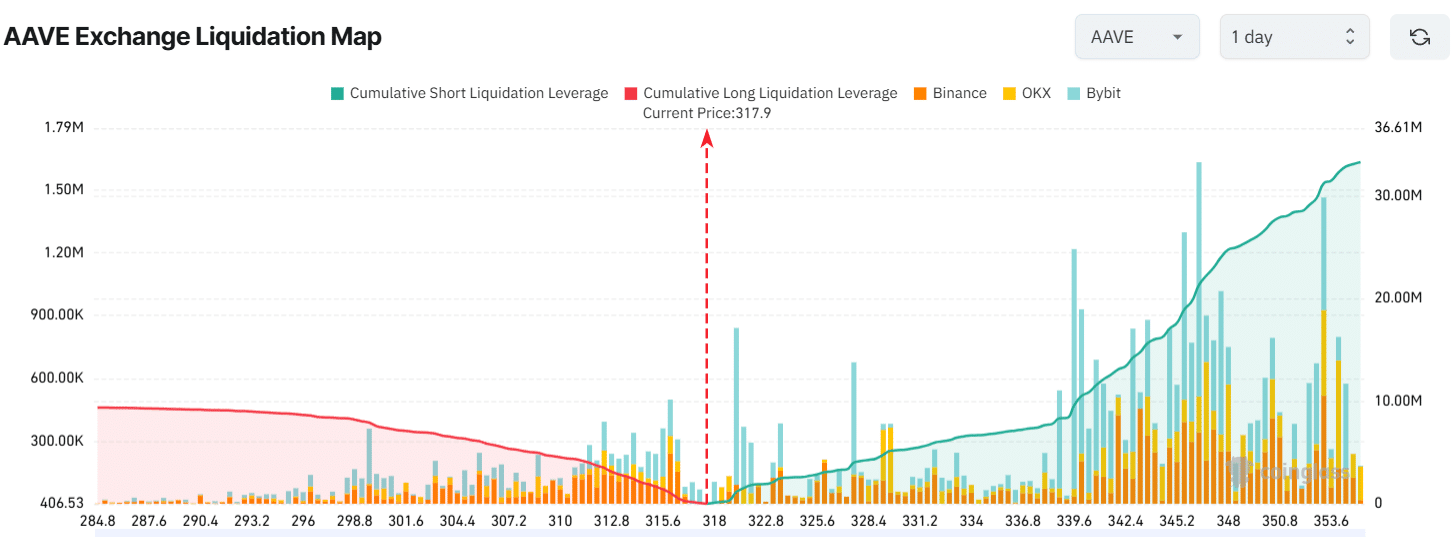

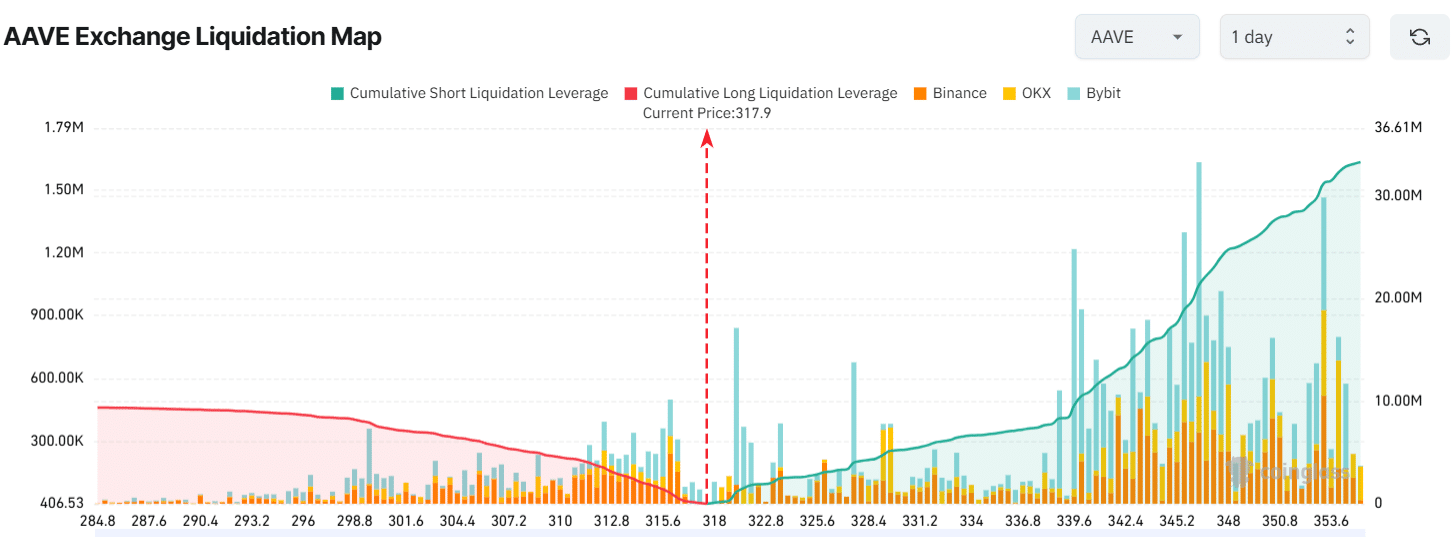

The data from CoingLass has even shown that bulls are used too much on the $ 316, $ 312 and $ 300 levels, where they have held in long positions for more than $ 7.90 million. Conversely, short-sellers are too much livered on the $ 320, $ 327, $ 340 and $ 345 levels, where they have held short positions for $ 21.33 million.

Source: Coinglass

These findings suggested that short-sellers actively dominate actively. That is why they can have the potential to cause sales pressure and fuel attacks of price decisions.

Despite considerable accumulation by whales and investors, the price of the token has difficulty getting speed because of the sentiment of the wider market. Especially because large cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) move aside for a longer period.

At the time of writing, Aave acted almost $ 320 after a very modest price increase of 0.45% in the last 24 hours. In the same period, however, it also attracted a lot of attention from traders and investors. This resulted in an increase of 70% in the trade volume, especially in comparison with the previous day.

Technical analysis and important levels

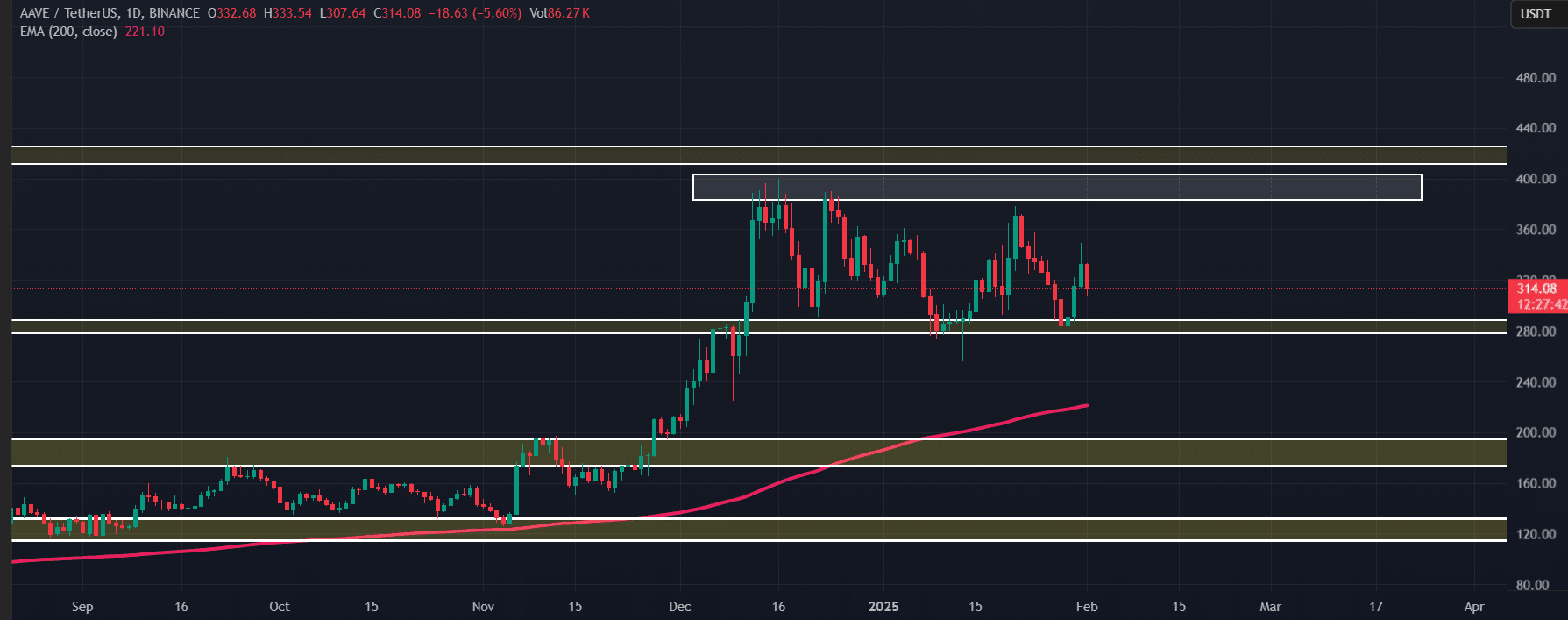

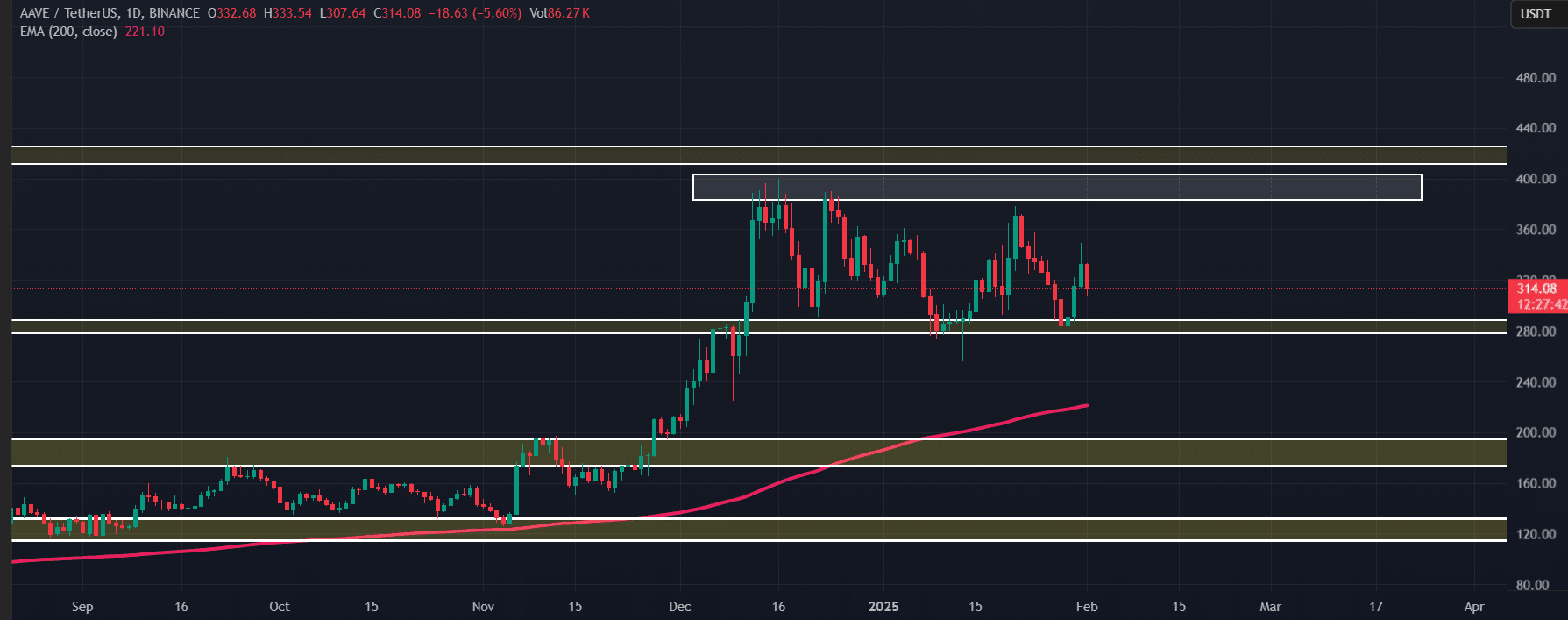

According to Ambcrypto’s analysis, Aave has moved between $ 384 and $ 285 in a parallel channel pattern in the last three months. Based on the last price action and the prevailing market sentiment, Aave can now be on the way to the support level of $ 285.

Source: TradingView

Despite a Bearish market forecast, Aave at the time of writing was still traded above the 200 exponential advancing average (EMA) in the daily period. This indicated that it is still an upward trend for the time being.

In addition, according to one Crypto -expertDetails of chains reveal that the $ 343 and $ 365 levels represent areas of sales pressure, or the supply zone, which are currently acting as barriers. An outbreak outside of these barriers could considerably propel Aave in the charts.