- Bitcoin crossed the $109,000 mark prior to Trump’s inauguration, driven mainly by Korean market activity.

- US investors have not yet made a significant contribution to this rally, leaving room for further gains.

The market has shown continued bullish momentum over the past week, with Bitcoin [BTC] increase of 15.06%. This upward movement has intensified over the past 24 hours, rising 2.68% and reaching a new record high.

Korean investors have played a crucial role in this rally, supported by rising market sentiment and an increase in active Bitcoin addresses.

Insights from AMBCrypto suggest further upside potential remains as conditions evolve.

Bitcoin hits a new all-time high as activity on the chain increases

According to CoinMarketCap, Bitcoin hit a new all-time high on January 20 at the time of writing, trading at $109,114.88. At the time of writing, BTC trading volume increased 120.34% to $110 billion. The market capitalization rose to $2.13 trillion.

This milestone comes just before Donald Trump’s inauguration today. The market optimism surrounding its perceived pro-crypto stance may fuel bullish sentiment.

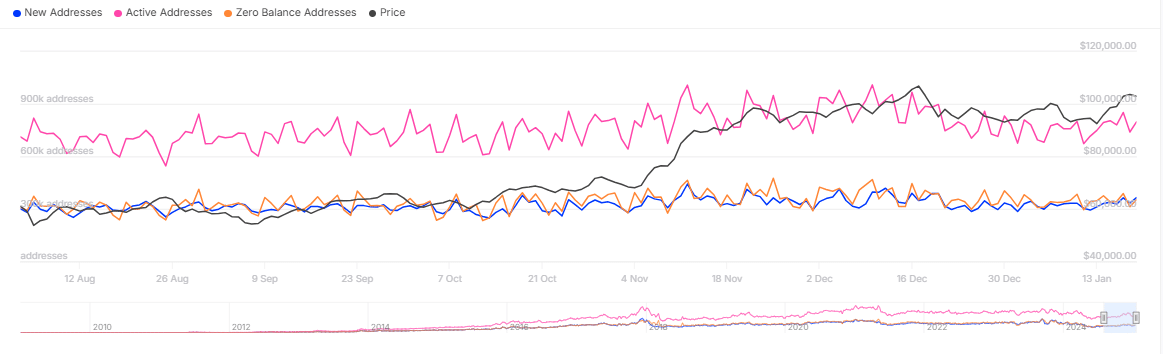

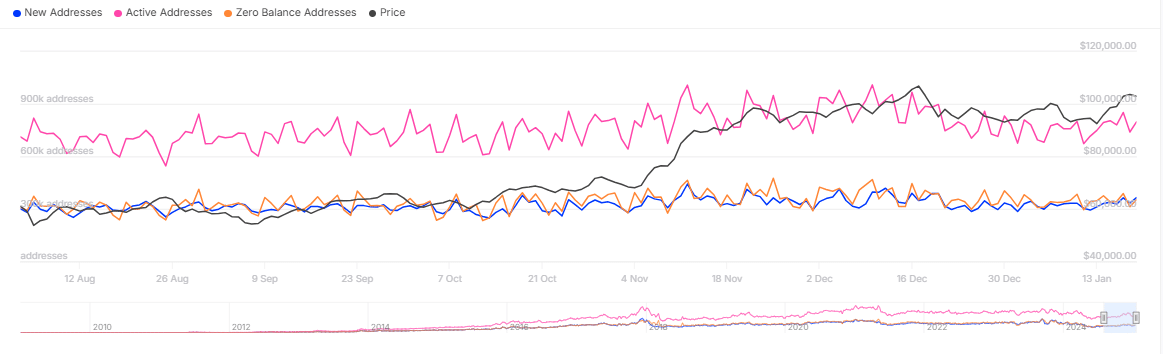

The increase is further supported by an 11.47% increase in active Bitcoin addresses in the past 24 hours. 798,140 addresses participated in on-chain transactions.

Source: IntoTheBlock

Spikes in activity, alongside increases in price and trading volume, often indicate the potential for a continued market rally. BTC’s momentum could continue to gain momentum as investors respond to market dynamics.

Korean investors are driving BTC’s rise

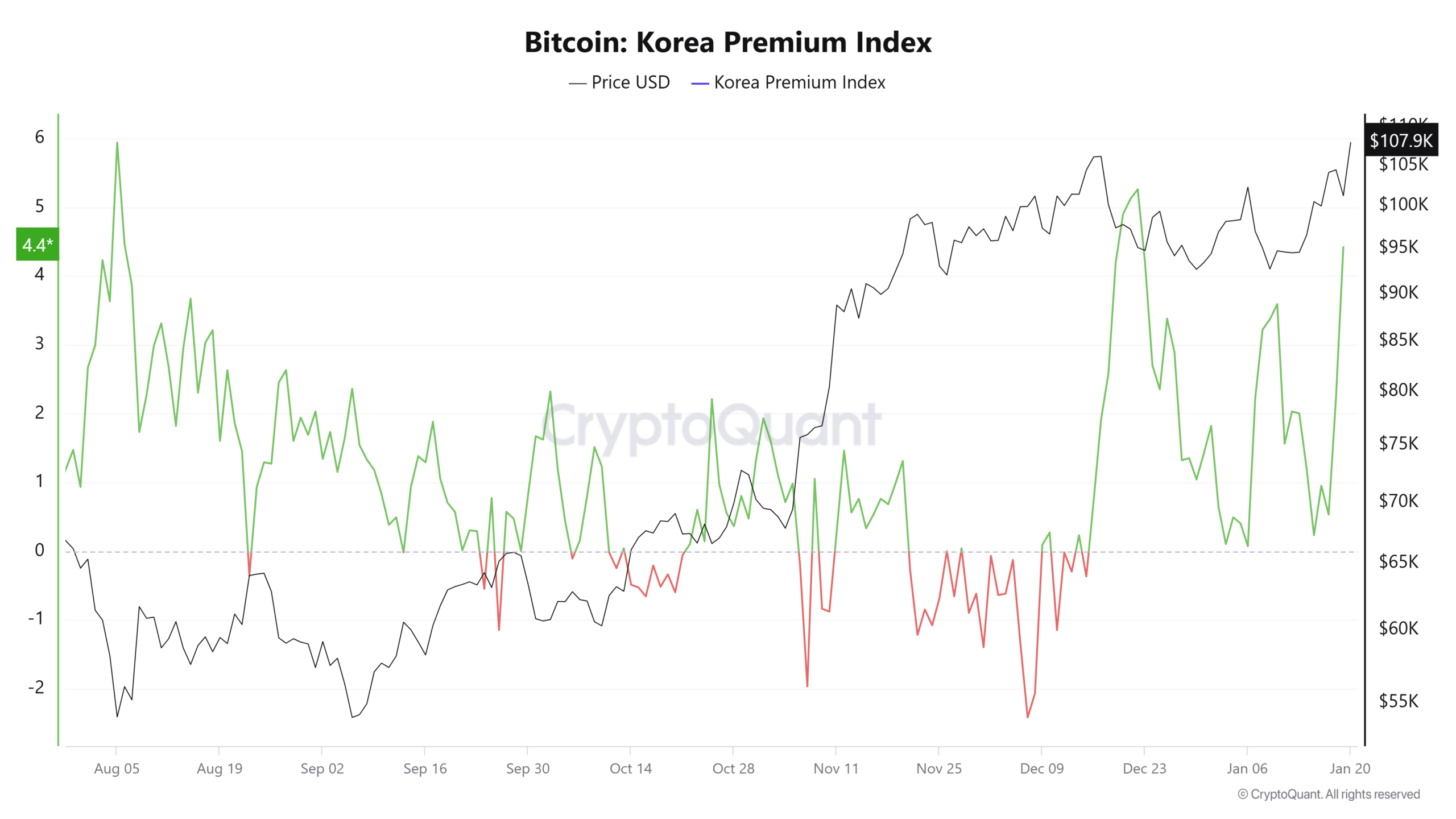

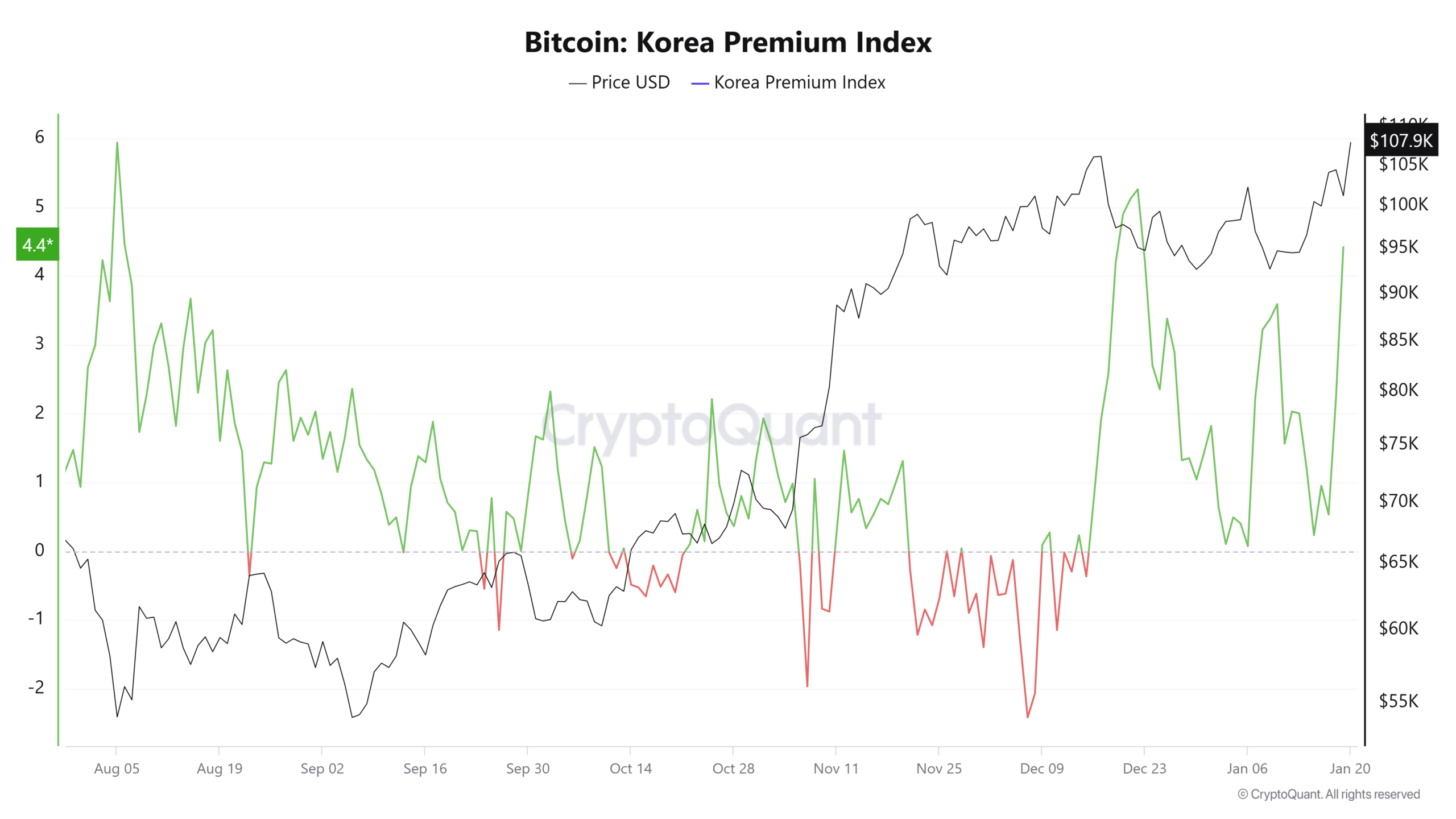

Data from CryptoQuant shows that BTC’s recent spike is closely tied to a rise in the Bitcoin: Korea Premium Index – a metric that measures the relative strength of Korean retail investors by tracking the price difference between South Korean exchanges and others.

The index reflects market sentiment, with values above the neutral zone (0) signifying bullish, and below this zone bearish behavior among Korean investors.

At the time of writing, the index stood at 4.42, indicating a significant price differential on South Korean exchanges and strong BTC buying activity.

Source: CryptoQuant

The US Premium Index, which compares Coinbase’s prices to other exchanges, shows a negative value of -0.1189. This suggests that US investors are currently selling BTC.

While this may seem bearish, it points to an opportunity for further price gains. US investors, known for their market influence, have yet to enter the current rally.

If they start buying BTC after Trump’s inauguration, Bitcoin could see another significant price increase.

A similar trend occurred on November 5, when increased US participation pushed BTC to its previous all-time high of $108,353 following Trump’s presidential victory.

The market capitalization of BTC and ETH reaches an all-time high

The market cap gap between BTC and ETH has reached an unprecedented $1.75 trillion, marking the largest gap in history.

This signals a significant shift in investor preference for BTC, which is now attracting more capital compared to ETH, the second largest cryptocurrency by market capitalization.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2025–2026

The widening gap could present an opportunity for investors to increase their BTC holdings or shift their focus from ETH.

This trend aligns with the prevailing bullish sentiment around BTC, potentially pushing the price higher. Analysts suggest that BTC could cross $110,000 in the coming market sessions if the momentum continues.