- Coinbase’s outage during the BTC surge led to $0 funds for users, causing panic.

- Despite FUD, Coinbase’s Layer 2 (Base) network remained resilient with growing daily transactions and active addresses.

After substantial gains in the value of Bitcoin [BTC] On February 28, several Coinbase users reported experiencing a baffling situation where their account balance suddenly dropped to $0.

Major problems on the network

This unexpected event left users baffled and searching for explanations for the discrepancy. The problem was highlighted when many users took to X (formerly known as Twitter) to post their wallet balances.

The company acknowledged the problem and assured users of the safety of their belongings. Despite modeling a 10x increase in traffic and testing the load, the actual increase after the BTC increase exceeded expectations.

Finally, Brian Armstrong, CEO of Coinbase announced that the apps have been restored.

After the incident, sentiment around Coinbase was affected and panic and FUD followed. Not only did this cause the price of Coinbase stock to drop temporarily, but according to some, even BTC was affected by this outage.

Bitcoin’s value plummeted by $100 billion in just 15 minutes, apparently caused by the Coinbase crash.

Between 12:15 PM ET and 12:30 PM ET, Bitcoin’s price fell from $64,000 to $59,000, a swing of almost 9%. The crash coincided with numerous Coinbase users experiencing issues on their networks.

Notably, this sharp decline occurred when Bitcoin was on the verge of hitting a new all-time high, less than 10% away from the milestone.

How is Bas doing?

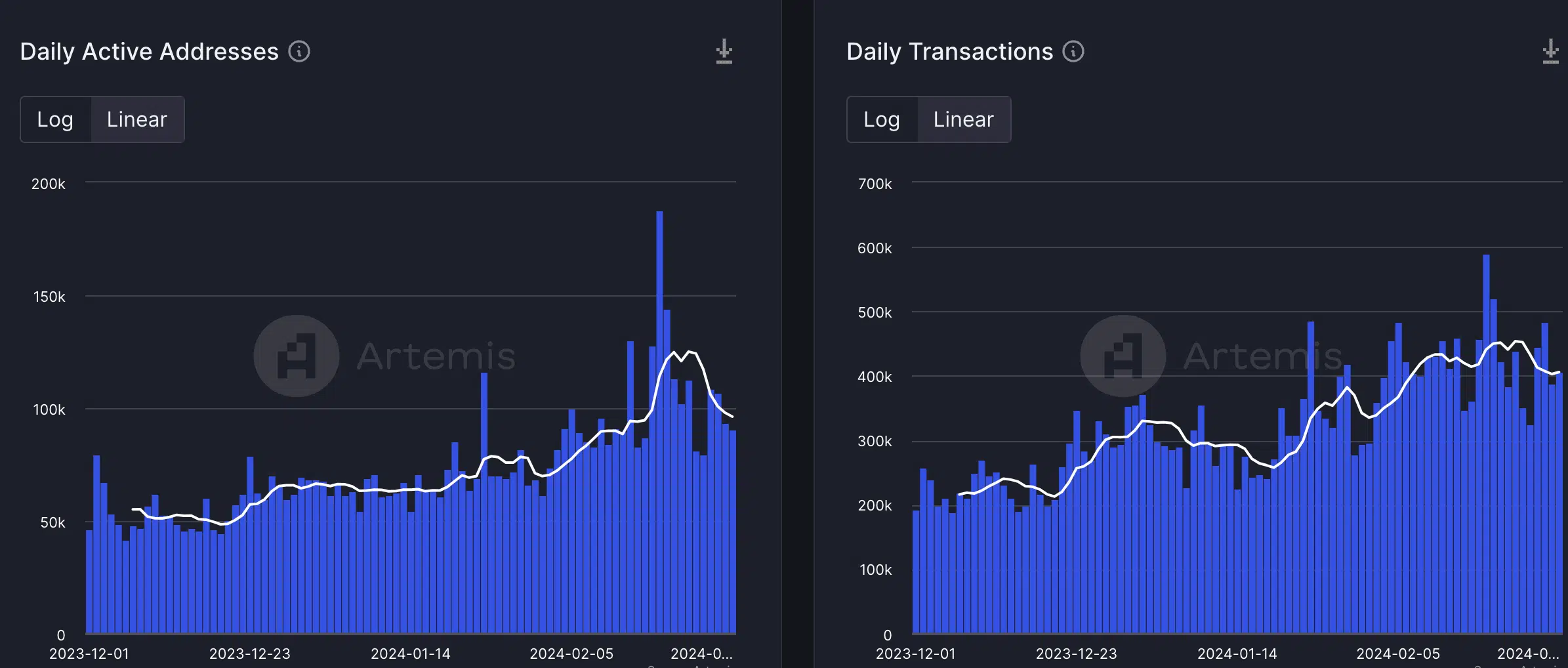

Base, the layer 2 network created by Coinbase, was unaffected by the FUD. The number of daily active addresses on the network continued to grow.

At the time of writing, the number of daily active addresses was 90,000. In terms of transactions on the network, an increase was observed and the number of daily transactions grew to 406,000.

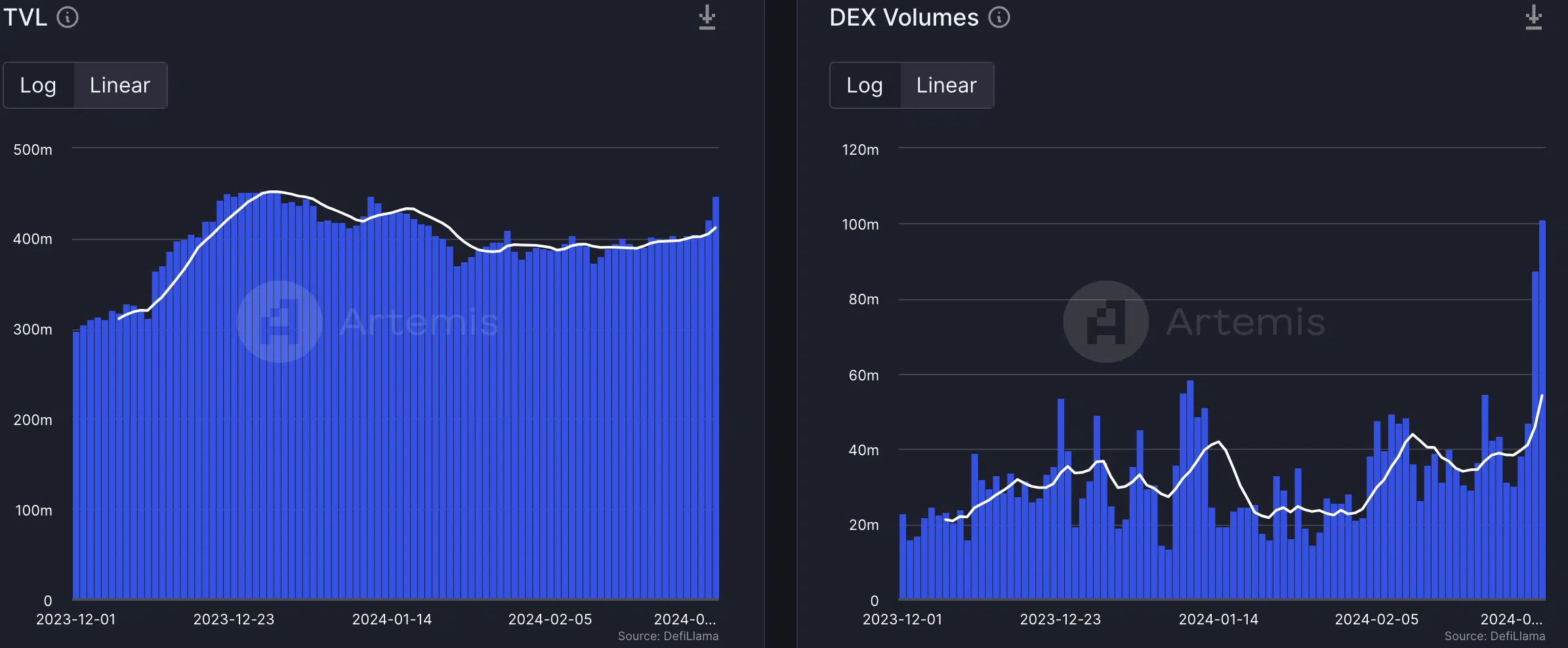

Moreover, Base did relatively well in the DeFi sector. The TVL collected on the Layer 2 network had grown, in addition to DEX volumes on the network.