- Voyager’s bankruptcy and continued asset sales raised concerns about its impact on Bitcoin.

- Grayscale ETF ruling could offset some of the selling pressure going forward.

In an unexpected turn of events in July 2022, Voyager, a prominent player in the crypto space with assets and liabilities totaling $10 billion, filed for bankruptcy. This decision reverberated across the market, leaving more than 100,000 customers and investors in a state of uncertainty.

Read the Bitcoin price forecast for 2023-2024

The bankruptcy announcement was closely intertwined with the demise of Three Arrows Capital (3AC), a notable borrower, which met with a catastrophic outcome due to a high-stakes gamble on the Terra Luna stablecoin.

The sale continues

Although the bankruptcy filing took place more than a year ago, Voyager’s behavior continues to echo across the crypto landscape. Recent data from lookonchain has shed light on Voyager’s ongoing business, particularly selling assets on the popular exchange Coinbase.

In the space of four days, Voyager liquidated a series of tokens worth about $63 million. Among the assets sold were:

Voyager resold assets #Coinbase for the past 4 days and has sold 49 tokens for ~$63M.

Included:

781 $BTC ($23 million);

9,570 $ETH ($17.6 million);

1.4T $SHIB ($14.4 million);

234,660 $LINK ($1.74 million);

1.87M $MATIC ($1.27 million);

3M $MANA ($1.1 million);

… pic.twitter.com/SUGjjQQvja— Lookonchain (@lookonchain) August 15, 2023

This consistent offloading of assets by Voyager has sparked speculation about its potential impact on the broader cryptocurrency market, particularly Bitcoin[BTC]. There were concerns about the sheer volume of assets being sold and potential ripple effects across the ecosystem.

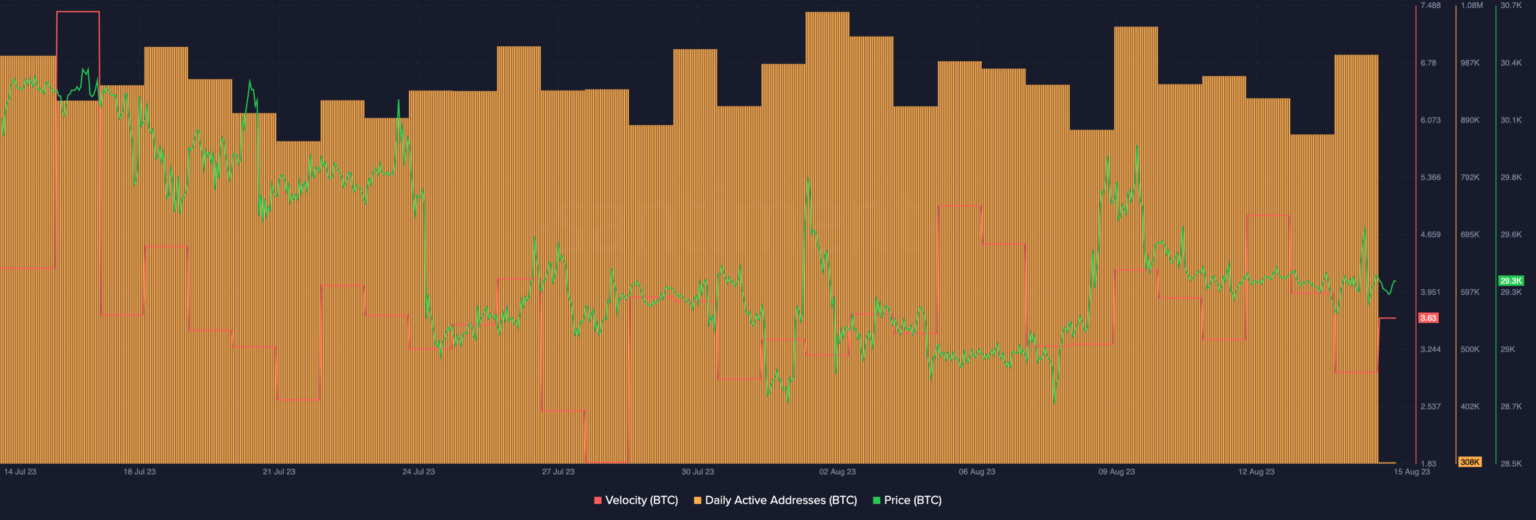

A closer look at Bitcoin’s current status provided more insight. At the time of writing, Bitcoin’s price has hovered around $29,390, reflecting its stability amid the recent market turmoil. However, the speed of Bitcoin transactions showed a slight decline over the past week, possibly indicating a cautious approach by traders.

Source: Sentiment

Grayscale waits anxiously

The impending Grayscale ETF ruling adds an intriguing dimension to the equation. Grayscale Investments, a major asset management player, pursued its ambition to launch a Bitcoin exchange-traded fund (ETF).

Van Buren Capital’s Scott Johnsson tweeted on Aug. 11 that U.S. district courts usually settle pending cases before new staff arrive, noting that in March 2021 and 2022, 30 of 32 cases were resolved within 160 days of oral testimony. It’s also been 160 days since Grayscale made its plea to the U.S. Securities and Exchange Commission on March 7.

Is your wallet green? Check out the Bitcoin Profit Calculator

This could suggest that the Grayscale ETF ruling would come sooner rather than later.

March ’21/’22 cases with decisions within 160 days of hearing: 30/32 (94%)

Days since Grayscale (March 23) oral: 160 days

Why should we expect August? Since clerks for D.C. are generally moving in and out this month, so judges are trying to clear out the previous workload before the new clerk arrives. https://t.co/vVj0dHus90

— Scott Johnsson (@SGJohnsson) August 14, 2023

The outcome of this legal battle could have far-reaching consequences for Bitcoin acceptance and adoption.