- At the time of writing, Bitcoin was trading above $60,000 despite declines.

- However, BTC price development remained bearish.

In recent weeks, Bitcoin [BTC] has experienced significant volatility, characterized by rapid price movements.

Despite this turbulence, there are encouraging signs in market dynamics, especially in terms of trading activity and new addresses.

Recently, this increased activity coincided with a price rebound, allowing BTC to rise back to the $60,000 range.

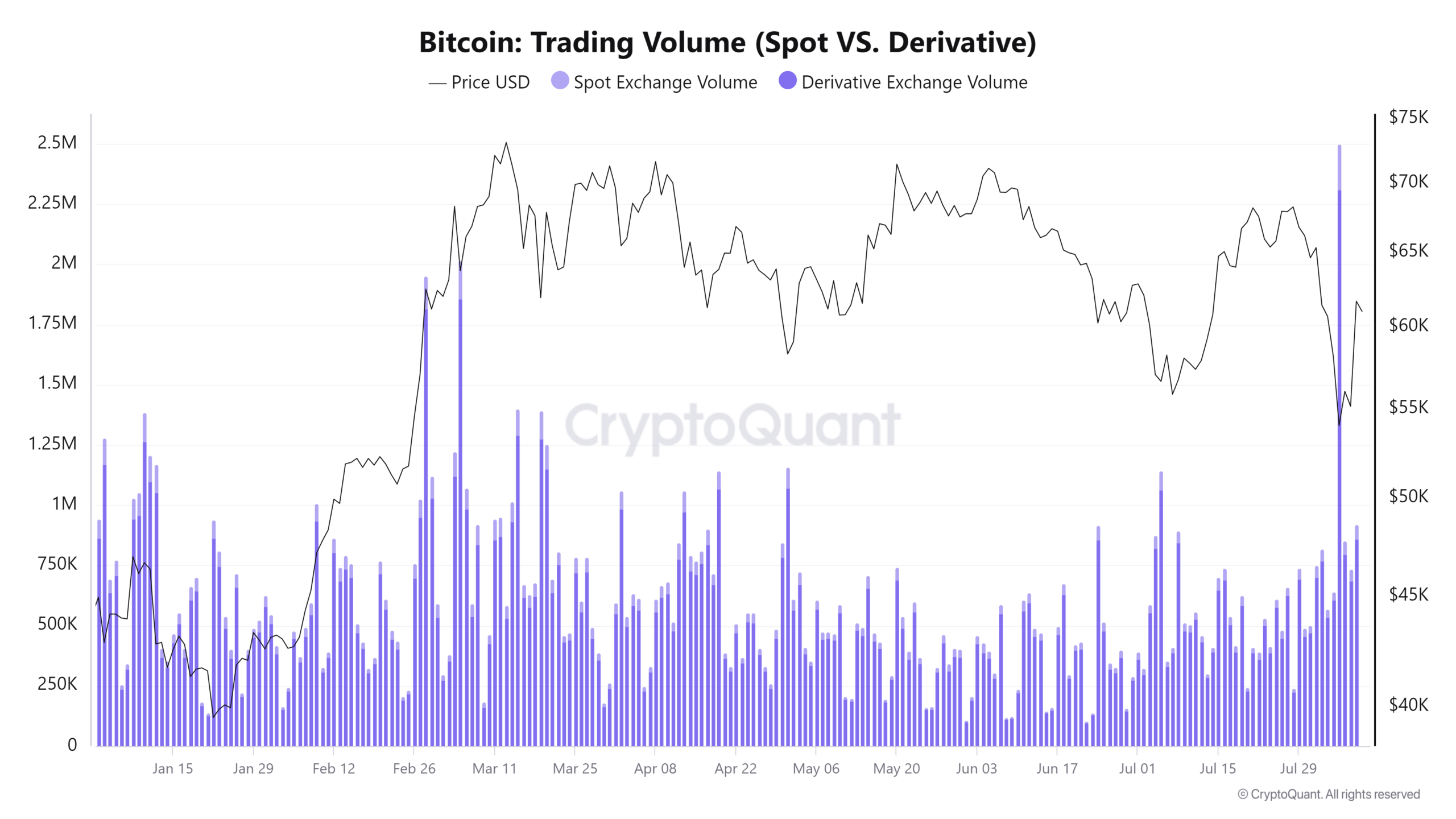

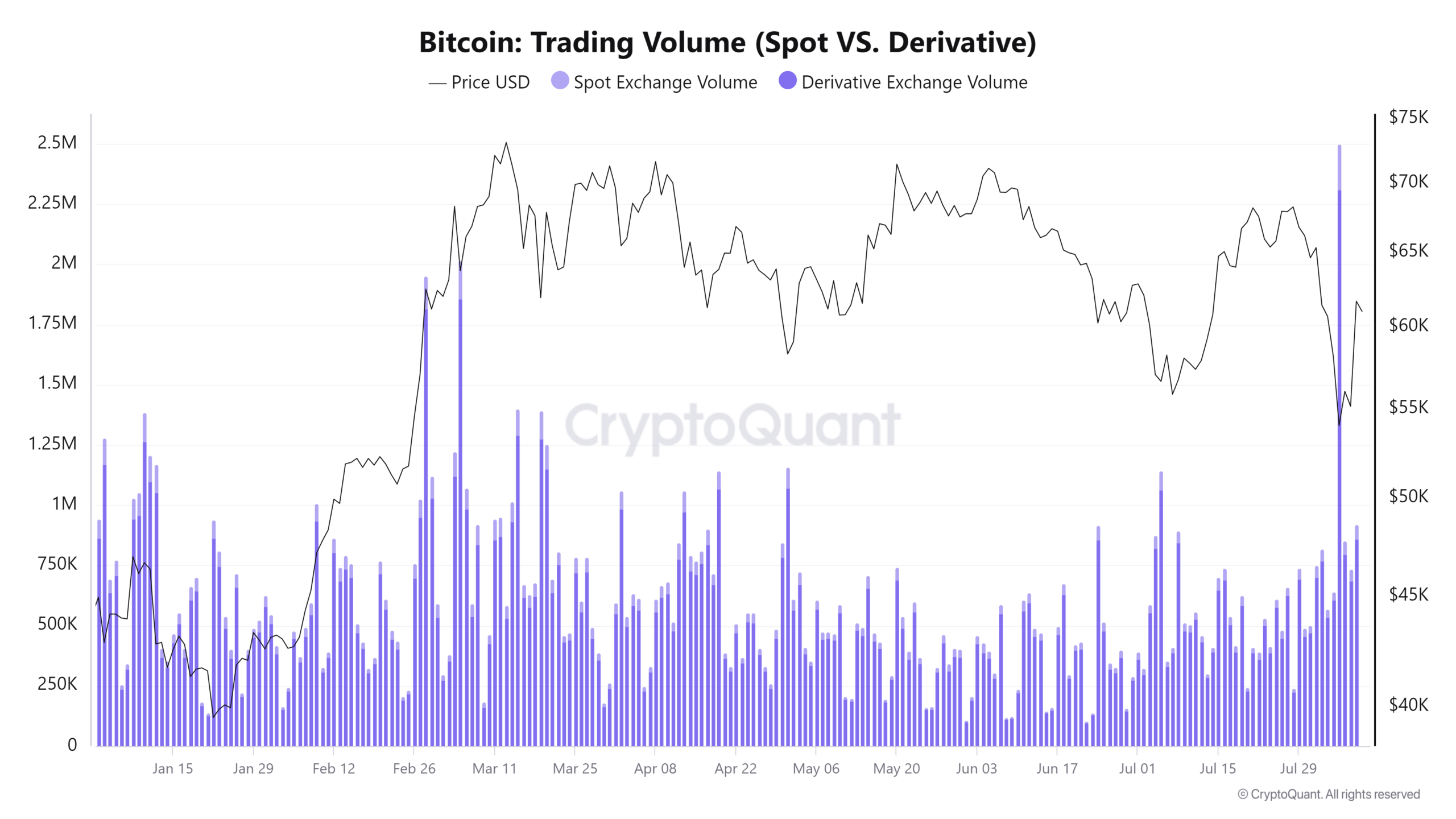

Bitcoin sets record volumes

During a recent decline in the price of Bitcoin, where it dropped to around $50,000, there was a significant increase in market activity.

Data showed that both derivatives and spot trading volumes reached near-historic levels.

According to data from CryptoQuantOn the day of the price drop, futures trading volume rose to an all-time high (ATH) of $154 billion.

This spike in Futures volume indicated an increased level of trading activity, likely driven by traders taking advantage of the volatility to place large bets on Bitcoin’s price direction.

Source: CryptoQuant

At the same time, trading volume on the spot market increased dramatically, reaching $83 billion. This figure represented the second highest volume in Bitcoin trading history.

Such a significant level of volume during a sharp price decline usually indicates a combination of selling and buying pressure.

Existing holders are trying to limit their losses, or new or existing investors are looking to accumulate at lower prices.

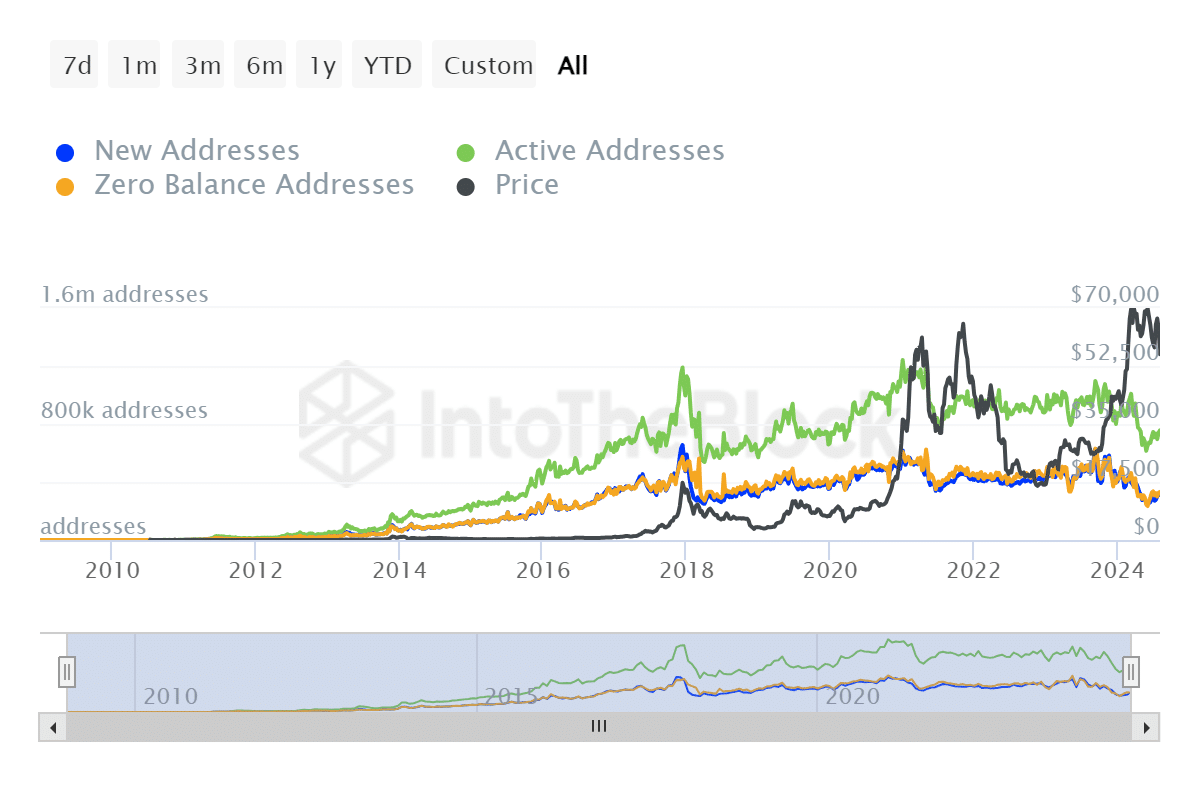

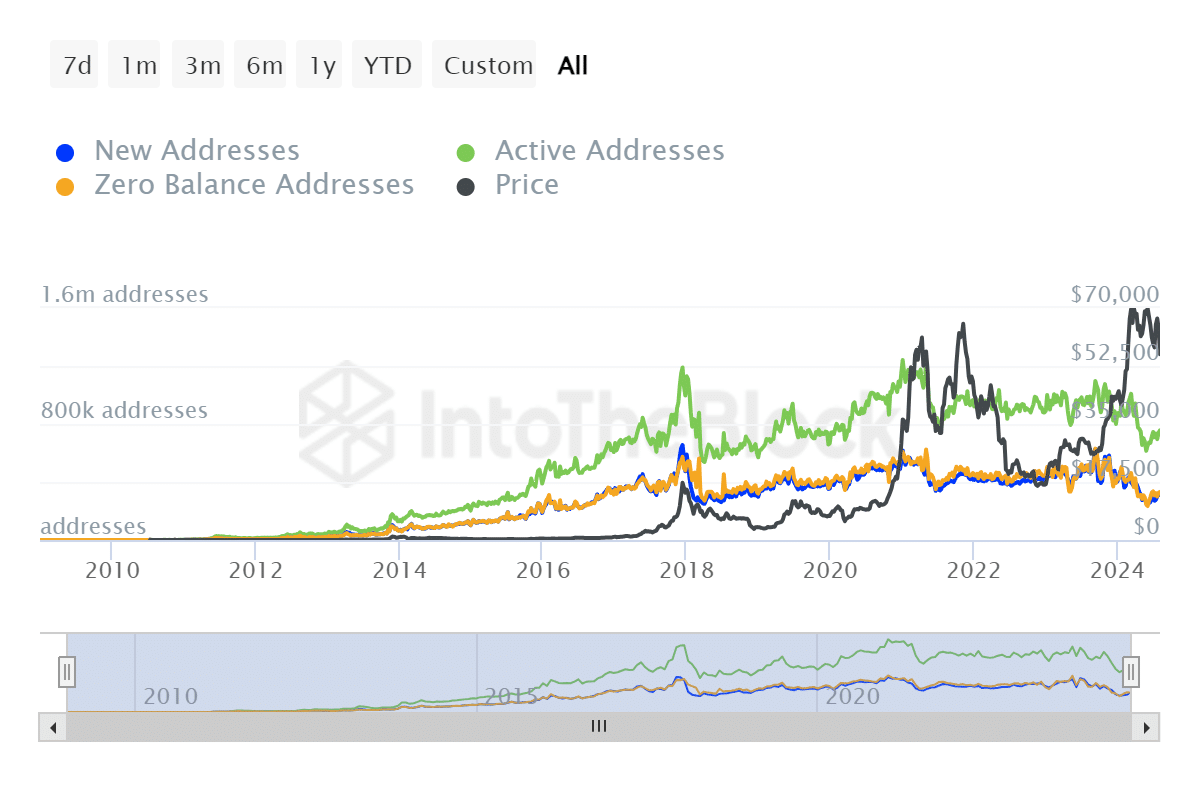

Bitcoin addresses see a slight increase

Recent data from InTheBlok highlighted a notable shift in Bitcoin activity, particularly regarding new addresses.

Although the trend for new day addresses has been on a downward trend since November 2023, there has been an increase recently.

This increase in the formation of new addresses in recent weeks indicated a renewed interest from private investors.

Source: IntoTheBlock

The upward trend in new addresses is a positive sign, usually interpreted as a bullish indicator, as it indicates that a growing number of new participants are entering the market, especially from the retail sector.

This change could signal broader involvement in Bitcoin, potentially leading to further market activity and investment.

BTC sees a nice recovery

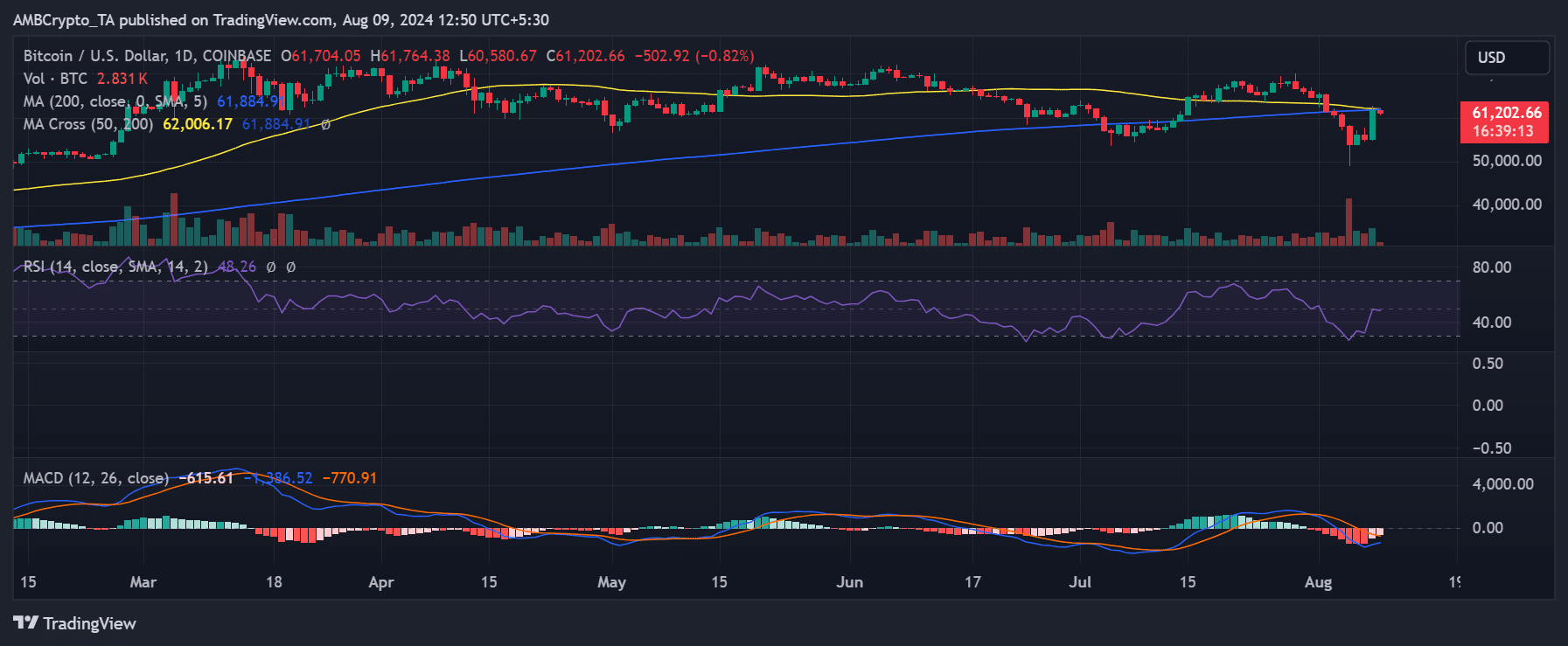

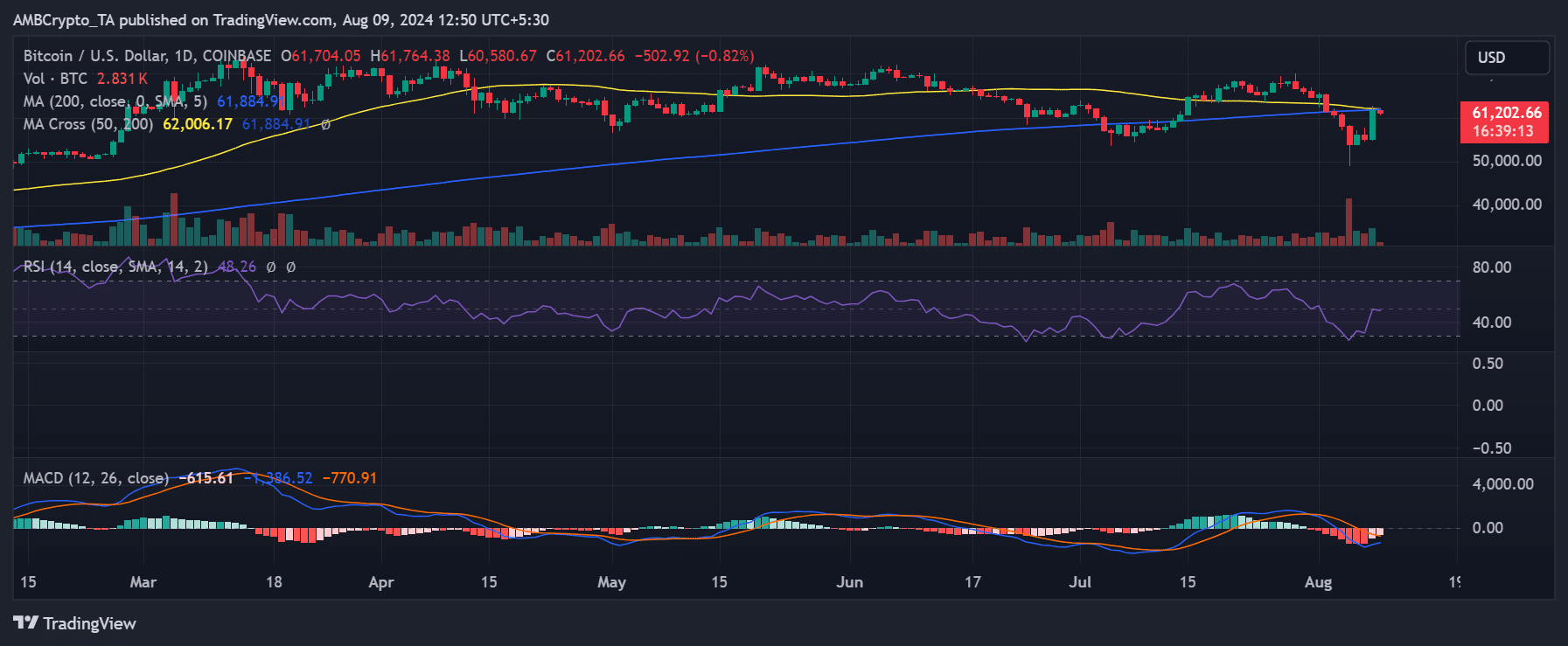

AMBCrypto’s analysis of Bitcoin on a daily time frame has shown a significant recovery in the last trading session.

The king coin spiked 11.89%, pushing its price from around $55,000 to a peak of over $62,000. The session ultimately closed with Bitcoin at $61,705 at the time of writing.

Source: trading view

Despite this remarkable increase, the increase was not strong enough to completely put Bitcoin into a bull trend. The Relative Strength Index (RSI) remained below the neutral 50, indicating that it was still in a bearish phase.

Read Bitcoin’s [BTC] Price forecast 2024-25

This suggests that while the price spike represents a significant positive move, it has not yet been enough to definitively change broader market sentiment.

At the time of writing, the price has fallen slightly by more than 1%, to around $60,900.