- MicroStrategy’s MSTR stock led the market with triple-digit gains in the first half

- Solid recovery in the first half, greater regulatory clarity, upcoming ETH ETF and expected Fed rate cuts are key catalysts for the second half of 2024

Crypto-related stocks and Bitcoin [BTC] Mining stocks emerged as the biggest winners in the first half of the year, led by shares of MicroStrategy [MSTR]which posted triple-digit profits.

According to the recent version of CCData report“2024 H2 Outlook,” MSTR reported a whopping 380%, which the report linked to its massive BTC holdings.

“MicroStrategy led with a 380% share price increase, driven by its 214,000 Bitcoin holdings now worth $13.3 billion, purchased at an average cost of $35,158. These holdings have earned the company approximately $6.54 billion since 2020.”

BTC Mining Stocks and Overall Market Performance

In addition, other crypto-related stocks such as Coinbase [COIN] and Robinhood [HOOD] also posted impressive increases, up 329% and 122% respectively, according to the report.

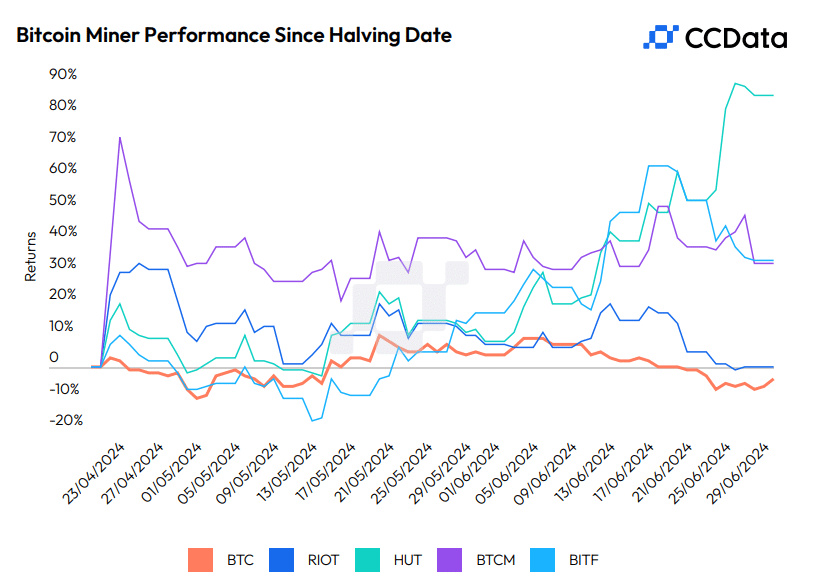

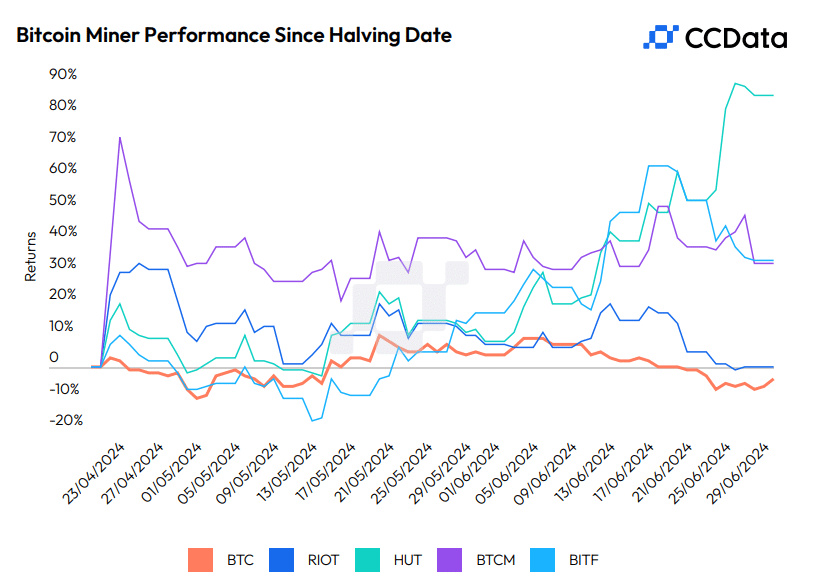

Crypto mining stocks also showed a notable recovery. After the halving in April, shares such as Hut 8 Corp [HUT] and Bitfarms Ltd [BITF] rose 86% and 34% respectively, outperforming the king coin. In turn, it fell by 3.2% over the same period.

Source: CCData

As for spot BTC ETFs, the report noted that the products have “improved institutional adoption.” These products have attracted,

“$14.41 billion in inflows and total net worth increases to $53.56 billion. These ETFs now represent approximately 4.4% of Bitcoin’s total market capitalization. The IBIT ETF alone has raised nearly $17.64 billion, capturing over 1.5% of Bitcoin’s market cap.”

CEX markets share dynamics

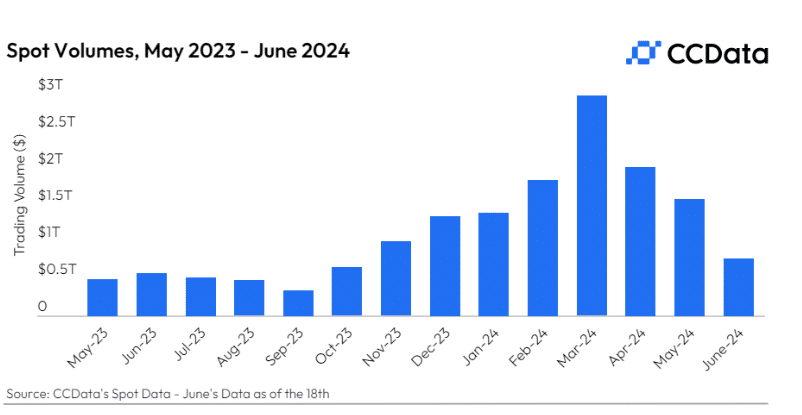

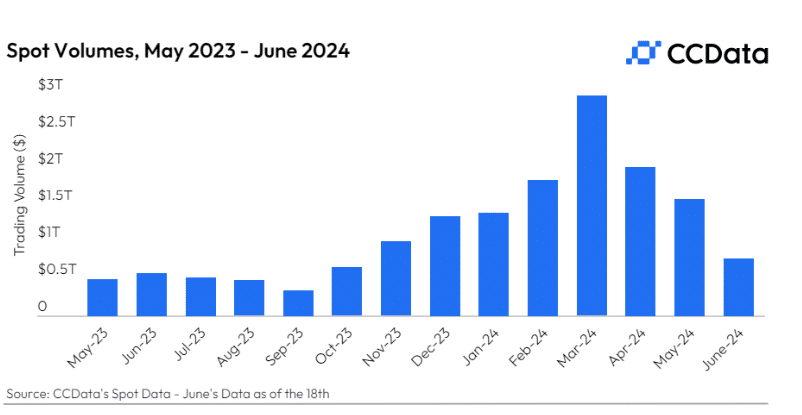

Massive growth was also seen in the centralized exchange sector (CEX), with the first half (H1) delivering a total spot volume of $10.6 trillion – an increase of 145% compared to H2 2023.

Source: CCData

In terms of market share, the report added:

“Bitget, Crypto.com and Bybit saw the biggest increases of 38.4%, 24.6% and 22.2% respectively, while Coinbase saw small declines of around 6.0%.”

Bitcoin and crypto markets: outlook for the second half of 2024

The report underlined that the first half year’s performance could provide a solid foundation for an even better half year. In particular, it looked at the Fed’s expected rate cuts later in 2024 and the upcoming launch of the Ethereum platform. [ETH] ETF as an important catalyst for the market.

Furthermore, increasing regulatory clarity in the US and EU (via MiCA) are also crucial catalysts for the second half of the year. In fact, AMBCrypto’s recent July outlook report echoed this bullish outlook, especially for BTC and memecoins.