- Binance leads Stablecoin reserves with 66% market share, with $ 31 billion in assets about trade fairs

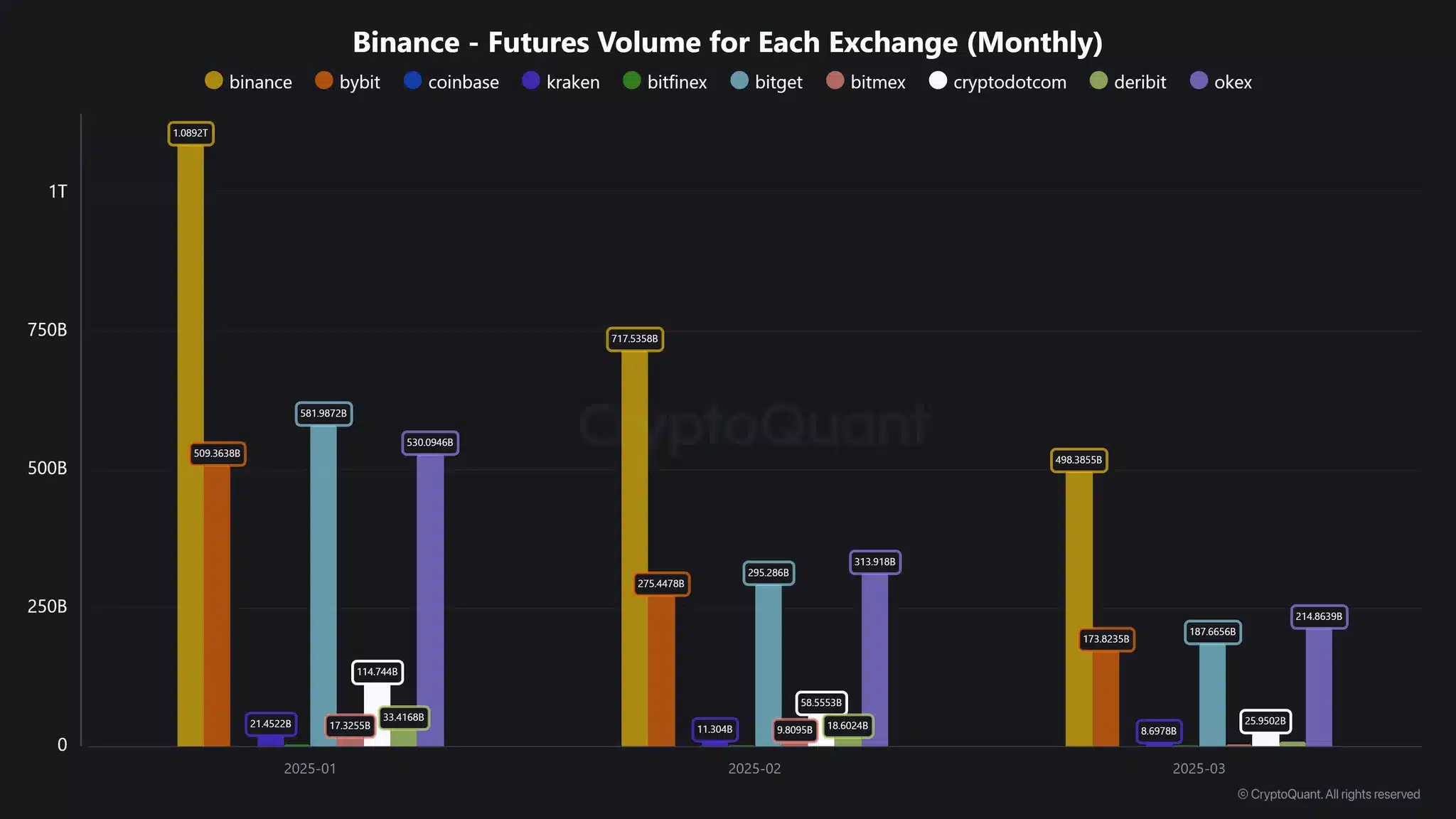

- Exchange also dominated Futures -Trade with $ 1.08 trillion in January 2025 volume

Binance has consistently maintained a dominant position in the Crypto exchange landscape, with recent data that emphasizes its considerable lead over competitors. From keeping an impressive share of Stablecoin reserves to leading the peloton in Futures -trading volumes, the presence of the exchange continues to exceed other exchanges,

Needless to say, these findings have simply strengthened the role of Binance as an important player in the crypto space.

Binance’s Dominance in Stablecoins

In the current market, Stablecoins continue to offer the backbone of liquidity on chains and commercial efficiency of price stability, reducing friction in capital movement and serving as the unit of account for traders worldwide.

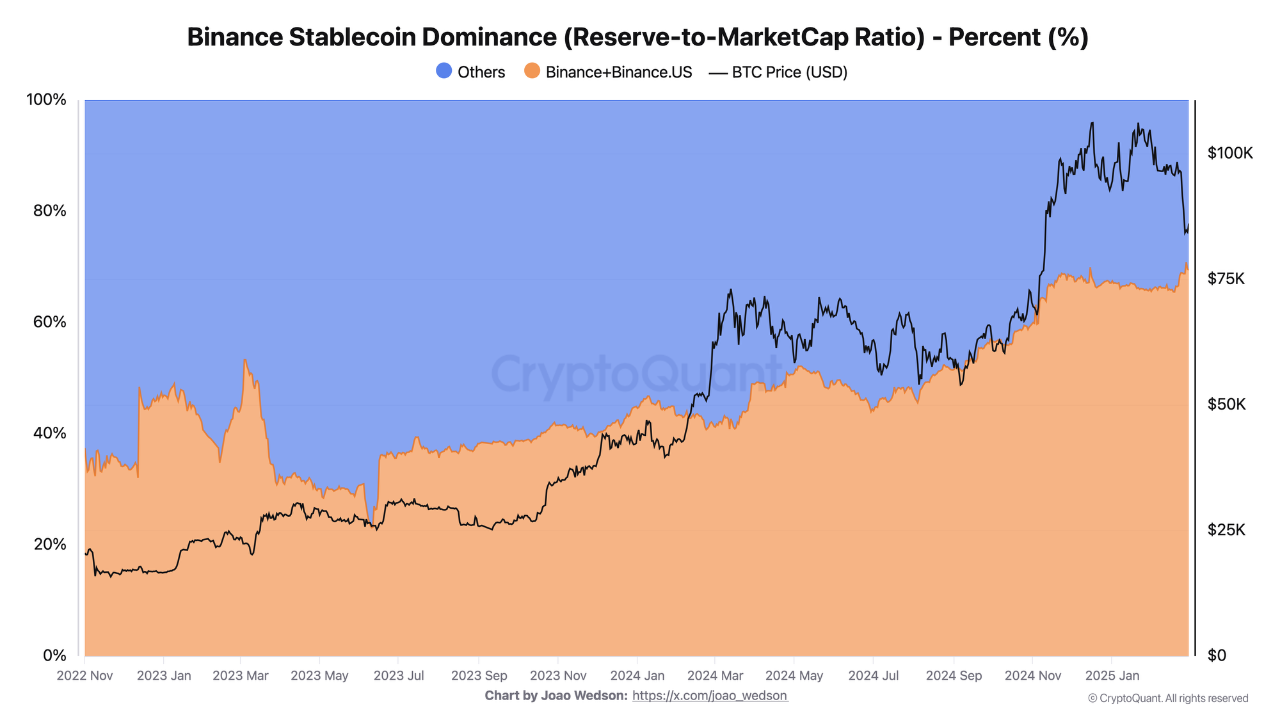

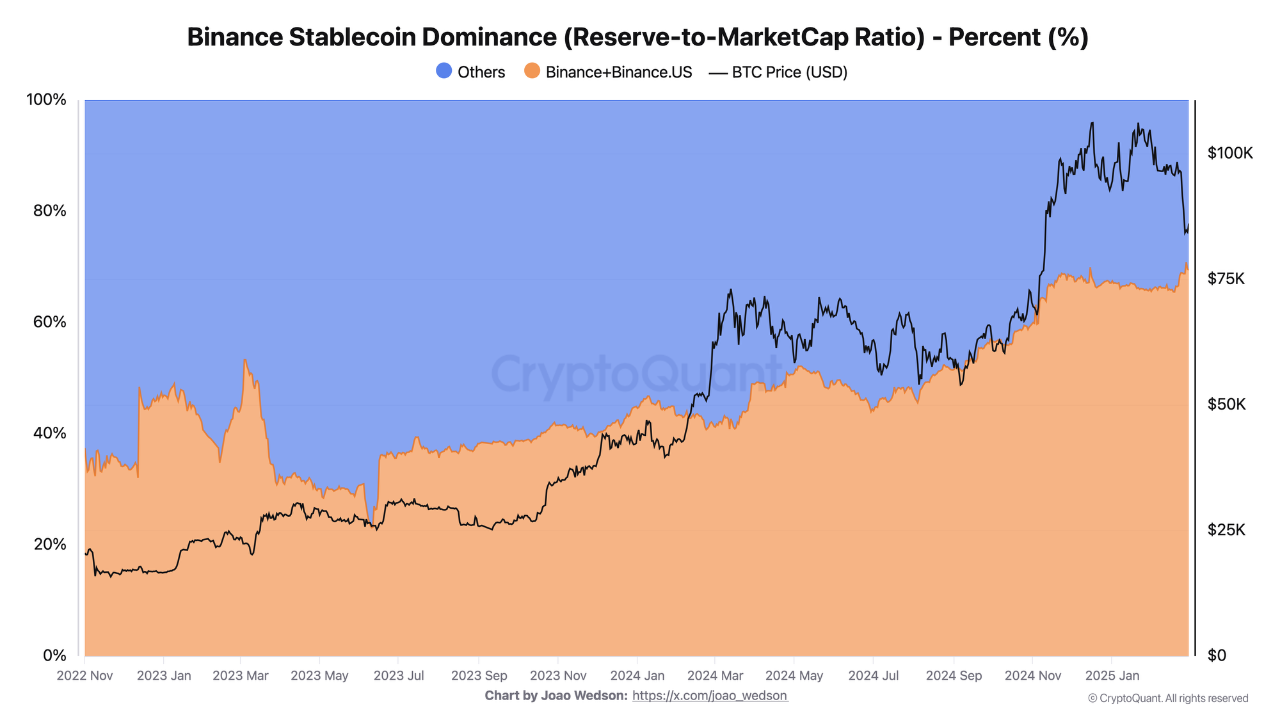

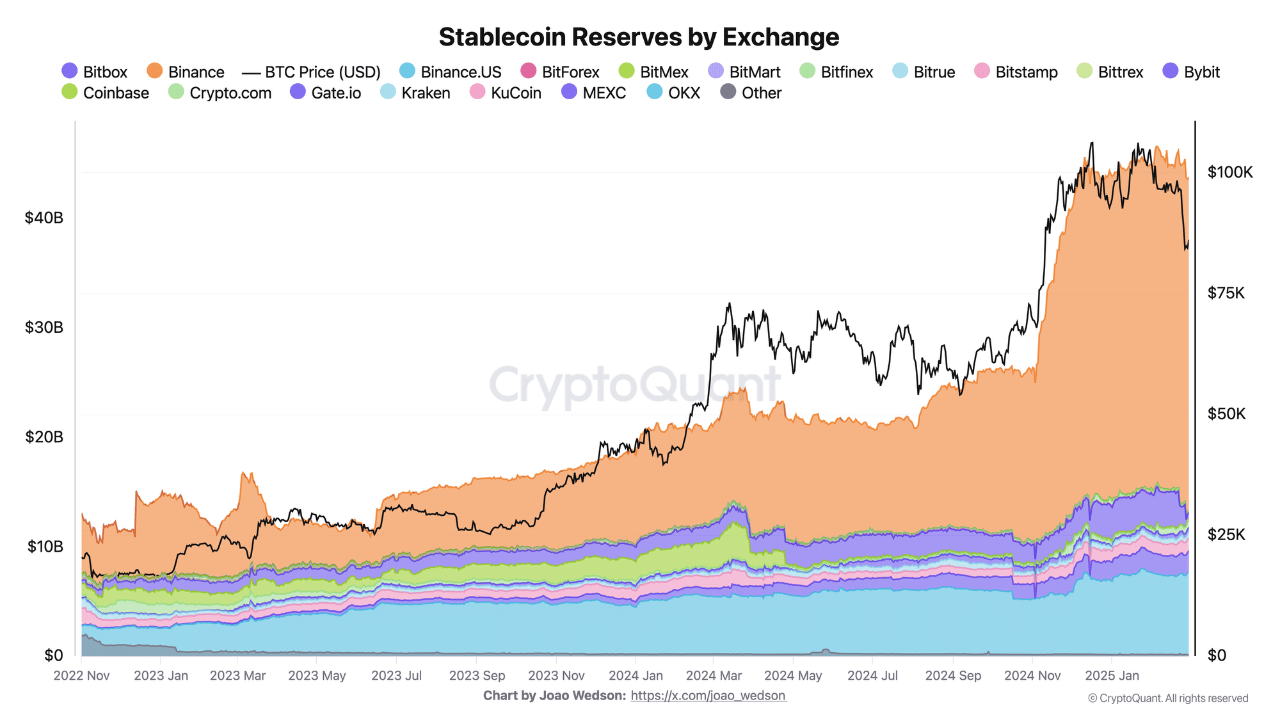

From March 2025, Binance has surpassed a stunning share of 66% of the Stablecoin reserves between large stock exchanges, which fares rivals such as OKX, Bitget and Bybit. In fact according to Cryptuquant -Data, The reserve-to-market cap ratio of Binance has risen steadily since the end of 2023, while competitors have seen their shares stagnate or fall.

Source: Cryptuquant

The data underline this growing gap-binance and Binance.US dominate two-thirds of the stablecoin ecosystem on centralized exchanges, thereby strengthening the deep liquidity of the exchange and trust of investors.

With $ 31 billion in reserves, Binance benefits from a strong influx of users and a robust institutional presence. In the meantime, new Stablecoin projects in 2025 – in Layer 1S, Fintech startups and even potential government initiatives – the strategic grip of the exchange in this fast -growing activa class is only deepened.

Binance is expanding its lead in Stablecoin -reserves

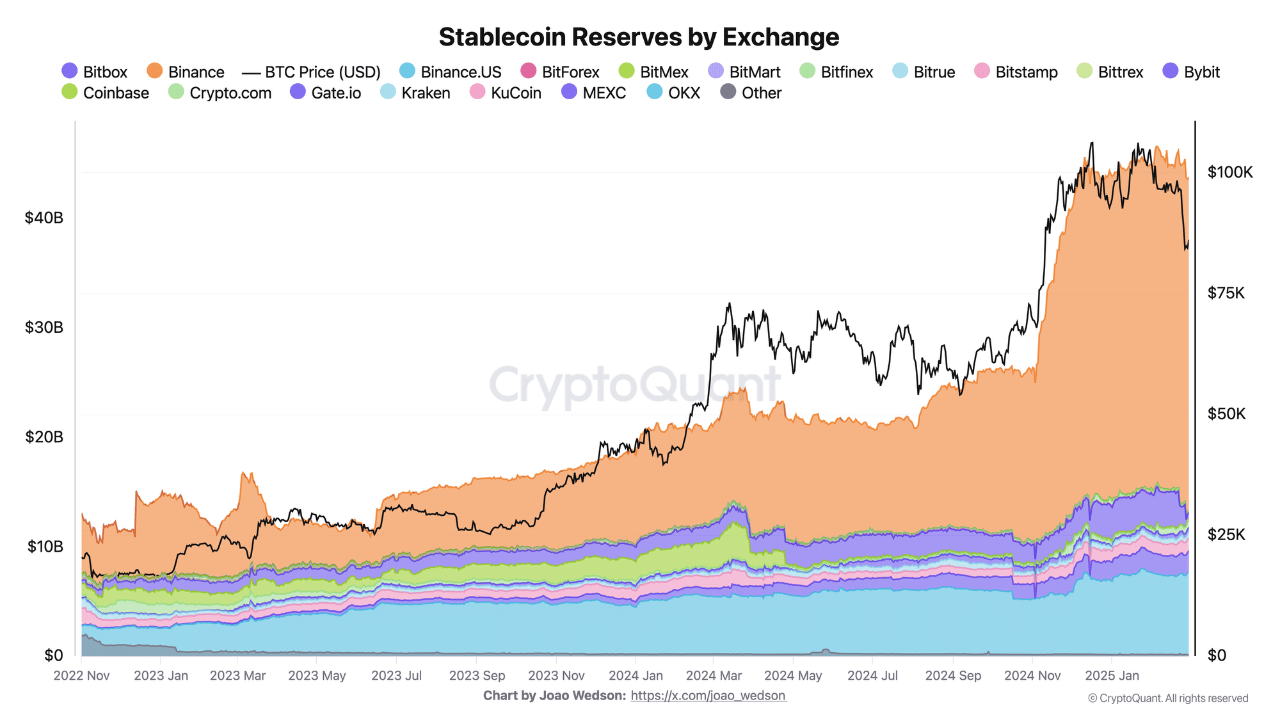

Binance remains the undisputed leader in Stablecoin reserves and has around $ 31 billion – more than double the combined reserves of OKX, Bybit and Coinbase.

The data revealed a dramatic walk in the Stablecoin Holdings of Binance since the end of 2024. This coincided with renewed shops, ETF-driven market optimism and the revival of USDC na Circle’s January deal with BlackRock to expand tokenized treasuries.

Source: Cryptuquant

While Binance.us also saw some steady growth, competitors such as bitget and cracking can be overshadowed in comparison.

The dominance of Binance stems from its deep liquidity pools, low-fee structure and aggressive market programs that attract both institutional and retail users. Moreover, the early integration of stablecoins such as FDUSD and TUSD has kept volumes high as zero-fee-trading savings.

With new layer 1 ecosystems that launch stabilecoins, Binance continues to capture most of that inflow.