-

The Avax price action can benefit from the open interest of BTC after the Treasury -Reserve -update of Gamestop

-

Altcoin was able to see price profits on the back of an adoption peak

Bitcoin’s newest price promotion has fueled Bullish Technical and On-Kettrends last week. In fact, at the time of writing, despite losses to the 24-hour front, BTC still held on to the $ 83,000 level. These figures can be expected to contribute to the increasing acceptance and positive institutional news from the crypto market.

However, that is not all. Especially since the latest institutional update GameStop includes announcement that it will now Hold BTC as a reserve treasury assets.

Thanks to the same, the open interest rate climbed to a new highest point of $ 61.17 billion-one sign of increased market activity and a persistent bullish run.

Source: Coinglass

Institutional interest rate grows as the crypto market responds

Gamestop’s Move indicates that growing institutional confidence in Bitcoin, a trend that could further strengthen the position of BTC as a reserve activity. Historically, institutional investments have both price and approved, for the benefit of the wider crypto market.

In most cases, as Bitcoin strengthens, altcoins follow the tendency to follow, under the helping hand of rising statistics on chains and improving sentiment.

Avax wins from BTC’s market influence

At the time of writing, the correlation In the past three months between Bitcoin and Avax there was 0.76 – a sign that the Avax price could respond positively at the momentum of BTC.

Avalanche Network lend more weight to the bullish bias, has recently been approved because of the cheap transaction costs. This has also led to the interests of traders and developers.

This can be demonstrated by the walk in Avax addresses and transactions, with more than 200k more than 200k in the last 6 days.

Source: Defillama

The rising adoption underlines Altcoin’s performance

As Avax’s institutional adoption rises, the larger crypto market could benefit accordingly. The analysis of Ambcrypto of data on chains showed that Altcoins, including Avax, are now noting higher transaction volumes and stronger technical indicators.

Thanks to the rising adoption percentage of BTC, the long -term provision of Avax generally remains Bullish. If the trend continues, Avax could get more momentum, especially given the strong correlation with BTC and the increasing network activity of the Altcoin.

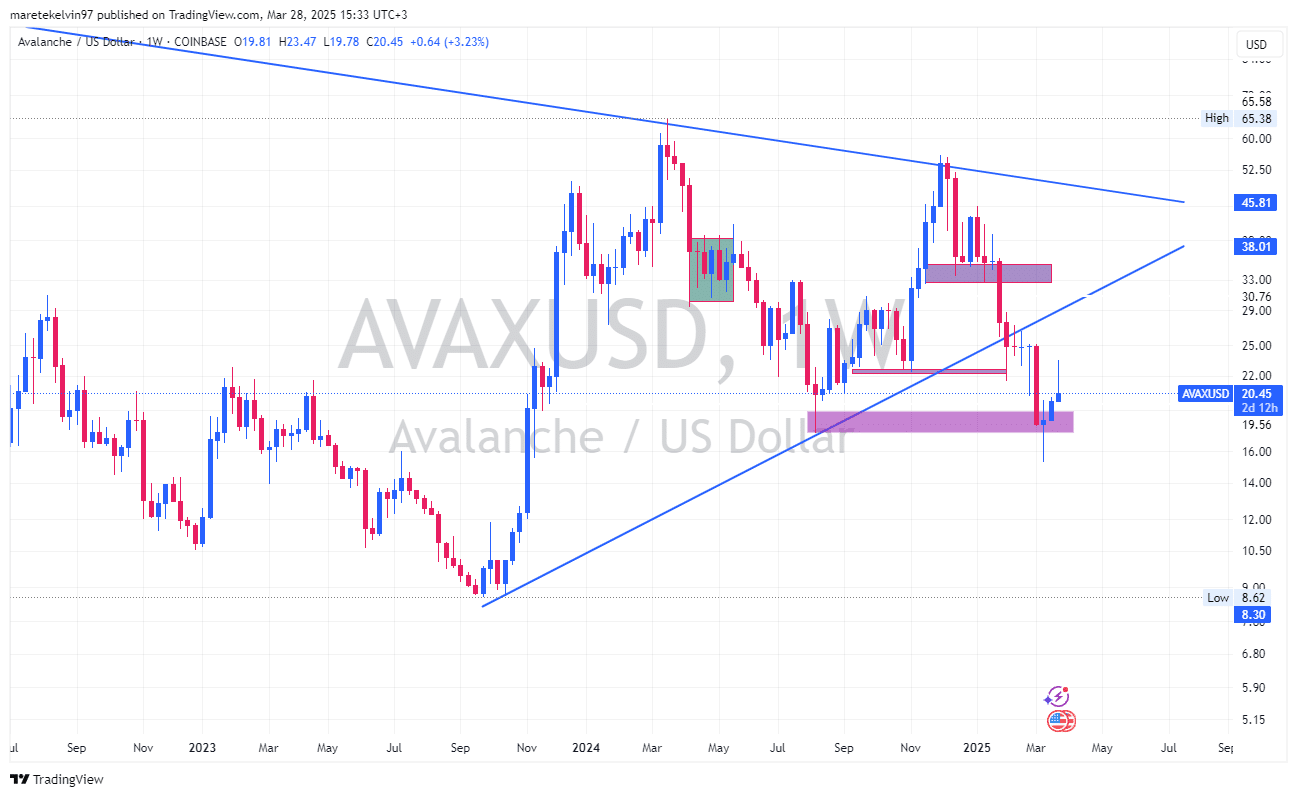

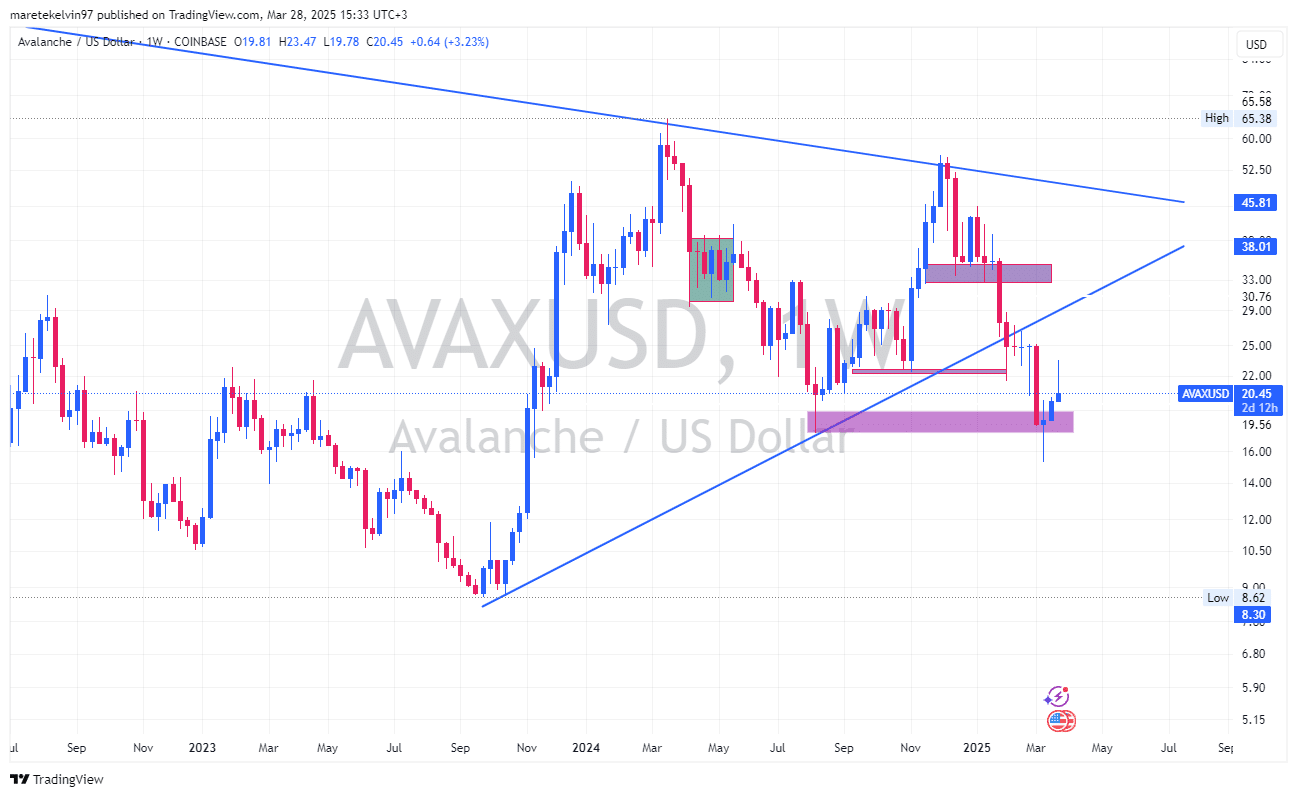

As the institutional acceptance increases, Avax could benefit and test higher food zones. The next in line will be the psychological level at around $ 30, especially if the momentum penetrates the time resistance zone of the press of around $ 20.

Source: TradingView