- NEAR rose 16.61% in seven days as altcoins suffered from high sell-offs.

- NEAR Protocol reaffirmed its commitment to the unification of blockchain and AI.

While most altcoins besides Bitcoin have experienced a downward trend [BTC]which fell to a recent low of $60,777.32, Near Protocol [NEAR] has become more assertive.

With the continued development and increased adoption of AI, all AI-themed tokens have experienced sustainable growth. Although the crypto market is generally experiencing a decline, NEAR has continued to rise.

What’s driving NEAR’s rise?

A recent surge can be attributed to increased adoption of AI and collaboration with blockchain companies. This is evident from recent comments from NEAR COO Foundation Chris Donovan.

In his remarks he said:

“The solution… is the unification of Blockchain and AI.”

He further said:

“We think this creates an opportunity for a world where user well-being can be optimized.”

In addition to AI integration, recent developments for AI giant NVidia have influenced the recent NEAR price increase.

According to the report, Nvidia has become the most valuable company in the world after surpassing Microsoft, with a market capitalization of $3.3 trillion.

Also according to X (formerly Twitter) user PlanetaVeNEARa,

“In the past month, NEAR Protocol took the top spot in number of users among blockchains, with 16.3 million addresses.”

These recent developments in AI technologies and the integration within the NEAR protocol have undoubtedly increased the prices of NEAR.

CLOSE to positive fundamentals

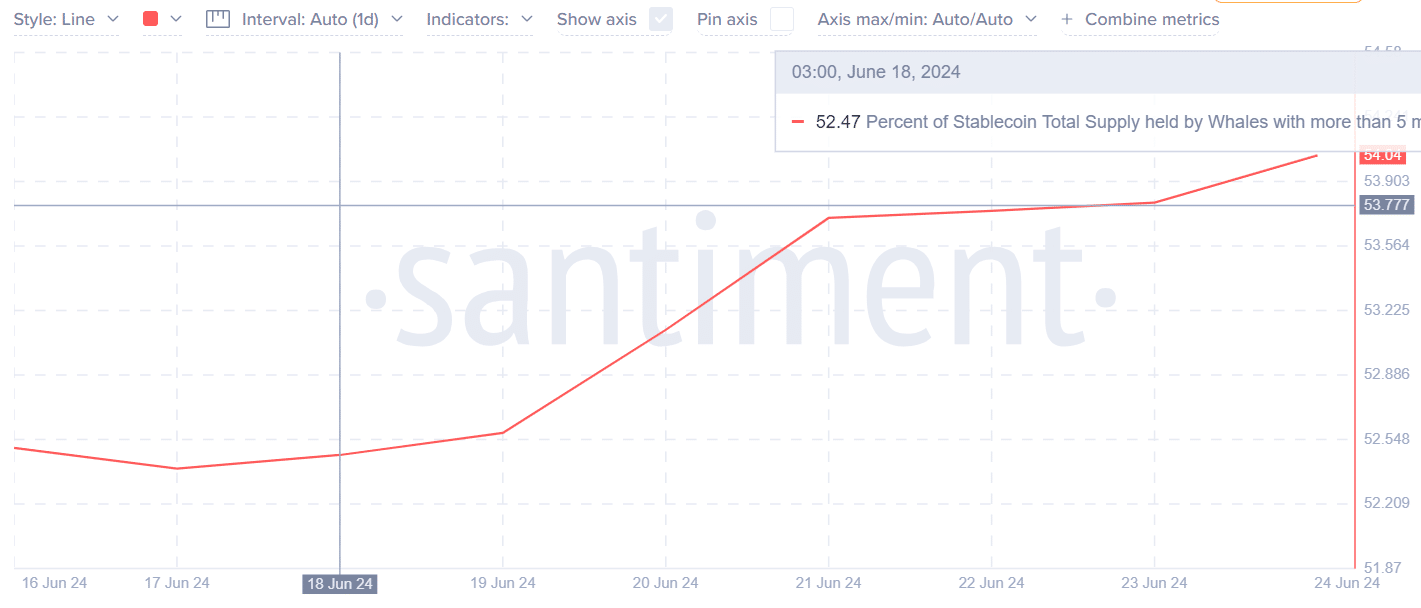

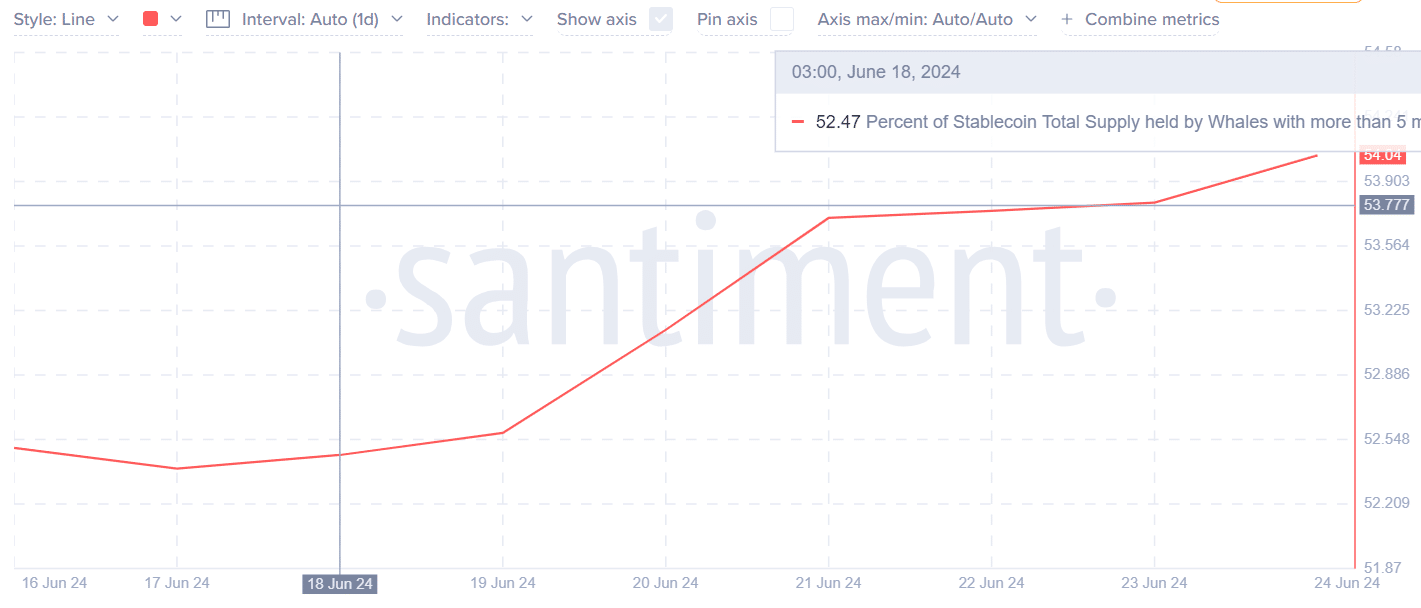

Source: Santiment

AMBCrypto’s analysis of Santiment showed that NEAR was well positioned towards a bullish trend.

For example, the percentage of the total stablecoin supply held by whales, which is over $5 million, has increased from $52 million to $54 million over the past seven days.

This demonstrated a phase of accumulation for whales as they prepare to deploy capital into the market. Greater accumulation of whales leads to a price increase and bullish market sentiment.

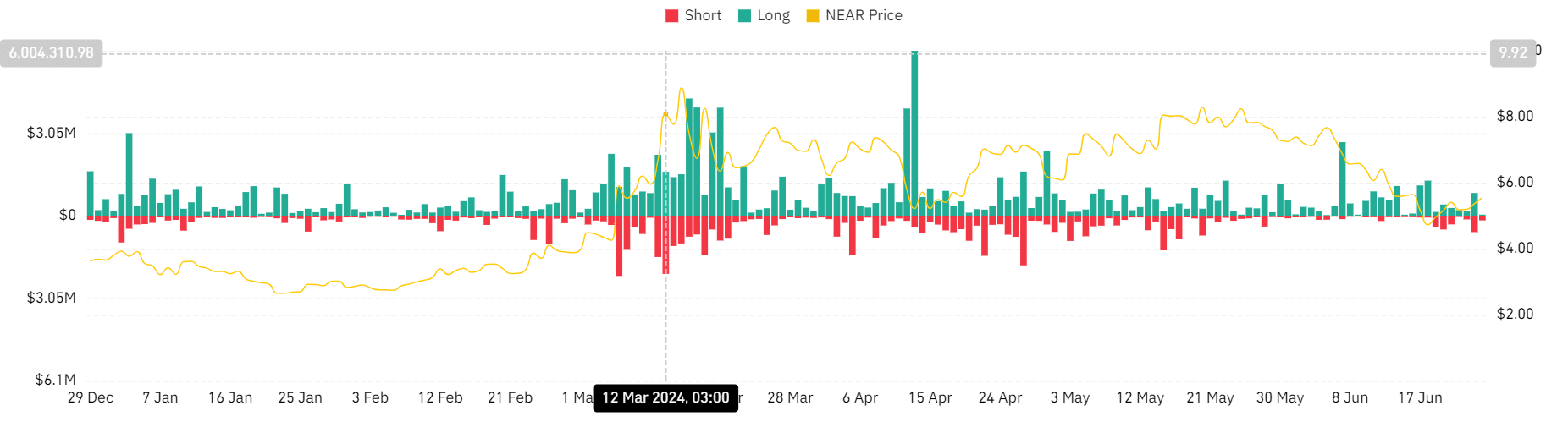

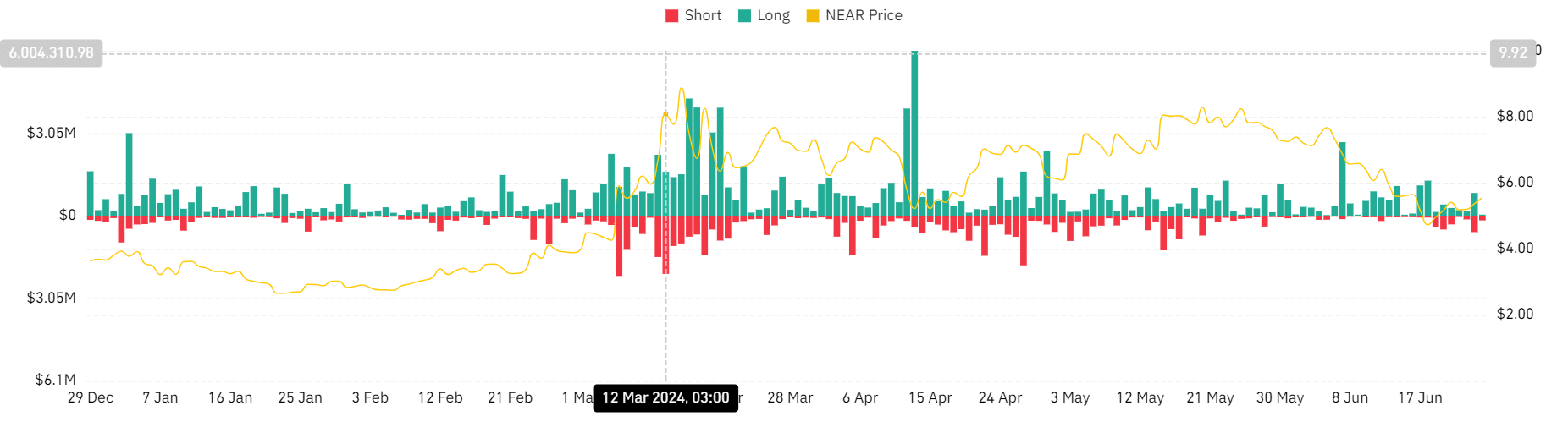

Source: Coinglass

Similarly, our analysis of Coinglass showed a short squeeze scenario, where short sellers tried to hedge their positions to limit losses in the last 24 hours.

These are the result of unexpected price increases that lead to higher purchasing pressure, causing prices to rise.

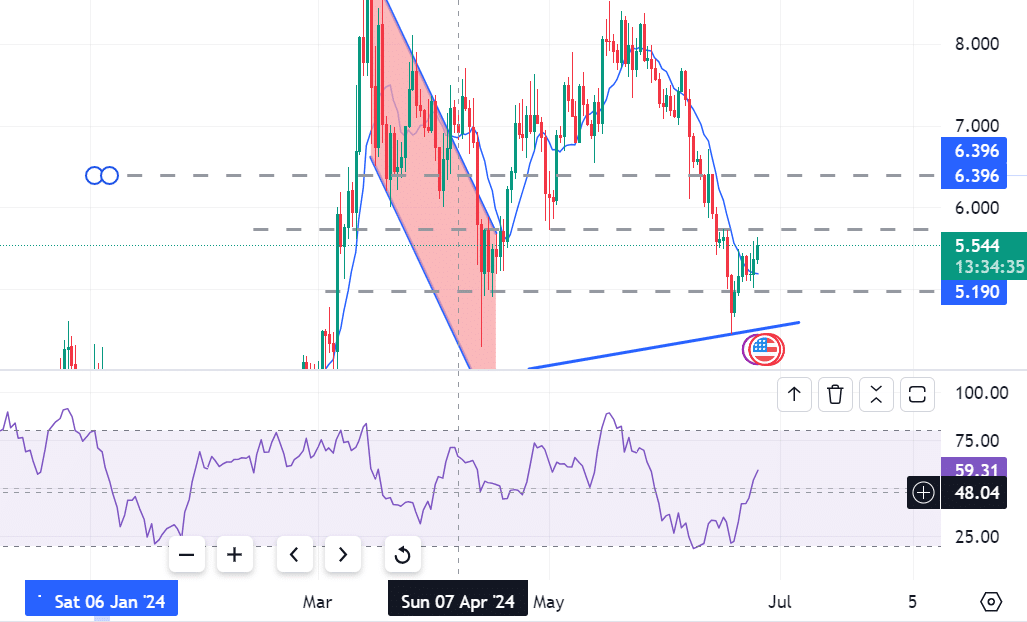

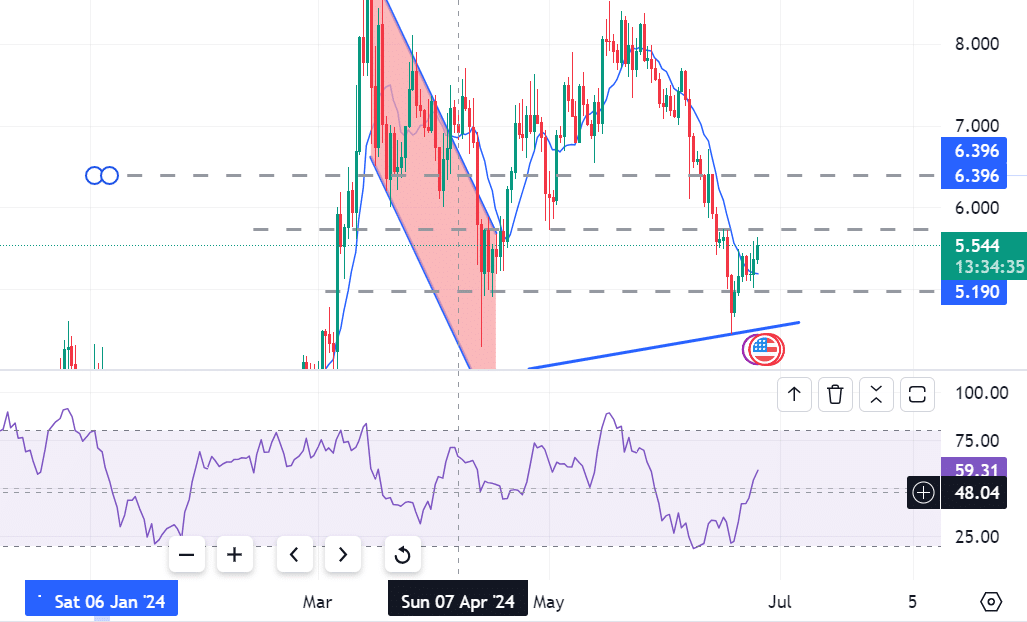

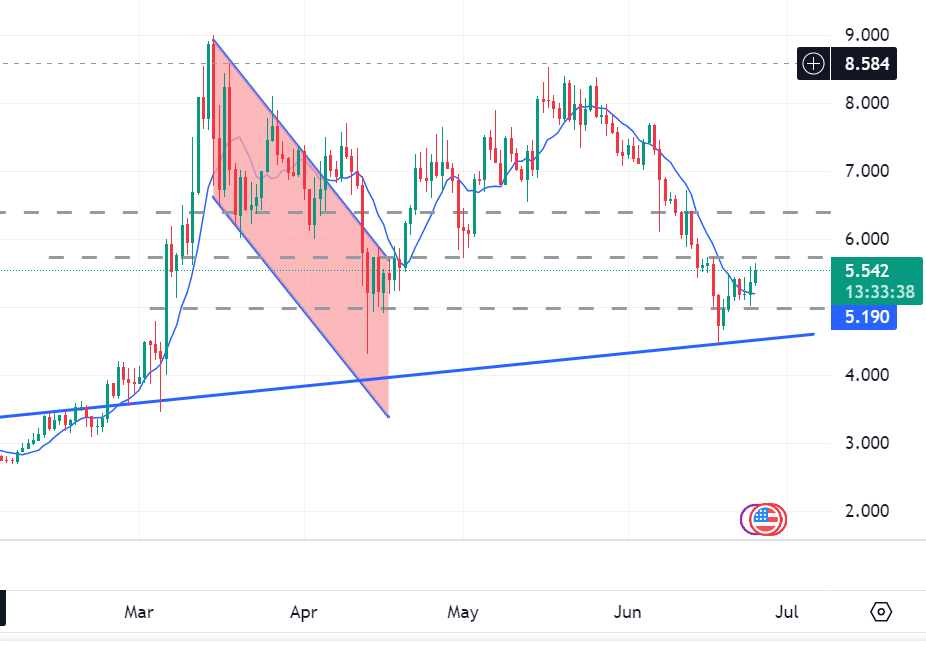

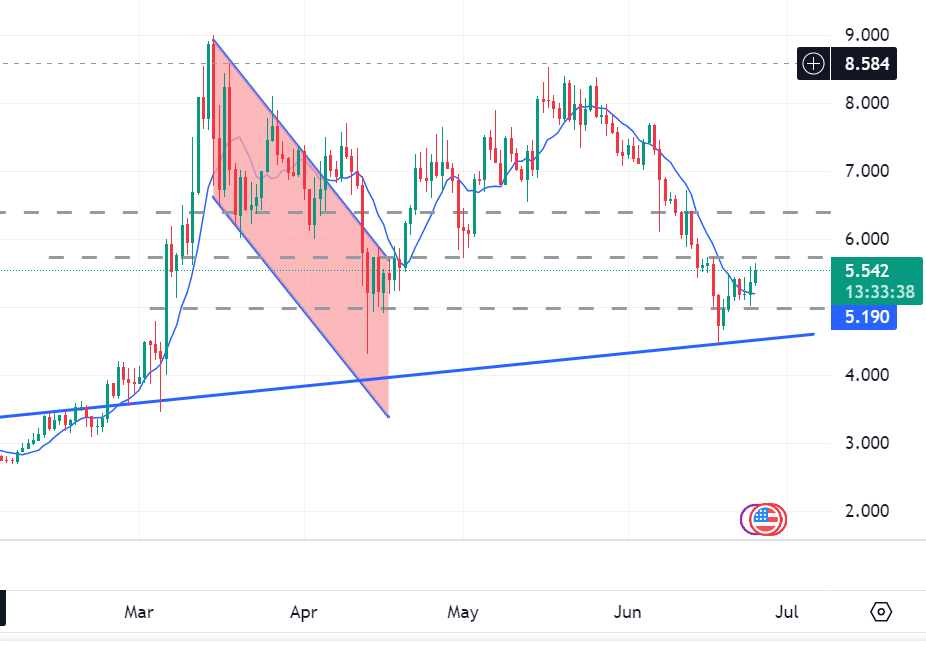

Source: Tradingview

The MFI (Money Flow Index) shows increasing purchasing pressure. At press time, NEAR reported an MFI of 59, showing more buying than selling.

Higher buying pressure leads to higher prices, as the daily charts indicate.

Source: Tradingview

The SMA (Simple Moving Average) was also below press time prices, indicating positive market sentiment.

When prices are above the SMA, buying pressure is dominant, with buyers being stronger than sellers, leading to an uptrend.

Realistic or not, here is NEAR’s market cap in BTC terms

How far can NEAR go?

At the time of writing, NEAR is trading at $5.58, up 2.36% in the last 24 hours. Moreover, trading volume increased by 29.98% in 24 hours to $492 million.

So if current buying pressure continues, NEAR will reach $5,755 in the near term. If it breaks out of the next resistance level around $5,755, it could reach $6,396 in a very bullish scenario.

![How AI helped Near Protocol [NEAR] increase of 16% in 7 days](https://bitcoinplatform.com/wp-content/uploads/2024/06/NEAR-GLADYS-1000x600.jpg)