- Aave would implement a strategy to support GHO’s secondary liquidity.

- Volume on the Aave protocol fell, but development activity increased.

The Aaf [AAVE] community has approved a proposal to position its decentralized autonomous organization (DAO) as a major influencer on the DeFi ecosystem while improving GHO’s liquidity.

The protocol had the proposaldubbed the “aCRV OTC Deal” earlier this month.

Realistic or not, here it is Market capitalization of CRV in AAVE terms

And according to the voting results, 370,359 community members voted for the proposal. On the other hand, 270,308, representing 42.19% of the voting population, voted against it.

Time to jettison “GHO”.

Details from the proposal showed that the leading DeFi platform intends to make a strategic move through acquisition Crooked Finance [CRV] use tokens Tether [USDT] from his treasury.

And all of these would be done in an effort to make the liquidity of GHO, its native decentralized stablecoin. To achieve this, Aave explained that,

“A CRV acquisition worth 2M USDT would send a strong signal supporting DeFi DeFi while allowing the Aave DAO to strategically position itself in the Curve wars, benefiting GHO secondary liquidity.”

Recall that the recent Curve exploit affected the Aave protocol. And despite several attempts by Curve Finance founder to salvage the situation, Aave lost grip ranked second by Total Value Locked (TVL).

Source: DefiLlama

TVL’s decline means deposits from unique smart contracts across the eight chains operating under Curve have declined. But at the time of writing, Defillama showed that the TVL had gained a paltry 1.28% in the past 24 hours.

Volume decreases, development increases

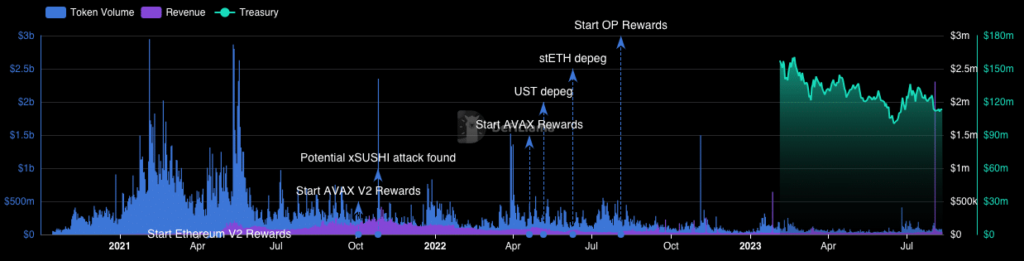

At the time of writing, Aave’s treasury was worth 112.99 million. However, the token’s volume was far from impressive at $77.87 million.

The drop in volume indicated that actual transactions on the Aave protocol were dropping. Meanwhile, Aave also noted that the approved proposal, which would be implemented shortly, would involve a CRV token contract transfer to the Aave collection protocol. His statement read,

“In terms of implementation, this AIP initiates a transferFrom() on the aCRV token contract to the Aave Collector, using a previous approval() of 0x7a16ff8270133f063aab6c9977183d9e72835428 of 5M aCRV tokens to the Aave DAO Treasury (collector contract).”

Is your wallet green? Check the Aave profit calculator

In addition, Aave’s development activity increased to 5.07. A project’s development activity follows the public GitHub repositories committed on-chain.

Source: Sentiment

An increase in the statistic suggests improved developer commitment to upgrades on the network. However, if the metric had decreased, it would mean that there were no commit codes for Aave.