- 460,000 previously dormant BTC have re-entered the market, impacting supply and demand

- Increased liquidity from reactivated coins could lead to volatility and price fluctuations in the short term

In a surprising turn of events, 460,000 previously dormant Bitcoins have disappeared [BTC] have recently come back into circulation, sending ripples through the market. These ‘lost’ coins, once thought to be inaccessible, are now actively circulating again.

This shift raises important questions about the perceived scarcity of BTC and its potential impact on the market.

Understanding Bitcoin’s scarcity and its impact on value

Bitcoin’s value is intrinsically linked to its scarcity. With a total supply of up to 21 million coins, Bitcoin is designed to be a limited resource, and this finite supply has long been a major driver of its value.

The principle of supply and demand dictates that when a good is scarce, its perceived value increases – especially when demand remains stable or increases. This scarcity narrative has cemented Bitcoin’s reputation as “digital gold,” a store of value.

The return of dormant Bitcoins

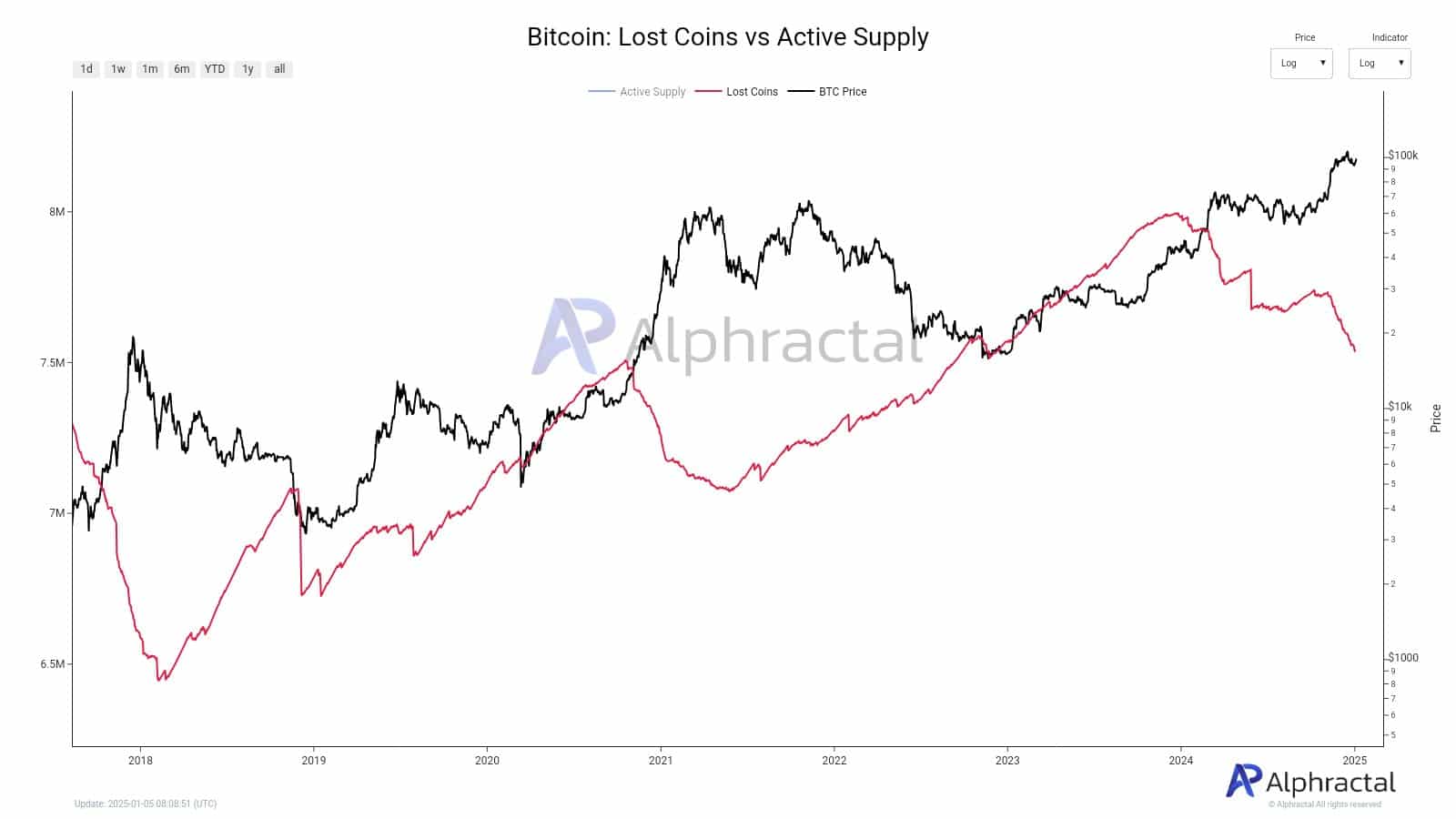

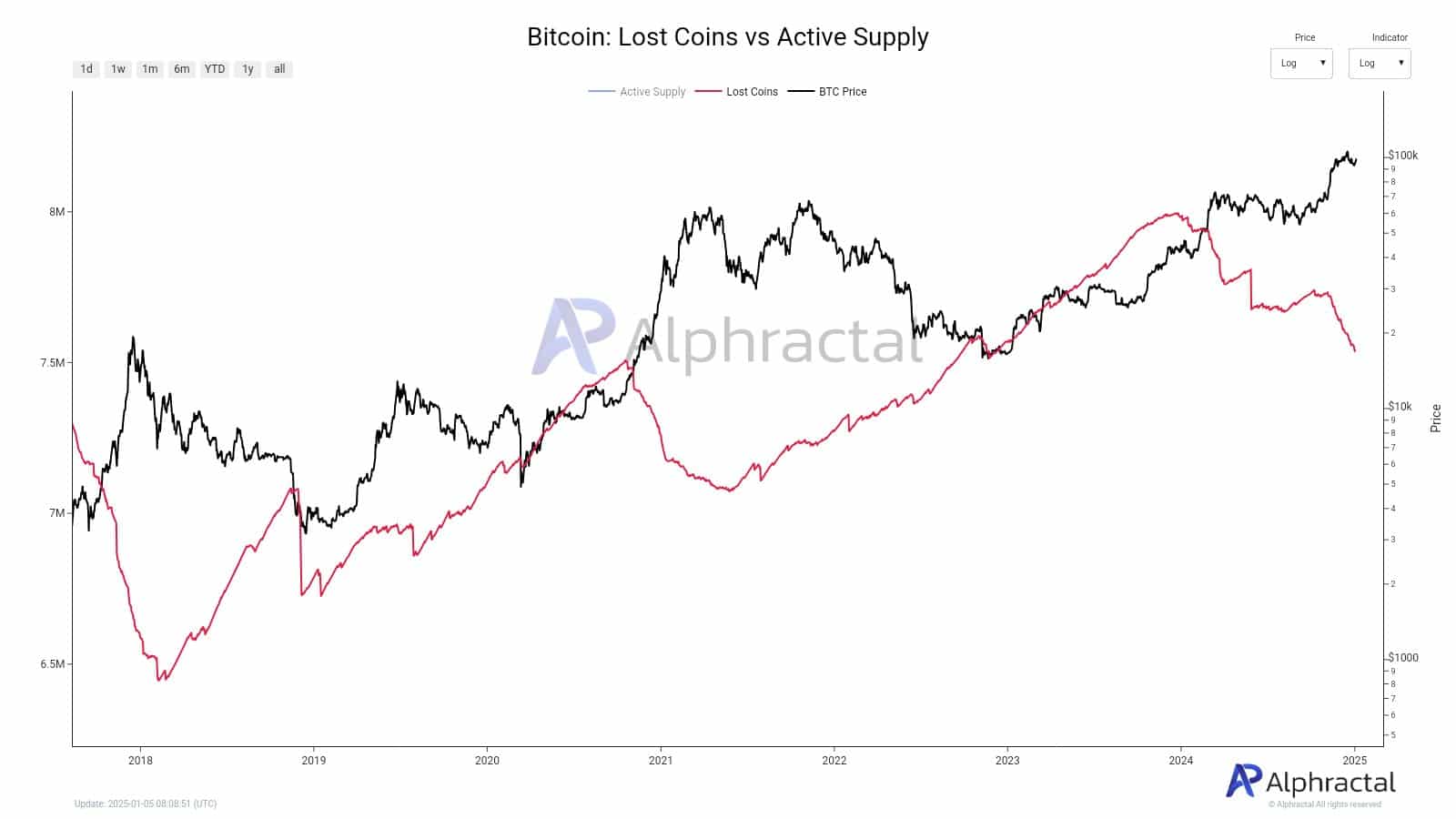

The reactivation of dormant BTCs, especially since 2024, marks a shift in Bitcoin’s market dynamics. About 460,000 BTC, thought to be lost, has resurfaced, largely thanks to the launch of the Bitcoin ETF.

This increase in the number of long-held coins suggests growing confidence among LTHs, who are benefiting from the current bullish cycle. As these coins become active again, the available circulating supply of Bitcoin increases, which could have broader implications for the scarcity story.

Source: Alpharactal

While the total supply of BTC is fixed, the availability of dormant coins returning to the market challenges the idea of scarcity.

This influx could temporarily weaken the asset’s perceived scarcity, especially if these coins are sold quickly in the market, potentially causing short-term volatility.

How Reactivated Coins Affect BTC’s Scarcity Story

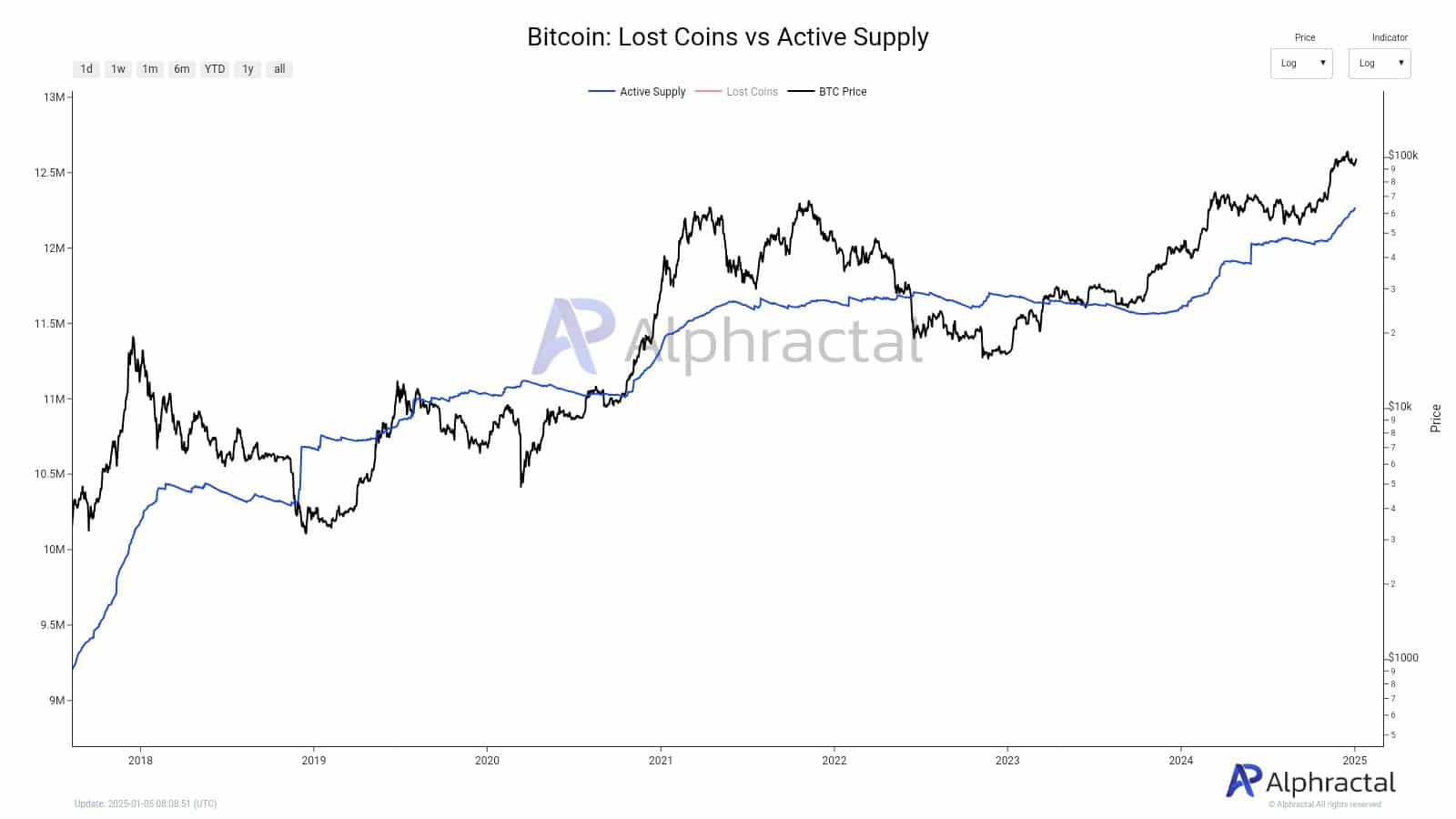

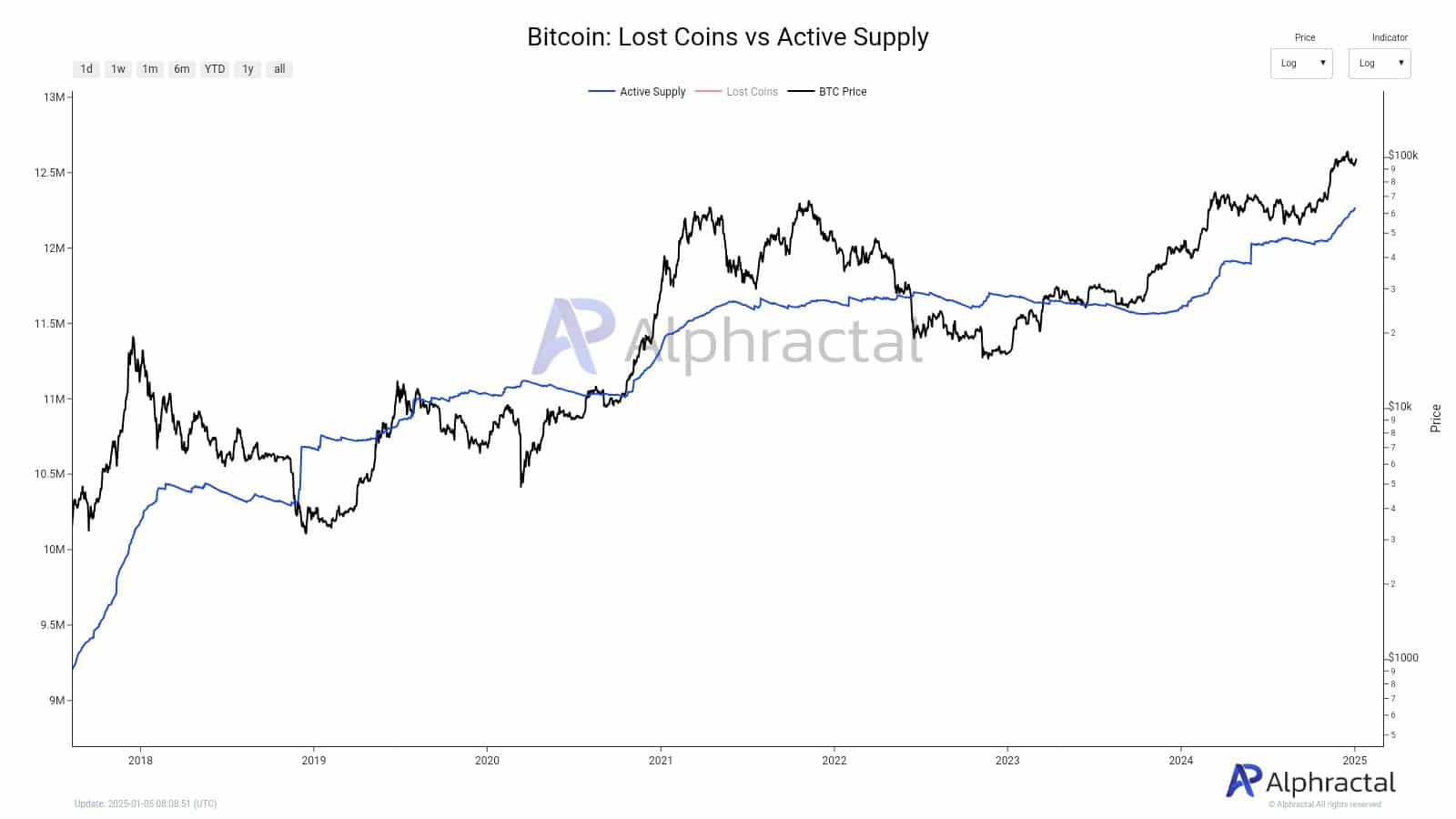

Source: Alpharactal

The return of dormant coins could disrupt the long-standing scarcity narrative that has defined Bitcoin’s value. While the total supply of Bitcoin remains limited, the reactivation of these coins increases the effective circulating supply, changing the balance between supply and demand.

In the short term, this could undermine the perceived scarcity of BTC, especially if significant amounts of BTC are moved onto exchanges and sold. This influx of supply could temporarily weigh on BTC’s value until the market absorbs the coins.

The future of Bitcoin in a more liquid market

The situation introduces additional liquidity to the Bitcoin market, with both positive and negative consequences. On the one hand, greater liquidity allows for smoother trading and greater market efficiency.

Read Bitcoin’s [BTC] Price forecast 2025–2026

On the other hand, a sudden increase in active supply could lead to price volatility, especially if large amounts of Bitcoin are sold at once.

Over time, this increase in liquidity could impact BTC price stability, potentially reducing speculative spikes and promoting more sustainable growth.