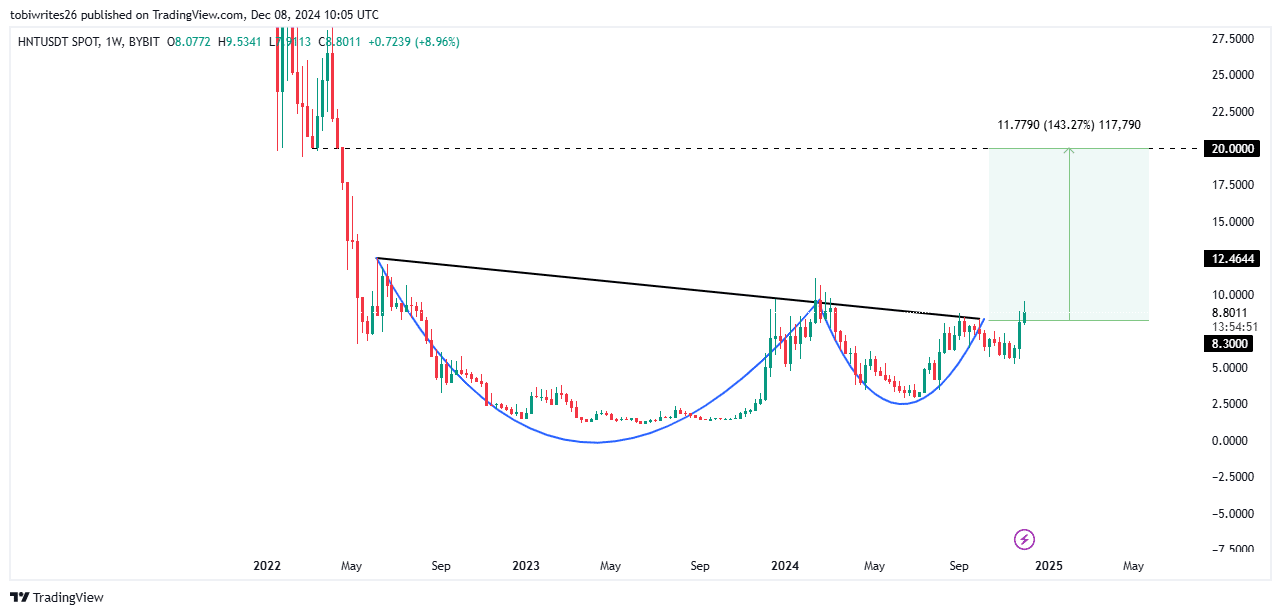

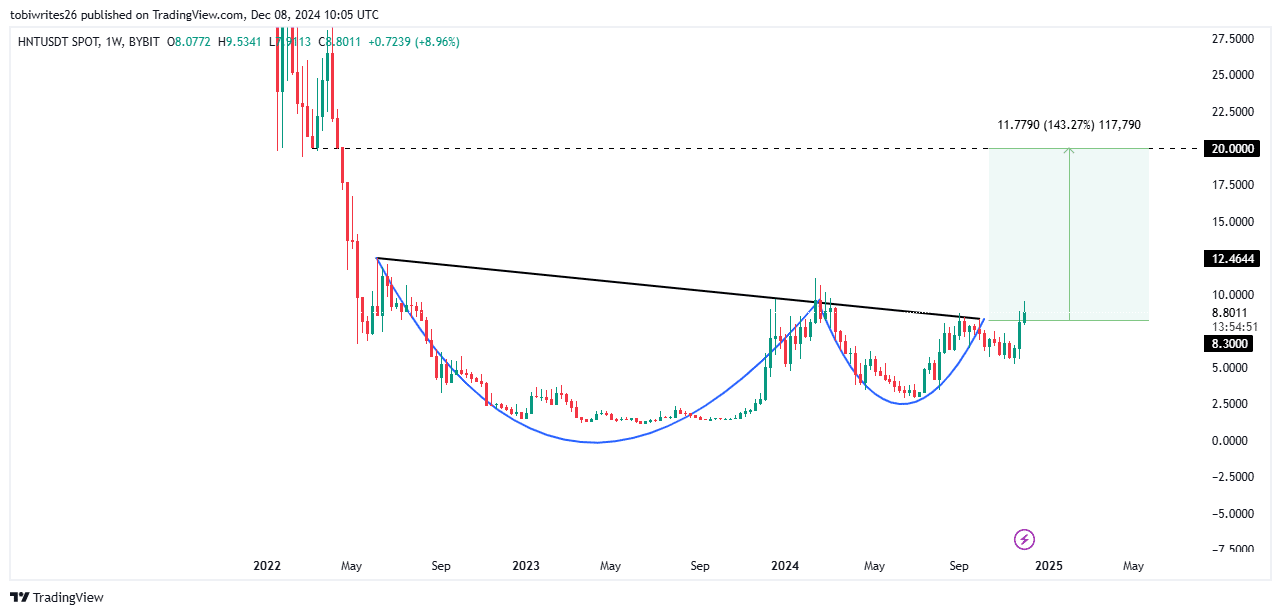

- At press time, HNT was trading within a classic cup and handle pattern, a formation that is often accompanied by price increases.

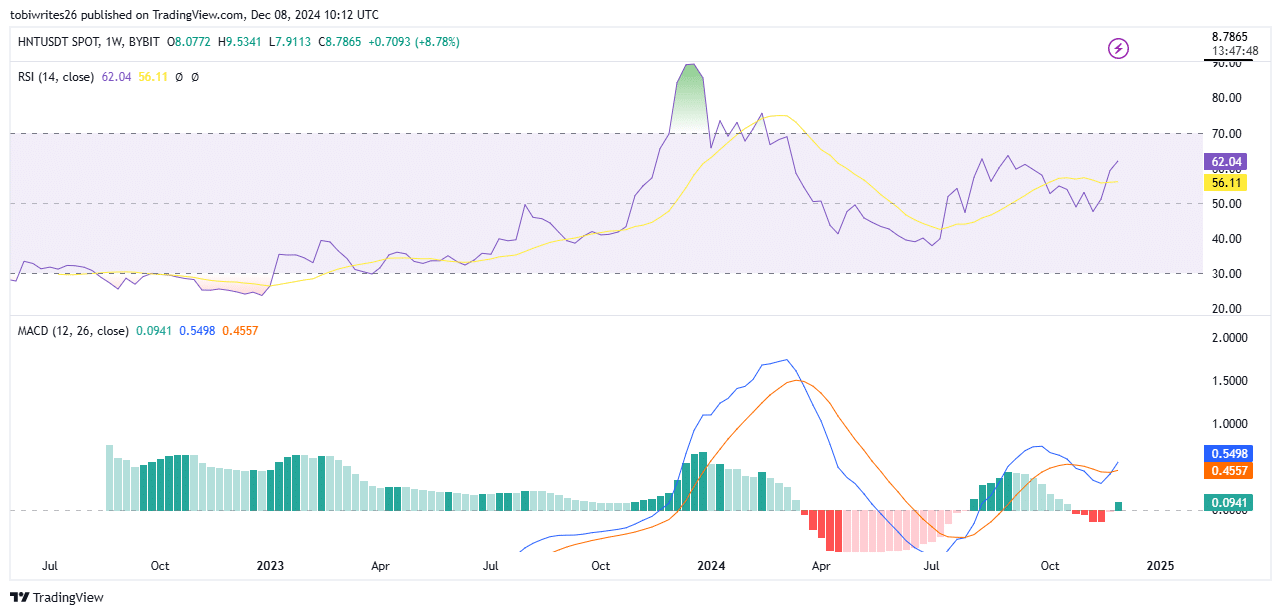

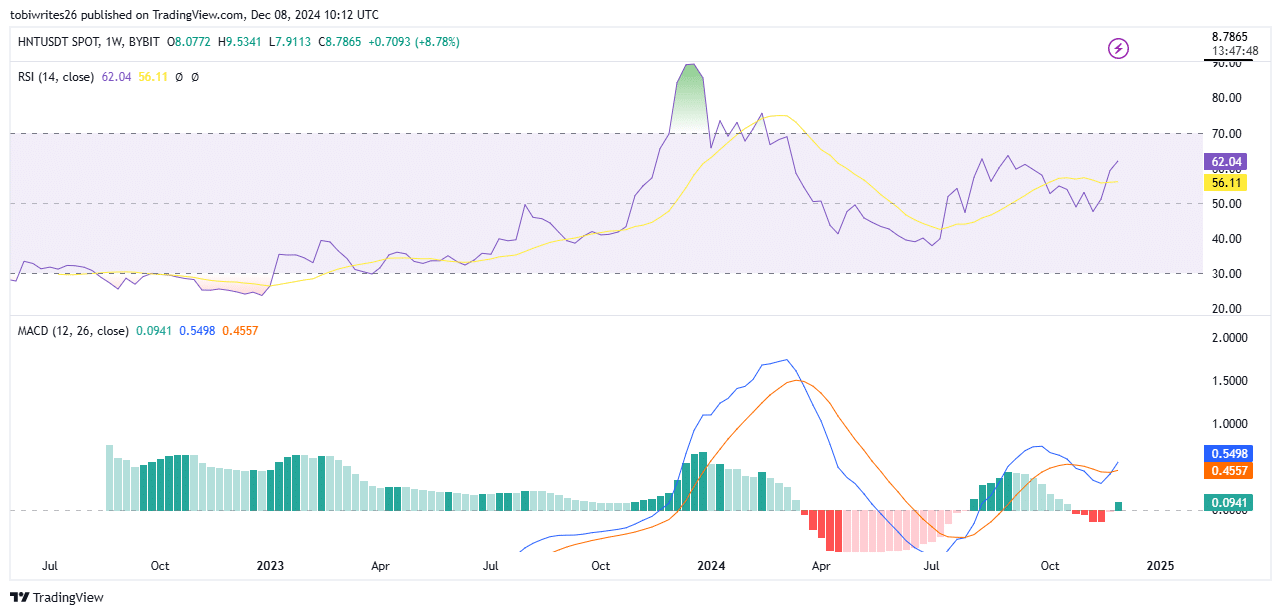

- The MACD has also formed a golden cross, indicating potential upside momentum.

From helium [HNT] recent market performance has shown some weakness. The asset is down 4.76% over the past 24 hours, cutting its monthly gain to 42.97% from previous highs.

Despite this short-term decline, analysis shows that the broader market structure remains intact, leaving room for further upside potential.

HNT waiting for rally

HNT currently trades within a cup-and-handle pattern, a structure that is often accompanied by significant price increases.

Although HNT has already started its upward move, analysis suggests that a rally could push the asset to $20, representing a gain of 143.27% and marking the completion of the pattern.

Source: trading view

Further upside momentum is possible at this level, but this will depend on the market’s ability to overcome expected selling pressure around $20.

A golden cross: a golden opportunity?

As of this writing, a golden cross has formed on the price chart, signaling significant momentum and a potential rally supporting the ongoing bullish trend.

This pattern occurs when the blue MACD line crosses the orange signal line. The MACD at the time of writing was at 0.5498, while the signal line reached 0.4557 as shown on the chart.

Source: trading view

Moreover, the Relative Strength Index (RSI), an indicator used to measure the speed of price changes based on the activity of buyers and sellers, confirms the bullish sentiment.

The RSI stood at 62.04, indicating active buying in the market. If the RSI remains below the overbought threshold of 70, further gains could follow as the asset continues its upward trajectory.

Buyers on the rise

The derivatives market signals a bullish outlook for HNT, supporting expectations of further price increases.

Is your portfolio green? Check out the helium profit calculator

Coinglass data shows that the long-to-short ratio has risen to 0.9976. This shift reflects an increase in the number of long contracts, indicating that the asset is very likely to continue its upward trend.

The funding rate for HNT also remains positive at 0.0353%, showing that long positions are helping to maintain the price gap between the spot and derivatives markets.